If you want to save for the college education of your child, you may want to look into a 529 college savings plan. This is an investment vehicle designed to fund higher education for a beneficiary, while providing you with tax benefits.

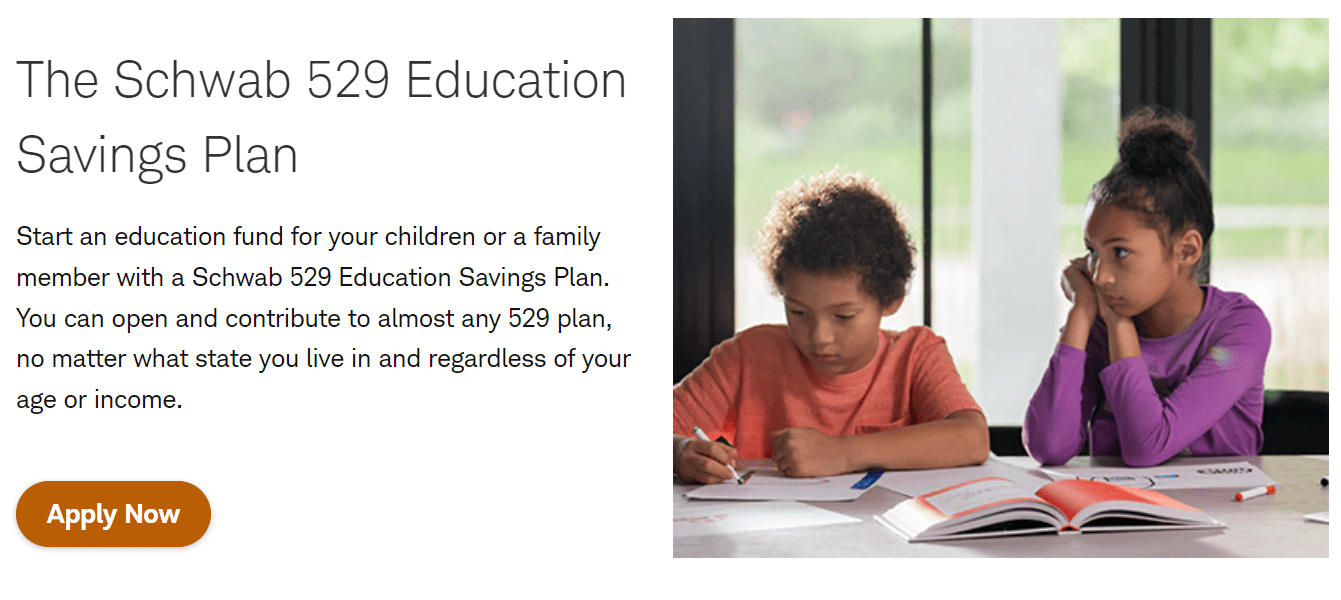

You can open a 529 plan through large brokerages like Charles Schwab, which offers the The Schwab 529 Education Savings Plan. Schwab doesn’t charge an enrollment fee to open a 529 account and you can start investing with as little or as much as you want. 529 plans were established through the IRS tax code. So federal tax rules and other factors are similar across providers. But state tax implications may vary.

The Schwab 529 Education Savings Plan was established by the state of Kansas, so account holders in the Sunflower State may be particularly interested. Still, the Schwab 529 plan offers federal tax benefits to account holders in any state.

Schwab 529 Plan benefits and tax advantages

The contributions you make to a Schwab 529 Education Savings Plan grow tax free at the federal and Kansas state levels. And the earnings portions of withdrawals made for qualified educational expenses are also tax-free at the federal and Kansas state levels.

Qualified educational expenses include tuition, fees, books and supplies needed for your beneficiary’s enrollment. Room and board counts too in some cases (More on this later). 529 plan contributions aren’t tax deductible at the federal level. However, the Schwab 529 plan offers specific benefits to Kansas residents.

Kansas taxpayers can get an annual adjusted gross income deduction on their state tax returns for their contributions of up to $3,000 per beneficiary or $6,000 if married filing jointly.

But here are some benefits to the Schwab 529 plan that all account holders can enjoy.

- No annual account maintenance fee

- Contribution limits of up to $475,000 per

beneficiary - Diversified investment options

And here are some perks to any 529 college savings plan.

- Any U.S. citizen or resident alien can open an account

- Friends and family can contribute to the account

- Savings can fund qualified educational expenses at any college, university, vocational school or other postsecondary institution that can be involved in a student aid program run the the U.S. Department of Education.

- You can withdraw up to $10,000 in 529 plan savings per year, per beneficiary to cover tuition at an elementary, middle or high school tax-free

- Your beneficiary doesn’t have to go to college in their state of residence to use 529 plan savings

- The beneficiary can still qualify for financial aid: Only 5.6% of the 529 account’s value is considered the parent’s assets for financial aid calculations. This rule applies even if the account owner is another relative such as an uncle.

- You can change beneficiaries at any time

- Any U.S. citizen or resident alien can be a beneficiary regardless of age

Schwab 529 plan investment options

The Schwab 529 plan offers a vast menu of professionally-managed investment portfolios. These are built with mutual funds that offer exposure to stocks, bonds and money market instruments, as well as different investment styles.

These portfolios break down into two categories: Age-based and static.

Age-Based: These portfolios automatically change their asset allocation as your beneficiary gets closer to college age. Early on, it’ll be more aggressive by devoting more of its asset allocation to stocks. Over time, the portfolio becomes more conservative by devoting more exposure to bonds and money market funds. The idea is that your beneficiary has more time to invest in growth-oriented or riskier securities early on. But you may want to focus more on preserving earnings as they approach college.

Static: The asset-allocation for these portfolios remains the same and would reflect a chosen investment type: Aggressive, Moderately Aggressive, Moderate, Moderately Conservative,

Conservative, Short-Term and Money Market.

For each type of portfolio –age based or static– you can choose the management style of the underlying mutual funds.

Actively managed funds: These funds are designed to outperform market indexes by strategically investing in stocks and bonds within those indices. Actively managed funds are generally costlier and take on more risk than passively managed funds.

Index-based funds: These funds are designed to reflect the performance of general market indices by investing in stocks and bonds in those indices. These index-based funds are generally associated with low management costs.

Schwab 529 plan fees

The Schwab 529 Education Savings Plan doesn’t charge an enrollment fee or an annual maintenance fee. But your account would face fees based on the portfolio you choose. With Schwab, it’s important to look at how the funds that make up these portfolios are managed.

Actively managed portfolios charge an annual total program fee that includes the portfolio’s program management fee and the fees of its underlying funds or expense ratios. Total program fees range from 0.34% to 0.86% – still competitive when it comes to actively managed strategies. So a 0.86% fee on a $10,000 investment would be $860 a year.

Index-based portfolios charge an all-inclusive fee of 0.20%. This fee on a $10,000 investment would be $200 a year.

529 Plan qualified withdrawals and taxes

Withdrawals from 529 plans are tax-free at the federal level if they’re used to fund qualified educational expenses as set by the IRS.

These generally are expenses required for your beneficiary’s enrollment at an eligible institution and used during the time there. Here are some common examples.

- Tuition and fees

- Books and school supplies

- Technological equipment including computers

- Software

- Internet access

Room and board may count as a qualified educational expense if the student is enrolled at least half time, and as long as the costs aren’t more than the greater of the following.

The allowance for room and board reported in the school’s “cost of attendance” documents for federal financial aid purposes.

- The amount charged if the student is residing in housing owned or operated by the school.

- The actual amount charged if the student is living in housing operated by the educational institution

So if your student lives off campus or housing not operated by the school, its costs can’t exceed the school’s estimates of their own room and board options in order to be considered a qualified educational expense.

It’s important to make sure that you check with the school’s financial aid office to determine the actual costs of room and board before you tap into your 529.

If you withdraw money from a 529 plan and spend it on anything else, it’ll be considered a non-qualified expense. As a result, you’d face regular federal and state income tax on the earnings portion of the withdrawal in addition to a 10% penalty.

Here are some common items and services that wouldn’t count toward qualified expenses.

- Insurance

- Gym memberships or sports-related expenses

- Transportation

- Electronics not required for classes

- Smart phones

One way to make sure you’re using your 529 plan money the right way is to do a little math. So chalk up your qualified educational expenses (tuition, fees, books and supplies, eligible room and board, etc.).

Then, subtract money provided through tax-free educational aid. Here are some common examples.

- Pell grants

- Tax-free scholarships

- Tax-free employer educational assistance programs

- Benefits from the Veterans Educational Assistance Program

Next, deduct any credits you may receive from the American Opportunity Tax Credit or Lifetime Learning Credit. Uncle Sam won’t let you double dip on tax benefits for the same college spending.

The result of this equation would be your beneficiary’s adjusted qualified higher education expenses. So 529 plan withdrawals should not exceed this amount to make the most out of your account.

And keep in mind that you’d need to report your 529 plan expenses to the IRS, so make sure you keep records of what you spend these savings on.

529 plans and gift tax

And as you consider the tax benefits of a 529 plan, you may be wondering about paying any gift tax.

Contributions toward a 529 plan are considered gifts under IRS rules. But there’s a gift tax exclusion. For 2024, anyone can give up to $18,000 ($36,000 for married couples) per person without facing any gift tax implications.

But if you go over that limit, it doesn’t necessarily mean you have to pay any gift tax. That’s because of the lifetime gift tax exemption. For 2024, that’s $13.61 million ($27.22 million for a married couple giving jointly). So anytime you go over the gift tax exclusion, the excess amount counts toward that lifetime gift tax exemption.

Most people don’t go over the lifetime gift tax exemption and thus never pay any gift tax. But if you go over the gift tax exclusion for the year, you’d need to report it to the IRS for tracking purposes.

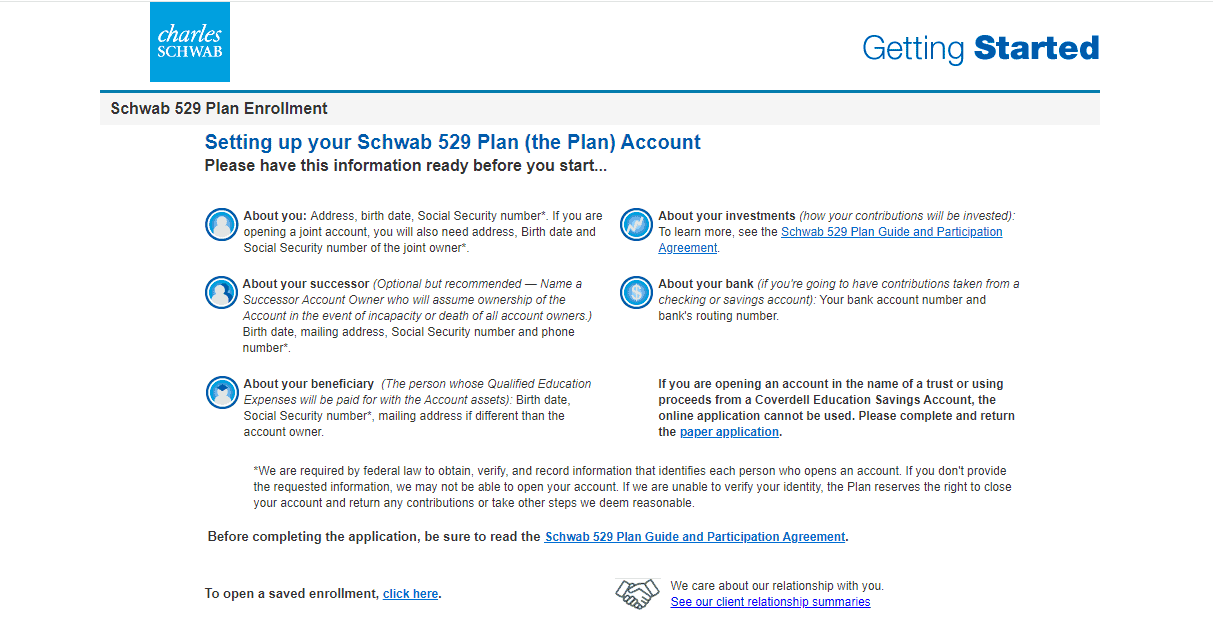

How to open a Schwab 529 plan

To open a Schwab 529 Education Savings Plan, visit the firm’s official product page and follow these steps.

1. Click “Apply Now”

2. Enter information about yourself and successor

3. Enter beneficiary’s information

This includes the following

- Birth date

- Social Security number

- Mailing address if different from the account owner

4. Select your investments

5. Enter banking information to fund your account.

Schwab 529 plan: The verdict

A 529 college savings plan can be a tax-efficient way to fund the college education of your child or any other loved one. Because the Schwab 529 Education Plan was established by the state of Kansas, it offers some exclusive benefits to residents of that state.

But anyone can open a Schwab 529 plan, regardless of residency. And with Schwab, you have the backing of a well-established financial services firm managing trillions in assets. You also get other benefits like the firm’s tailored menu of diversified investment portfolios that offer exposure to various asset classes and investment strategies.

And you can do more with Schwab than save for your child’s college education. You can invest in your retirement with the Schwab Roth IRA or save for future healthcare expenses with the Schwab HSA. But although you can link your Schwab credit card to your brokerage account, you can’t link it to your Schwab HSA.

But keep in mind that 529 plans are governed by the IRS. So outside of perks like state-specific tax benefits and exclusive investment menus, they would be generally uniform across providers.

And you can open a 529 plan through a variety of brokerages and state sponsors. So it’s important to do your homework. Additionally, you can open a custodial brokerage account on behalf of a minor. As the custodian, you would manage the account of then transfer its assets to your child when they reach the age of majority — typically between the ages of 18 and 25, depending on the state. You also have the option of opening a custodial robo-advisor account through the Schwab Intelligent Portfolios platform. This can be an ideal option for hands-off investors who want an automated investment portfolio for the benefit of a minor.

If you’re curious about any other part of the Charles Schwab, check out this page: a regularly updated list of all our Charles Schwab, news coverage, and lists of benefits.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.