If you want to help your child be smart about money and learn about the value of investing, one way you could do it is by opening a custodial account on their behalf. You can open one through various brokerages including Charles Schwab.

A Schwab One Custodial account allows you to establish and manage an investment portfolio on behalf of your child. Once they reach the age of majority, the account becomes theirs. That age ranges from 18 to 25 depending on the state.

Schwab doesn’t charge a maintenance fee or account opening fee on its custodial accounts. And as with a traditional Schwab brokerage account, you can trade commission-free stocks, ETFs and options within your account.

How does a custodial account work?

When you open a Schwab custodial account on behalf of a minor, it functions similarly to a traditional brokerage account. You manage the account and you can choose from a range of investments including the following.

- Stocks

- Bonds

- ETFs

- Mutual funds

- Treasury securities

- Municipal securities

You’d also have access to Schwab’s award-winning research tools including stock screeners and investing simulators, as well as research from third parties like Morningstar and Schwab financial experts.

You can pick and manage these investments by the minor’s side to teach them about investing strategies. But once they reach the age of majority, the account is theirs and they can do whatever they want with it.

But you should also keep in mind that your contributions to a custodial account are considered irrevocable gifts to the minor. This means you can’t take the money back. Plus, any withdrawals from the account must cover expenses for the direct benefit of the minor prior to their reaching the age of majority.

And be aware that selling investments that have grown can trigger a taxable event.

Custodial accounts and taxes

If you sell any investments within a custodial account that have generated income in the form of capital gains, interest or dividends while the beneficiary is a minor, that income may be subject to taxation. Here’s how it breaks down for 2024.

- First $2,600: Tax free

- Above $2,600: Taxed at your tax rate

And because contributions to a custodial account are irrevocable gifts to the beneficiary, these may come with gift tax implications. But don’t fret.

The annual federal gift tax exclusion allows you to give up to $17,000 ($36,000 for married couples) to anyone in 2024 without facing any gift tax implications.

But even if you breach that level, it doesn’t mean you need to actually pay gift taxes. However, you’d need to report it to the IRS so they keep track of your lifetime gift tax exclusion. This is the amount of money you’re allowed to give within your lifetime before you may owe gift taxes.

For 2024, the lifetime gift tax exclusion is $13.61 million. This is also called the lifetime estate and gift tax exemption.

Schwab custodial account: The verdict

Opening a Schwab custodial account can be a great way to manage a brokerage account on behalf of your child or another minor. Once that child becomes an adult, they own the account and can use it as they please.

You can manage this account alongside your child using Schwab’s robust research tools and their hardy menu of investment options. As your portfolio develops, your child can learn more about the values of investing strategically, as well as the risks involved.

But keep in mind that even though you manage the custodial account, any withdrawals must directly benefit the minor. And earnings on those withdrawals may be subject to varying tax calculations.

Nonetheless, a custodial account isn’t your only option when you want to meet specific goals. If you want to invest in your child’s future college education, a 529 plan may offer more flexibility and provide distinct tax benefits. You can also change beneficiary of a 529 plan anytime. You can explore the Schwab 529 plan to see if it may benefit you and your child.

And if you want to give your kid a boost in their retirement savings, you can open an individual retirement account (IRA) or Roth IRA as a custodial account on their behalf. Weigh the pros and cons of the Schwab Roth IRA to see if it could be a better option.

But regardless of your goals, a custodial account can be beneficial in helping your child understand and value of money at a very young age.

How to open a Schwab custodial account?

If you’re ready to open a Schwab One custodial account on behalf of a minor, follow these steps.

1. Visit the official Schwab One Custodial Account page and click on “Open a custodial account.”

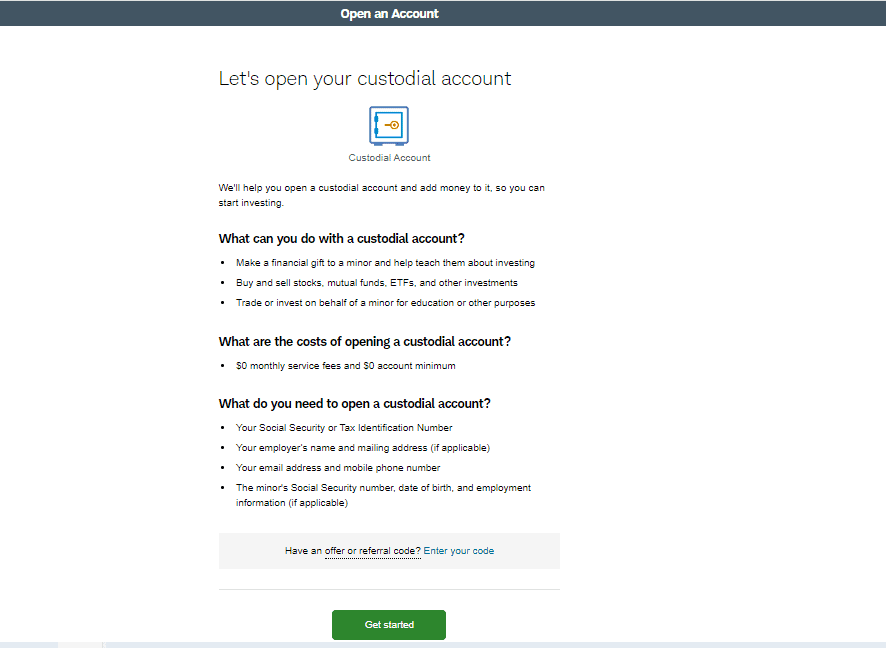

2. Gather required information and click on “Get Started.”

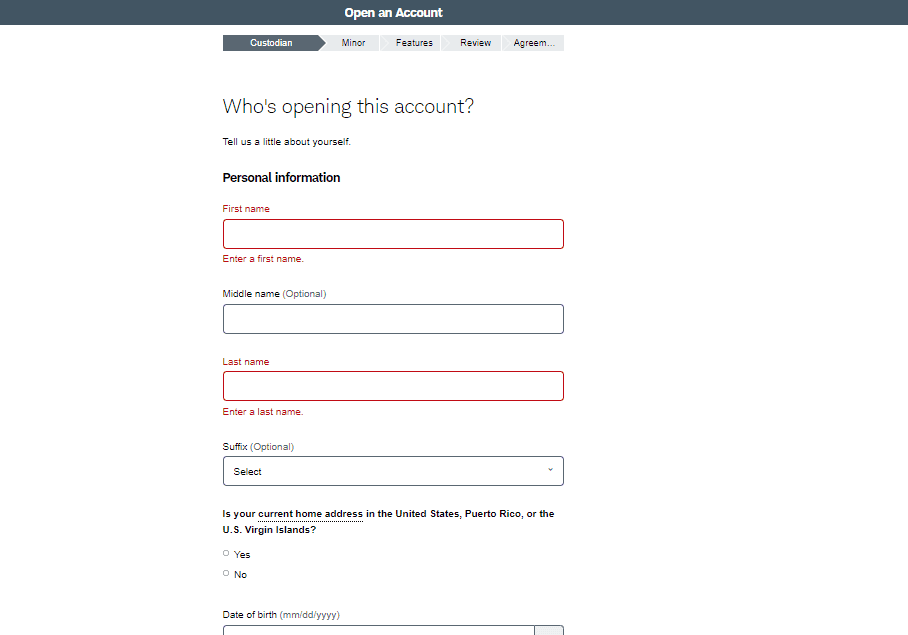

3. Fill out personal information

4. Fill out information about your child

5. Select features you’d like including research tools

6. Finalize the agreement

7. Pick your investments

If you want to learn more about Schwab, check out our regularly-updated list of Charles Schwab guides, news and coverage.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.