Energy

Could Israel's War With Hamas Push Oil to $100 a Barrel?

Published:

Last Updated:

Oil prices rose by $3 a barrel in the immediate aftermath of the Hamas attacks on Israel on October 7, 2023. The outbreak of the conflict prompted fears that oil prices could soar if the war escalated further. In that worst-case scenario, analysts warned prices could top $150 a barrel. Within a month, prices stabilized and those dire predictions have not come to pass. Six months on, the conflict’s impact on oil prices has been minimal. Yet the escalation risk is ever present as long as the war continues.

This article will examine the likelihood of the war pushing oil prices past $100 a barrel by looking at the historical, economic, and geopolitical factors.

Almost precisely 50 years before the present conflict, the Yom Kippur War began when a coalition of Arab nations attacked Israel. American support for Israel led to an oil embargo imposed by members of OPEC (Organization of the Petroleum Exporting Countries). At the time, the United States was heavily dependent on foreign oil and the boycott wreaked havoc on the US economy as prices skyrocketed from $2 to $11 a barrel. Drastic measures were taken to counter the crisis, for example, the Netherlands temporarily banned private vehicle use on Sundays.

A second major oil crisis hit in 1979 with the Iranian Revolution. Despite only causing a small dip (c.4%) in the global oil supply, memories of 1973-4 led to widespread panic and steep price rises.

The response to these crises has a significant impact on the present day. In the short term, the Nixon administration moved to boost domestic oil production through Project Independence. The project had limited success but paved the way for further legislation to ease American dependence on foreign oil. Nixon’s successor signed the Strategic Petroleum Reserve into law in 1975 along with legislation to improve fuel efficiency standards and a national speed limit. A combination of greater domestic production and the use of alternative fuel sources has diluted OPEC’s unilateral influence on oil prices.

While the Middle East remains a critical region for the world’s oil supply, the area directly affected by the conflict is not. Israel is not a major oil producer and imports 99% of its domestic supply. So long as the war is contained to Gaza, there is limited potential for disruption. OPEC members have little appetite for another embargo after the long-term economic and diplomatic damage of 1973-4.

Despite moves towards alternative energy sources, demand for oil in industrialized nations remains high in the short to medium term. However, current global supplies are sufficient and there is no immediate fear of shortages. Domestically, the United States produces more oil than ever, slightly exceeding anticipated output. The Strategic Petroleum Reserve is gradually replenishing after reaching historically low levels in the summer of 2023.

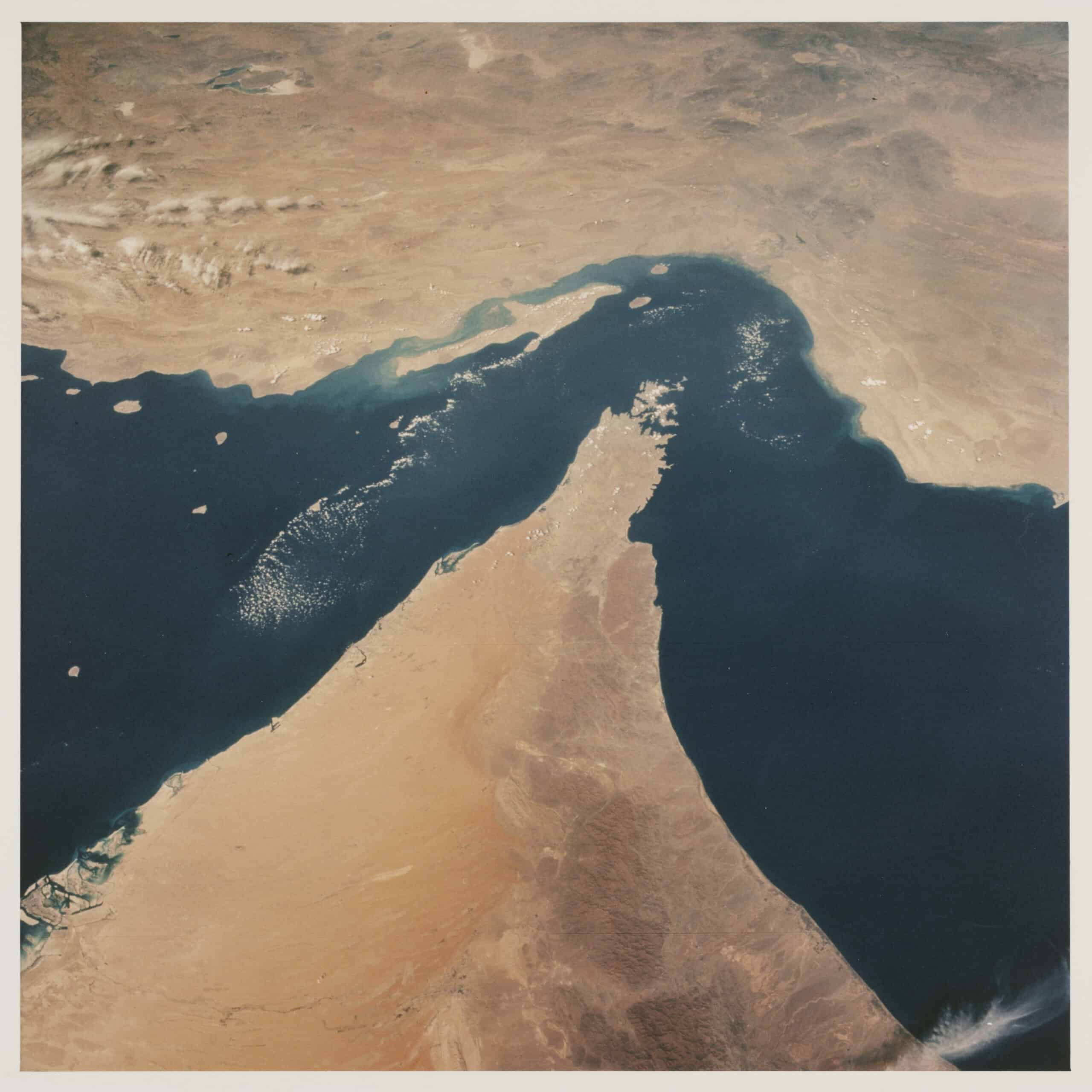

The greatest threat to the world’s oil supply is the roughly 30-mile strait between the Persian Gulf and the Gulf of Oman. A vast amount of oil passes through this chokepoint each day, around 20-30% of the world’s global trade. Saudi Arabia has shifted some trade towards the Red Sea with the East-West pipeline to mitigate this risk, though that carries its own dangers.

If the war in Gaza escalates to a regional conflict involving Iran, the shipping lanes through Hormuz will be extremely vulnerable. However, though Iran could inflict catastrophic damage on the world’s oil supply, it is equally vulnerable to attack. Exports are a vital component of the Iranian economy. Iran is still one of the world’s largest exporters of oil. Exports grew by 50% in 2023, with the vast majority going to China. Beijing’s response to the war has been muted, rather than any direct involvement, China has sought to form stronger ties with the so-called global south that opposes American support for Israel.

The risk of a regional conflict seemed to ignite in April 2024 when Israel and Iran exchanged aerial attacks on one another. Israel struck the Iranian embassy on April 1st, prompting Tehran to unleash a large but ineffective attack on Israel on the 13th. In response, Israel attacked an Iranian airbase deep inside Iran on the 19th. Both sides appeared to back down in the aftermath, unwilling to see a long proxy war escalate into the real thing. A regional war is still considered unlikely, but cannot be ruled out entirely.

Despite the dire warnings at the outset of the conflict, the Israel-Hamas War has not had any major impact on oil prices globally. While the threat of escalation to a regional war can never be discounted, neither Tel Aviv nor Tehran seem prepared to cross that strategic Rubicon. So long as the war remains confined to Gaza, the pain points will be political rather than economic for the wider world.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.