Investing in AI stocks isn’t easy. Generally, AI stocks have run up huge amounts across the past year and now stand at tough-to-stomach valuations, or companies are saying they have AI exposure but it’s not impacting their financial results. Across this past earnings season, we’ve seen plenty of semiconductor stocks with AI storylines sell off as weakness in other areas of technology (like smartphones or electric vehicles) overwhelm sales gains from AI.

Today, I want to introduce a stock I believe has legitimate AI tailwinds. While it has seen share gains recently, it trades for 18X trailing earnings, which is significantly cheaper than most stocks with AI exposure.

In addition, its customer base and exposure to trends like re-working data centers for AI workloads could lead to significantly higher growth than Wall Street is expecting in the coming years. Let’s look at why Celestica (NYSE: CLS) is an under-the-radar AI play that could be a perfect addition to your portfolio.

What Does Celestica Do

Celestica is an ODM and is categorized as an Electronics Manufacturing Services stock. ODMs (Original Design Manufacturers) take designs from another company and build a product that can then be rebranded.

The largest companies in this broader category are generally located in Asia. You’ve got Hon Hai Precision Industry, Foxconn, TE Connectivity, Jabil, Flex, and Fabrinet.

While all of these companies provide manufacturing, their end customers and areas of expertise differ significantly.

That’s why Celestica is such an intriguing play. The company has two main business units. One is the Advanced Technology Solutions unit that primarily serves the defense, smart energy, industrial, and health industries.

In recent years, this unit has grown faster. However, it has slowed recently. Their other unit is Connectivity and Cloud Solutions, and it has suddenly become very interesting.

Why Celestica Could See Strong Growth in the Years Ahead

In AI investing, it pays to find companies that have luck on their side.

NVIDIA (Nasdaq: NVDA) didn’t first make GPUs because of AI. It just happened that AI workloads run extremely efficiently on their processors. Likewise, Palantir (Nasdaq: PLTR) didn’t make its intelligence software because it would be excellent in creating corporate LLMs in the future, but the opportunity is now falling into its lap.

Of course, once an opportunity presents itself, execution matters. However, being in the right place when AI demand takes off is a huge part of which companies will become the biggest winners from the AI boom.

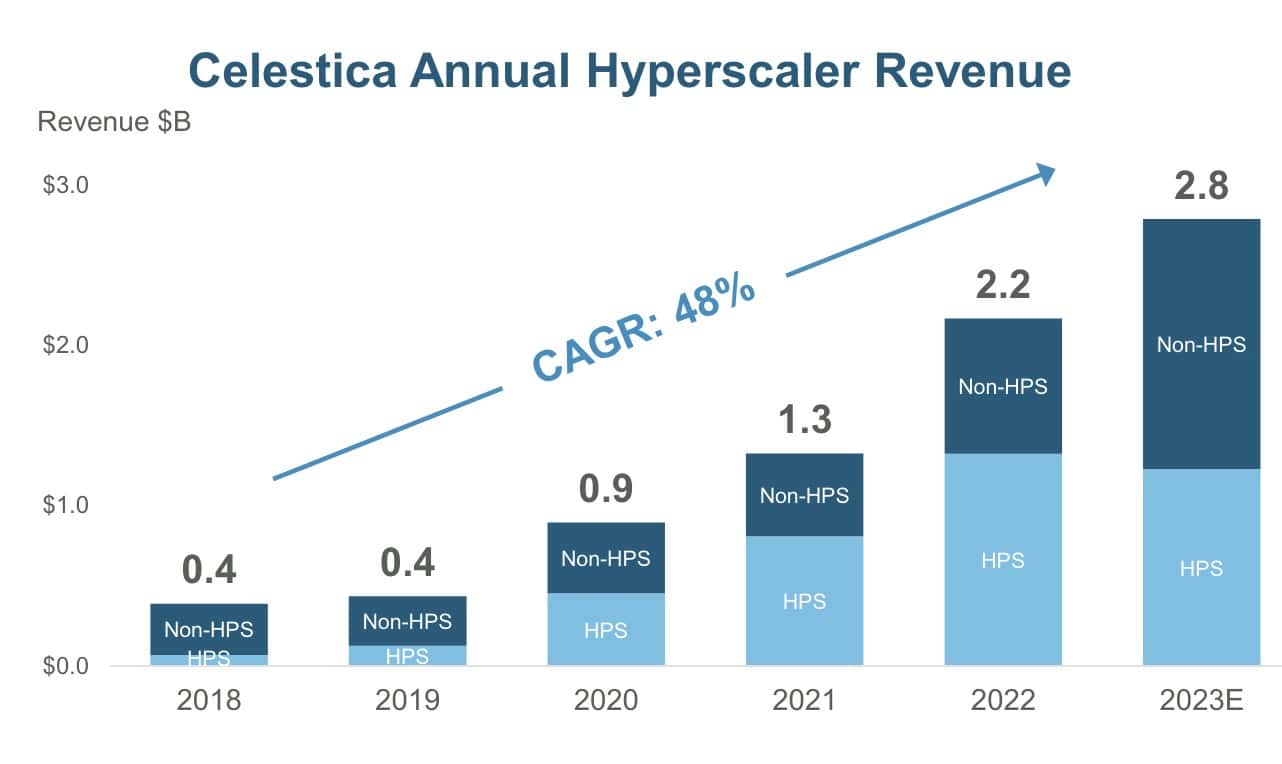

From this perspective, Celestica may be in the right place at the right time in its industry. The company focused on winning the business of large hyperscalers. If you haven’t heard the term “hyperscaler” before, it’s the name used for massive companies like Amazon, Meta, Microsoft, and Google that spend tens of billions yearly on data centers.

The decision to focus on hyperscalers has proven fortuitous as the AI spending boom has taken off in recent years. The company has seen revenue from hyperscalers grow at a 48% compounded rate since 2018.

And that revenue growth continues at an incredible clip. In the first quarter of 2024, revenue to Celestica’s CCS segment that includes hyperscalers increased by 38% from last year while profits jumped by 61%.

Margins are Growing as Well

You may have noted that profit growth is significantly outpacing revenues. A key reason for that is that Celestica gets higher margins from its business with hyperscalers (and other enterprise customers) than it does from other markets like industrials.

So, as Celestica sees the percentage of its business to hyperscalers and AI build-outs grow, its profits will also grow at an outsized rate.

| Year | 2020 | 2021 | 2022 | 2023 |

| Gross Margin % | 7.2% | 8.9% | 8.8% | 9.8% |

| Net Income % | 1.1% | 1.8% | 2.0% | 3.1% |

As you can see, Celestica’s net income margin has roughly tripled since 2020, and that trend should continue to rise in the future. The company reported just $60.6 million in net income in 2020, but thanks to those rising margins by 2023 net income increased to $244.6 million (all figures in current US exchange rates, Celestica is a Canadian company).

More Catalysts to Come

Celestica has already been growing nicely and has exposure to a number of trends in AI. It specializes in custom silicon at a time when companies like Meta, Amazon, and Google are pursuing ambitious custom chips. It also helps design liquid cooling systems that are seeing incredible gains in popularity.

However, there are other catalysts on the horizon. Another under-the-radar AI company named Applied Optoelectronics (Nasdaq: AAOI) recently reported earnings and on their call emphasized that demand for 800G networking products was accelerating, with several large hyperscalers bringing their schedules for deployment forward.

Well, it just so happens that Celestica has focused on their 800G networking product to gain market share in the space. With 800G deployments moving forward at a rapid rate thanks to the AI arms race, Celestica could have another massive demand driver that will force Wall Street to bump profit estimates up in the years to come.

The Bottom Line

Celestica isn’t without its risks. You’ve likely never invested in an ODM before for a reason, it’s not an industry cutting-edge investors are typically interested in! Margins have historically been near zero, and it’s hard to maintain an enduring competitive advantage.

However, my bet is that Celestica is a company that’s simply in the right place at the right time. Even with its shares up significantly across the past 18 months, it still trades for a reasonable valuation. In addition, I see catalysts that could force higher estimates from Wall Street and likely drive its price higher. Celestica isn’t the most high-upside AI stock, but it also might be one of the most overlooked ones. I personally own shares and will likely continue adding to my position in the year ahead.

More AI Stock Reading

- This AI “Moonshot Stock” Has 10X Returns Potential

- 2 AI Stocks That Could See Faster Growth Than NVIDIA

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.