In recent years, Bitcoin’s (BTC) allure has become undeniable. You can hardly talk about investing without mentioning It. It’s captured both headlines and imaginations, promising to usher in a revolution of change in finance.

However, for investors seeking a more stable path to long-term wealth, the reality of Bitcoin’s high volatility and limited real-world applications can be a sobering truth.

Instead, we propose a different strategy: investing in established Artificial Intelligence companies. Unlike Bitcoin, which is relatively speculative, AI is rapidly transforming entire industries, and many companies already have proof of concept. With proven applications and a clear trajectory for future growth, AI stocks offer a more sustainable path to long-term gains.

Let’s take a look at why Bitcoin’s appeal may be waning and which AI stocks you should invest in.

The Rise of AI and the Uncertainties of Bitcoin

Bitcoin’s early adopters reaped significant rewards, but its future remains largely uncertain. Cryptocurrency is notoriously volatile. Prices are very susceptible to dramatic swings based on nothing more than a news headline. This volatility makes Bitcoin a very risky investment if you’re looking for long-term growth.

Plus, Bitcoin’s real-world applications are still limited. Mainstream businesses don’t accept it, and transaction fees can be high. Those who own Bitcoin typically do not use it every day. If you really want to invest in crypto, there are likely better crypto options, too.

On the other hand, AI is currently experiencing a period of explosive growth. It isn’t just a futuristic concept anymore. Many industries are seeing AI being introduced as tangible applications that really work. It’s not speculative.

AI is affecting tons of different industries, ranging from healthcare to manufacturing. This widespread adoption suggests a bright future for AI. The best AI stocks are those that are backed by concrete technological advancements.

Top AI Stocks for Your Portfolio

You can’t just invest in any AI stock, though. Preferably, you want a stock that is at the forefront of this technological revolution. The best companies to invest in are those with real products that have real-world impacts.

1. Nvidia

Nvidia (NASDAQ: NVDA) is the undisputed king of graphics processing units, providing the muscle behind all the complex AI computations other companies rely on. They don’t necessarily create AI themselves, but all the AI companies out there need their stuff, making them a logical company to invest in.

As AI becomes more common, their GPUs will be in even higher demand.

Nvidia also has a strong track record of innovation. They continuously upgrade their hardware, one reason they’re largely unopposed in the industry. They simply make better stuff in many cases.

2. Palantir Technologies

Palantir (NYSE: PLTR) is best known as a defense company. However, they are currently utilizing AI-powered solutions for government and enterprise clients. Their platform can integrate massive datasets from different sources, making it a powerful tool for complex operations.

In national security, there is often a lot of data to deal with. Palantir’s technology makes dealing with all this information easier, and their use of AI may make it even easier in the future. They’re a strong growth contender within the next decade or so.

3. International Buisness Machines

You can’t have an article about AI companies without talking about IBM (NYSE: IBM). This tech giant has a well-established AI division known as IDM Watson. Watson focuses on natural language processing (like chatbots) and automation. Its goal is to streamline workflows, improve efficiency, and generate data-driven insights.

While AI is a new frontier, IBM is a reliable player in which to invest. They have a proven track record and a stable AI division.

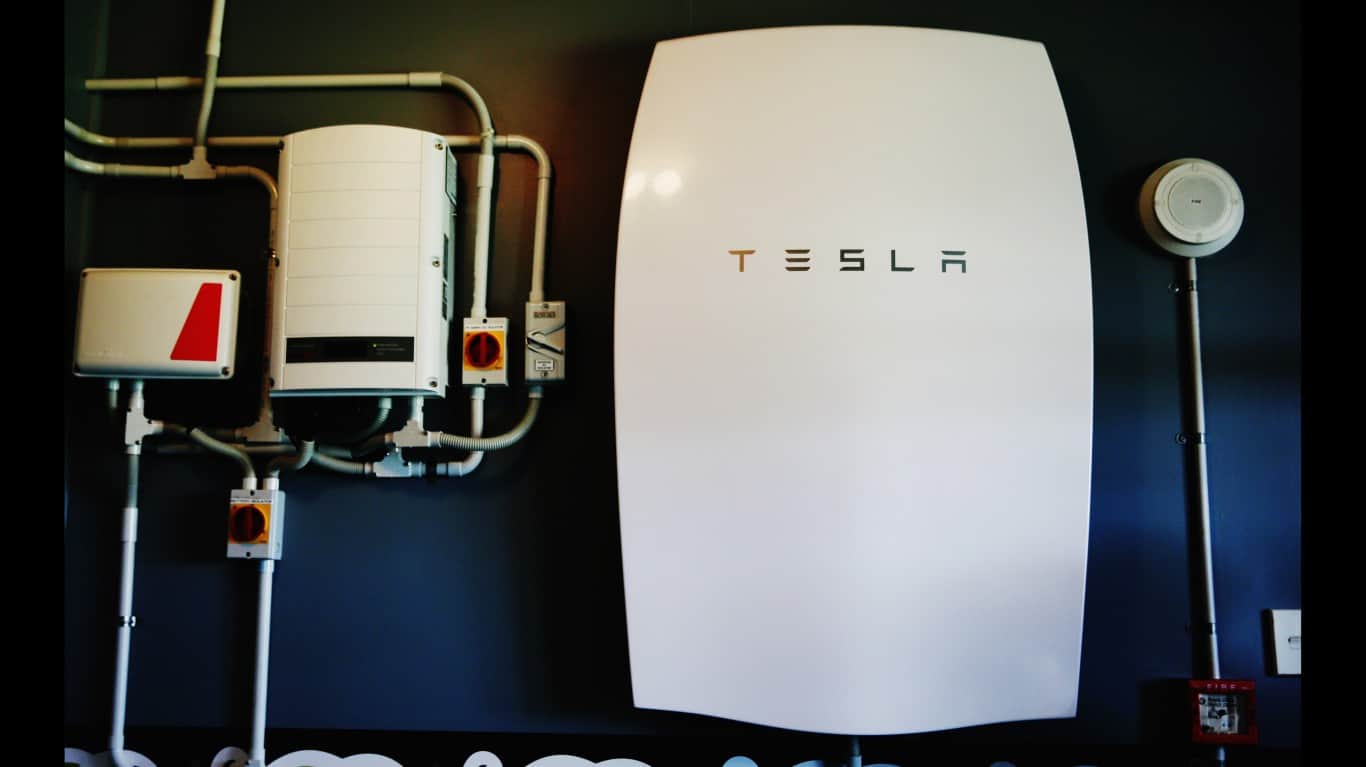

4. Tesla

Tesla (NASDAQ: TSLA) is a company that’s best known for its electric cars. It integrates AI heavily into its vehicles, though. The self-driving car program Tesla Autopilot is one of the most advanced AI programs in the automotive industry.

However, this company uses AI in other places, too. For instance, AI is utilized for battery management and manufacturing.

Plus, everyone knows what Tesla is. The brand recognition itself does a lot to propel growth and make this one of the more stable (surprisingly) stocks to invest in.

5. Alphabet

Alphabet (NASDAQ: GOOGL) is a diversified company that is also investing a lot in AI. They have their own self-driving car program and an Assistant leveraging natural language processing. They’ve used AI in a wider ranger of applications than most companies on this list.

Their very wide range makes them an easy company to invest in. Google isn’t going anywhere anytime soon. They’re also looking to break into areas like personalized machine technology and AI smart home devices.

6. Baidu

Baidu (NASDAQ: BIDU) is a Chinese company, so you must also consider currency fluctuations and geopolitical tensions. However, they are an undervalued AI stock with immense future potential, particularly within China. They are the Chinese AI stock, focusing on search engines and autonomous vehicles.

Baidu’s dominance in the Chinese search engine market allows them to gather and analyze massive amounts of data, further fueling their AI development.

Of course, due to their country of origin, Baidu is a bit more risky than other stocks. However, if you’re looking to capitalize on an undervalued stock, It’s a great option.

7. BenevolentAI

You’ll be forgiven if you haven’t heard of BenevolentAI (OTCMKTS: BAIVF). They’re an incredibly small company. However, they’re attempting to use AI to accelerate drug discovery and development. Their AI works by using vast datasets to identify new drug candidates.

There is a lot of risk here, as they don’t necessarily have a foothold in the market. However, if their AI development turns fruitful, it could be a big payday for early investors.

Plus, their stock is incredibly inexpensive currently, so it’s a good time to get your foot in the door.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.