Charles Schwab is a full-service brokerage firm that’s been around since the 1970s. It offers access to commission-free stocks, exchange-traded funds (ETFs) and options. You can also invest in mutual funds, bonds, futures and more.

Schwab stands out for customer service satisfaction and its award-winning investment research tools.

You can research investments and place trades on Schwab.com, the Schwab mobile app or the thinkorswim platform (available on web, desktop and mobile).

But if you’re interested in opening an account with Schwab, you’re probably wondering what it’s like to trade on their platforms.

So let’s get started with the basics.

How to place a trade with Schwab

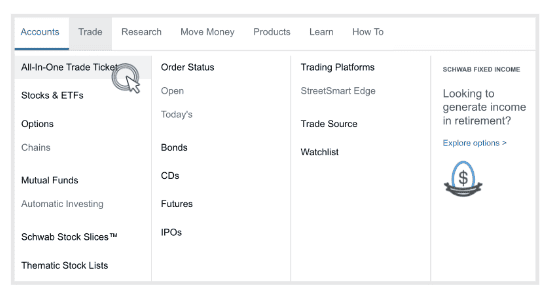

One of the easiest ways to place a trade with Schwab is by using its online All-in-One Trade Ticket. When you log into your account, click “Trade” and select “All-in-One Trade Ticket.”

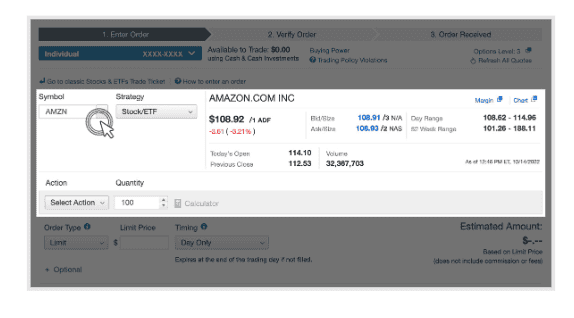

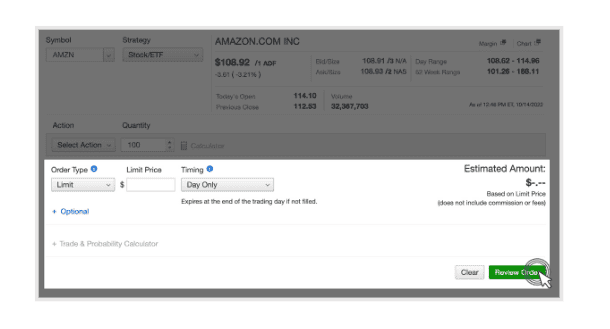

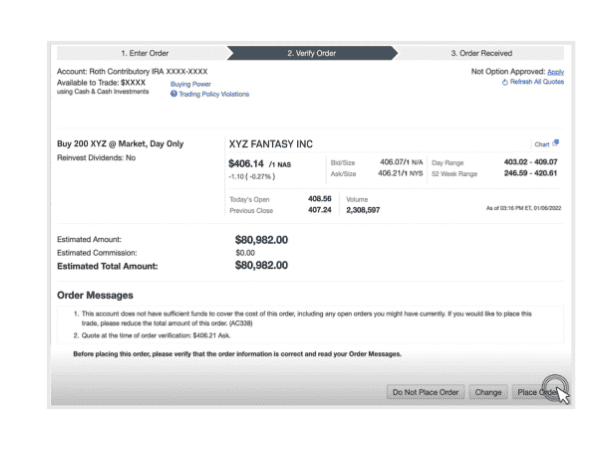

Then, enter a stock symbol and choose a strategy. Next, select “Buy” or “Sell” under the Select Action drop list. Under Quantity, select how many shares you’d like to purchase or sell.

Now, scroll down and choose an “Order Type” using the dropdown menu and also select a “Timing” function.

Building your portfolio with Schwab

The interactive Schwab Personalized Portfolio Builder tool helps you create a portfolio based on your fund preferences, risk tolerance and initial investment. However, there’s no required minimum investment to use this tool.

You can choose from portfolios built with bonds and mutual funds or only ETFs.

Both ETFs and mutual funds are diversified and professionally managed baskets of stocks, bonds or other securities. But ETFs trade like stocks and their prices can fluctuate throughout the trading day. Mutual funds trade at one price each day. Both types of funds could aim to mimic the performance of a major stock index like the S&P 500, which contains some of the largest companies listed on stock exchanges in the United States. Or they can aim to outperform such indexes.

So after selecting the type of portfolio you prefer, you can choose its risk level. These range from conservative (focused on preserving income and stability) to aggressive (focused on growth and a high risk tolerance).

After choosing your asset mix and risk level, you can make an initial investment into your new portfolio.

Investing in Schwab’s robo-advisor

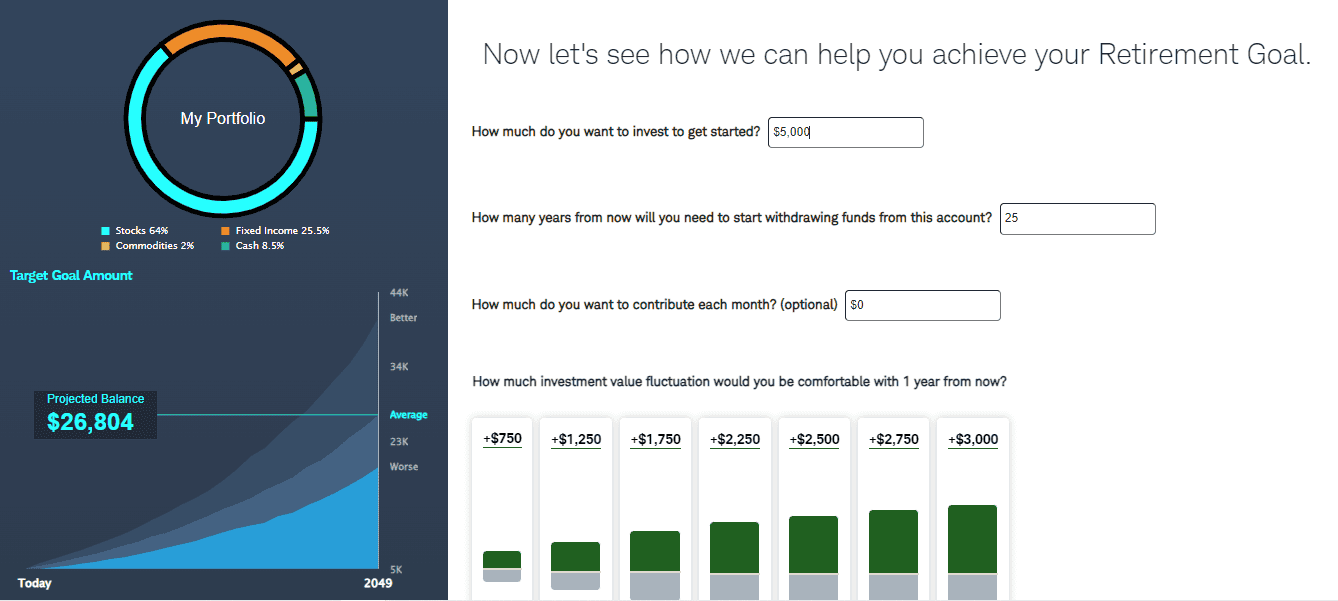

If you’re a hands-off investor, you may be interested in Schwab Intelligent Portfolios, a robo-advisor service. These platforms use technology and the know-how of experts to recommend diversified portfolios based on your financial goals, risk tolerance and more. The Schwab robo-advisor also automatically monitors your portfolio and rebalances it to stay in line with your goals.

So here’s how to open an account with Schwab automated investing. First, you’ll answer a series of multiple choice questions. These will cover topics like your knowledge of investing and how you’d handle events like stock market losses. You’d also be asked about your goals for your portfolio. Maybe you want to invest while making regular withdraws or you’re strictly focused on long-term growth. Additionally, you’d also be asked if you have any specific goals in mind such as saving for a house, a wedding, a child’s college education or retirement income.

The robo-advisor would also help you simulate your future savings based on factors like initial investment, contributions and time horizon.

As you near the end of the process, you’d also be asked what type of account you’d like. You can open a Schwab Intelligent Portfolios account as a taxable account (regular brokerage account). Or you can set it up as a tax-advantaged retirement plan. Your options include traditional individual retirement account (IRA) or a Schwab Roth IRA.

After you’ve answered the questionnaire and chosen your account type, the robo-advisor would present you with an asset-allocation for the portfolio it recommends.

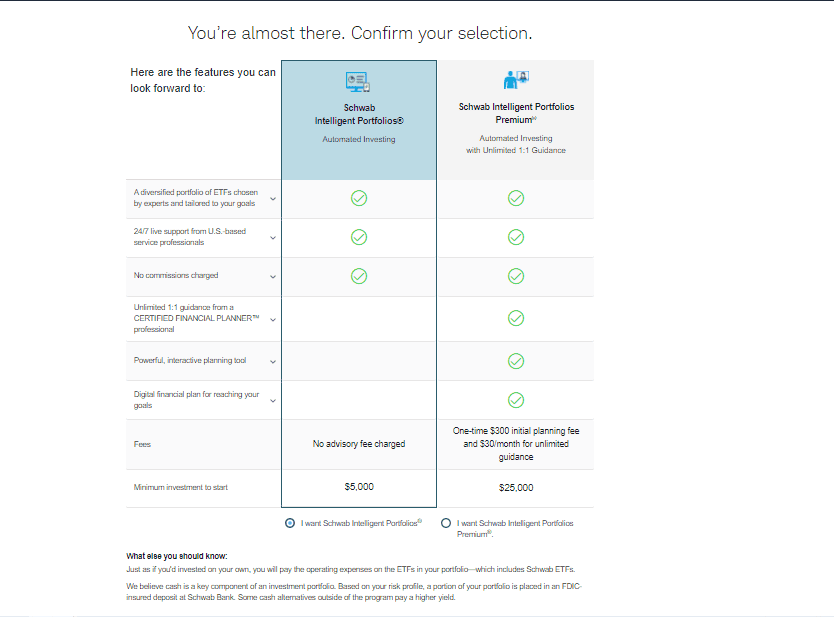

And right before you seal the deal with the robo-advisor, you get to choose your plan. A premium option would provide you with your curated Schwab Intelligent Portfolios account as well as access to a certified financial planner (CFP). This financial advisor can provide holistic guidance on every aspect of your financial life like debt management, savings, retirement and estate planning.

However, the premium option requires an initial $300 planning fee and a $30 monthly subscription.

Investing with Schwab thinkorswim

Following its merger with TD Ameritrade, Schwab offers the thinkorswim platform. This may be best for active day traders and those who want advanced research tools and analytical capabilities to test strategies, track market performance and deep-dive into various investments.

You can access thinkorswim on desktop, mobile and web. But each platform may differ.

thinkorwswim desktop

The thinkorwswim desktop platform is a customizable trading space where you can launch strategic testing algorithms to see how your investing scenarios could play out. It’s equipped with advanced stock screeners, technical analysis features and live market news and insights.

thinkorswim mobile

The thinkorswim mobile application has many of the same features as the desktop version. Its multi-touch charts could help you simulate future moves by overlaying company and economic events. And the in-platform chat rooms allow you to exchange ideas and strategies with other traders.

thinkorswim web

The thinkorswim web platform offers a wide variety of analytical tools you can access anywhere with an internet connection. It was designed with some enhanced features for options trading. Its proprietary Sizzle Index tool helps you find stocks that are seeing an increase in the number of options traded compared to the last five days’ average.

Charles Schwab Investing: Pros

Overall, investing with Schwab is easy and a solid option for beginners. Features like its All-in-One Ticket make it simple for traders to look up stocks and ETFs. The interface is intuitive and easy to navigate.

And those who want a bit of guidance can use its interactive Portfolio Builder feature to construct portfolios based on their preferences. Those who want to go completely hands-off can take a look at Schwab Intelligent Portfolios. This robo-advisor service provides automated portfolios that are continuously monitored and rebalanced.

Seasoned traders can take advantage of thinkorswim, an advanced trading platform that offers robust research and simulation tools.

Investing with Schwab: Cons

Beginner and intermediate inventors may find the thinkorswim platform a bit difficult to understand and use. Plus, the three different platforms thinkorswim operates on can make it confusing for the novice investor.

In addition, the basic plan for Schwab’s robo-advisor service requires a minimum investment of $5,000. Investors can find similar and lower-cost options at firms like Fidelity Investments and E-Trade.

If you want to learn more about Schwab, check out our regularly-updated list of Charles Schwab guides, news and coverage.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.