Dividend stocks can be an excellent source of passive income, especially for those with liquid investible funds. In order to budget for monthly payment allocations, dividend stocks that pay on a monthly basis can be an invaluable resource.

24/7 Wall Street has an extensive database of dividend stocks, and often publishes articles with selections that might suit investors’ criteria. The following below list can generated a cumulative $1,200 per month in dividend income, based on stock prices at the time of this writing:

Ellington Residential Mortgage REIT

- Stock # 1 : Ellington Residential Mortgage REIT (NYSE: EARN) AKA Ellington Credit Company

- Yield: 14.26%

- Shares for $15,000: 2,228

- Total monthly dividend income: ~$178.25

Recently rebranded as Ellington Credit Company, the former Ellington Residential Mortgage REIT is a registered Real Estate Investment Trust, and as such, is required to distribute 90% of its taxable income as dividends to shareholders. Founded in 2012, the bulk of Ellington Credit Company’s activities are in managing its portfolio of mortgage backed securities (MBS), which are a mix of US federal government agency issues from entities such as Fannie Mae or Freddie Mac, and private mortgage backed securities, which can include some subprime loans.

The three largest institutional shareholders are: Vanguard Total Stock Market Index Inv (2.46% of total shares), Vanguard Institutional Extended Market (1.43%), and Hoya Capital High Dividend Yield (0.55%).

Pimco Dynamic Income Opportunities Fund

- Stock #2 : PIMCO Dynamic Income Opportunities Fund (NYSE:PDO)

- Yield: 14.21%

- Shares for $15,000: 1,169

- Total monthly dividend income: ~$177.63

Pacific Investment Management Company (PIMCO) is based in Newport Beach, CA. It is an asset manager that also has a family of mutual funds. The PIMCO Dynamic Income Opportunities Fund invests exclusively in fixed income securities from the global credit markets.

Strategy-wise, the fund invests a minimum of 25% of the portfolio in mortgage and mortgage backed securities, both government issued as well as private. A 30% maximum allocation is assigned to emerging market issues with no limits on sovereign debt. Up to 40% is designated for bank loans of various configurations. Average maturities are from 0-8 years.

With $2.44 billion AUM, the fund’s exposure categories were: 28.26% government, 24.4% securitized, 24.17% corporate, with the remainder in cash and equivalents, as of the end of 2023.

Apollo Senior Floating Rate Fund Inc.

- Stock #3 : Apollo Senior Floating Rate Fund Inc. (NYSE:AFT)

- Yield: 11.83%

- Shares for $15,000: 1,056

- Total monthly dividend income: ~$147.88

Based in Midtown Manhattan, New York City, Apollo Asset Management is one of the premier asset management companies in the finance industry. It has recently been in the news over its bid for Paramount Studios, most recently in possible collaboration with Sony. The Apollo Senior Floating Rate Fund uses the S&P/LSTA Leveraged Loan Index for its benchmark, and primarily invests in below investment grade bonds and senior secured loans.

The average position size per issuer is $3.6 million, and average maturity is 4-5 years. Sector wise, 16.5% of the portfolio exposure is in business services, 14.6% is in high tech, and 14.2% is in healthcare and pharmaceutical, as of March, 2024.

BlackRock Floating Rate Income Strategies Fund, Inc.

- Stock #4 : BlackRock Floating Rate Income Strategies Fund, Inc. (NYSE: FRA)

- Yield: 11.27%

- Shares for $15,000: 1,142

- Total monthly dividend income: ~$140.87

In terms of AUM, BlackRock is the largest asset manager on the planet Earth, with a recently reported $10.5 trillion AUM. As such, it would not come as a surprise to anyone looking at the finance industry that BlackRock has some form of representation in every segment and aspect of finance and trading. The New York headquartered BlackRock Floating Rate Income Strategies Fund, Inc. is BlackRock’s presence in the private and public credit, high-yield arena.

With $593 million AUM to date, the BlackRock Floating Rate Income Strategies Fund’s portfolio holds roughly 62% of B rated securities, 22.5% rated BB, and 8% below B. The three largest issuer holdings are from Alliance Holdings Intermediate Llc (1.46%), Inmarsat PLC / Connect US FINCO (1.40%), and Realpage, Inc. (1.30%).

Cohen & Steers Real Estate Opportunities and Income Fund

- Stock #5 : Cohen & Steers Real Estate Opportunities and Income Fund (NYSE: RLTY)

- Yield: 10.90%

- Shares for $15,000: 1,135

- Total monthly dividend income: ~$136.25

NY based Cohen & Steers Real Estate Opportunities and Income Fund is a balanced mutual fund that, as of the beginning of April, 2024, holds a net 68.13% in equities and 15.72% fixed-income securities. The net positions are due to some leveraged short selling strategies that the fund will deploy to enhance returns.

As one could deduce from the fund name, the fund is exclusively invested in the real estate sector. The three largest holdings issuers are from American Tower Corp. (NYSE: AMT) – 6/68%, Prologis Inc. (NYSE: PLD) – 5.99%, Welltower, Inc. (NYSE: WELL) – 5.65%.

Sabine Royalty Trust

- Stock #6 : Sabine Royalty Trust (NYSE: SBR)

- Yield: 9.13%

- Shares for $15,000: 243

- Total monthly dividend income: ~$114.13

Royalty and mineral interests from oil and gas producing properties can be a very lucrative passive income stream. The Sabine Royalty Trust collects Texas based Sabine’s oil and gas royalty and mineral revenues from properties located in Florida, Louisiana, Mississippi, New Mexico, Oklahoma and Texas.

Sabine’s royalty and mineral interests include landowner’s royalties, overriding royalty interests, minerals production payments and all other similar, non-participatory interests, in the aforementioned Royalty Properties.

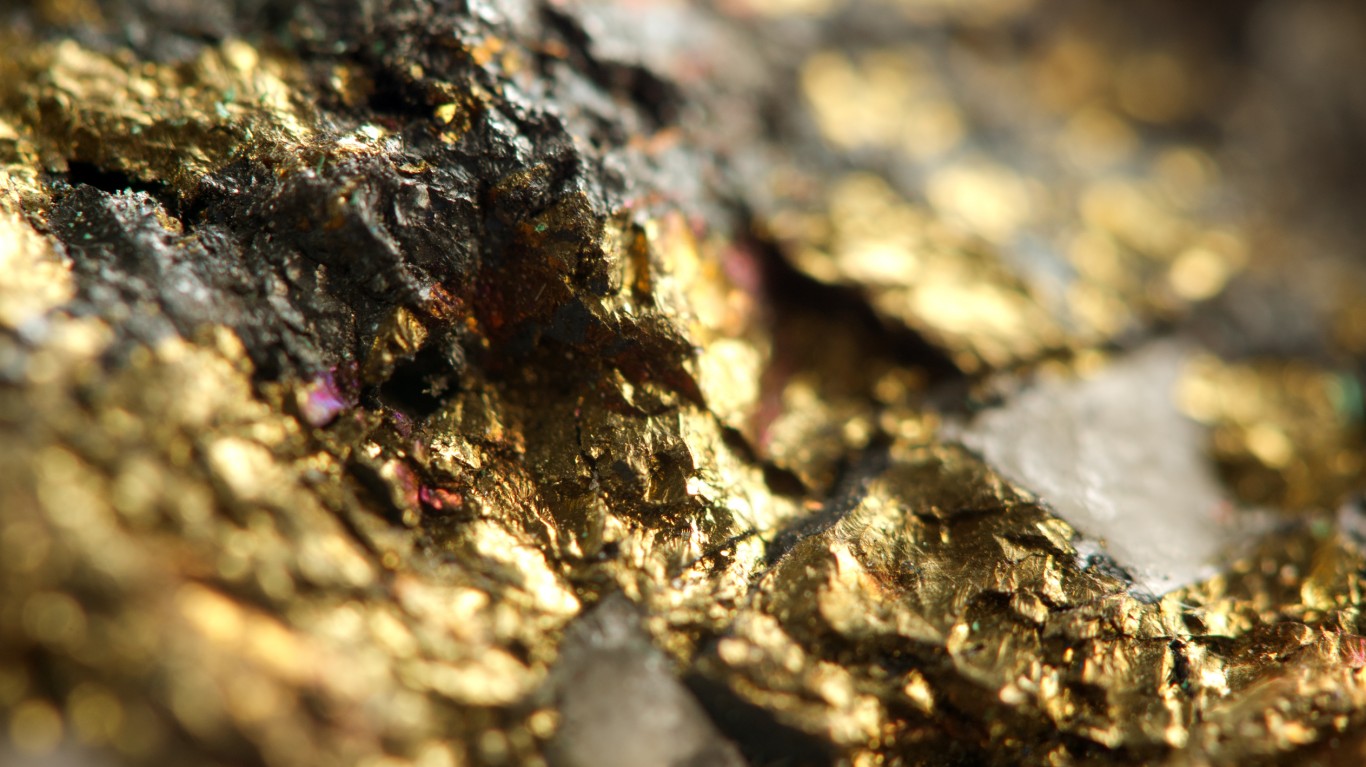

GAMCO Global Gold, Natural Resources & Income Trust

- Stock #7 : GAMCO Global Gold, Natural Resources & Income Trust (NYSE: GGN)

- Yield: 8.96%

- Shares for $15,000: 3,685

- Total monthly dividend income:~$112.00

Mutual funds that specialize in particular sectors are often a no-fuss, diversified, low-entry price way to invest in real estate, precious metals, and other asset classes that would otherwise be cost prohibitive to engage in. The GAMCO Global Gold, Natural Resources & Income Trust is a way to invest into the global marketplace of public companies involved with the exploration, mining, processing, and distribution of gold, precious metals, minerals, and energy resources.

Managed by Gabelli Funds, LLC, the fund’s portfolio as of the start of 2024 was 50.37% Non-US stocks, 33.5% US stocks, 3.27% in fixed income, with the remainder in cash. Strategically, the fund utilizes option writing and trading to augment returns.

The fund’s three largest individual holdings are: Exxon Mobil (NYSE: XON) – 4.96%, Newmont Corp (NYSE: NEM) – 4.66%, Northern Star Resources, Ltd. (OTC: NESRF) – 3.82%.

First Trust Infrastructure Energy Fund

- Stock #8 : First Trust Infrastructure Energy Fund (NYSE: FIF)

- Yield: 8.23%

- Shares for $15,000: 818

- Total monthly dividend income: ~$102.88

Specialized mutual funds can also focus on industrial sector companies solely registered in the US. The First Trust Infrastructure Energy Fund invests mostly in US companies that operate in the energy industry, more specifically, in pipelines, storage, transmission, and power generation.

Headquartered in Wheaton, IL, the First Trust Infrastructure Energy Fund portfolio is invested roughly 67% in the energy sector and 31% in utilities. With $357 million AUM as of the end of 2023, 84% were US companies, while 12% were foreign.

First Trust MLP and Energy Income Fund

- Stock #9 : First Trust MLP and Energy Income Fund (NYSE: FEI)

- Yield: 7.78%

- Shares for $15,000: 1,529

- Total monthly dividend income: ~$97.25

Similar to its sister fund, the above-mentioned First Trust Infrastructure Energy Fund, the First Trust MLP and Energy Income Fund is also a mutual fund focused on the energy sector. However, the First Trust MLP and Energy Income Fund differs from the Infrastructure Energy Fund in two (2) aspects. First, it is a balanced fund, so it invests in both equities as well as fixed-income securities. Second, its focus is on the midstream industry, so its investments are mostly Master Limited Partnerships (MLP), which are involved with pipeline and inland storage and transportation of oil and refined petroleum products.

The fund’s $543 million AUM warchest was 49% invested in its top 10 largest positions as of Q4 of 2023. The top three largest issuers’s stock being held in the portfolio were: Enterprise Products Partners LP (NYSE: EPD) – 8.89%, Energy Transfer LP (NYSE: ET) – 7.39%, and MPLX LP Partnership Units (NYSE: MPLX) – 5.18%.

Passive dividend income is a topic in which 24/7 Wall St, has published about frequently, and dividend paying stocks come in a very broad range of industrial sectors, ratings, and dividend history reliability. Companies that have a history of increasing dividends on a regular basis can often be relied upon to not miss a dividend due to sudden contractions in their market, management disruptions, or other factors.

Like any other stock portfolio, a dividend stock portfolio requires regular monitoring, especially when it involves news events or other conditions that may affect dividends, which are especially critical if those dividends are to be used to make crucial mortgage or rent payments.

| Name: | Yield: | Monthly Dividend Income: |

| Ellington Residential Mortgage REIT (NYSE: EARN) | 14.26% |

$178.25

|

| Dynamic Income Opportunities Fund (NYSE:PDO) | 14.21% | $177.63 |

| Apollo Senior Floating Rate Fund Inc. (NYSE:AFT) | 11.83% | $147.88 |

| BlackRock Floating Rate Income Strategies Fund, Inc. (NYSE:FRA) | 11.27% | $140.87 |

| Cohen & Steers Real Estate Opportunities and Income Fund (NYSE: RLTY) | 10.90% | 136.25 |

| Sabine Royalty Trust (NYSE: SBR) | 9.13% | $114.13 |

| GAMCO Global Gold, Natural Resources & Income Trust (NYSE: GGN) | 8.96% | $112.00 |

| First Trust Infrastructure Energy Fund (NYSE: FIF) | 8.23% | $102.88 |

| First Trust MLP and Energy Income Fund (NYSE: FEI) | 7.78% | $97.25 |

Total: $1,207.14

The Average American Is Losing Momentum On Their Savings Every Day (Sponsor)

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4%1 today. Checking accounts are even worse.

But there is good news. To win qualified customers, some accounts are paying more than 7x the national average. That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn a $200 bonus and up to 7X the national average with qualifying deposits. Terms apply. Member, FDIC.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.