If you’re changing jobs, you may want to rollover your 401(k) assets to an individual retirement account (IRA) so you could keep investing in your retirement nest egg.

A Schwab IRA allows you to invest in commission-free stocks and exchange-traded funds (ETFs). And while 401(k) investment menus are typically limited to a collection of mutual funds, large brokerages like Schwab let you invest in a variety of stocks, ETFs, mutual funds, certificates of deposit (CDs) and more.

But it’s important to be aware of some rules of thumb.

First, contact your former employer to see what your options are with your 401(k). Generally if your 401(k) balance is between $1,000 and $5,000, then your 401(k) plan sponsor would move the balance into an IRA in your name with a different provider. In this case, you’d need to rollover an IRA from this new provider into a new account with Schwab.

And if the company sends you a check for the 401(k) balance, you have 60 days to deposit the amount into a new IRA without facing taxes and penalties. This is known as an indirect rollover. So your former employer may withhold 20% to pay taxes on your distribution. The IRS may also see this as an early withdrawal, which means you’d face a 10% penalty and income taxes on the distribution if you’re under the age of 59.5.

This is why it’s important to request a “direct rollover” from your 401(k) into an IRA of your choice.

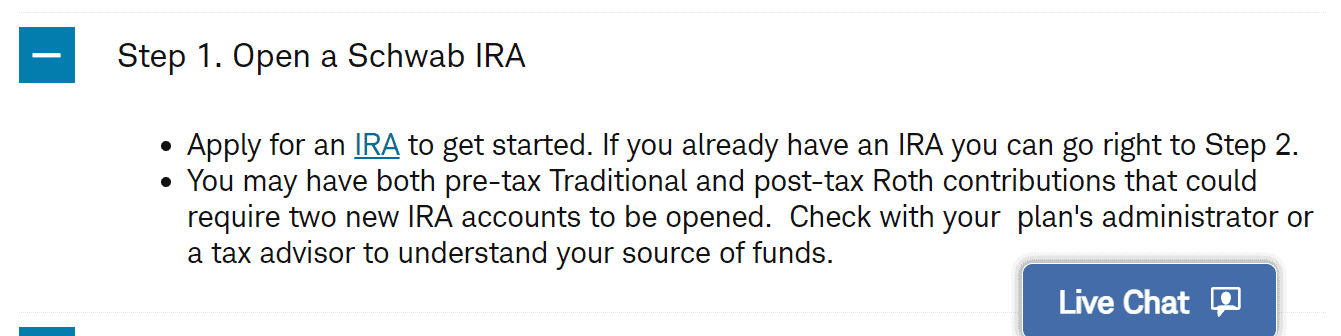

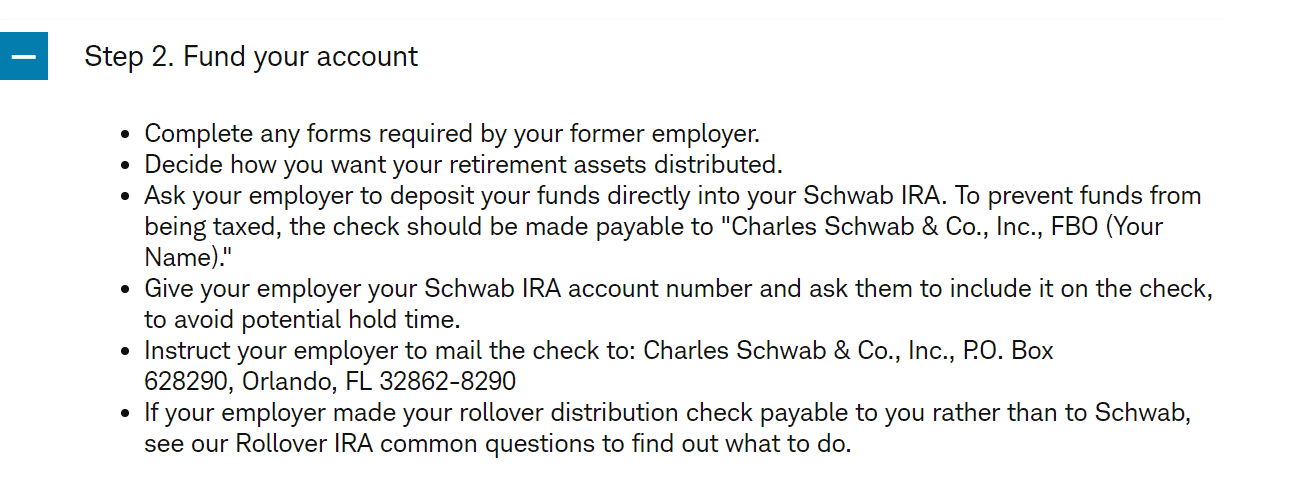

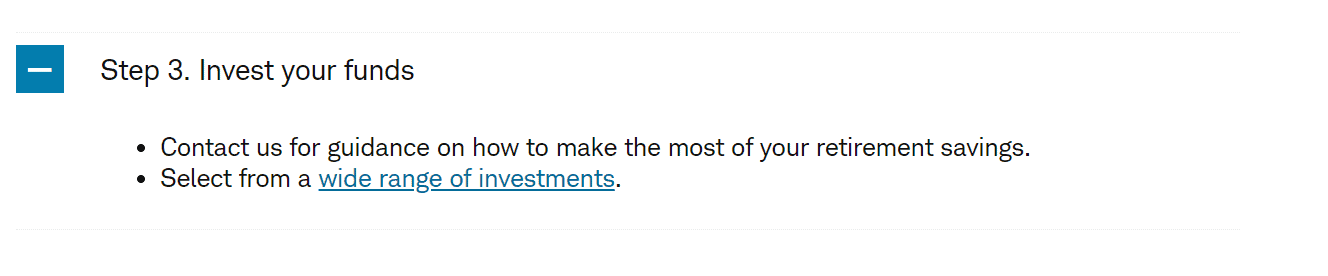

Rolling over your 401(k) to a Schwab IRA In 3 Steps

If you’re looking to move your assets to a Schwab IRA, you can complete the process in a few steps.

Tax implications of a 401(k) rollover to a traditional IRA

One thing you may want to do in order to avoid taxes and penalties is to request a direct rollover to the same type of account: Traditional or Roth.

A traditional 401(k) works similarly to a traditional IRA. Your contributions are tax deductible and earnings grow tax deferred until you make qualified withdrawals at age 59.5 or later. So if you make a direct rollover from a traditional 401(k) to a traditional IRA, you should be in the clear.

Moving investments from one Roth account to another may also help you avoid taxes and penalties. Your contributions to a Roth IRA aren’t tax deductible. But qualified withdrawals are tax free. You shouldn’t trigger a taxable event by rolling over a Roth 401(k) to a Roth IRA.

If you move assets from a traditional 401(k) to a Roth IRA, you’d owe taxes on the distribution and potentially face a 10% early withdrawal penalty.

But these aren’t your only retirement planning options with Schwab. Small business owners with no employees other than their spouse may be interested in a Schwab solo 401(k).

If you want to learn more about Schwab, check out our regularly-updated list of Charles Schwab guides, news and coverage.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.