Investing

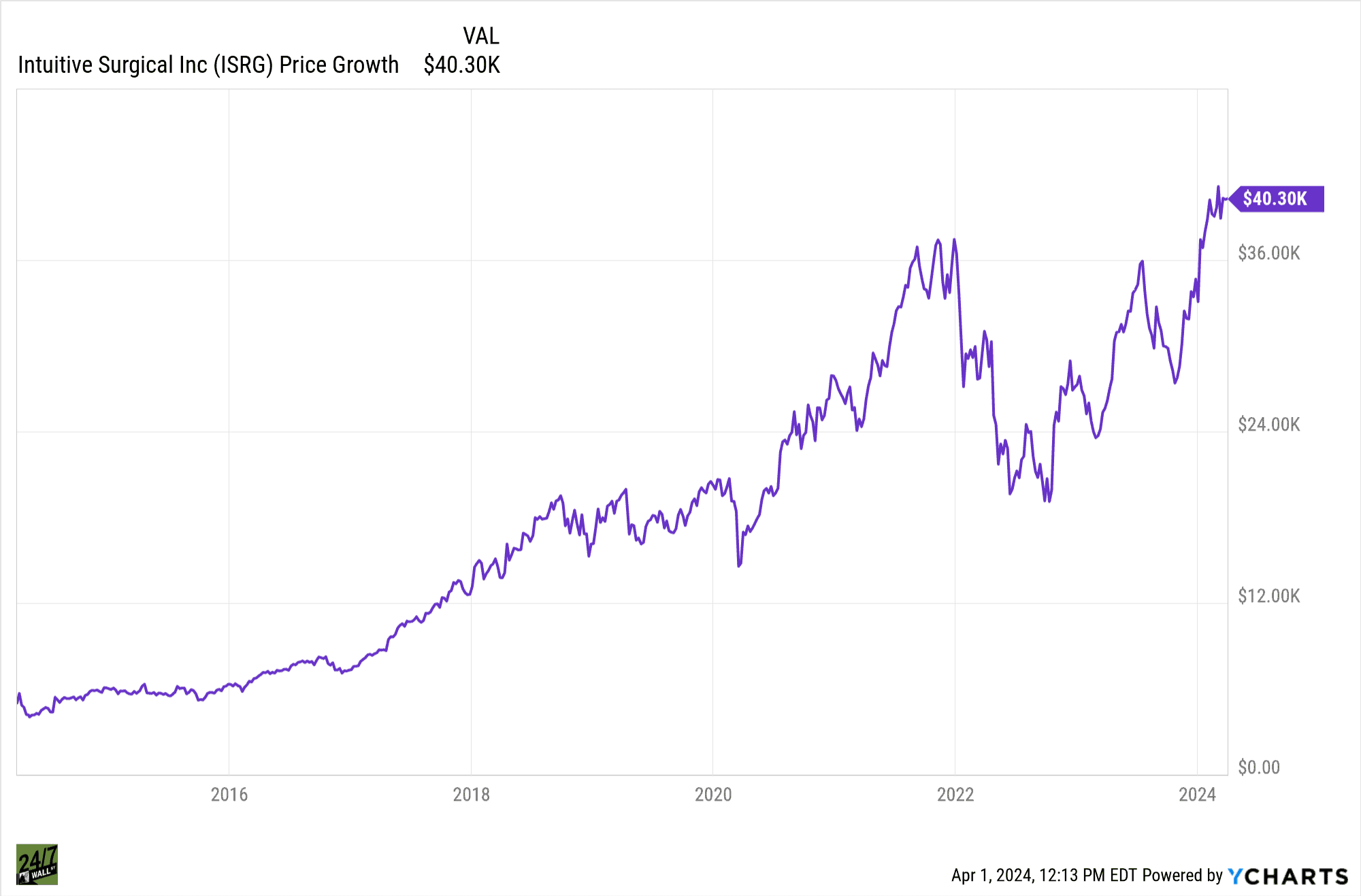

If You Invested $5000 In Intuitive Surgical 10 Years Ago, This Is How Rich You Would Be Today

Published:

One of the time-tested investment methods is the “buy and hold strategy”. Popularized by investment guru Warren Buffett, this strategy attempts to take emotion out of market peaks and valleys, and relies on holding the stock while the fundamentals of the company’s finances, management, and business model all remain solid, so that the underlying value will be recognized.

24/7 Wall St. has tracked a number of stocks over the period of a decade that have made triple and even quadruple digit percentage returns for those investors intuitive enough to have taken the plunge early.

One such company is Intuitive Surgical, Inc. (NASDAQ: ISRG).

Founded in 1995, Intuitive Surgical, Inc. is a pioneer in Robotic Assisted Surgery (RAS), and was one of the first companies to expand its use to urology and other areas of surgery not normally deployed. These developments led to the creation of Intuitive Surgical’s da Vinci surgical systems, which are now used for such surgical tasks as: incisions, stapling, endoscopy, and others.

The da Vinci system reduces many open, invasive surgeries to a series of robot-assisted microsurgeries with built-in endoscopy so the surgeons can view organs while minimizing the surgical area to foster accelerated healing and recovery.

ISRG stock executed a 3-for-1 forward stock split in 2017, and a second one in 2021. Therefore, for each share of stock purchased in 2014, a shareholder now had nine in 2021.

This run coincided with the introduction of Intuitive Surgical’s Ion Robotic Bronchoscopy platform, which minimizes the invasive nature of lung biopsy procedures in the treatment and diagnosis of lung cancer.

At the end of 2023, Intuitive Surgical had sold and installed 8,606 da Vinci systems. Demand continues to grow, and one can easily add Ion’s sales to the future prognostications. The Baby Boomers are getting older and living longer, thanks to medical developments and devices like da Vinci and Ion. The demand will only continue to expand for the foreseeable future, since the market only has roughly 5% saturation at this stage in time.

As of the time of this writing, ISRG stock is trading at $385.29. Back in 2014, at the end of Q1, split-adjusted stock price was in the $56-57 price range.

In 2017, Intuitive Surgical, Inc. announced a 3-for-1 forward stock split. repeating in 2021 with another 3-for-1 forward stock split. A $5000 investment 10 years ago in Intuitive Surgical, would have turned into over $40,000 today.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.