Investing

Full E*Trade Review: Everything You Need To Know Review. Is It Worth It?

Published:

If you’ve decided to get into trading stocks, you might be wondering where to start. Should you stick with one trading platform, or spread your trading activity and investments over a few? Doubtless, if you’ve done any research online you will have been bombarded with new subscriber deals, account benefits, and success stories from several companies. But which should you pick, and how does E*Trade stack up against them? This is our full review of E*Trade.

Given the shaky, unreliable, and shady history of the American financial system, it is natural to feel uneasy about investing a substantial amount of money into the stock market, regardless of which institution you choose to invest with. That being said, in order to trade stocks, you will need to sign up with a registered broker like E*Trade in order to do so. That’s why you should enter that relationship armed with all the facts and information you need to make the best decision possible.

For this review, we are focusing on E*Trade’s online trading functionality. Since its acquisition by Morgan Stanley (NYSE:MS), it has inherited a number of additional features and options including small business retirement plans, premium savings accounts, lines of credit, checking accounts, retirement accounts (including a variety of Roth IRAs and Traditional IRAs), and more. E*Trade also offers managed portfolios for qualified customers which allow access to Morgan Stanley’s financial advisors. Since E*Trade began as a trading platform is that remains its core position, this review focuses primarily on the trading aspect of the platform.

E*Trade is an online trading platform founded in 1991. It quickly grew over the years, becoming public in 1996 and now boasts over five million clients. Morgan Stanley acquired E*Trade in 2020 and it continues to operate independently.

E*Trade has been a staple of the online trading scene ever since it launched and remained among the top performers until recent online-only brokers entered the industry with zero-commission trades and an appeal to amateur traders. As a result, E*Trade joined other traditional brokers by eliminating commissions on trades and most account fees.

Currently, E*Trade has no commissions on all online, US-listed stocks, ETFs, and mutual funds. There are minimal fees for options contracts and trades, bonds trades, and futures, among other more complicated investment options.

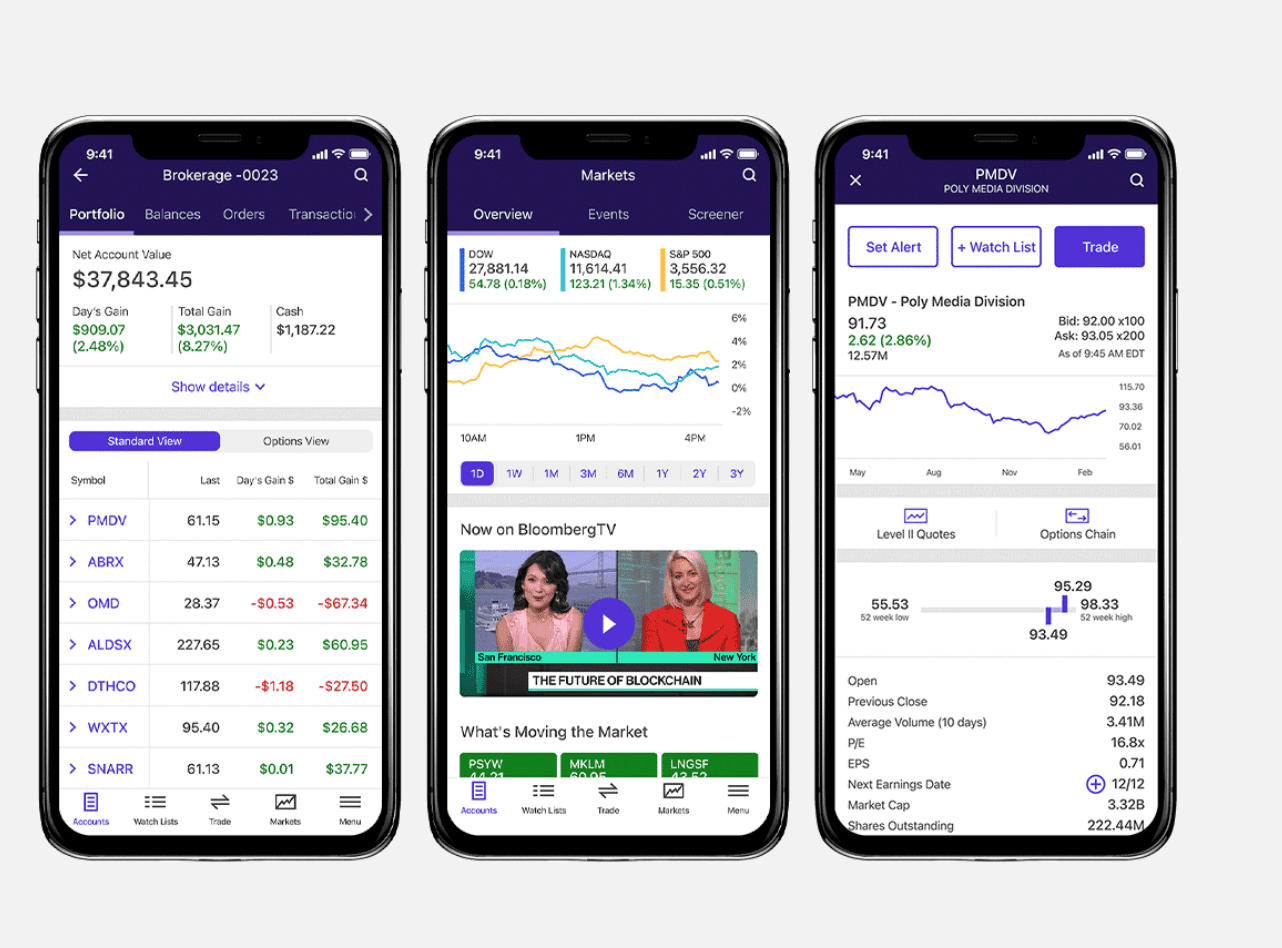

How does it stack up to other online brokers, though? We looked through several online reviews and customers tend to agree that E*Trade is a great choice for new and experienced traders alike because of its easy-to-use tools, superior customer service and account support, an advanced mobile app that can operate independently of the website, and largely commission-free operations. It also offers many more stocks for trade than more recent online-only brokerages.

E*Trade has won several awards and accolades for its platform design, educational tools, and site features. These include winning Best Trading Technology in Benzinga’s 2023 Global Fintech Awards, the “Best in Class” award by Stockbrokers.com for the E*Trade mobile app, and more.

The fact that E*Trade is now a subsidiary of Morgan Stanley also gives the platform a much wider range of services and products than it did before. This includes integrated cash management and debit cards that allow you to access and use the uninvested funds in your brokerage account as though it were a normal checking account. Customers can receive a free debit card that would function as a normal card attached to any checking account, and they can also initiate cash transfers, write checks, and set up automatic online bill payments.

Some of the downsides we’ve seen online include difficulty in closing an account and expensive fees for transferring your account to another broker. Also, E*Trade has among the lowest interest rates for uninvested funds. Other brokers offer higher interest rates or offer a cash sweep program that pays interest on funds in your account but not invested in any asset. As interest rates rise, E*Trade maintains one of the lowest interest rates in the industry.

To make up for this, E*Trade does offer a Premium Savings Account. The Premium Savings Account is a high-yield savings account that pays 4.25% APY, which is well above the national average interest rate, but still falls below the highest high-yield savings accounts. The benefit of this account, beyond the high interest rate, is the ease with which users can transfer funds from this account into their brokerage account for trades and other investment activities.

Read more about E*Trade’s Premium Savings Account in our full review here.

Another area in which E*Trade falls short is that it does not offer trading for digital assets including EFTs, cryptocurrency, and other digital investment options. If you want to trade cryptocurrencies, you will need to use a separate platform in addition to E*Trade or pick a broker that allows stock trades and digital asset management.

In terms of accessibility, customers have the option of using the E*Trade app or the online website. However, if you want to kick your trading into high gear, E*Trade also offers something called Power E*Trade which it touts as a professional platform built by traders for traders. This is a separate app and website experience for more dedicated traders.

Power E*Trade is tailored for a more trading-centric experience instead of being an all-in-one platform. It offers traders more technical pattern recognition, earnings analysis tools, risk, and reward probability calculators, live scans with preset or custom filters, more powerful charts, exit planning tools, paper trading, and much more. If you’ve ever had the dream of sitting in your office surrounded by numbers and charts that only you understand, then Power E*trade is for you.

E*Trade has done a fantastic job of tailoring its online trading experience for traders of all levels and specialties. Due to the extremely wide range of financial tools and accounts available at E*Trade some traders have made it their sole financial resource. This has been facilitated by their acquisition by Morgan Stanley.

If you want to become a professional trader quickly and don’t want to worry about migrating to more in-depth platforms in the future, E*Trade is definitely the platform for you. With an extremely wide range of investment options, award-winning design, professional tools, and all the financial resources any trader could ever want, we would be impressed if you ever used all of them to their maximum potential.

While it might have a steep learning curve, E*Trade has made great efforts to remove jargon from its online platform and educational resources, meaning you can spend more time trading, and less time trying to figure out what certain buttons mean or what a specific report is trying to say.

If you’re just looking to do the occasional trade, E*Trade might be more machine than you need. Though with no commissions on trades, it is certainly not a bad decision, either.

As of the writing of this article, E*Trade is also trying to entice new traders to join its platform with a $1,000 bonus for all new accounts with a qualifying deposit. The promotion lasts until May 31, 2024.

If you’re curious about any other part of the E*Trade platform, check out this page: a regularly updated list of all our E*Trade guides, news coverage, and lists of benefits.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.