Investing

Want $15,750 In Passive Income? Invest $30,000 In These Dividend Stocks

Published:

Contrary to the proclamations made by The White House, the actual experience of many American households indicates that inflation does not seem to be under control. The price of staples, such as eggs, have doubled in the last few weeks.

Goldman Sachs (NYSE: GS) and Apollo Capital Management (NYSE: APO) finally came forward to break ranks. In response to the Fed’s prediction of 2.25% as the next cycle terminal rate of inflation, the Goldman Sachs’ report stated that, “ For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.”

Since inflation is continuing to eat into the buying power of every American without any end in sight for the future of at least 2024, augmenting income is becoming a growing priority. For those with investable funds that are in growth vehicles, it might be time to consider switching to dividend stocks, which have the potential for growth appreciation, but more importantly, can usually be relied upon to supply timely and much needed passive income on a quarterly or monthly basis.

We screened our 24/7 Wall St. dividend equity research database, looking for stocks that pay massive dividends, and we found a collection of companies that, combined, can generate over $15,750 a year in passive annual income if you invest just $30,000 in each stock at the time of this writing.

You may notice that 4 out of the 5 dividend stocks listed here are Business Development Companies. The current economic climate, where major banks like Chase (NYSE: JPM) and Bank of America (NYSE: BAC) are experiencing difficulties with Basel III international compliance and others like Silicon Valley Bank (OTC: SIVBQ) are going belly up. This has created a void where well capitalized BDCs with savvy managers can create the liquidity and cash flow that many small, midsized, and even upper tier private companies require.

Headquartered in Miami, FL, WhiteHorse Finance, Inc. is a Business Development Company that finances lower and mid-tier companies with growth capital in the form of senior secured notes or first lenient notes. It typically originates its debt underwritings in the the $25 million to $50 million range for US companies in the $50 million to $350 million enterprise value category.

WhiteHorse’s preferred industrial sectors are in retail, business office, and healthcare related supplies and services, building supplies, cable & satellite, software, leisure, and data processing outsource services

As one of the top 5 largest private equity firms in the world, the NY based Carlyle Group (NASDAQ: CG) is also a huge asset management company that spans many industrial sectors and has investments from all over the world. While its multiple defense industry deals with Northrop Grumman (NYSE: NOC), General Dynamics (NYSE: GD), Hughes Aircraft, United Defense Industries, and others gave them an ominous reputation, Carlyle’s asset management team has stakes in most every industry and asset class that can be profitable. Carlyle Secured Lending, Inc. is Carlyle Group’s entry into the BDC arena.

On the debt finance origination side, Carlyle prefers to use lien debt, senior secured notes, second lien secured and unsecured note configurations, and mezzanine loans, but won’t dismiss equity investments. Middle market healthcare, pharmaceutical, aerospace & defense, business services, software, gaming and leisure, high tech, real estate, and banking & finance companies from the US, UK, Luxembourg, Cyprus and Cayman Islands are the current scope of interest. Financing per deal ranges from $25 million to $100 million.

Asset manager Nuveen Investments is a wholly owned private subsidiary of the Teachers Insurance and Annuity Association of America (TIAA). However, it has spun off a number of funds that manage independent portfolios which have become both lucrative and large.

With annuities as a key mandate of its parent, Nuveen has a significant footprint in the fixed income arena, operating from its offices in Chicago, IL. This is reflected in the Nuveen Floating Rate Income Fund, a closed end bond fund which is focused on the US high yield debt market.

Of the $165 billion AUM Blue Owl Capital has on its books, slightly over half is devoted to the credit markets. As a Business Development Company, Blue Owl deploys a range of debt origination tools that include: senior secured loans, unsecured, subordinated, and mezzanine loans, and will also use preferred stocks, warrants, and direct equity.

Use of proceeds can be growth based acquisitions, product or market expansions, recapitalizations, or refinancings.

Blue Owl prefers middle to upper tier US client companies with $10 million to $250 million EBITDA, or $50 million to $2.5 billion in annual revenues.

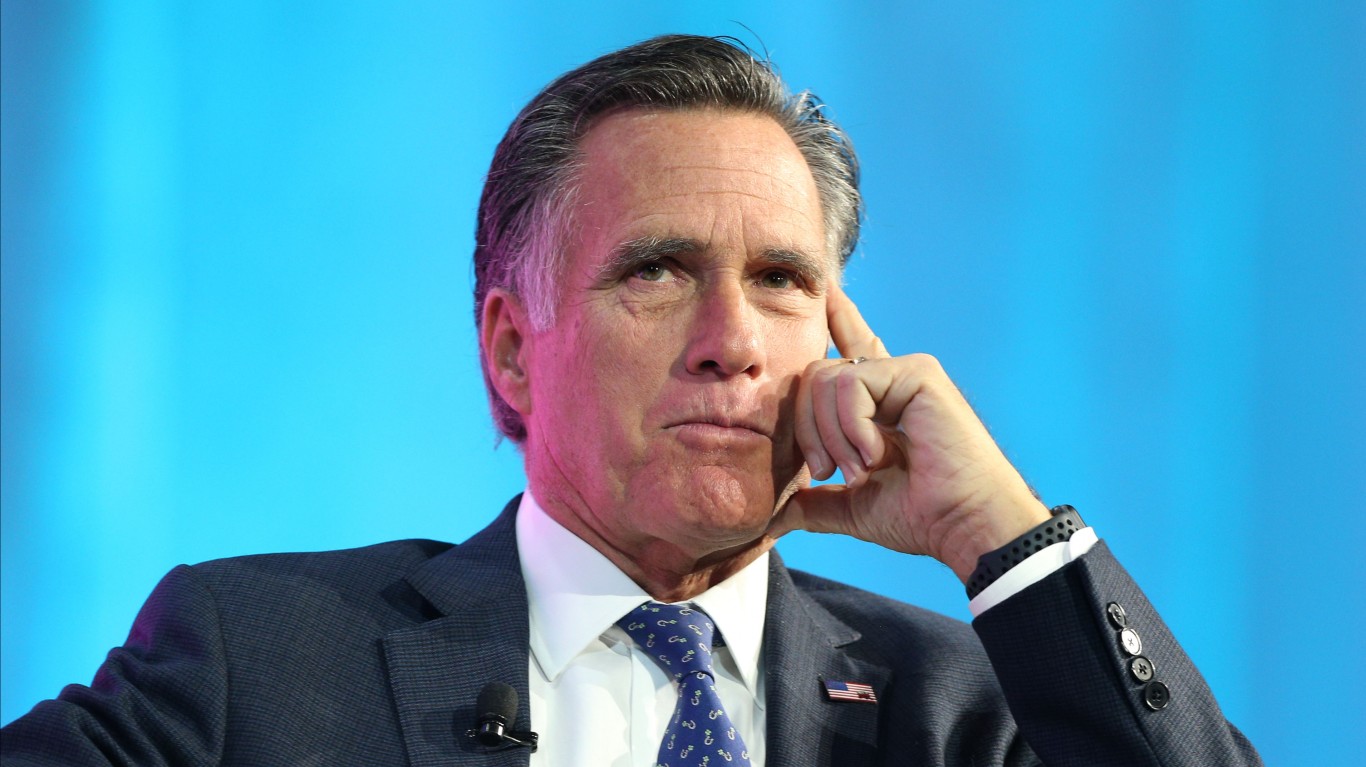

Mitt Romney’s 2012 presidential campaign is the first time that Middle America first learned about his founding of Bain Capital, touting his HCA hospital chain turnaround as an example of his business acumen for solving the US government’s economic woes. . Although the Boston, MA based private equity and asset management firm had been doing business since 1984, Bain’s role in some highly publicized LBOs (ex: Guitar Center, Toys ‘R’ Us, Clear Channel and Burlington Coat Factory) that wound up losing thousands of jobs and saddling high interest debt on companies was seized by journalists as red meat for their readers.

Despite the high profile flops, Bain Capital has remained in the game and has since been able to thrive, and competes with its rivals on all market fronts. Bain Capital Specialty Finance, Inc. is Bain’s BDC arm. .

| Name: | Yield: | Annual Passive Income |

| WhiteHorse Finance, Inc. (NASDAQ: WHF) | 12.39% | $3,717 |

| Carlyle Secured Lending, Inc. (NASDAQ: CGBD) | 11.64% | $3,492 |

| Nuveen Floating Rate Income Fund (NYSE: JFR) | 11.27% | $3,381 |

| Blue Owl Capital Corporation (NYSE: OBDC) | 10.84% | $3,252 |

| Bain Capital Specialty Finance, Inc. (NYSE: BCSF) | 10.60% | $3,180 |

| Total: | $17.022 |

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.