A Fidelity solo 401(k) can help self-employed individuals and small-business owners with no employees other than their spouse save for retirement.

Officially called the Fidelity Self-employed 401(k), this retirement plan has higher contribution limits than a handful of other retirement accounts.

And there’s no account opening fee or annual maintenance fee for a Fidelity Self-employed 401(k).

How does a Fidelity Solo 401(k) work?

When you open a Fidelity solo 401(k), you can save for retirement and enjoy distinct tax benefits.

Contributions to a solo 401(k) are tax deductible. Plus, your earnings grow tax-free until you make qualified withdrawals in retirement. But try not to touch your retirement nest egg before reaching age 59.5. This would be an early withdrawal and it could trigger a 10% penalty as well as regular income taxes on the withdrawal.

With a Fidelity solo 401(k), you can invest in commission-free stocks, exchange-traded funds (ETFs) and options. Fidelity also lets you invest in 3,700+ no-load and no-transaction-fee mutual funds.

Fidelity solo 401(k) contribution limits: How does it work?

With solo 401(k)s, you contribute money as an employee and as an employer.

So to understand contribution limit rules, it helps if you separate your contribution limits as an employee and as an employer.

As an employee in 2024, you can make salary deferral contributions of $23,000 or 100% of compensation, whichever is less. Those 50 or older can make catch-up contributions of $7,500 for a total of $30,500.

And as your own employer, you can make additional profit-sharing contributions of up to 25% of your compensation or net self-employment income (Your net profit minus half your self-employment tax and the plan contributions you made for yourself.)

So for 2024, the total maximum contribution from both sources is $69,000 or $76,500 for those who are age 50 or older.

And there can be additional benefits if your spouse is an employee of your business. Your spouse can contribute up to the applicable employee contribution limits. And as the employer, you can make a profit-sharing contribution to your spouse’s account of up to 25% of compensation.

So together, you and your spouse could effectively double the $69,000 solo 401(k) contribution limit.

But keep in mind that the maximum compensation that can be used to factor your contribution is $345,000 in 2024.

Fidelity Solo 401(k): The verdict

A Fidelity Self-employed 401(k) can offer distinct tax benefits, high contribution limits, and a wide array of investment options.

You can also use Fidelity’s free research tools to find funds based on your criteria like Morningstar ratings and asset class.

So it can be a solid retirement plan option for the self-employed or small-business owners without any employees other than their spouse.

But as with all solo 401(k)s, you must make required minimum distributions (RMD) at age 73. And Fidelity doesn’t currently offer a Roth option for its solo 401(k) plan, which could allow you to make tax-free withdrawals at retirement.

Deadlines to establish a solo 401(K)

In general, the deadline to open a solo 401(k) is the tax filing deadline – including extensions – of the business.

Partnerships and corporations that establish their solo 401(k)s after the business’s year end can only make employer profit sharing contributions in the first year. And sole proprietors must open their plans by their tax filing deadline – not including extensions – to make profit sharing and salary deferral contributions in the first year.

How to open a Fidelity solo 401(k)

You can open a Fidelity Self-Employed 401(k) account online if you meet the following requirements.

- Are creating a new plan

- Are the plan administrator and plan participant

- Are a U.S. Citizen

- Are naming your spouse as your primary beneficiary if you are married

If you meet this criteria, follow these steps.

1. Click on “Open a self-employed 401(k)”

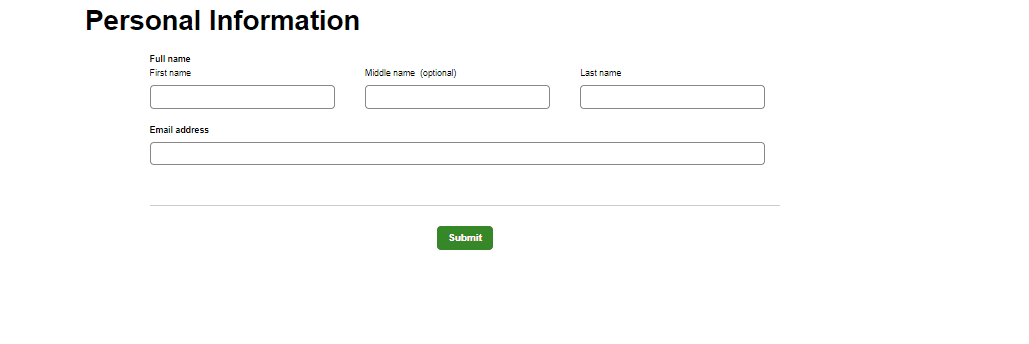

2. Submit personal information

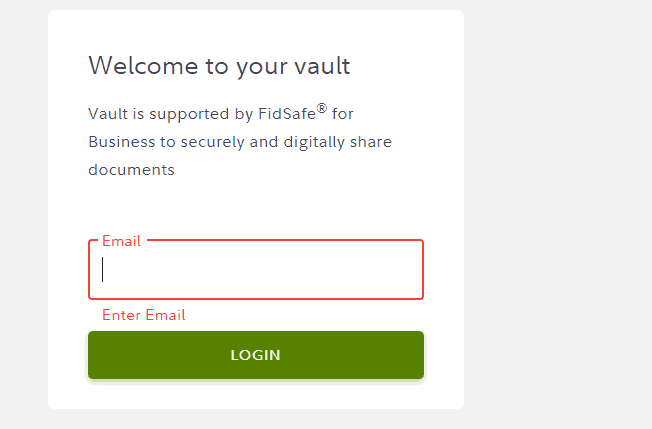

3. Submit email address

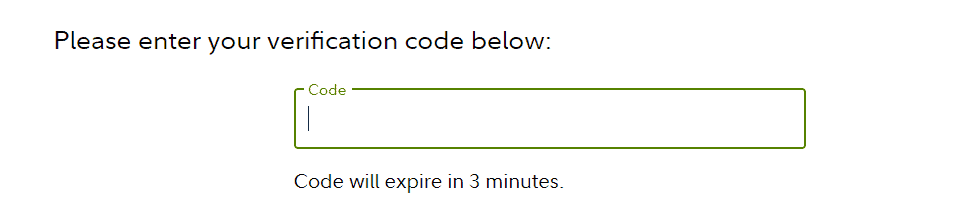

4. Enter verification code

5. Open and sign required documents

If you’re not eligible to sign-up online, you can review the Defined Contribution Retirement Basic Plan Document No. 04.

All applicants must also sign and return to Fidelity Investments the following.

- Self-employed 401(k) adopting agreement

- Trust agreement

- Self-employed 401(k) account application for yourself and each participating owner (including the business owner’s spouse, if applicable).

After establishing your plan, you must contribute to your account. These are the acceptable methods.

- EFT on Fidelity.com or from a Fidelity non-retirement account in the name of the plan administrator and used for the business.

- Check deposits on Fidelity’s mobile app

- External billpay service

For salary deferrals: Use the 401(k) Salary Reduction Agreement Form. You don’t need to forward this form to Fidelity.

The #1 Thing to Do Before You Claim Social Security (Sponsor)

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.