With a Fidelity Roth IRA, you can enjoy tax-free qualified withdrawals at retirement. And you can grow this retirement savings fund with commission-free stocks, exchange-traded funds (ETFs) and options – as well as other investments.

Fidelity Roth IRA overview and benefits

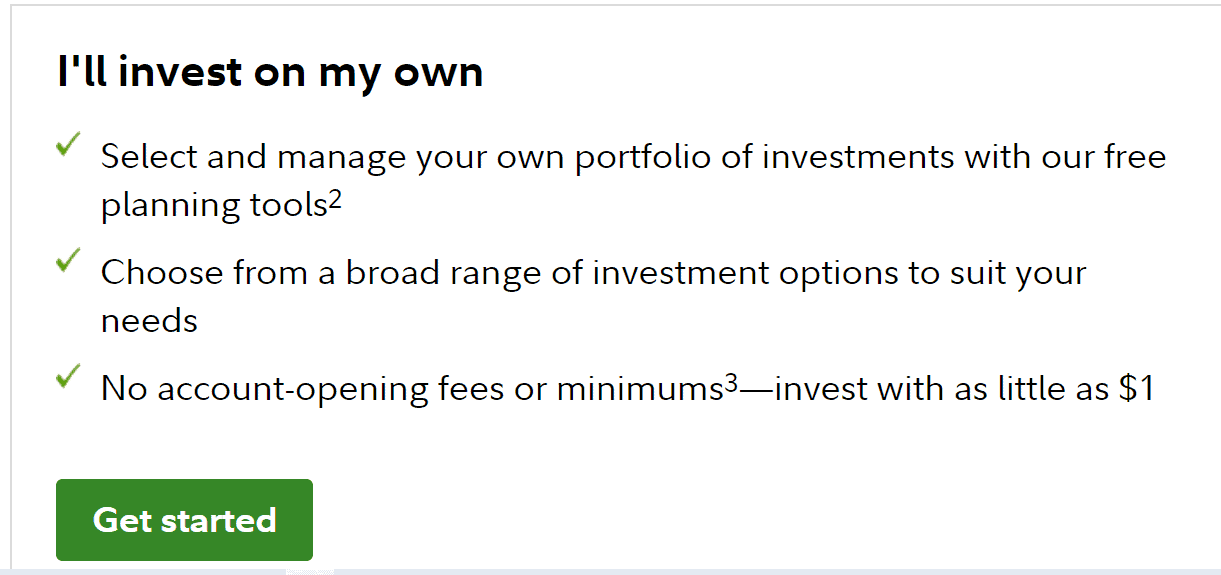

You can open a Fidelity Roth IRA online and start investing with as little as $1. And the account has no opening fees.

When you contribute to a Roth IRA, your money grows tax-free with compound interest. Plus, withdrawals are tax-free as long as you’re at least 59.5 years-old and at least five years have passed since you made your first contribution.

Additionally, you can withdraw your contributions to a Roth IRA tax-and-penalty free any time.

And unlike with most workplace 401(k)s, a Fidelity Roth IRA won’t limit your investment options to a set menu of mutual funds. With Fidelity, you can invest your Roth IRA in a variety of assets including the following.

- Stocks

- Bonds

- ETFs

- Mutual funds

You can evaluate and select these investments using Fidelity’s free research tools like screeners that let you look up funds based on your own criteria like asset class and Morningstar ratings. You’d also have access to Fidelity’s Active Trader Pro.

Fidelity GO Roth IRA

Fidelity Investments also gives you the option to invest in a Roth IRA managed by a robo-advisor as part of its Fidelity GO service.

A robo-advisor recommends a personalized and diversified investment portfolio based on your answers to a questionnaire about your financials, goals, time horizon and more. The Fidelity GO robo-advisor automatically manages this portfolio and rebalances its asset allocation to stay in line with your goals.

You can open a Fidelity GO account as a Roth IRA, so you enjoy the same tax benefits that’ll come with a self-directed Roth IRA.

Fidelity GO charges no advisory fee for balances below $25,000. The advisory fee is 0.35% for balances of $25,000 or more. Advisory fees for other similar services, however, may be more competitive. Betterment’s robo-advisor charges a flat annual advisory fee of $0.25% or $4 a month. The Schwab robo-advisor charges no advisory fee, but requires a minimum investment of $5,000.

Roth IRA contribution limits

For tax year 2024, the Roth IRA contribution limits are $7,000 for individuals under the age of 50. Those over 50 can make additional catch-up contributions of $1,000 for a total of $8,000.

But be aware that eligibility requirements for Roth IRAs depend on your Modified Adjusted Gross Income (MAGI) and filing status.

Here’s an overview.

- Single filers: MAGI must be under $161,000 for tax year 2024 to open a Roth IRA.

- Married and filing jointly: MAGI must be below $240,000 for tax year 2024 to open a Roth IRA.

Moreover, your ability to contribute the maximum amount to a Roth IRA also depends on your MAGI and filing status.

Once your MAGI crosses a certain point, your maximum contributions begin to reduce until it reaches a point where you can’t open a Roth IRA at all.

For single filers, the maximum contribution for tax year 2024 begins to lower when MAGI goes above $146,000. And for those married and filing jointly, their maximum contribution begins to lower when their MAGI increases past $230,000.

How to open a Fidelity Roth IRA

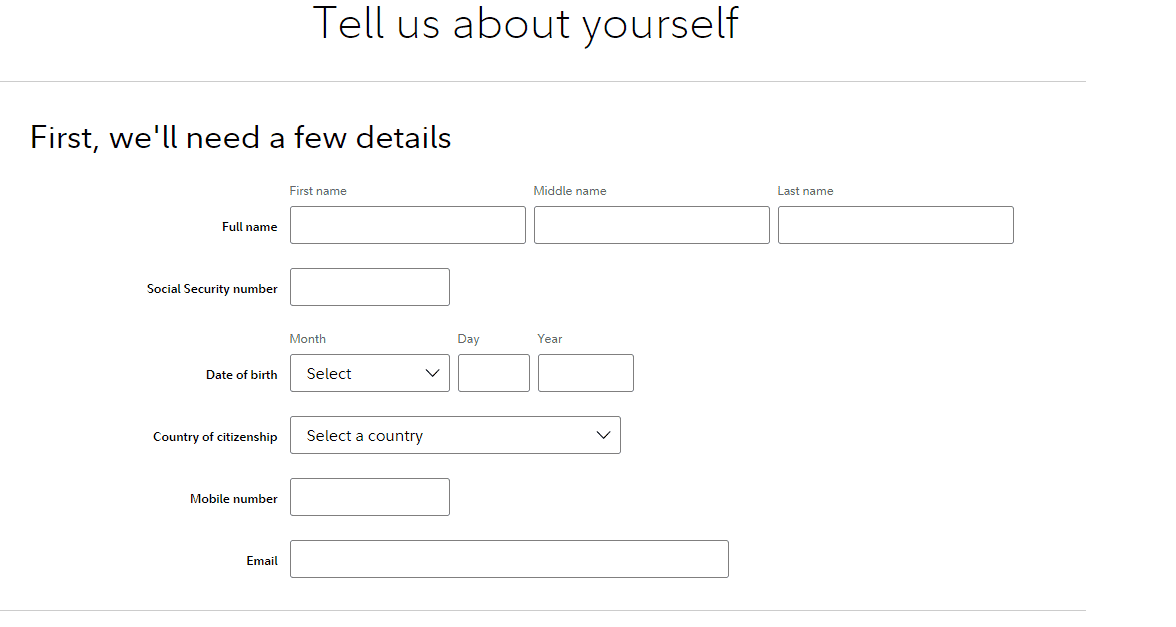

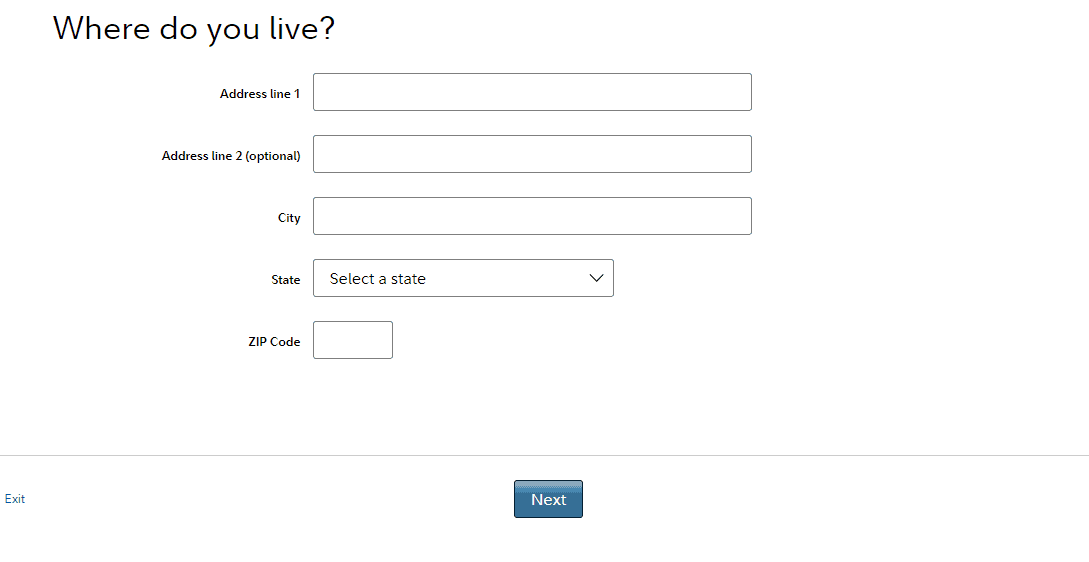

If you’re not an existing Fidelity customer, you can open a Fidelity Roth IRA online in a few minutes. Just follow the following steps after visiting the official Roth IRA page and clicking on “Get Started.”

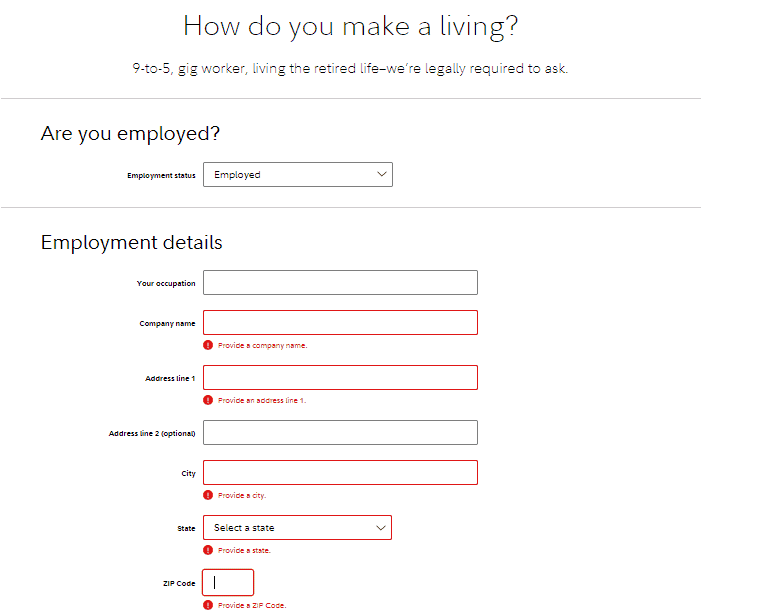

1. Confirm your identity and employment information to open an account.

2. Create a username and password.

3. Link an account to transfer money from.

Fidelity Roth IRA : The Verdict

Those who want to manage their own investments within their Roth IRA could find a suitable option at Fidelity. The firm lets you invest in commission-free U.S. stocks, ETFs and options.

Fidelity also offers access to nearly 3,700+ no-load and no-transaction fee mutual funds. Overall, this can help you keep more of your investment earnings to benefit from at retirement.

Hands-off investors can benefit from Fidelity GO, which allows you to open a Roth IRA managed by a robo-advisor.

You can also take advantage of Fidelity’s Wealth Management Services. Through these programs, you can work with financial advisors who can guide you on every aspect of your financial life including retirement planning, healthcare expenses and estate planning. However, these services may be open to only high-net worth individuals. Still, Fidelity has retirement planning options for all kinds of investors.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.