Fidelity GO is a robo-advisor service that recommends a diversified portfolio based on your financial goals and automatically manages it for you.

It stands out for its zero fees on smaller balances and access to human advisors on larger balances. But it may not be right for all investors. So let’s take a closer look.

Fidelity GO at a glance

| Account opening minimum | $0 |

| Fees | 0-0.35% |

| Account options | Taxable brokerage account, IRA, Roth IRA, Health Savings Account (HSA) |

| Investment options | Zero-expense-ratio mutual funds |

| Access to human advisors | Yes, on balances of $25,000+ |

Where Fidelity GO stands out

You can open a Fidelity GO account for $0. And you could start investing with just $10. Plus, Fidelity GO charges no advisory fee on balances under $25,000.

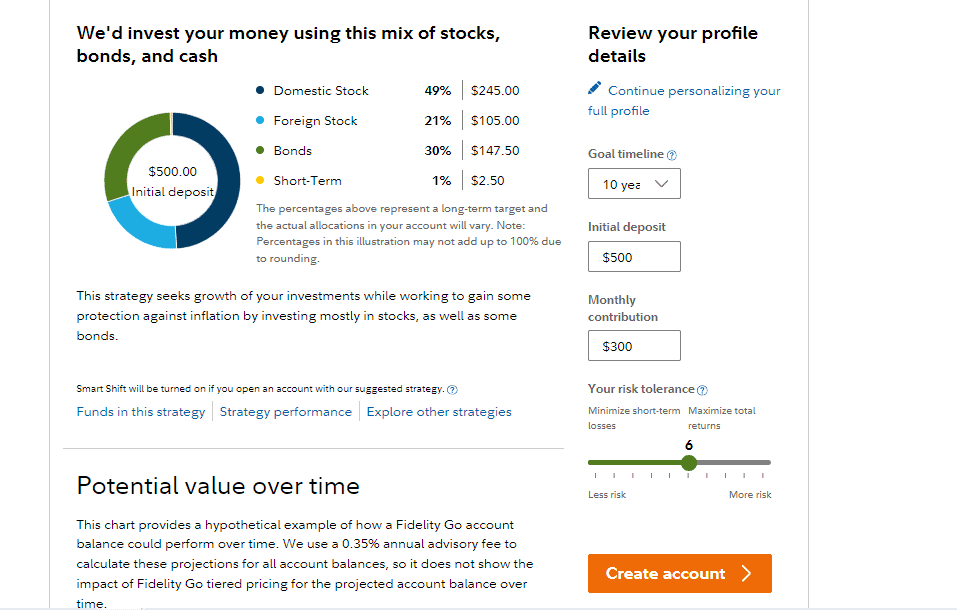

And the annual advisory fee on balances of $25,000 or more is still competitive at 0.35%. Plus, this gives you access to unlimited 30-minute coaching calls with individual Fidelity advisors. These advisors can help you build a personalized financial plan to help meet your goals.

Moreover, your Fidelity GO portfolios would be built with Fidelity Flex Funds, which charge no expense ratios (management fees). This means you could keep more of your returns.

Additionally, Fidelity GO portfolios are monitored and rebalanced by the Fidelity company Strategic Advisors, a registered investment advisor (RIA).

Where Fidelity GO falls short

Unlike several robo-advisors, Fidelity GO doesn’t offer automated tax-loss harvesting. This is a method of using losses from selling investments to offset gains made by selling other investments and thereby reducing your federal income tax. But for taxable brokerage account portfolios, Fidelity GO may use municipal bonds which are generally exempt from federal income tax.

But while Fidelity GO’s portfolio options are well diversified, they don’t offer exposure to environmental, social, and governance (ESG) funds. This may place a roadblock in front of some investors.

Fidelity GO: How it stacks up

Fidelity GO is a solid option for those seeking a low-cost robo advisor. Those with larger balances can also benefit from human financial advisors.

And its use of zero-expense-ratio mutual funds means Fidelity GO could keep more of your savings in your pocket.

But those seeking tax-loss harvesting services or access to ESG or SRI options may want to look elsewhere.

Overall, however, Fidelity GO stands out among the competition and should be something to take a look at if you’re shopping around for a robo-advisor.

How to open a Fidelity GO account?

To set up a Fidelity GO account, follow these steps.

1. Visit the Fidelity GO page and click on Get started

2. Choose an account type

You can choose from taxable accounts, IRAs, Roth IRAs, and HSAs.

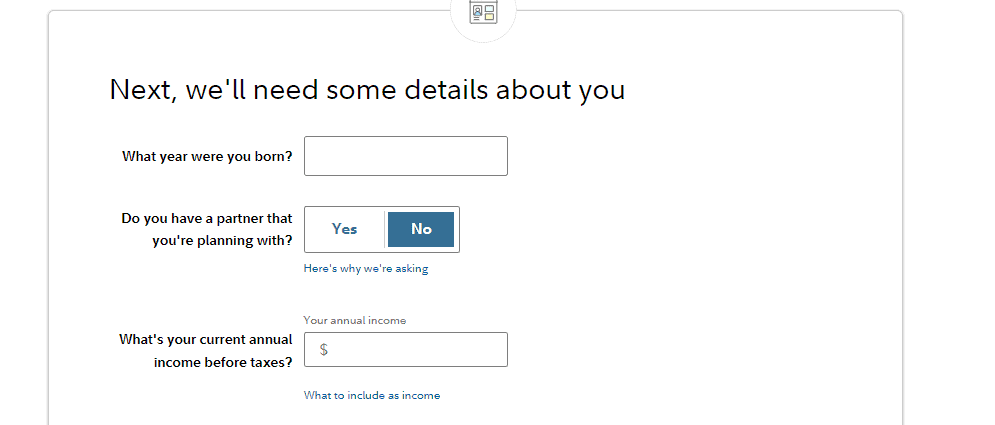

3. Enter personal details

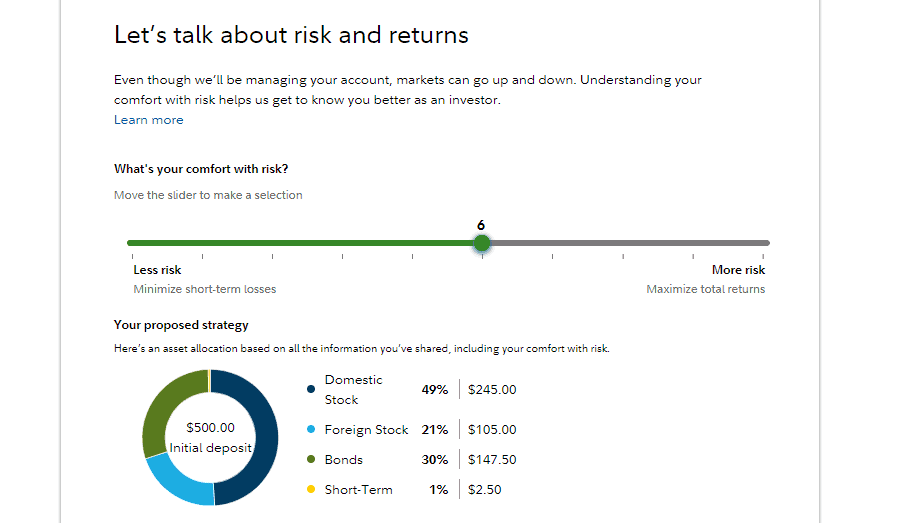

4. Choose risk preference

5. Review your recommended portfolio and click on create account

6. Follow prompts

Here, you’d be asked for more personal information like the following.

- Social Security number

- Citizenship status

- Address

- Date of birth

- Phone number

Why this matters

Robo-advisors are becoming increasingly popular options to automate investing and build wealth. But as robo-advisors take more in assets under management (AUM), you should be aware of where you are putting your money. Not all robo-advisor services are created equally. Some may suit one type of investor while lagging for the next. So to help you understand what’s out there, we looked under the hood of Fidelity GO, the robo-advisor of one of the largest investment management companies in the country.

If you want to learn more about Fidelity, check out our regularly-updated list of Fidelity Investments guides, news, and coverage.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.