Investing

Here's Why Meta Will Likely Announce a Stock Split in 2024

Published:

Last Updated:

The Social Network (2010), was a surprise box-office hit, with a star-making role for Jesse Eisenberg as Mark Zuckerberg, the accredited founder of Facebook, which is now known as Meta Platforms, Inc. (NASDAQ: META). The film reportedly overdramatized some events, but, Zuckerberg’s disclaimers aside, was deemed to have been accurate in its depiction of the personal and legal controversies involved with the genesis of the first social media giant.

In Gen-Z eyes, Facebook users are baby boomers or Gen-Xers who aren’t hip enough to be on TikTok. Even though Meta also owns Instagram, Whats App, Oculus, and Messenger, there is an entire generation that grew up thinking of Facebook as something their parents used, much like a previous generation derided the bulky laptop computers, cassette mixtapes, and cellphones with RAM measured in megabytes of their forebears.

Despite the appearances, Meta has been making technological developments and business moves that savvy investors have noticed. Perhaps not as press worthy as Nvidia (NASDAQ: NVDA) or as internationally significant as Apple (NASDAQ: AAPL), Tesla (NASDAQ: TSLA), or Microsoft (NASDAQ: MSFT), but enough to drive accumulation in the stock. Underestimating recent events which may give clues that a Meta forward stock-split is in the cards for 2024 can be a potential huge missed opportunity. But first, some context:

Mark Zuckerberg started Facebook, along with Eduardo Saverin and Dustin Moskowitz, while attending Harvard in the early 2000’s. As depicted in The Social Network, there have been numerous legal controversies over proper credit for the IP, stock ownership, and subsequent activities. Nevertheless, between that nascent college dorm startup and Facebook’s 2012 Morgan Stanley underwritten $16 billion IPO, Facebook use would grow to 845 million users.

However, there were some significant private investments that helped Zuckerberg along the way, prior to that IPO. Peter Thiel of Palantir (NYSE: PLTR), Reid Hoffman of LinkedIn NYSE: LNKD), Mark Pincus of Zynga (NASDAQ: ZNGA), Hong Kong magnate Li Ka-Shing of CK Hutchison Holdings (OTC: CKHUY), Yuri Milner of DST Global (NYSE: DST), Uzbek metals oligarch Alisher Usmanov, and even Microsoft were all early investors.

Within three years, Facebook use would top 1 billion users per day.

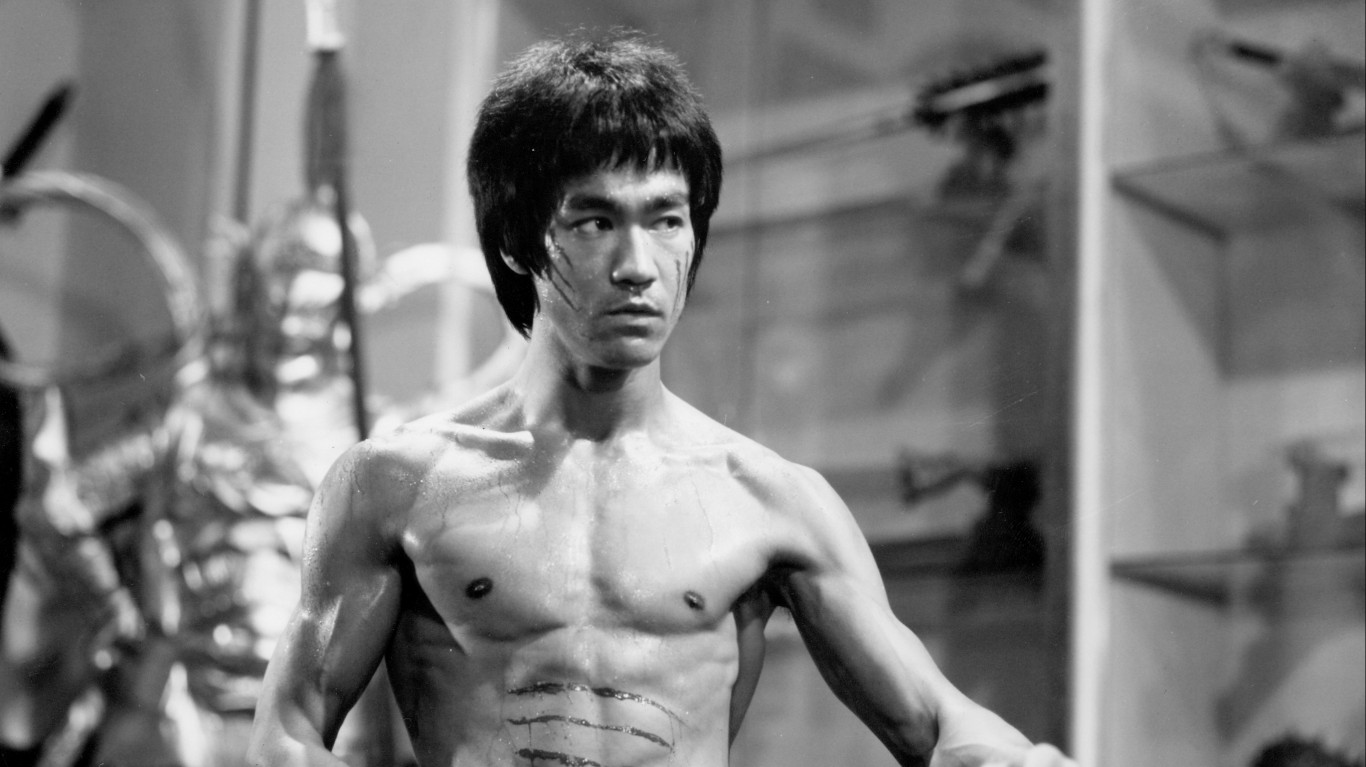

Apart from his phenomenal martial arts skills, Bruce Lee captured the attention of millions with the stealthy nature of his physique. While the 1970s ordinarily lauded the muscle size and bulk of bodybuilders like Arnold Schwartzenegger, Bruce Lee appeared very slim until he flexed his muscles, when their defined nature would pop out to explain the unreal strength behind his punches and kicks. In similar fashion, Meta Platforms has some impressive financial muscle concealed by its ubiquitous social media operations and Zuckerberg’s precoocupations with Brazilian Jiu-Jitsu and Maui real estate. For example, take Meta’s debt.

Now one might ask, “Why should Meta Platforms need to borrow money?”

It has become no secret that AI as a sector is a significant engine powering the Magnificent Seven stocks. Whether it be in hardware, platforms, or applications, each holds incalculable revenue generation potential. In the case of Meta Platforms, Mark Zuckerberg is targeting all three.

Meta AI’s most advanced current model is Meta Llama 3. To power Meta Llama 3 for further development, Meta unveiled its next generation proprietary chip in April to replace the Meta Training and Inference Accelerator (MTIA) v1, which launched in 2023.

Zuckerberg has gone on record at Meta’s last earnings conference outlining his plan to use Meta AI to monetize higher returns for advertising customers with AI generated images, algorithms for more precise individually targeted marketing, and a host of other tools and options – for users of all of its platforms, in each country, in each language.

Zuckerberg: “On the upside, once our new AI services reach scale, we have a strong track record of monetizing them effectively. There are several ways to build a massive business here, including scaling business messaging, introducing ads or paid content into AI interactions, and enabling people to pay to use bigger AI models and access more computers. And on top of those, AI is already helping us improve app engagement which naturally leads to seeing more ads, and improving ads directly to deliver more value.”

Meta’s debt increased by $9 billion, poured in primarily for further Meta AI Research and Development work. Despite the expenditures’ failure to date to generate revenue, Zuckerberg has no plans to curtail Meta AI work and is apparently playing the long game, with Meta AI destined for Facebook, Instagram, WhatsApp, Messenger, and Oculus.

While the company has yet to make a formal announcement, there are a number of indications why Meta Platforms may be planning a forward stock split:

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.