If you’re looking to open a Charles Schwab brokerage account, you can complete the process online within a few minutes. Here’s how to do it step-by-step.

1. Visit the Schwab brokerage account page

Here, you can decide whether you want to open an individual account or a joint account.

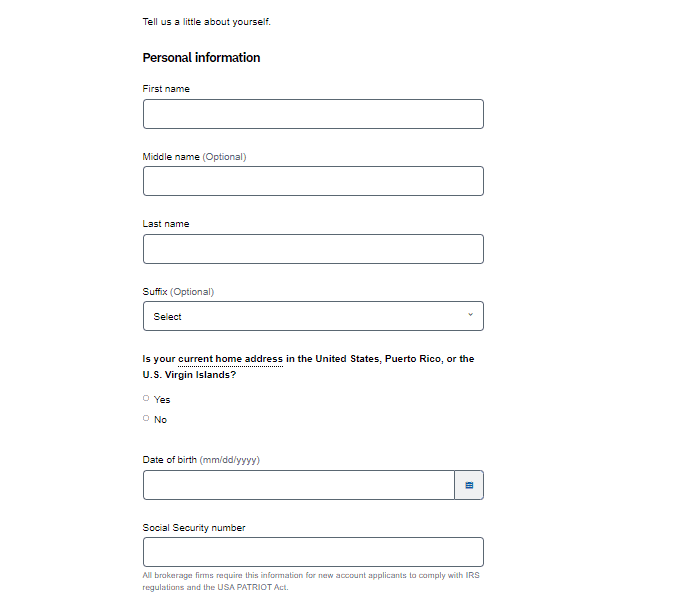

2. Fill out personal information

3. Review and agree to regulatory disclaimers

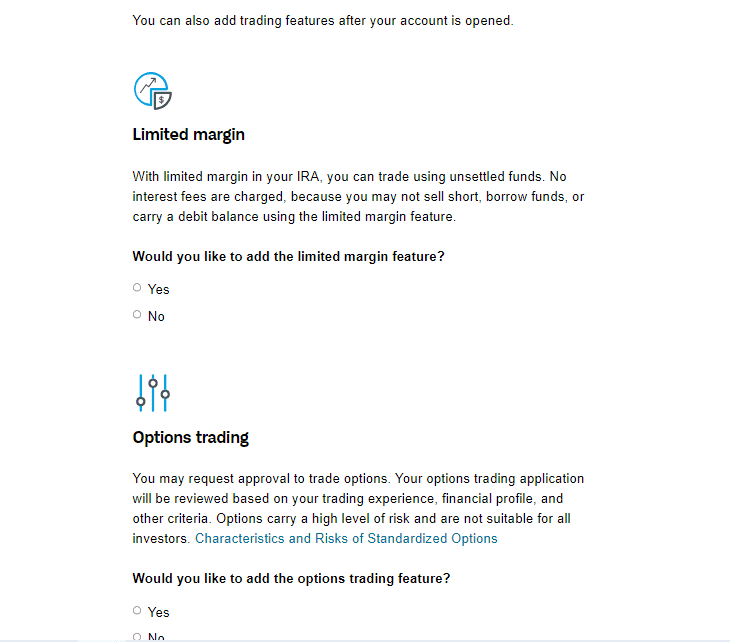

4. Choose features

Here, you can choose to add free features like thinkorswim, an advanced research and trading platform available via desktop, mobile or web. You can also select to be approved for options trading. You can select these features after creating your account too.

4. Review your application

Take a look at the information you provided and make sure it’s accurate.

5. Finalize the agreement

6. Pick your investments

Schwab offers a variety of securities including the following

- Stocks

- Bonds

- Mutual funds

- ETFs

- Options

- Futures contracts

- Forex

Why open an account with Charles Schwab?

Charles Schwab is one the largest brokerage companies in the country and has been providing services since the 1970s. Today, it oversees more than $8 trillion in assets and services more than 35 million accounts. Schwab was also one of the first firms to offer commission-free trading of stocks, exchange-traded funds (ETFs) and options.

But you can do more with Schwab than just open a brokerage account. You can start saving for retirement by opening an individual retirement account (IRA) or a Schwab Roth IRA. If you want to begin investing in your child’s college education, you can see if the Schwab 529 college savings plan is right for you.

And if you’re a hands-off investor, you may want to learn about Schwab Intelligent Portfolios. This is a robo-advisor platform that automatically builds, manages and rebalances a diversified portfolio based on your financial goals.

Additionally, you can link your regular Schwab brokerage account to the Schwab Investor Card. Using this card, you can earn cash-back rewards automatically reinvested into your brokerage account.

If you want to learn more about Schwab, check out our regularly-updated list of Charles Schwab guides, news and coverage.

Find a Qualified Financial Advisor (Sponsor)

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.