Investing

11 Dave Ramsey Quotes Every 20 Year Old Needs To Hear

Published:

Last Updated:

Dave Ramsey is a famous author and radio personality who shares financial advice with his audience. As host of The Ramsey Show, an investing podcast, Ramsey covers a wide variety of financial topics, from climbing out of debt to budgeting.

For 20-somethings navigating the business world, finance can be a sensitive topic. Many young adults are struggling with student loan debt or working long hours for low wages, unable to keep up with the current renting and housing rates as well as inflation.

If you’re looking for support from a financial expert, here are 11 Dave Ramsey quotes every 20-year-old needs to hear.

“There is nothing wrong with having nice things, but when you are trying to buy nice things to be happy, you are going to hurt. It’s not going to work.”

Source: Dave Ramsey, Desert News interview

Money can buy — or at least support — a lot of things, including stability and sometimes even health. However, no matter how many flashy clothing items and luxurious products you invest in, you cannot buy true happiness and contentment. This is an important reminder to those in their 20s who are just beginning to navigate adulthood. From renting an apartment to starting a career to potentially even getting married, our 20s involve various milestones that look different to each individual. However, one of the most important sentiments to acknowledge at this age is that money — and the gifts it can buy you — is not a means to fulfillment.

“While I encourage people to save 100% down for a home, a mortgage is the one debt that I don’t frown upon.”

Source: Dave Ramsey, Business Insider interview

Many people buy houses in their late 20s or early 30s, and there shouldn’t be any sort of shame in having mortgage debt — especially in today’s market.

“We buy things we don’t need with money we don’t have to impress people we don’t like.”

Source: Dave Ramsey, The Total Money Makeover: A Proven Plan for Financial Fitness

As stated earlier, our 20s are often a time for figuring out who we are. Many 20-somethings fall into the common trap of using money to impress others. This might look like buying the most expensive designer products or even purchasing a car way outside your budget just for the wow factor. If you’re in your 20s, don’t throw money away on things you don’t actually love or need. Instead, save it or spend it on items or experiences that will actually enrich your life.

“Pray like it all depends on God, but work like it all depends on you.”

Source: Dave Ramsey, N/A

Whether you believe in a higher power or not, this quote is a great reminder to back your desires with intentional actions. For example, it’s not enough to just pray or wish for your ideal career or life. Instead, you have to take the proper steps to make your dream a reality. Your 20s are often a time for experimenting and hustling.

“Act your wage.”

Source: Dave Ramsey, N/A

While you might be tempted to keep up with all the latest and greatest trends, book the most luxurious trips, and dine at the classiest restaurants, spending outside of your budget will only haunt you in the long run. In fact, you could end up in more debt that will only set you back. While your 20s is a great time to enjoy your life and relish in your blessings, it’s also an important time to save your money and build a solid financial foundation.

“If you will live like no one else, later you can live like no one else.”

Source: Dave Ramsey, N/A

Carving your own path in your 20s is a great way to set yourself up for success later in life. Success might look different to you than others, and that’s okay — in fact, that’s something you should embrace. The harder you work toward your dream life now, the more quickly you will get there. All the hustling you do will eventually pay off.

“Fear is the enemy of hope.”

Source: Dave Ramsey, N/A

If you’re constantly fearing the worst possible outcome, you won’t allow hope to shine through. In your 20s, there will be many times that you’re doubting yourself or your decisions. However, if you choose to only dwell on your fear, you won’t be able to see the light at the end of the tunnel.

“For your own good, for the good of your family and your future, grow a backbone. When something is wrong, stand up and say it is wrong, and don’t back down.”

Source: Dave Ramsey, The Total Money Makeover: A Proven Plan for Financial Fitness

When you’re in your 20s, it’s easy to feel timid and hesitant to stand your ground against those who are older or more seasoned in their careers. However, this is a great time to define your values and grow a backbone that will allow you to align with your own mission.

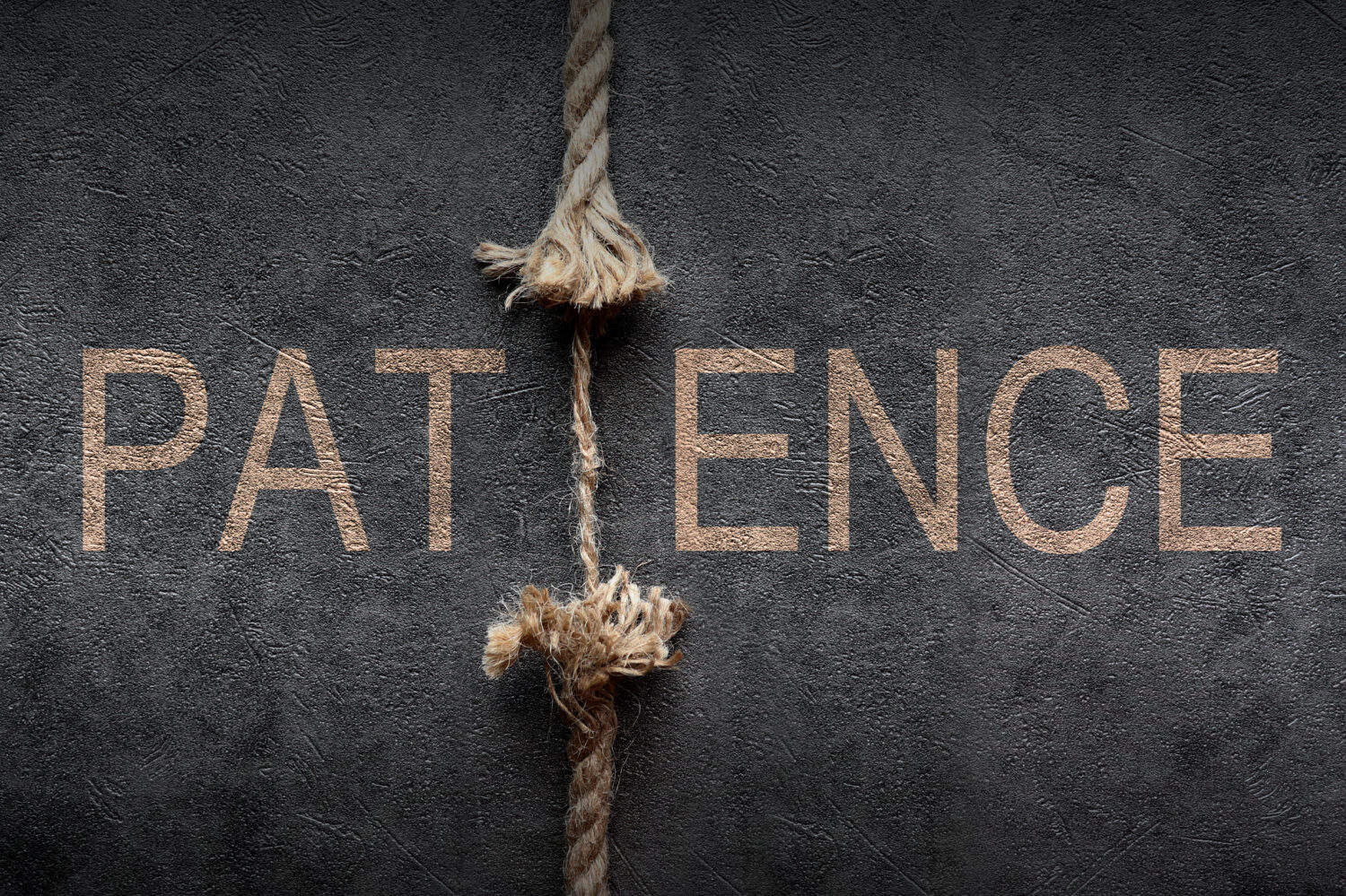

“It is human nature to want it and want it now; it is also a sign of immaturity. Being willing to delay pleasure for a greater result is a sign of maturity.”

Source: Dave Ramsey, The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness

In your 20s, you might be tempted to rush ahead and get your dream life. This could cause you to lose sight of the important steps you must take to get there. Don’t cut corners; be patient with your progress and align yourself with the right outcome.

“Change is painful. Few people have the courage to seek out change. Most people won’t change until the pain of where they are exceeds the pain of change.”

Source: Dave Ramsey, The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness

Takeaway: Embrace Change; Don’t Resist It

You’ll experience a ton of changes in your 20s, and this is a good thing. Rather than resisting the ebbs and flows and transitions in your life, let them happen and watch yourself transform.

“Study the habits of the people you want to be like and then imitate them. If they are succeeding, they must be doing something right.”

Source: Dave Ramsey, N/A

If you admire someone or their lifestyle, ask yourself what decisions and sacrifices they made to get there. If you want to succeed, pay close attention to the individuals who are successful in that particular space. Embody them. You’ll soon realize there are many open doors waiting for you.

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.