Investing

If You Invested $5000 In GameStop 5 Years Ago, This Is How Much You Would Have Today

Published:

Dumb Money is a 2023 comedy starring Paul Dano, Pete Davidson, Nick Offerman and Seth Rogen about the 2021 rapid rise and fall of GameStop (NYSE: GME) stock. GameStop is the world’s largest retail chain for video game fans, with over 4,400 outlets around the globe, but is best known in the investing world as the first of the “meme” stocks.

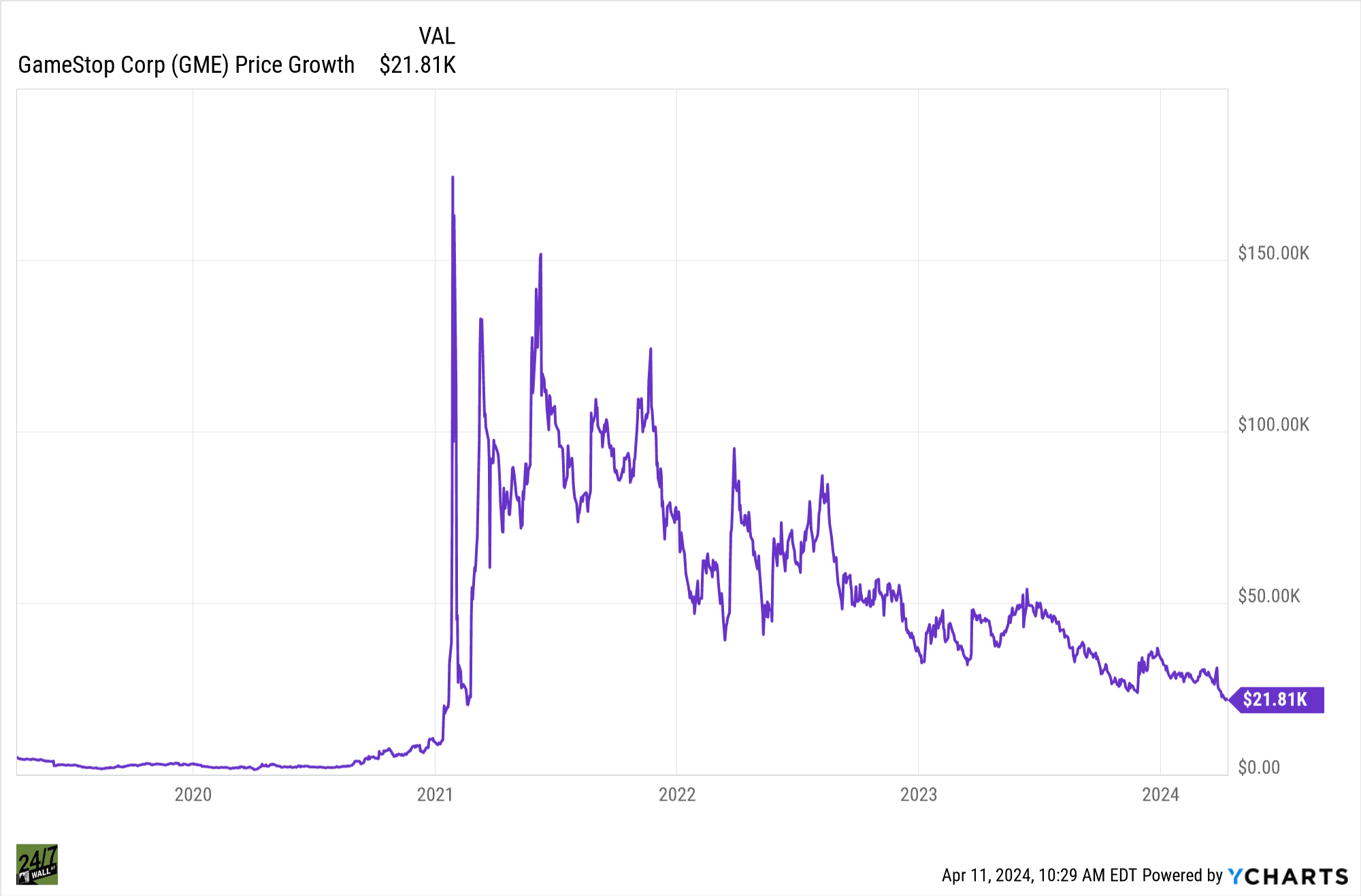

If there was any phrase to encapsulate meme stocks and their volatility in the market, one could say, “easy come; easy go.” During the period covered in Dumb Money, GameStock reached a high of $500 ($125 split-adjusted) per share. Nevertheless, a $5,000 investment made five years ago in GameStock would be worth several multiples more, even today, when GameStop’s meme glory has since faded. However, some historical context might be in order first:

GameStop’s origins are complex and labyrinthian. Its roots lie with Texas software retailer Babbage’s in the 1980s, and its decision to start selling computer games for Atari 2600 game consoles, as well as Nintendo (OTC: NTDOY) games. Following two subsequent mergers, the existing entity, renamed as NeoStar, was acquired by book retail chain Barnes and Noble Booksellers in 1999. Barnes and Noble, which also owned video game seller FunCoLand and video game magazine, Game Informer, merged them with NeoStar to become GameStop, and launched its spinoff IPO in 2002.

With capital markets money fueling its expansion, GameStop went on a buying spree that quickly extended its reach into Europe, PacRim, Australia, UK, Scandinavia, and in malls throughout the US. Companies like EB Games, Micromania, Jolt Online Gaming, Free Record Shop all fell under the GameStop umbrella.

As online games started to gain popularity, GameStop began acquiring portals and publishers, like Kongregate, Spawn Labs, and Impulse. It also began diversifying into wireless, cell phone services, and other related fields by purchasing BuyMyTronics, Simply Mac, Spring Mobile, GeekNet, and then acquired over 650 locations from AT&T and Radio Shack to repurpose them for GameStop’s subsidiaries.

Not unlike the impact video streaming had on Blockbuster Video and its DVD and videotape business, downloadable games would rapidly erode GameStop’s fortunes. As the company’s size encumbered its ability to react more quickly to market changes, a series of no less than five CEO management changes in three years would further paralyze GameStop as losses continued to mount. Even in spite of the pandemic lockdowns, GameStop would continue to survive, as it added merchandising and signed deals with Microsoft for XBOX X and S Series sales.

The consensus of stock analysts seem to concur that there are three components to a meme stock:

As depicted in Dumb Money, GameStop met all of these criteria, which caused it to jump as high as 1500%, The Reddit and r/wallstreetbets retail investors who followed GameStop online caused millions of retail sized buy orders to spook institutional shorts into covering with additional buying, thus creating a classic “short squeeze” scenario.

GameStop’s executive management woes continued after the meme stock roller coaster. At the time of this writing, the stock is at $10.94, a far cry from the aforementioned $500 short squeeze high.

Nevertheless, GameStop stock at this same time five years ago was trading at $2.33. The stock would drop as low as $0.83 in July, 2019 before zooming up to $500 ($125 split adjusted) in 2021 and then plummeting down over the next three years.

$5,000 at $2.33 per share of GME would have purchased about 2,145 shares. So even the real Diamond Hands of the GameStop boom would still be up 340% if they bought 5 years ago and those shares would be worth $21,960.

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.