Investing

You Would Have Over $670,000 If You Invested $15k In This Tech Stock 10 Years Ago

Published:

While much attention has been devoted of late to high flying stocks dealing with hot trends, like Artificial Intelligence, cloud computing, social media, or other areas, technology covers a wide area. In fact, there are conventional tech stocks that might have been analyst darlings in the past that have quietly continued innovating and growing, but with less fanfare.

24/7 Wall St. has tracked a number of stocks over the period of a decade that have made triple and even quadruple digit percentage returns for those investors intuitive enough to have taken the plunge early. One such stock that is well known, since it’s a semiconductor company best known for its PC, video game graphics, and server chips: Advanced Micro Devices (NASDAQ: AMD).

Analogous to the rivalry between sneaker companies Adidas (Adolph “Adi” Dessler and brother Rudolph) vs. Puma (spun off by Rudolph Dassler), AMD was started roughly 10 months after Intel (NASDAQ: INTC) by a former Intel employee in the late 1960’s, and for nearly 50 years was perceived as an Intel copycat, especially when it came to CPUs (Central Processing Units).

The perception that AMD was a “second-best compromise” persisted in the computing community for decades. Given that AMD chips were often slower than Intel ones, albeit less expensive, manufacturer like IBM (NYSE: IBM) and Compaq, which is now owned by Hewlett-Packard (NYSE: HPQ) would install them in their student and budget computer desktops and laptops.

In 2014, Taiwan-born Dr. Lisa Su, a veteran of IBM and Texas Instruments (NASDAQ: TXN), became CEO of AMD. She immediately went to work expanding AMD’s sales in non-PC markets from 10% to over 40%, establishing a niche in the video gaming and embedded devices sectors.

Within three years under her leadership, AMD was able to unveil the Ryzen, which became a game changer.

AMD’s Ryzen CPU, based on a principle of multiple microscopic CPUs working in tandem, outperformed Intel’s CPU’s in speed and efficiency, and most importantly – cost only half as much.

Ryzen added tens of billions to AMD’s revenues, and in 2022, AMD surpassed Intel in market cap.

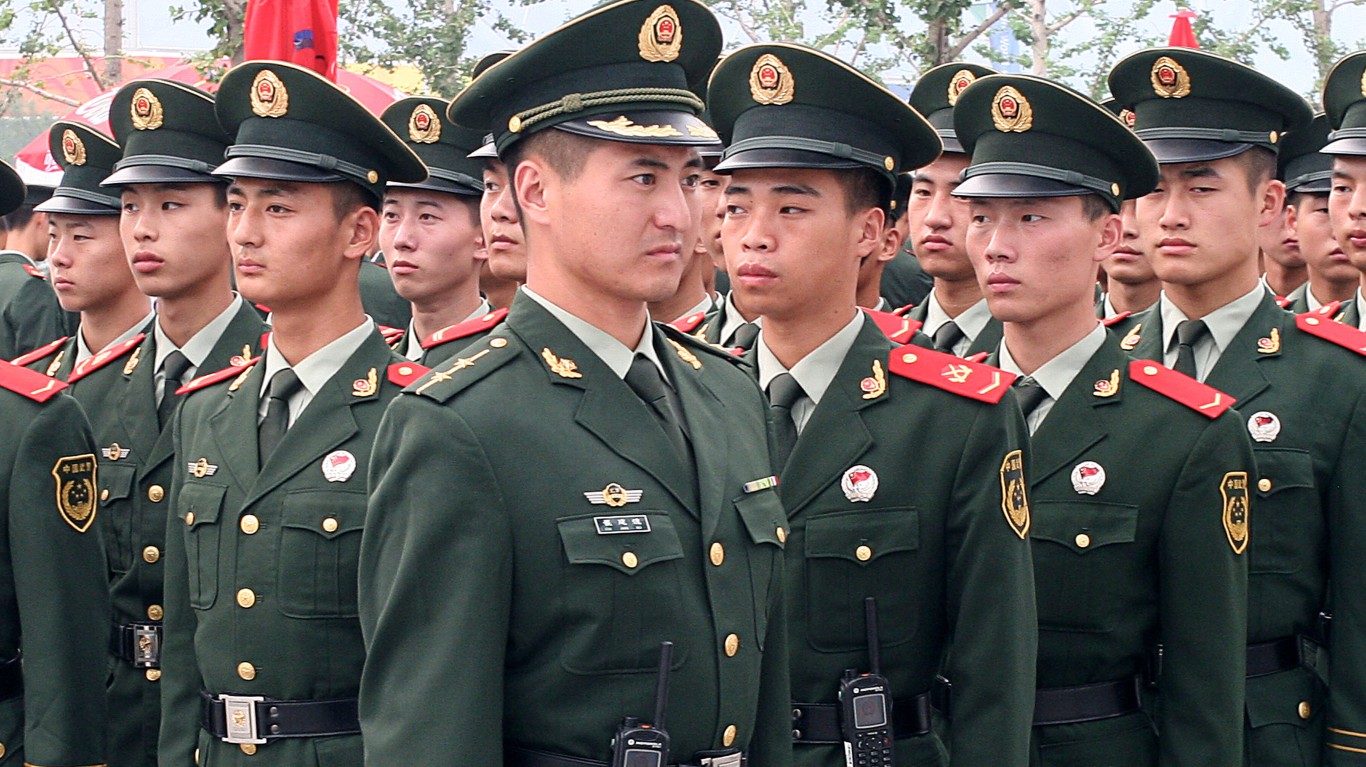

Unlike Intel, AMD does not have major manufacturing facilities in the US. Dr. Su’s reputation and ties to Taiwan have created a strong relationship with manufacturing plants owned by Taiwan Semiconductor Manufacturing Co, (NYSE: TSMC). While the relationship between AMD and TSMC remains strong, geopolitical tensions between Taiwan and China, whose CCP leadership continues to advocate for “reunification” with Taiwan, even if by military invasion, continues to be a risk factor.

In addition to Ryzen, AMD has also built a formidable reputation for itself with its graphic processors for video gaming and other applications.

AMD’s MI300 GPU (Graphics Processing Units) and similar products are addressing AI workloads for cloud computing, which is stirring up interest. Microsoft (NASDAQ: MSFT) and Oracle (NASDAQ: ORCL) are already using the MI300. As a result, AMD is now on the radar alongside other AI related stocks, such as Nvidia (NASDAQ: NVDA), and will likely trade in tandem with the AI sector going forward.

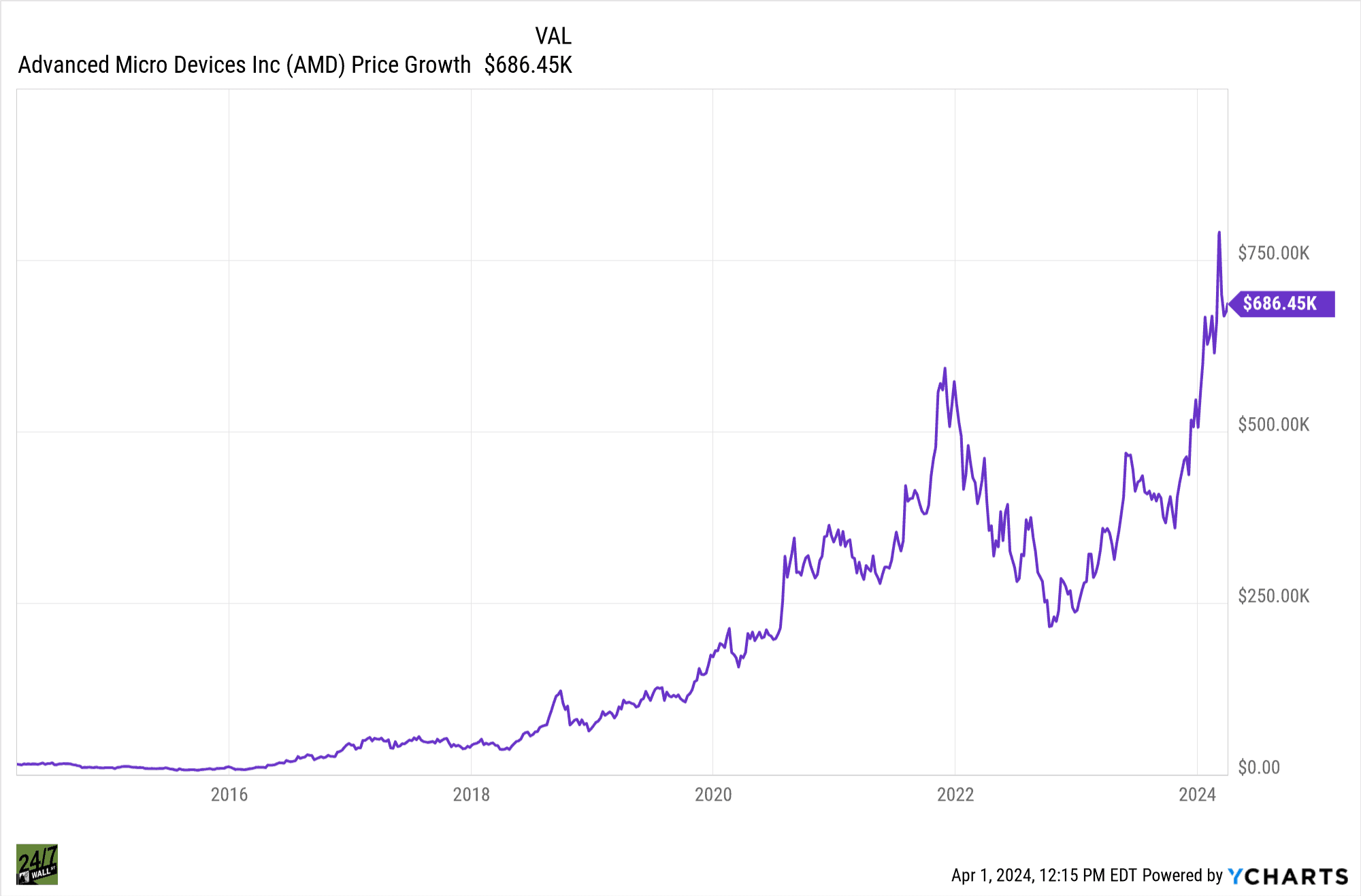

So just how much money would you have today if you invested $15,000 in AMD stock 10 years ago? At the beginning of Q2 2014, AMD stock was trading at roughly $4 per share. A $15,000 investment would have purchased 3,750 shares. At the time of this writing, AMD stock closed at $183. That equals $686,450,000 or a 44.7X ROI.

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.