Schwab’s automated investing platform is called Schwab Intelligent Portfolios. This robo-advisor service creates an investment portfolio based on your financial goals, risk tolerance and other factors. It also monitors and automatically rebalances your portfolio to stay in line with your objectives.

If you think a Schwab robo-advisor is right for you, you can open an account online within a few minutes. Just follow these steps.

1. Visit the Schwab Intelligent Portfolios page and click on “Get Started.”

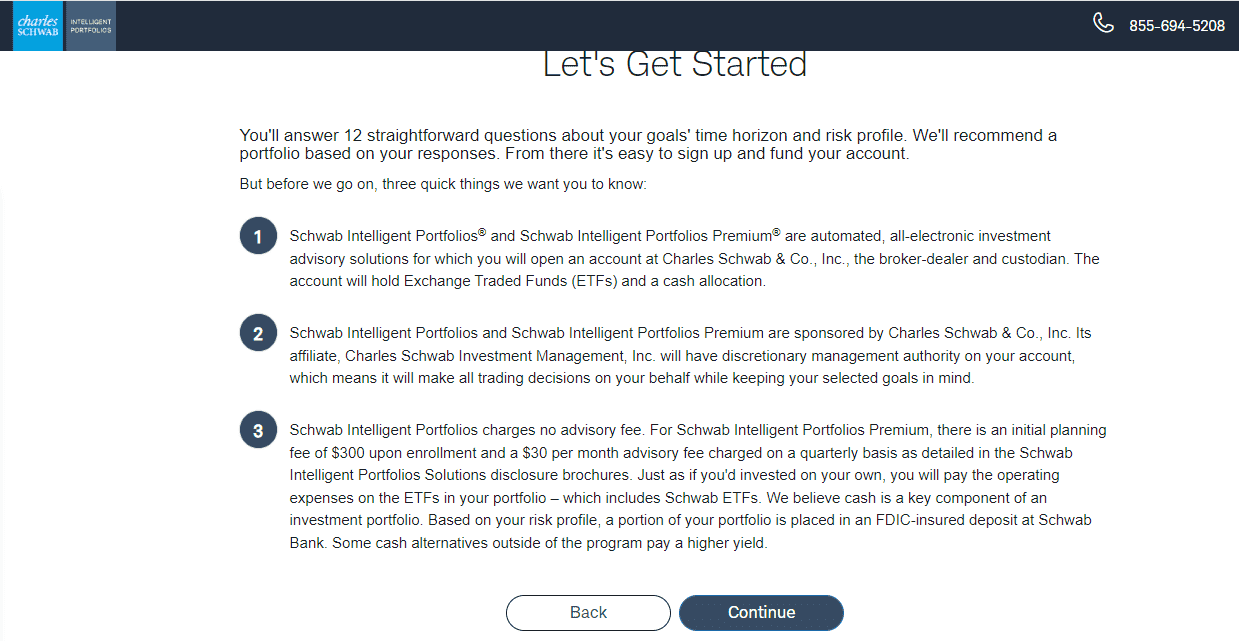

2. Review basic information

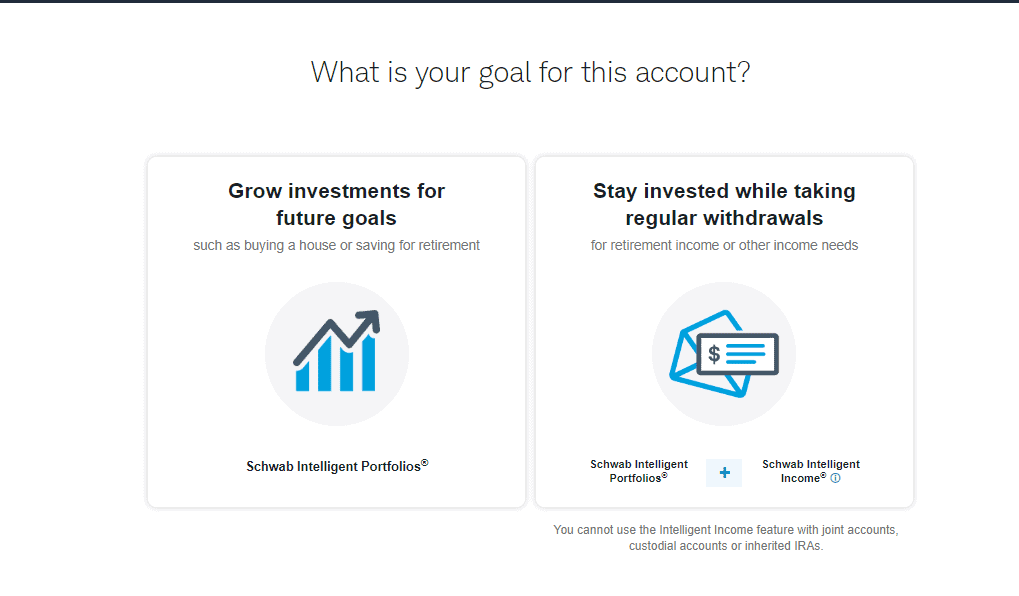

3. Choose a goal for your portfolio

Here, you can decide whether you want to make your portfolio a long-term investment or an account that you would make regular withdrawals from to support needs like retirement income.

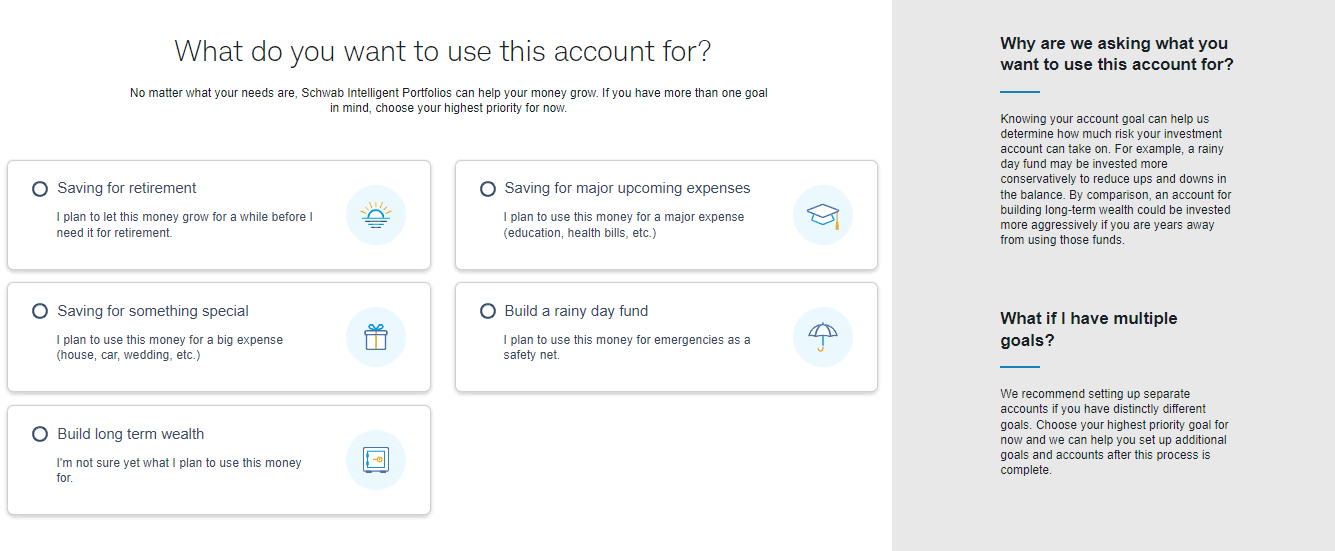

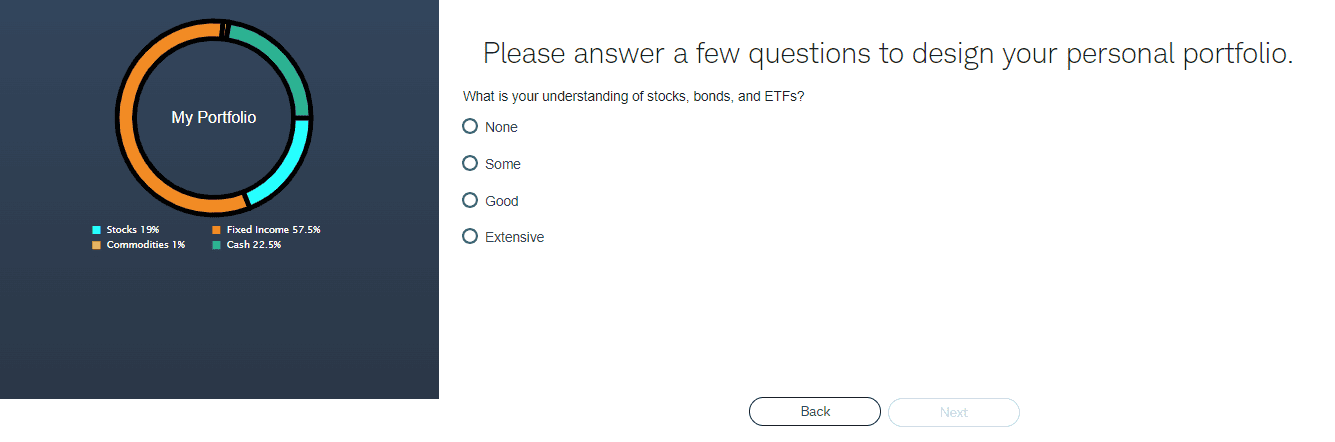

4. Answer a few questions and follow the prompts

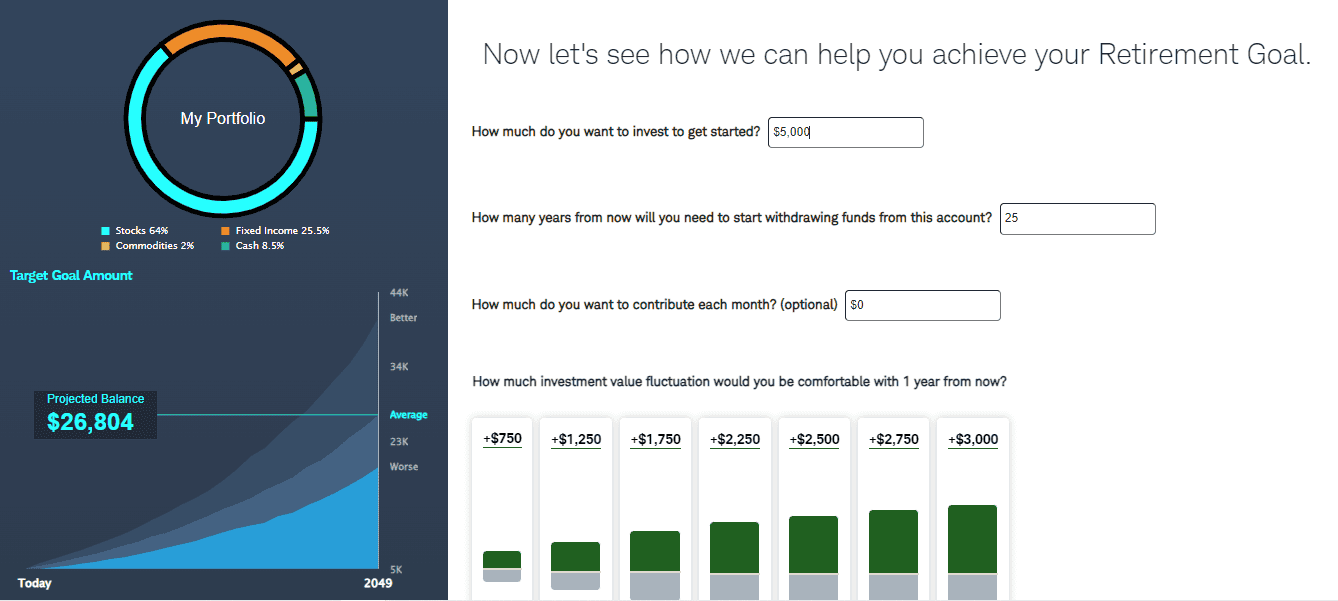

Throughout the sign-up process, you’d be asked questions about how comfortable you are with investment losses, the types of markets that gain your interest, the type of account you’d like, and more.

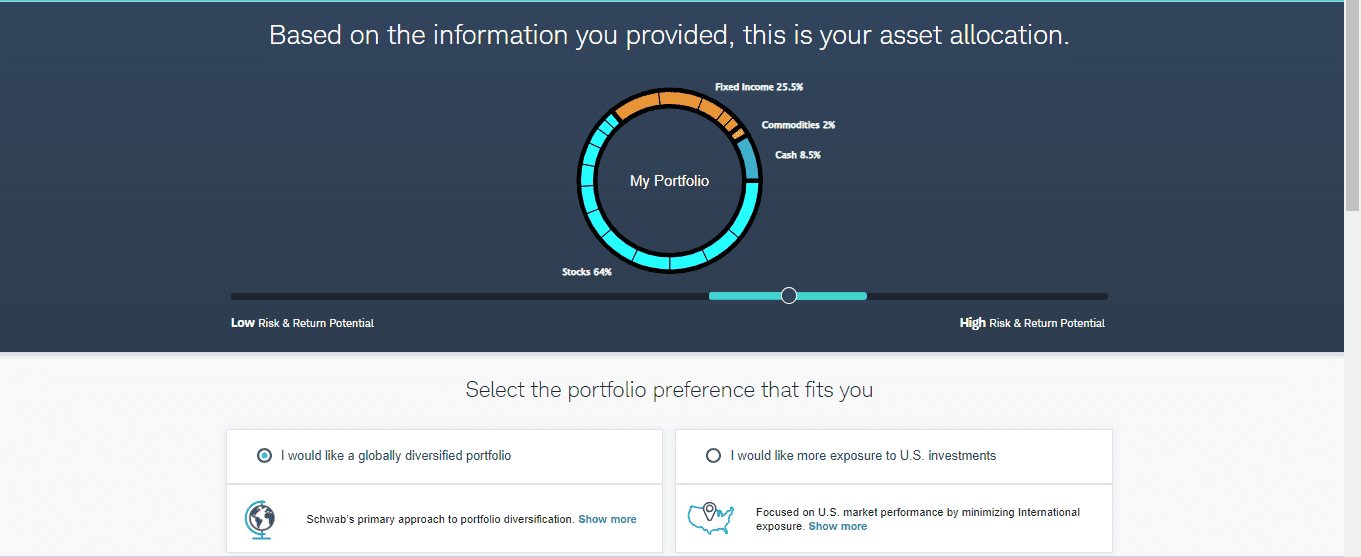

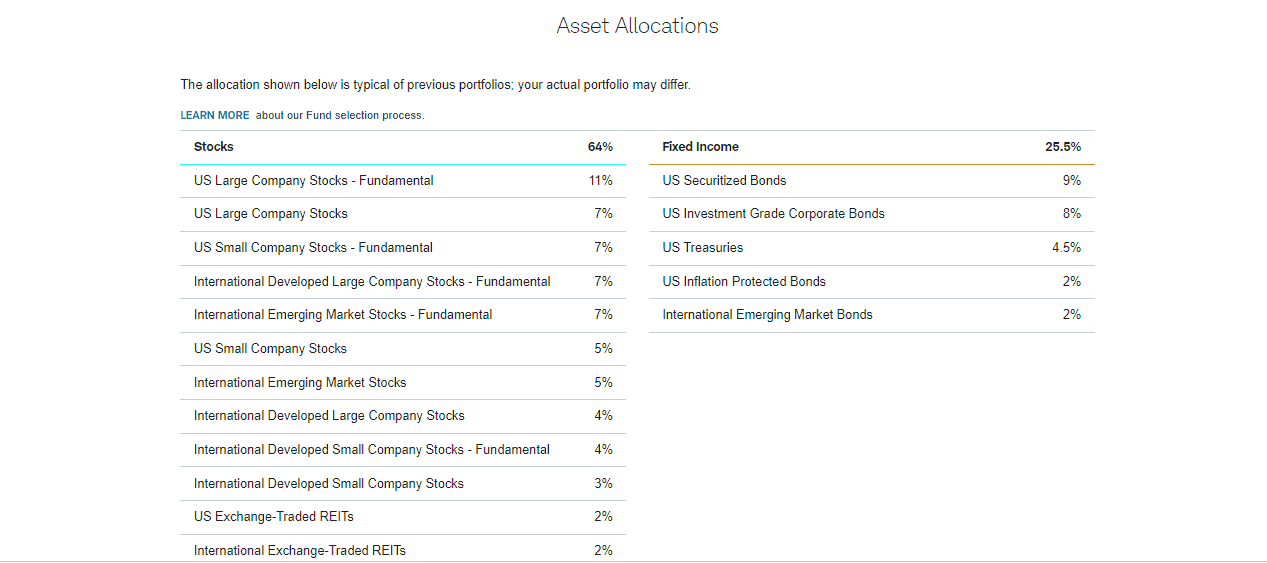

Toward the end of the process, Schwab would recommend a diversified portfolio and present you with its asset allocation.

5.Choose which version of Schwab Intelligent Portfolios you want

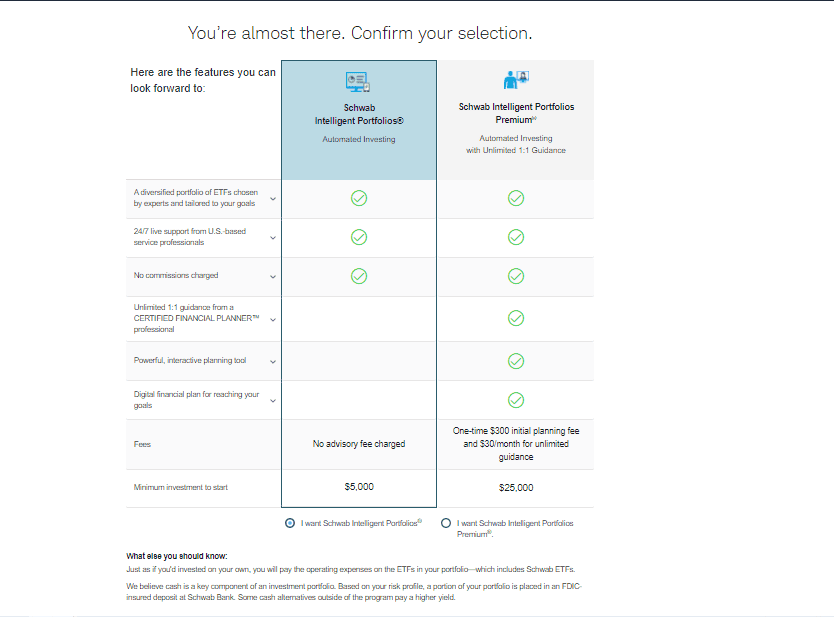

After you agree to take the portfolio Schwab recommended, you can choose whether you want the basic automated investing account or Schwab Intelligent Portfolios Premium. The premium version gives you unlimited access to a certified financial planner (CFP).

Schwab Intelligent Portfolios Premium requires a minimum investment of $25,000 along with a one-time $300 planning fee and a $30 monthly advisory fee.

Why Invest in Schwab Intelligent Portfolios?

As a robo-advisor, Schwab Intelligent Portfolios lets you put your investments on cruise control. The platform uses advanced technology and the expertise of investing experts to construct, manage, and monitor client portfolios in order to best meet their needs.

These portfolios are built with exchange-traded funds (ETFs), which are known for their low operating costs. So Schwab Intelligent Portfolios could be cost-effective and strategically diversified investment options for hands-off investors.

However, the regular Schwab intelligent Portfolios account requires a minimum investment of $5,000. That could be hefty for some investors and you can find similar, lower-cost options elsewhere. And tax-loss harvesting features are only available for taxable portfolios with at least $50,000.

However, the basic Schwab Intelligent Portfolios account doesn’t charge an advisory fee. Plus, Schwab is an established financial services firm with high customer satisfaction ratings. You can see if Schwab automated investing is right for you by checking out our review of Schwab Intelligent Portfolios.

Additionally, you can open a self-directed brokerage account for yourself or a custodial account for the benefit of a minor.

Schwab has been providing financial services since the 1970s and remains one of the nation’s largest brokerage firms with more than $8 trillion in assets. You can take a look at its founder by reviewing our profile of Charles Schwab.

If you want to learn more about Schwab, check out our regularly updated list of Charles Schwab guides, news and coverage.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.