If you’re self-employed or a small-business owner and your spouse is your only employee, you may be interested in a Schwab 401(k).

Officially called the Schwab Individual 401(k) plan or I401(k), this retirement savings account allows you to potentially make far higher contributions than you could with an individual retirement account (IRA) – and still receive similar tax benefits.

As a self-directed account, a Schwab 401(k) lets you choose from a variety of investments including commission-free stocks and exchange-traded funds (ETFs), as well as no transaction-fee mutual funds and more.

How does the Schwab Individual 401(k) plan work?

The Schwab Individual 401(k) plan is a type of Solo 401(k), as defined by the IRS. These accounts are designed for self-employed individuals that have no full-time employees other than their spouse.

With a Schwab Individual 401(k) plan, you may contribute as the employee and as your own employer. This is why Individual 401(k) contribution limits can be substantially higher than their counterparts.

In 2024, you could potentially contribute a maximum of $69,000 to a Schwab I401(k). Those aged 50 and over could make catch-up contributions of up to $7,500 for a total of $76,500.

Schwab Individual 401(k) contribution limit rules

When it comes to Individual 401(k) contribution limits, it helps to separate the limits that apply to you as an employee and yourself as the employer.

As an employee in 2024, you can contribute the lesser of $23,000 or 100% of compensation. Those 50 or older can make catch-up contributions of $7,500 for a total of $30,500.

And as your own employer, you can make what’s called an additional profit-sharing contribution of up to 25% of your compensation or net self-employment income. Your net self employment income is your net profit minus half your self-employment tax and the plan contributions you made for yourself.

But keep in mind that for 2024, the cap on compensation that can be used to determine your maximum is $345,000.

Still, the Schwab 401(k) can be lucrative if you’re a business owner and your spouse is your only employee. Your spouse can be a participant to the plan and contribute up to the employee contribution limits listed above. And as the employer, you can then make a profit-sharing contribution to your spouse’s account of up to 25% of their compensation.

As a family, you and your spouse could essentially double the $69,000 individual 401(k) contribution maximum.

Schwab 401(k) tax rules

Schwab Individual 401(k) tax rules depend on the type of account you open: traditional Individual 401(k) or Roth Individual 401(k).

When you contribute to a traditional I401(k), your contributions are tax deductible. So investing in a Schwab 401(k) can reduce your federal tax bills for the year you contributed. However, you’d owe ordinary income tax on qualified withdrawals. If you make withdrawals before age 59.5, you’d owe regular income tax on the withdrawal and a 10% penalty.

With a Roth Individual 401(k) plan, your contributions aren’t tax deductible. But the earnings portions of qualified withdrawals are tax free as long as you make these after reaching age 59.5 and you’ve had the account for at least five years. If you make withdrawals before reaching age 59.5, you’d owe taxes on the earnings portion of the withdrawals and a 10% penalty.

Schwab 401(k): The verdict

The Schwab Individual 401(k) plan stands out for its potential for higher contribution limits than other retirement accounts like IRAs or workplace retirement plans. As an employee and your own employer, you could potentially contribute a maximum of $69,000 to your retirement nest egg, while enjoying tax deductions.

And if you employ your spouse, you can both join the plan and essentially double that contribution maximum.

But as with all individual 401(k)s or solo 401(k)s, it has strict eligibility requirements. To invest in a Schwab Individual 401k(k) plan, you need to be self-employed with no employees – your spouse is the only exception.

Sole proprietors, C corporations, S corporations, partnerships, and limited-liability companies (LLCs) can open a Schwab Individual 401(k) as long as these eligibility requirements are met.

Plus, the Schwab 401(k) can deliver a hefty boost to your retirement savings. And you can choose from a traditional I401(k) or Roth I401(k). But overall, these plans can be complex.

Nonetheless, these aren’t your only retirement plan options if you’re self-employed. Schwab also offers a traditional IRA and a Roth IRA, which you can open with no maintenance fee and no minimum investment requirement. Both offer similar tax benefits to their I401(k) counterparts.

You can explore to see if a Schwab Roth IRA with eligible tax-free withdraws is right for you.

Additionally, you can learn about Schwab Intelligent Portfolios, a robo-advisor option that may be best for hands-off investors who rather let advanced computer systems and investment professionals handle their retirement savings. This robo-advisor option is available as a traditional and Roth IRA.

But those who want personalized guidance on every aspect of their financial lives and not just retirement can weigh the benefits of Schwab Advisor Services.

Additionally, you can learn how to open a traditional Schwab brokerage account for yourself or a custodial brokerage account for the benefit of a minor.

Regardless of account type however, Schwab clients can benefit from access to commission-free stock, ETF and options trading as well as award-winning research tools and market data from experts. And through the subsidiary Charles Schwab Bank, you can open checking accounts and the Schwab credit card. But keep in mind these five ways to avoid interest charges on credit cards. As a reminder, Charles Schwab Bank products like checking accounts, savings accounts and certificates of deposit (CDs) are FDIC-insured up to the applicable legal limits.

Schwab is a well-established financial services firm that has been around since the ‘70s. If you’re interested, you can learn more about the founder Charles Schwab.

How to open a Schwab Individual 401(k) plan

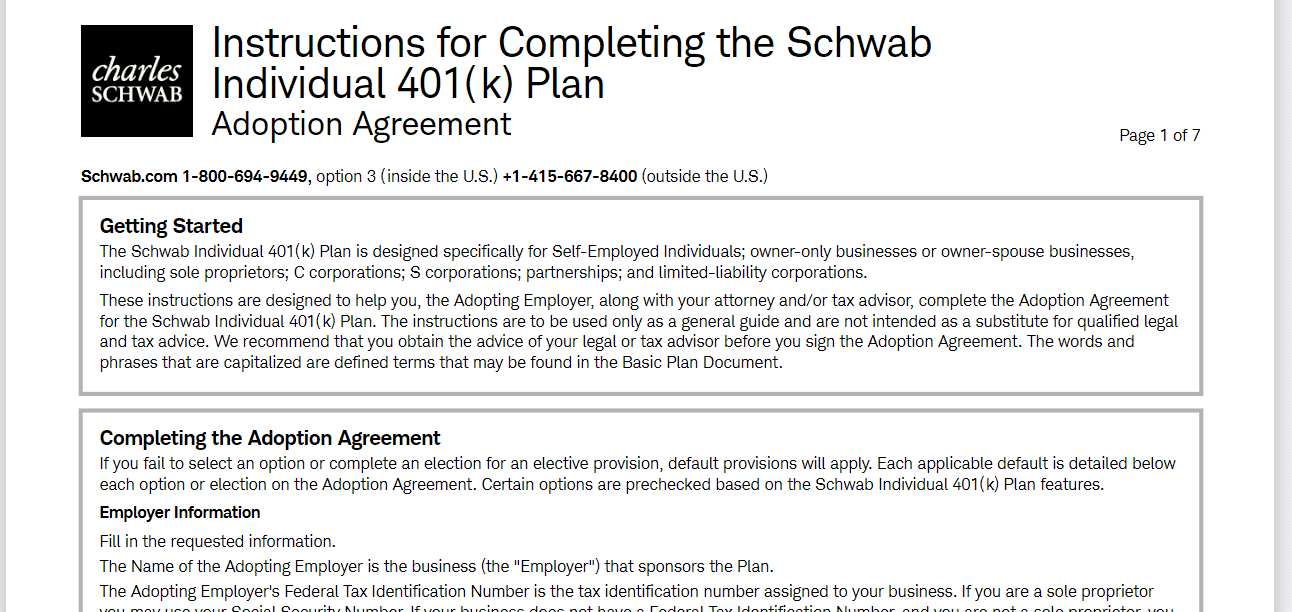

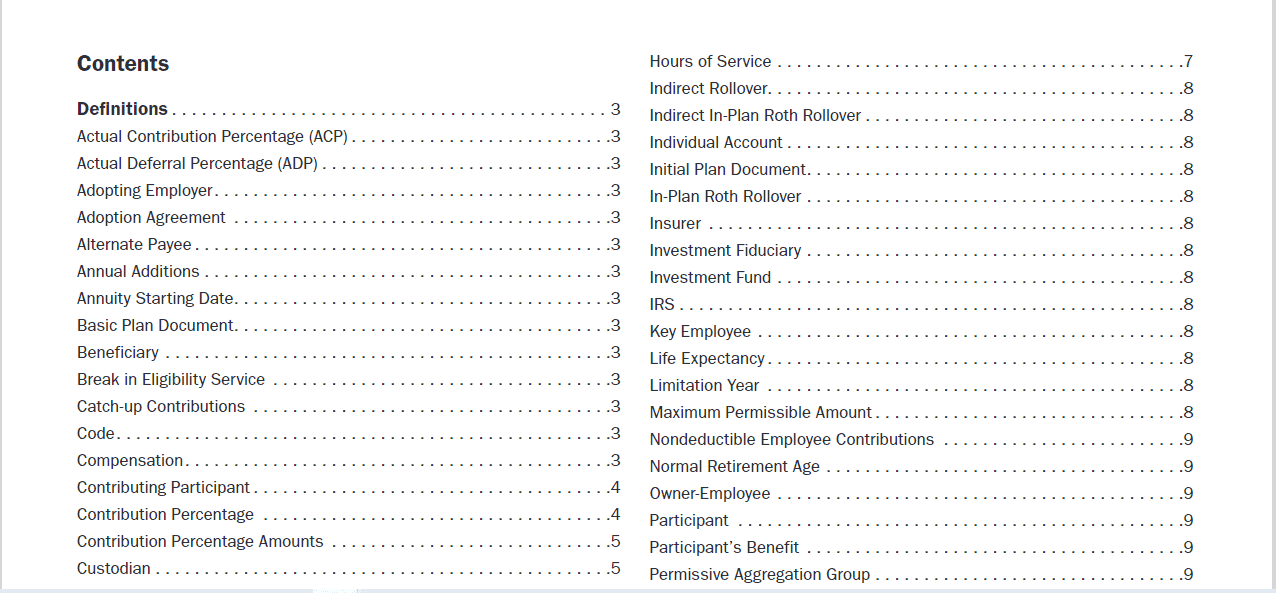

To open a Schwab Individual 401(k) plan, you need to fill out some paperwork. These forms can be found on the official webpage of the Schwab Individual 401(k) plan. After you visit the site, click on the relevant links and follow these steps.

- Complete and sign the Adoption Agreement & the Trustee and Custodial Agreement. Return signed copy to Schwab.

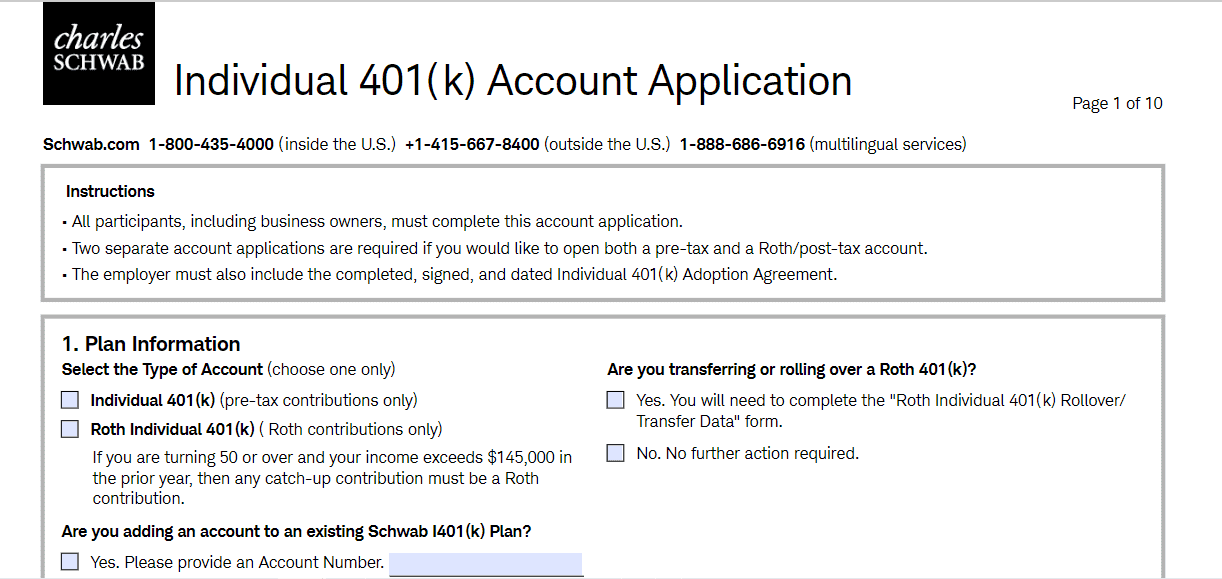

3. Complete account application and return to Schwab (You’d need to complete separate applications if you want both a traditional and Roth option).

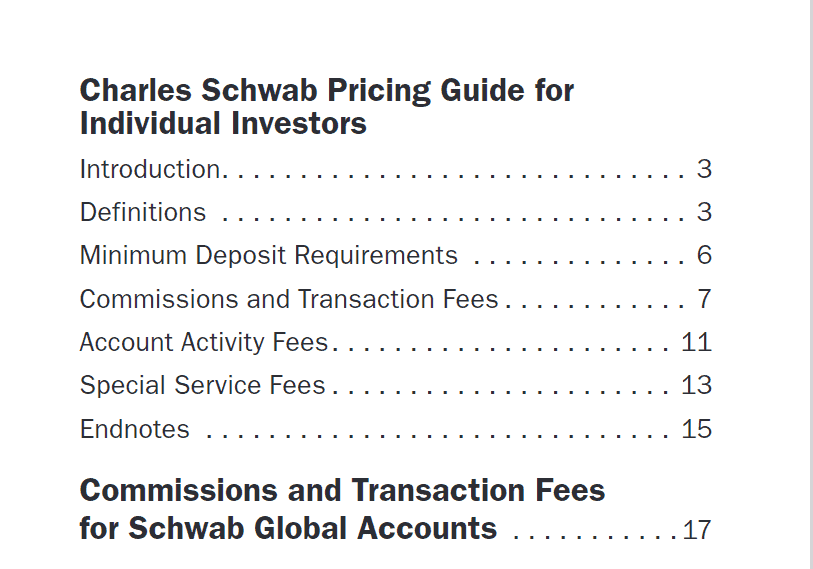

4. Distribute the pricing guide to all participants (Your spouse would be the only participant in this case).

If you want to learn more about Schwab, check out our regularly-updated list of Charles Schwab guides, news and coverage.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.