Dave Ramsey is considered a 21st-century financial guru for his approach to personal finance. His advice is easy to understand, focusing on principles like living debt-free, budgeting, and saving for emergencies. Through Ramsey’s radio show, books, and podcasts, his message of discipline in managing finances has reached millions of people. Ramsey’s ability to simplify complex financial concepts and motivate people to take control of their finances makes him a favorite. After culling the internet, 24/7 Wall St. has created a list of the 8 times Dave Ramsey nailed it with savings advice. Continue reading to learn how to improve your financial outlook.

Why It Matters

Dave Ramsey is respected for his straightforward financial advice which emphasizes getting out of debt. His principles, such as the baby steps method and the debt snowball approach, have helped many people achieve financial stability.

Not Your Shoesize

- Act your wage. -Dave Ramsey

Live Within Your Means

- Take Away: You can’t eat caviar if you’re getting paid peanuts

Living within your means is essential to maintaining financial stability and long-term security. Simply put, it requires spending less than you earn, prioritizing needs over wants, and avoiding excessive debt. Acting your wage allows you to build savings, reduce financial stress, and achieve your goals. However, in today’s world, living within one’s means is becoming increasingly challenging. Stagnant wages and rising costs have made covering essential expenses all but impossible. These challenges may require adjustments and sacrifices that are worth securing financial security.

Don’t Borrow Against Your Future

- Never take a loan against your retirement! When you pay interest against your retirement, you cost yourself interest. -Dave Ramsey

Live Like You’re Living

- Takeaway: Pay now, work later

of the advice on 24/7 Wall St.’s list of the 8 times Dave Ramsey nailed it with savings advice, this is one of the most important! Borrowing against your retirement can have significant downsides. Taking money out of retirement funds comes with fees, interest, and tax implications. Borrowing against retirement savings interrupts the compounding growth potential of those funds, hindering their ability to generate returns over time. While it may provide short-term financial relief, borrowing against your retirement should be a last resort due to the long-term consequences on your retirement readiness.

No More Guessing Games

- A budget is telling your money where to go instead of wondering where it went. -Dave Ramsey

Budget Isn’t Just A Rental Car Company

- Takeaway: Having a budget keeps you in the black.

Having a budget is essential for achieving your long-term financial goals. A budget serves as a roadmap for managing income and expenses, allowing you to make informed decisions about spending and saving. A solid budget includes Fixed expenses (rent/mortgage, utilities), variable expenses (groceries, transportation, entertainment), savings, debt repayment, and an emergency fund for unforeseen expenses. Maintaining a budget requires financial discipline while empowering you to make sound financial decisions and enhancing your overall financial well-being.

Your Future Depends On It

- You must gain control over your money or the lack of it will forever control you. -Dave Ramsey

Be A Control Freak

- Takeaway: Pinching pennies can keep you out of a pinch.

It’s imperative to hold the reins to your finances. Financial control empowers you to shape your future and achieve your goals. When you’re in charge of your finances, you can manage debt effectively, save for emergencies, invest for the future, and build wealth. Taking ownership of your finances fosters financial independence. Though it’s never too late to grab the reins, the sooner you gain control of your finances, the sooner they go to work for you.

There Are No Shortcuts

- There are no shortcuts when it comes to getting out of debt. -Dave Ramsey

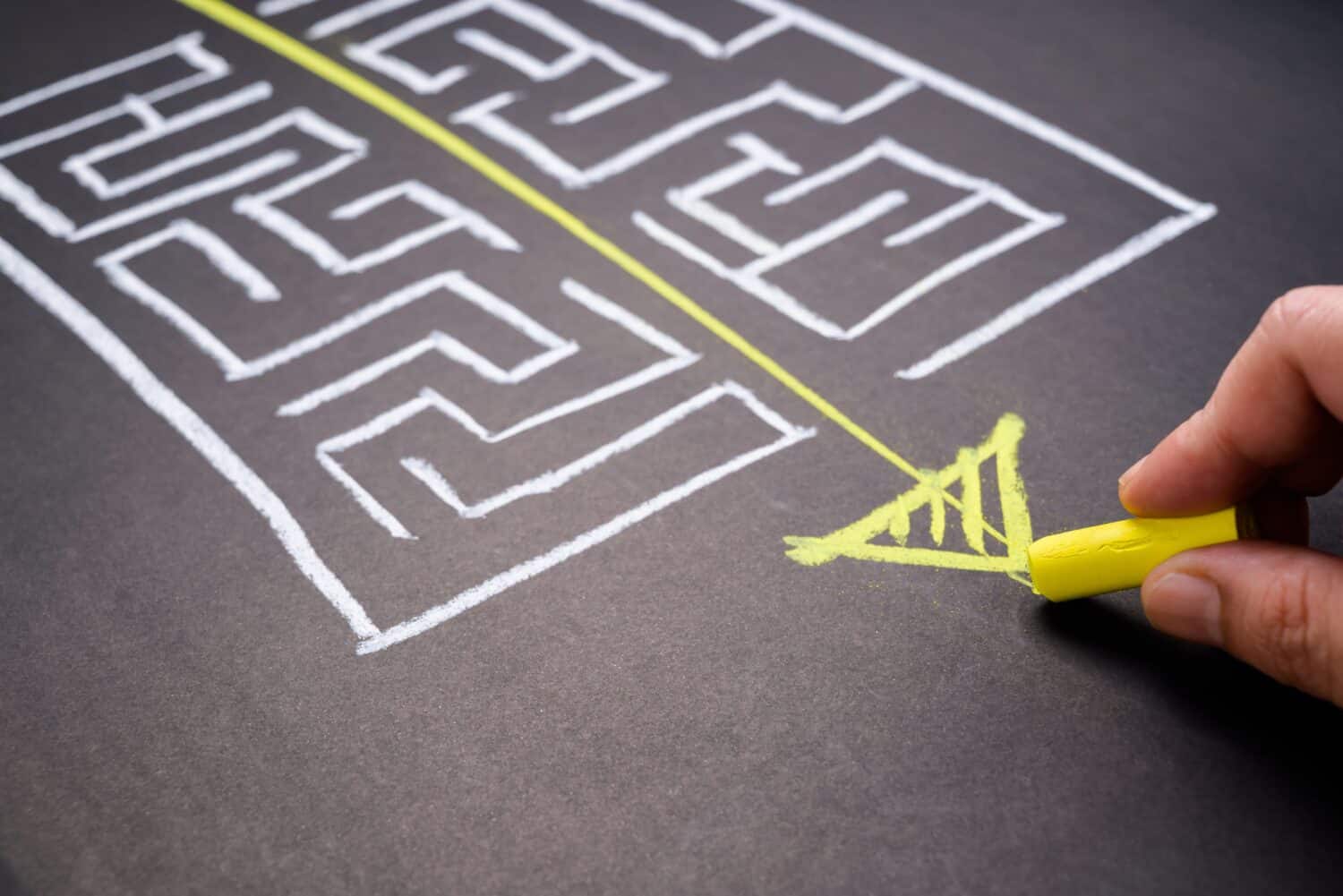

But Take The Direct Route

- Takeaway: There is no secret formula for becoming debt-free.

As much as we would like to think there’s a secret passageway to erasing debt, it’s simply not so. The most direct route to getting out of debt is through disciplined budgeting. This involves creating a realistic budget that prioritizes debt repayment and identifies areas where expenses can be lowered. Focus on paying off high-interest debts using Ramsey’s debt snowball or debt avalanche methods. While there are no shortcuts to becoming debt-free, committing to a structured plan and staying the course is the most effective path to financial freedom and long-term stability.

Pennywise, Poundwise

- A typical millionaire lives in a middle-class house, drives a two-year-old or older car, and buys blue jeans at Walmart. -Dave Ramsey

Do As He Says, Not As He Does

- Takeaway: Just because you can afford it, doesn’t mean you should buy it.

Though he might buy his jeans at Walmart, Ramsey recently upgraded from his 10 million dollar, 14,000 square foot home on a 14+ acre plot. So, while this is solid advice, take it with a grain of salt. Wealthy individuals who employ this mindset choose to live modestly, eschewing excessive spending and conspicuous consumerism. By maintaining a lifestyle significantly below their financial means, millionaires accumulate even more wealth. This approach reflects discipline, foresight, and a focus on long-term financial security. The path to wealth and success is paved by prudent financial choices.

The Credit Trap

- It takes some discipline and hard work, but relying on credit when things go wrong is a trap. -Dave Ramsey

Don’t Get Caught

- Takeaway: Buy now, retire later

Statistically speaking, you’re probably carrying some credit card debt. You’re in good company with the 82% of Americans whose average debt hovers around $5,000. Relying on credit has significant ramifications on one’s financial well-being. While credit provides short-term relief and access to funds, excessive reliance on credit can lead to a cycle of debt, high-interest payments, and financial stress. The consequences of relying on credit include diminished financial freedom, increased vulnerability to excessive debt, and an inability to achieve long-term financial goals. Maintaining your focus on responsible borrowing and timely repayment creates financial stability.

Investing Makes Cents

- Someone who never invests money will never have any. –Dave Ramsey

Saving Is Not Enough

- Takeaway: Savings alone will not save you.

Of the list items on 24/7 Wall St.’s list of the 8 times Dave Ramsey nailed it with savings advice, this one is more important than ever. Today’s low-interest rates pose challenges to relying on savings to retire comfortably. With interest rates at historically low levels, the returns on traditional savings accounts, certificates of deposit (CDs), and other low-risk investments are minimal, often failing to keep pace with inflation. As a result, relying on savings may not generate sufficient income to support a comfortable retirement, especially considering longer lifespans and potential healthcare costs.

Investing your money is essential for building wealth, and securing your future. By investing, you have the opportunity to grow your funds over time through the power of compounding returns. Investing allows you to put your money to work, generating passive income and beating inflation. Investing provides diversification, spreading risk across different assets and potentially mitigating losses. Whether it’s through stocks, bonds, real estate, or other investment vehicles, putting your money to work can pave the way for long-term financial security.

The #1 Thing to Do Before You Claim Social Security (Sponsor)

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.