It can be difficult to decide where and how to get started trading stock. With all the personalities on television and social media talking endlessly about how to get rich and how to invest in stock, it seems like the easy and fast way to make money. Friends, family, and coworkers who trade on the stock market love to talk about it, but where should you begin?

Whether or not you’ve already settled on E*Trade as your brokerage of choice, it is helpful to understand the process that goes into buying and selling stock on the platform. If you’re new to the industry, you might want to understand what you’re in for. On the other hand, if you’re planning on migrating from an existing platform, it would be nice to see how the processes compare. Here is how to buy stock on E*Trade, step by step.

Why Are We Talking About This?

Companies typically aren’t upfront about the details of their service until after you’ve signed up. This can be annoying at best, and an expensive mistake to fix at worst. In order to make your leap into the stock market a bit less stressful, we have outlined the process of buying stock so you know exactly what you’re in for.

Background on E*Trade

E*Trade is an online trading platform launched in 1991. At the time, the typical way to trade on the stock market was through mail orders or through a broker on the phone or in their office. It was slow and you needed a lot of money to justify the commission fees. When E*Trade entered the market, that barrier to entry disappeared and millions of people began trading on the stock market for the first time with much less money than before. It was a tremendous success.

E*Trade went public in 1996 and continued to grow. Then, commission-free trading platforms began to enter the market which operated in a digital-first environment and appealed to young and new traders. E*Trade was forced to adapt. In order to keep up with newer industry competitors, E*Trade eliminated its commissions, account minimums, and many of its trading fees like many other brokers. Today, anybody can set up an E*Trade account with any amount of money and make basic trades for free.

In 2020, Morgan Stanley (NYSE:MS) acquired E*Trade and incorporated it into its online financial ecosystem. This includes new banking account options (along with a high-yield savings account), retirement options, a debit card that can be attached to your investment account, and more.

Want to learn more? Read our full review of E*Trade here.

How to Buy Stock on E*Trade

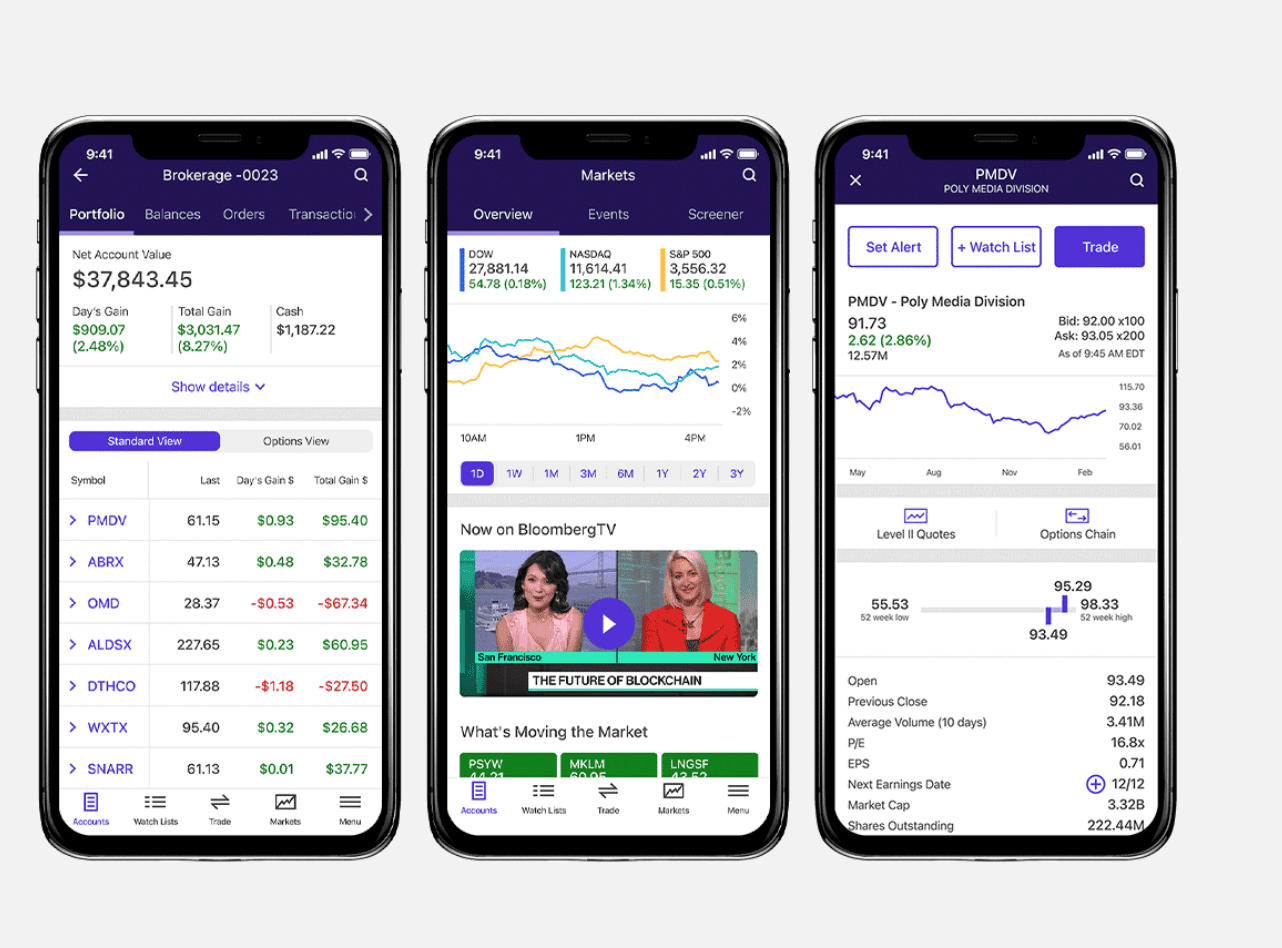

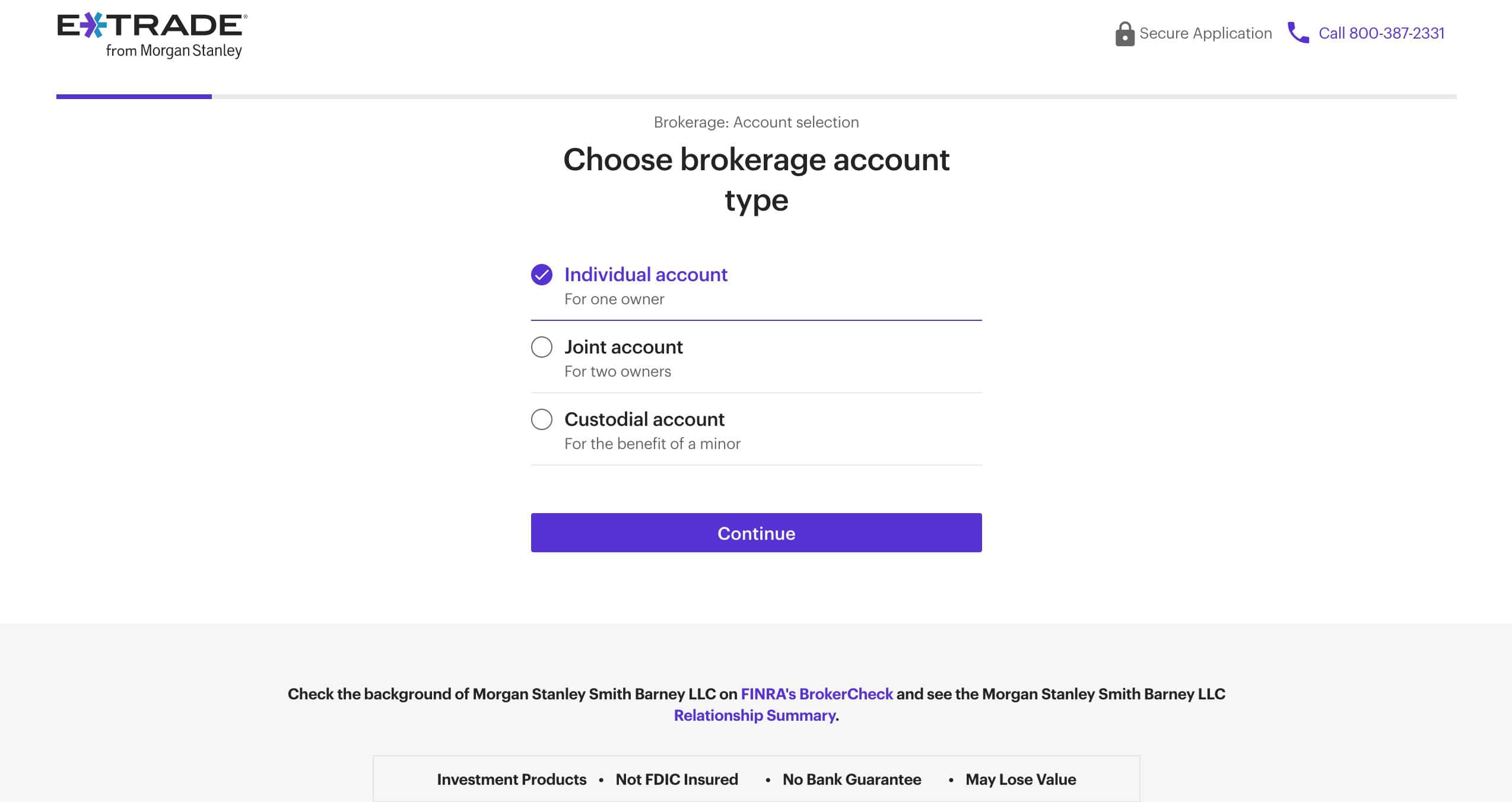

To begin trading stock on E*Trade you will need an account, specifically a brokerage account. You can do this either on the website or through the mobile app, whichever you prefer. The whole process should only take about ten minutes, as long as you have all the information you need on hand.

First, you will need to select the kind of account you want. Then you will be asked for your contact information (and any information for additional account owners if you selected a joint account) and other basic details. You will need to connect your account to your bank account in order to transfer funds to fully activate your account.

Currently, E*Trade is offering a $1,000 bonus for qualifying new accounts until the end of May 2024. If you open a brokerage account and fund it, E*Trade will deposit a cash credit into your account. We recommend you look on the website to learn more.

E*Trade will walk you through the process, so it will be very easy and straightforward.

Once your account is set up, and activated, and you have transferred funds into your account, it’s time to get started.

We are assuming that you have done your research and learned the basics of trading before starting this whole process. This involves more than listening to the resident stock expert at your local coffee shop. Watch tutorials and read the guides on the E*Trade website or other reputable sources. Look into the stocks you want to buy and learn what the terms mean. Begin consuming regular market news, and sector information, and learn your way around watch lists.

Once you have a stock in mind and are confident in your ability, you should choose where you want to make your purchases. You can do it on the website or the mobile app. The process is similar but there are some small differences that might slow you down if you change between platforms.

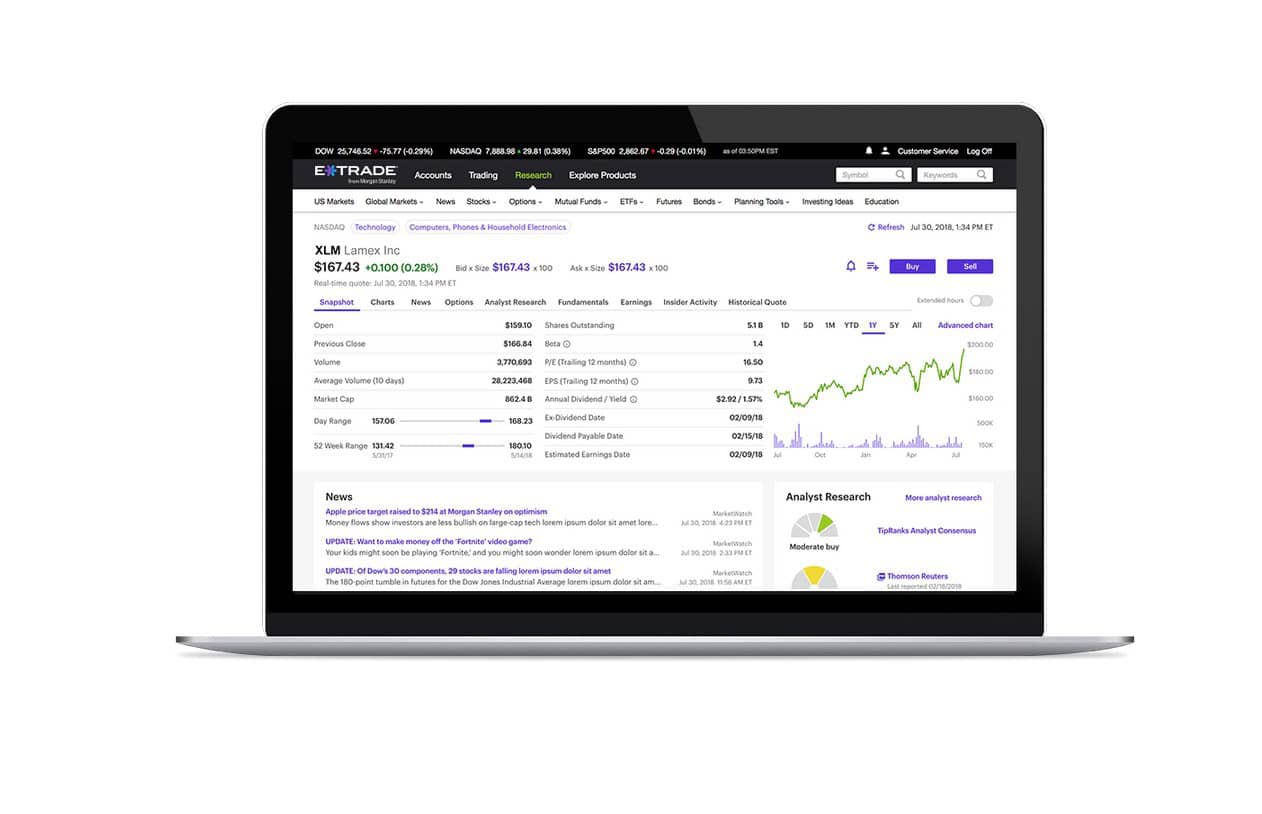

Now, you will create your order. Type in the company you want to buy or sell in the search bar and go to the hub page for that company. Click on the buy or sell button to begin the process.

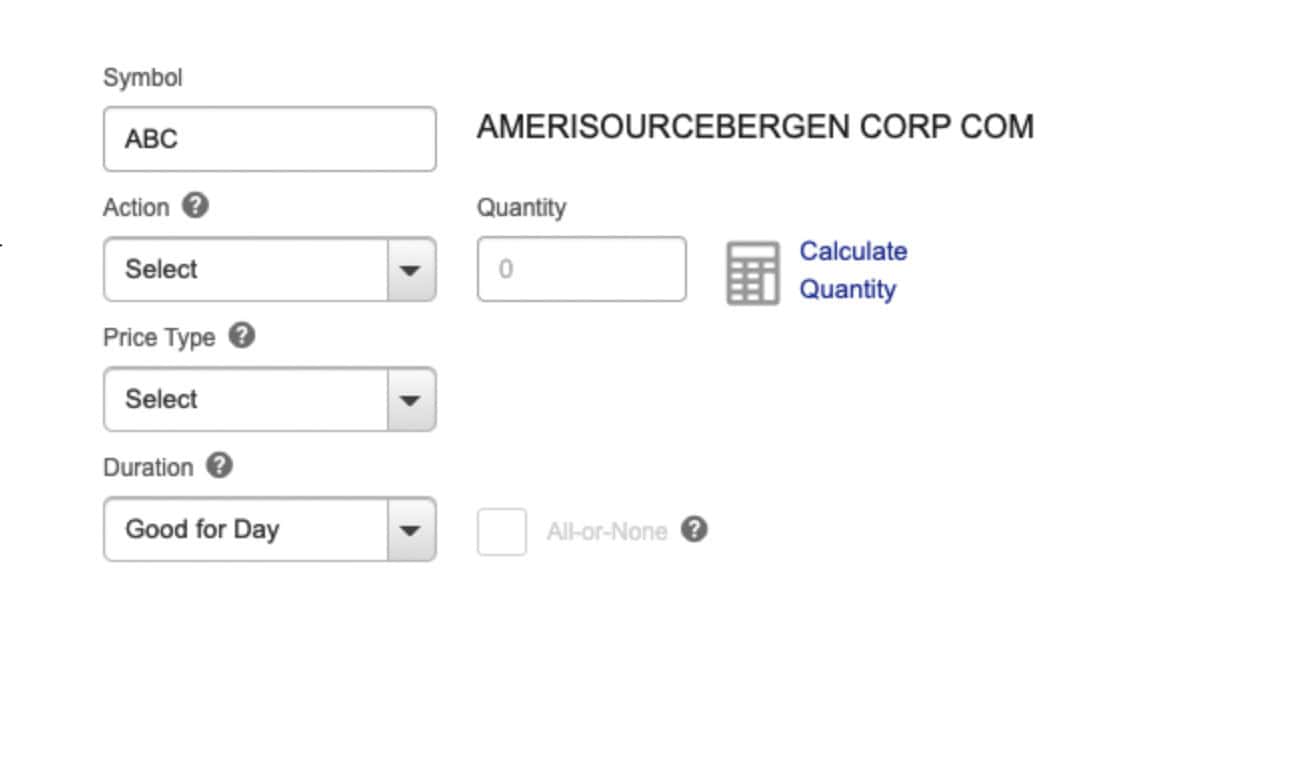

Clicking either button will open a trade ticket, and you will see all the information for the order you want to make. This includes the symbol, action, price type, and duration. Under the symbol option, type in the symbol of the company you want to buy (this is the three- or four-letter identifier used on stock tickers).

Under the action option, you will want to select Buy (not Buy to Cover) to process a simple stock purchase. Make sure to put in the total number of those shares of your selected company that you want to purchase.

Price type is a bit more complicated, but for this simple trade, you will want to select the Market option. This option means that your order will be processed immediately at the current market price for the sock you selected.

The final option, duration, will automatically populate with Good for Day, which means that your order will remain active for a full trading day or until it is fulfilled or you cancel it early. You should leave this option as it is.

Once you are satisfied with your details, you can click on the Preview Order button to see your final order. You can also save it for later. If everything looks right, you can complete the order and you will be notified (based on your account preferences) once your order has been filled.

That’s it! Once you’ve done your first order you can see how easy it is and you can begin to process more complicated buy and sell orders.

Things to Keep in Mind

Trading stocks is never risk-free, no matter how reliable or fancy the platform is. And definitely no matter what your uncle might tell you. Never invest more money than you are willing to lose, and always seek sound financial advice from people you trust.

We always recommend consumers do their own research before making any decision that involves their money. Read our guide on how to use E*Trade and look into alternatives before you commit to any platform.

If you’re curious about any other part of the E*Trade platform, check out this page: a regularly updated list of all our E*Trade guides, news coverage, and lists of benefits.

“The Next NVIDIA” Could Change Your Life

If you missed out on NVIDIA’s historic run, your chance to see life-changing profits from AI isn’t over.

The 24/7 Wall Street Analyst who first called NVIDIA’s AI-fueled rise in 2009 just published a brand-new research report named “The Next NVIDIA.”

Click here to download your FREE copy.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.