Fidelity Active Trader Pro is an advanced trading platform that allows you to research and trade stocks, exchange-traded funds (ETFs), mutual funds, and options.

Active Trader Pro: The pros

Fidelity’s Active Trader pro offers a range of tools for experienced traders who want to take a deep dive into the markets, develop strategies, and enhance their trading experience.

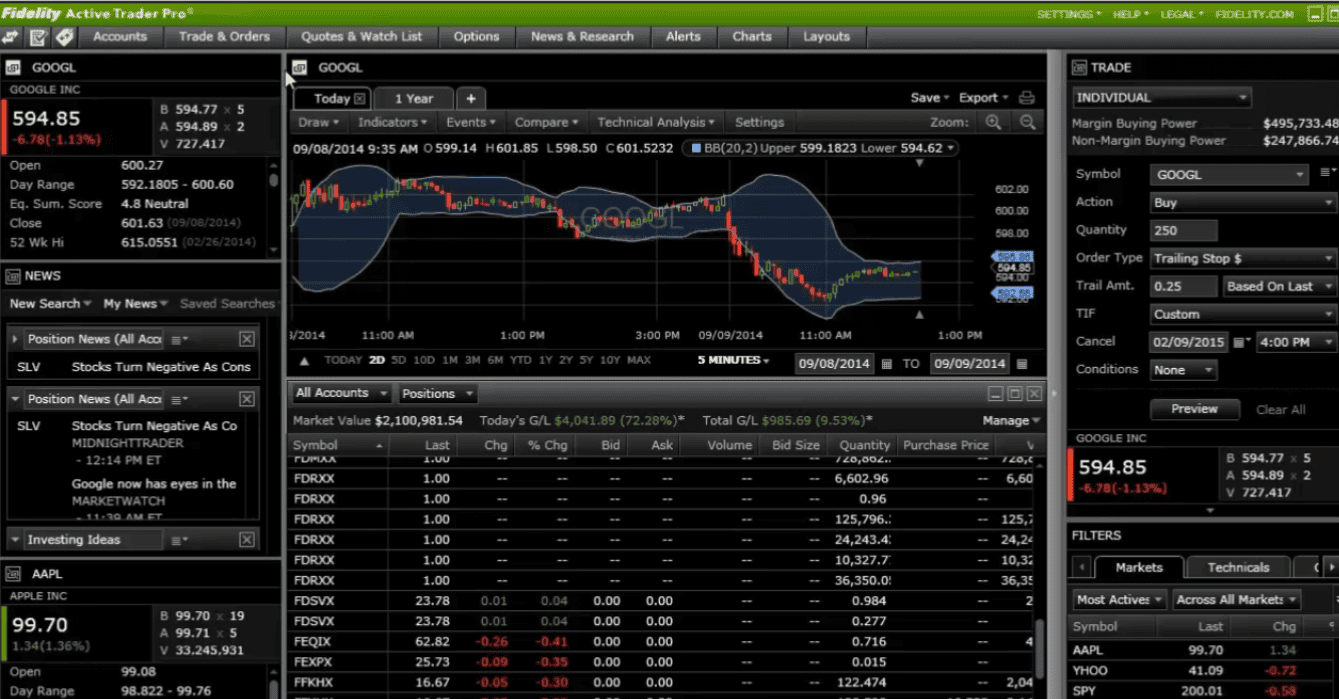

Among various effective features, Active Trader Pro stands out for its robust charting capabilities that let you track and visualize a security’s price movements across time. These charts are customizable, and you can add multiple indicators like simple moving average.

You can also apply drawing tools within your charts and add events to trace factors like dividends and earnings across time. Additionally, these charts have a “compare” function that allows you to visualize price performances between one security and up to 25 others, or to an index. Plus, these charts are equipped with advanced technical analysis capabilities.

And the Active Trader Pro layout is fully customizable. You can arrange components like quotes, live market news, watchlists, charts, and more as you see fit.

Some of the tools themselves are customizable as well. For example, you can update the market data tool to run on a streaming basis or at different time intervals.

The customization capabilities of Active Trader Pro can help meet the needs of different traders with various goals and preferences. These components can also prevent the platform from becoming too overwhelming for some active traders.

Fidelity Active Trader Pro: The cons

Despite its multitude of features and capabilities, Active Trader Pro has its drawbacks. One of these is accessibility.

Active Trader Pro is currently not available as an application for mobile devices like smartphones or tablets. The platform exists solely as a desktop application today. This is not the case with similar options at other major brokers like Charles Schwab.

Moreover, Active Trader Pro is intended for experienced investors. Even with its customization capabilities, beginners may find Active Trader Pro a bit overwhelming. And Fidelity currently doesn’t offer a paper trading version of Active Trader Pro, which would have allowed you to practice the platform with virtual money.

However, curious Fidelity customers have access to an Active Trader Pro Learning Center complete with how-to videos and articles featuring Fidelity experts.

With that said, you’d also need to be an existing Fidelity customer to access the platform.

Active Trader Pro: The Verdict

Fidelity’s Active Trader Pro has plenty to offer for the experienced investor. You’d have advanced analytical tools, charting capabilities, and technical analysis features all in one place. Plus, the sleek and customizable layout would be comforting for many traders. But those looking to take this experience outside their desktop screens or on the go may be disappointed as you can’t download Active Trader Pro on your phone or tablet. This may bring Fidelity’s trader platform down a peg, as competitors provide advanced trading platforms that can be accessed in various forms and on multiple devices.

Still, existing Fidelity customers or those interested in what the brokerage has to offer may want to give Active Trader Pro a test drive.

The bottom line

Active traders need the right set of analytical tools and research capabilities to develop strategies and make important investment decisions. And there are several platforms out there that aim to deliver this. But not all hit their target. So to help you weigh your options, we took a look at Fidelity Active Trader Pro.

If you want to learn more about Fidelity, check out our regularly-updated list of Fidelity Investments guides, news and coverage.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.