Investing

If You Invested $15,000 In Disney 10 Years Ago, This Is How Much You Would Have Today

Published:

Last Updated:

The House of Mouse has recently settled a proxy battle between current CEO Bob Iger and activist shareholder Nelson Peltz, who was seeking a seat on Disney’s board and who objected to a number of the ultra-large budget box office flops and political stances that Disney had released of late. However, Walt Disney Company (NYSE: DIS) is the kind of stock that people buy and often will hold for decades, even going so far as to keep the stock in certificate form as a type of collectible art, rather than in a digital street name form at a brokerage account. Many of Disney’s beloved characters have entertained as many as 4 to 5 generations, reinforced by family trips to Disneyland and Disneyworld. When one digs deeper, the various media properties, merchandising, and other Disney holdings contribute to a company that has been the 800 lb. gorilla of the entertainment industry for a long period in history, but whose last decade has been decidedly more turbulent than usual. Nevertheless, the stock has both soared and plummeted, with many questionable executive decisions that have subsequently prompted the return of Bob Iger in 2022, after his 2020-1 retirement.

Bob Iger became Disney CEO not long after its ABC/ESPN acquisition in the mid 1990s. Among Disney’s biggest acquisition coups during Iger’s tenure, Disney acquired super-hero based Marvel Entertainment in 2009, followed by Lucasfilm, better known as the Star Wars world, in 2012.

Marvel Entertainment was on a roll that started with its MCU (Marvel Comics Universe) hits, Iron Man (2008), Captain America: The First Avenger (2011), and others, culminating in Avengers: Endgame (2019), and Avengers: Infinity War (2018), which are the #2 ($2.8 billion) and #6 ($2.05 billion) historically largest box-office hits worldwide to date. Black Panther (2018), was also a huge hit ($1.3 billion), and showed that a predominant cast led by African-Americans could sell internationally.

Star Wars Episode VII: The Force Awakens (2015) ranks #5 all-time box-office with $2.07 billion.

Disney’s homegrown properties also flourished, with The Lion King (2019) grossing $1.66 billion and Frozen II notching $1.45 billion. At the beginning of Q1 2021, DIS stock would soar to trade over $200 per share.

At the request of Disney’s board, Bob Iger came out of retirement to once again take the CEO reins of Disney in November, 2022. However, Disney’s stock price still staggered, falling below $80 in Q3 2023, until finally heading back upwards, perhaps fueled by Disney’s investment in Epic Games (creator of the popular Fortnite) and an activist investor initiative focused on curbing losses, led by investor Norman Peltz.

Buoyed by support from George Lucas and the Disney family, Iger was able to fend off Peltz’s proxy fight, so we will see if Iger can steer Disney back to its former glory.

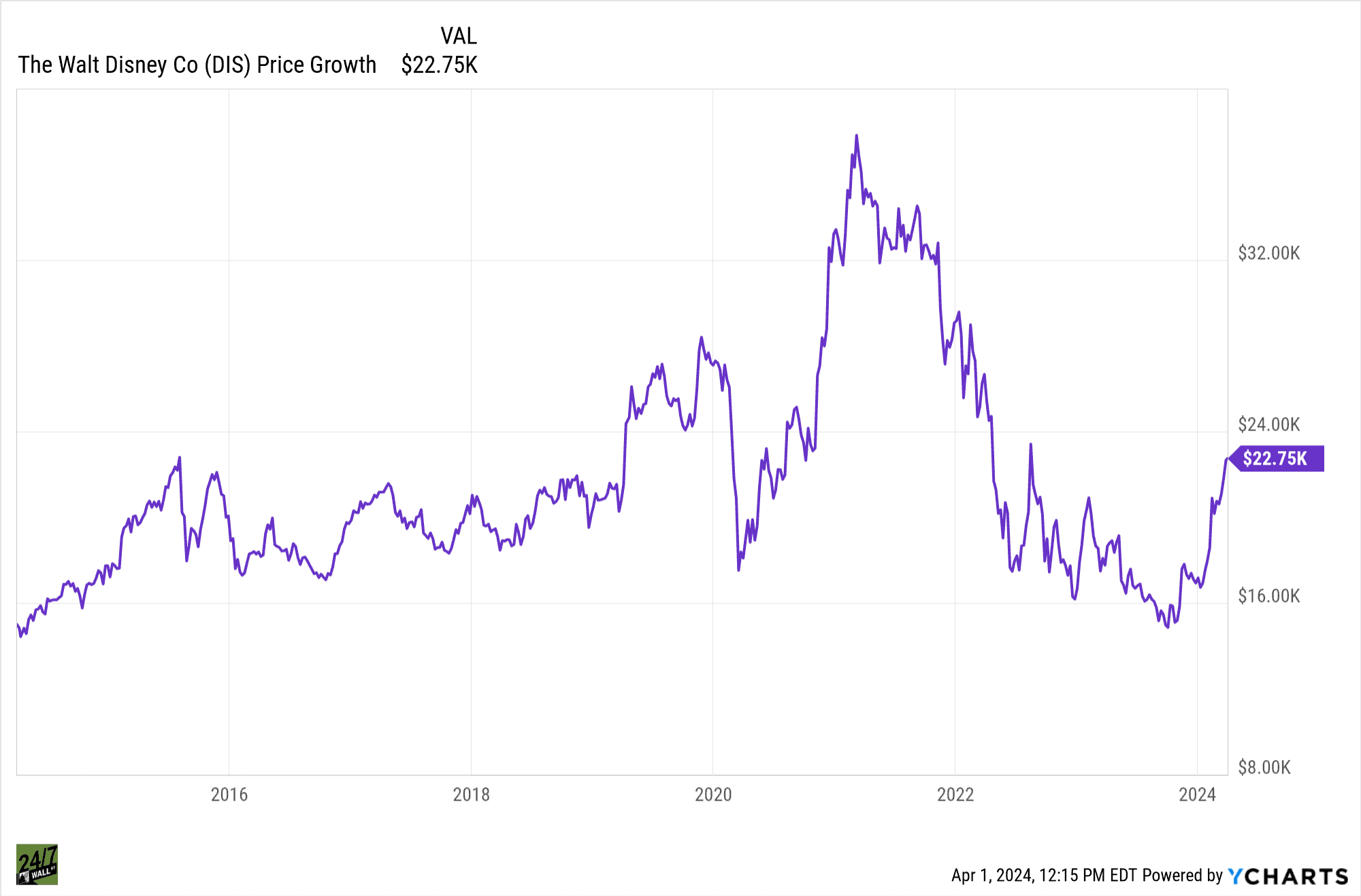

At the beginning of Q2 2014, Disney was at $77. A $15,000 investment would have purchased 194 shares. At the time of this writing, DIS is at $111. This investment would thus be worth $23,267.30. This equates to a 36% ROI.

Below chart courtesy of Y-Charts.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.