When it comes to buying and selling stock, you have more options today than ever before. There is a plethora of platforms and brokers that all offer different features, customization options, account benefits and perks, and other things that they hope will convince you to trade with them. But which one should you choose, and does it matter that much in the end? To help with your decision-making process, we looked at the features of E*Trade and Fidelity, perused online reviews, and compared the two options to see which one is better and find the pros and cons of each.

Why Are We Talking About This?

While many professionals and trading enthusiasts make it sound like trading stock is easy and risk-free, it can actually be very addictive and risky. Too many people have lost their life savings trading on the market, or trading with untrustworthy institutions. It is important to do your research before investing your money with any company, let alone a stockbroker. To help with that important process, we looked into E*Trade and Fidelity for you.

Background on E*Trade

E*Trade started in 1991 and found enormous success among new and amateur traders. Typically, traders needed a substantial amount of wealth to be able to have their trades managed by a stock broker, or they would have to deal with paper orders or making orders over the phone. Either way, it was a lengthy and expensive process.

E*Trade removed the high barrier of entry and many people began trading on the market through the internet. The company grew rapidly, going public in 1996, and now has over five million customers.

E*Trade was acquired by Morgan Stanley (NYSE:MS) in 2020 which has vastly increased the range and variety of products available on the platform. This includes options for baking (read about E*Trade’s Premium savings account here), a debit card that can be attached to your investment account, retirement accounts of all kinds (you can read about E*Trade’s Solo 401(k) accounts here, and much more. Over time, E*Trade has evolved from a stock broker into an all-in-one financial platform. For example, it now offers a Premium Savings Account.

After the introduction of trading platforms that charged no commissions on trades and eliminated account fees, E*Trade followed the example of other large brokers and eliminated its own trading commissions and many of its account fees that used to be common in the industry. Today, you can buy and sell stocks and many other assets on E*Trade without paying a fee of any kind. You can also learn more in our full E*Trade review here.

Background on Fidelity

Fidelity Investments is a private, multinational corporation founded in 1946, but with roots in the years before then. It is one of the largest asset management companies in the world with over $12.6 trillion in assets in administration and more than $4.9 trillion in assets that it directly manages (as of December 2023). It provides a wide variety of financial services including its brokerage firm, mutual funds, investment advice and consulting, retirement options, index funds, life insurance, wealth management services, and much, much more.

Only the infamous BlackRock and Vanguard Group beat Fidelity among American asset management firms in terms of size and assets managed.

E*Trade vs. Fidelity Comparison

Both companies have eliminated their commission fees and most of their account fees. Neither company has a required minimum balance. E*Trade Charges a $75 fee to transfer your account to another company.

E*Trade and Fidelity both charge $0.65 per options contract.

Both companies allow users to trade bonds, stocks, mutual funds, ETFs, options contracts, and futures. E*Trade just barely has the edge in the number of mutual funds available to trade with more than 4,000 compared to Fidelity which has just over 3,300.

On the other hand, Fidelity has many more tradeable assets that E*Trade does not offer, including fractional shares, FOREX, cryptocurrency (currently limited to Bitcoin and Ethereum), and precious metals. Fractional shares are portions of a full share that allow investors to own a portion of a share at a much lower cost. This is a perfect option for people who want to trade, but don’t have a lot of money to invest in full shares which can get expensive.

The rates and charges for broker-assisted trading and margin trading as well as more complicated trades and contracts vary between them and can change at any time. We recommend you look into the fee schedule for both companies to see what they charge for the particular trade you have in mind.

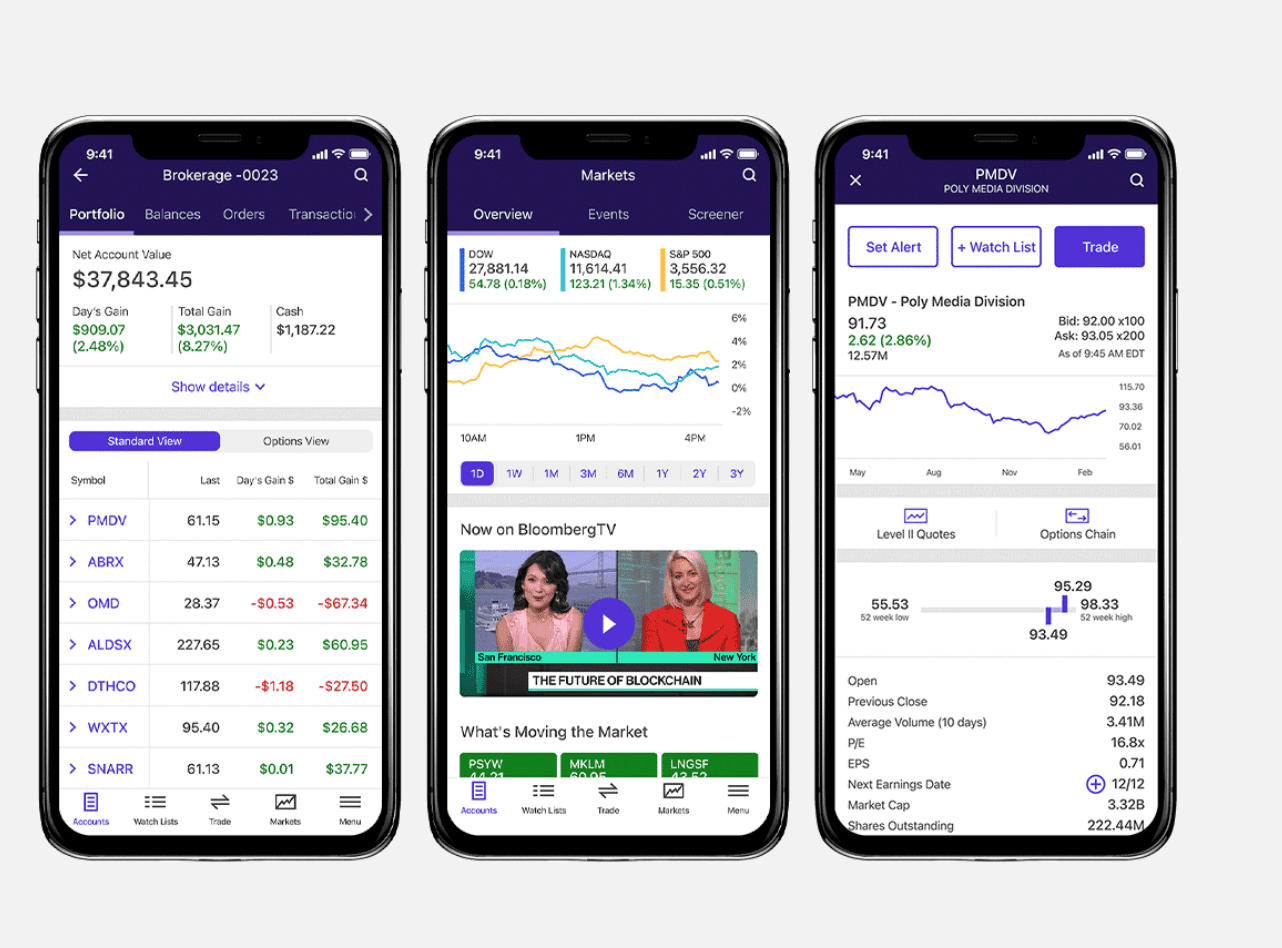

Both E*Trade and Fidelity have different platforms tailored to different types of traders. As the number of options for trading has increased, these companies have had to appeal to both amateurs and professionals alike in order to keep ahead of the competition.

E*Trade offers its standard mobile app, the more robust Power E*Trade, and the exclusive E*Trade Pro. Power E*Trade is positioned as a platform designed by traders for traders. It is tailored for professional traders and includes tools and customization options for those who want to trade full-time. E*Trade Pro is a downloadable program that gives traders access to the top-level trading software that is still a favorite among professionals today. E*Trade customers need to qualify for E*Trade Pro before requesting a download link. This includes maintaining a certain account value and making a regular number of trades every month.

Fidelity offers its online trading platform and its Active Trader Pro platform for more experienced traders. This web-based platform is similar to Power E*Trade and full-time and professional traders appreciate it for its charts, screeners, and ability to create advanced order types.

In our research, we looked into the reviews of both companies, and the general consensus seems to be that both platforms are fantastic for beginner investors, and frequent traders, and provide fantastic research and data tools. However, E*Trade does tend to receive higher and more positive reviews for its usability and user-friendly design.

So Which One Should You Choose?

As is the case with anything involving money, the answer depends a lot on your financial goals and how you want to use the platform. International traders will want to use Fidelity. Traders who want to engage with margins will save money at Fidelity as well, while those who invest in mutual funds or options will save more money with E*Trade.

Because both platforms offer different assets and access to different markets, it would be impossible to recommend a platform for each specific need or person. If you have a particular investment strategy in mind, then we recommend you look into the details of each company to see if they offer that stock or service, and which one does so more cheaply than the other. For example, those who want to trade in Bitcoin would have to choose Fidelity. If you’re still not satisfied, you can see our comparison of TD Ameritrade and E*Trade here.

Both platforms are fantastic at easing new traders into the stock market and offer plenty of helpful guides and tutorials to learn what trades to make, how to make them, and how to find success as a trader. Both provide full 24/7 customer service and offer other financial services besides stock trades. The companies diverge as the trades become more complicated or increase in volume, so your long-term trading goals are what will determine which platform to choose.

If you are curious about any other part of the E*Trade platform, check out this page: a regularly updated list of all our E*Trade guides, news coverage, and lists of benefits.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.