Seeing the lavish lifestyles that the rich and successful post about online, it can be tempting to throw all our money into the stock market with the hopes of joining them in the upper class. But knowing where to begin and how to invest your money is often very intimidating. One wrong investment and you could lose your life’s savings.

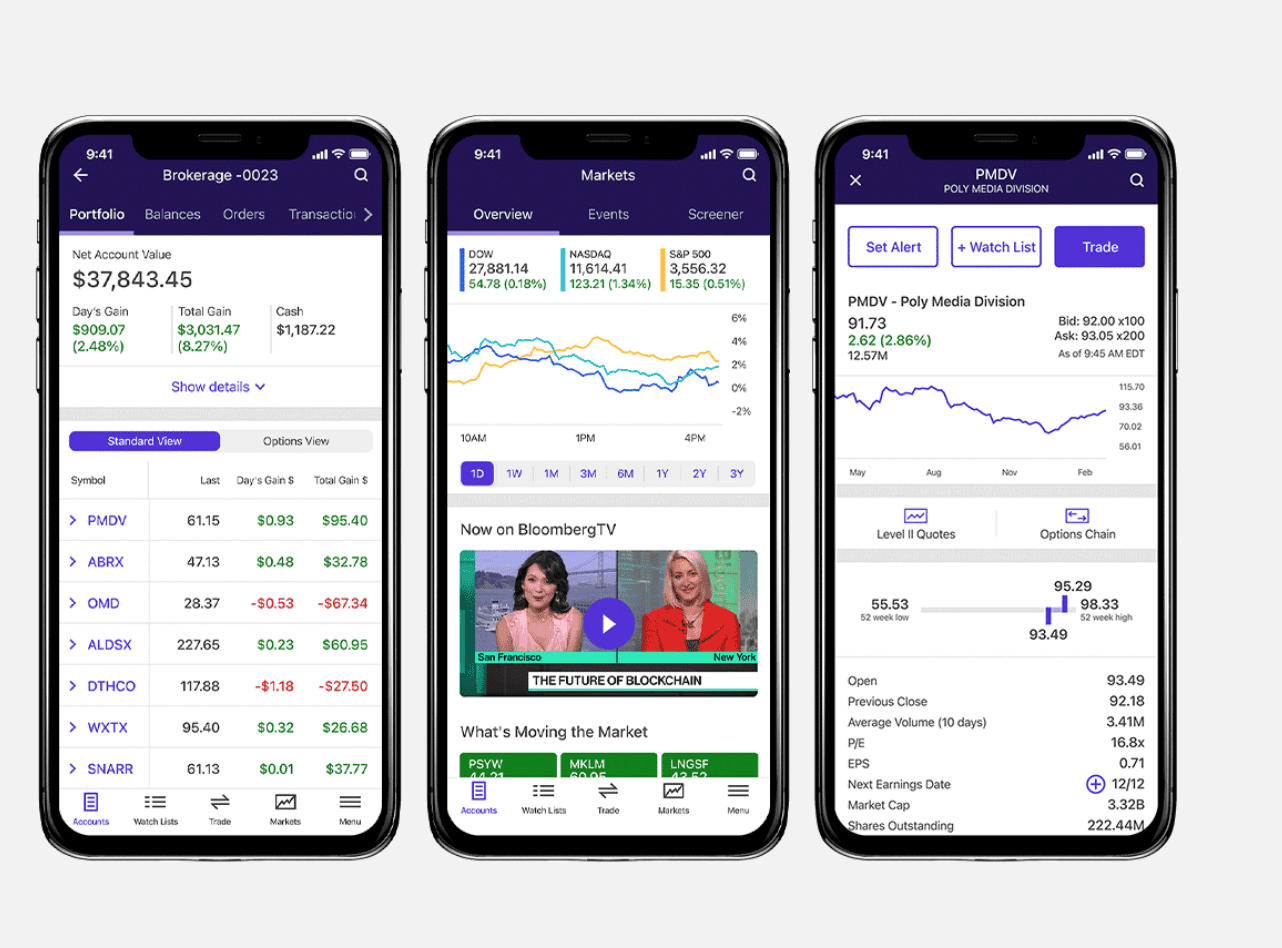

That’s why many people choose to use automatic investment tools. If you’re looking for an online broker that has automatic investing options, then E*Trade should be close to the top of your list. But what automatic investment options does it have, and how do they stack up against the competition? This is everything you need to know about E*Trade’s automatic investing.

Why Are We Talking About This?

You should always put significant effort into your research about any decision you might make with your money. This is doubly true with investing in the stock market. Investing is risky, but automatic investment can help mitigate at least some of that risk with better-informed investment decisions and strategies.

Background on E*Trade

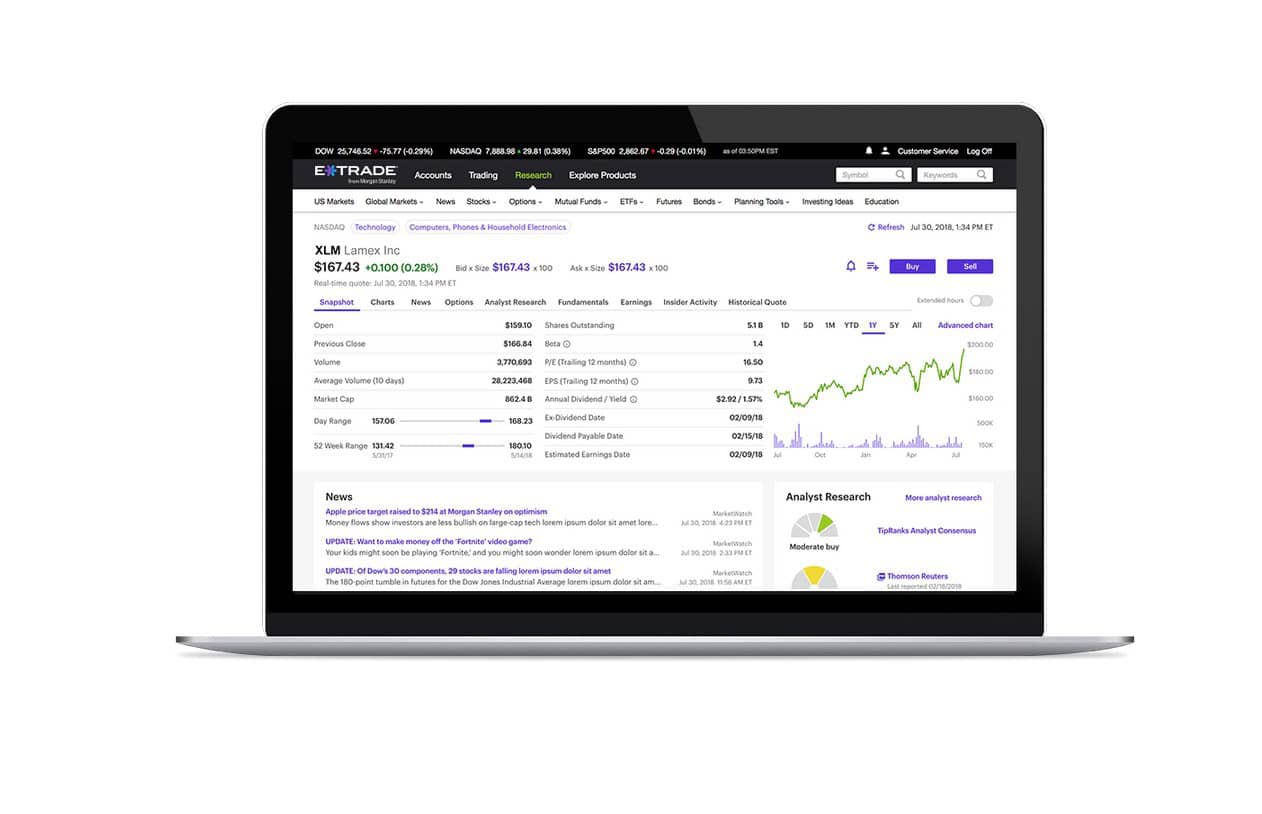

E*Trade is an online stock broker and investment platform. It was founded in 1991 and quickly gained widespread popularity as a cheaper and easier alternative to traditional brokers.

At the time, the only ways to really trade effectively on the stock market were through slow and frustrating paper forms or with brokers over the phone who often upsold their clients, or with expensive asset managers who required their clients to have significant amounts of money before signing up for their services. So, when E*Trade entered the market with other digital-first brokers, people who hadn’t been able to afford stock trades in the past flocked to the platform.

E*Trade went public in 1996 and continued to grow, adding new features and tools through the years, including automatic investment options.

With the introduction of zero-commission trading platforms, E*Trade followed the example of other traditional brokers and eliminated its stock trading commissions, account minimum requirements, and most of its regular fees. It still charges some fees for certain contracts and trades, of course, so we encourage you to look into the specific trades you want to execute.

In 2020, E*Trade was acquired by Morgan Stanley (NYSE:MS), and it was subsequently integrated into the Morgan Stanley ecosystem. This includes adding banking options (like a high-yield savings account), a debit card attached directly to your uninvested cash in your brokerage account, retirement options, and much more.

Learn more about E*Trade in our full review here.

E*Trade’s Automatic Investing

One of the primary benefits of using automatic investing with E*Trade is that it removes much of the emotions associated with trading, thus reducing some of the risk of financial investments.

Before we begin, it is important to remember that there are many different types of automatic investing, and most of them depend on the type of account you have. You can set up recurring investments based on your own preferences, or have a machine or algorithm make trades on your behalf. There are varying levels of automation, and as technology improves, they will only grow in complexity and capability.

One of the most common and widespread uses of automatic investing is through employer-sponsored 401(k) retirement plans. After the initial setup, these automatic deductions get invested into your pre-selected stocks and run on autopilot until the day you hopefully get to enjoy it. E*Trade offers a number of different retirement plans.

Another simple automatic investment option you can activate is something called a dividend reinvestment plan. If you invest in a stock that pays dividends, you can have E*Trade automatically reinvest that cash back into a stock that you picked beforehand. This saves you the effort of having to log into your account just to reinvent small amounts of money each time a dividend is paid.

From there, the role of automation only grows. You can set up recurring investments in mutual funds and ETFs, or pick from a number of pre-built stock portfolios crafted by professionals that you can invest in which will automatically allocate your money into the selected stocks. You can also choose the amount of money you invest, the timing of any investments as well as withdrawals, and cancel the investments at any time. This is what people typically refer to when they speak about automatic investing.

You will need an E*Trade account to fully explore the range of automatic investment plans available to you, as they will vary based on your goals and personal financial situation. The great thing is that you only need a minimum balance of $25 to begin with an automatic investment strategy, so you can always test the waters with a little money before committing your savings to your plan.

However, for full automation, you might be looking for a robo-advisor. Robo-advisors vary from company to company, but they are essentially algorithm-based systems that replace the human advisor role. They incorporate your financial situation, your tolerance for risk, your financial goals, and other details about you to automatically invest your money into a stock that will best achieve your goals while staying within your risk tolerances.

Most of these robo-advisors are hands-off and run completely by themselves after an initial setup, though E*Trade does offer a hybrid model with their robo-advisor it calls Core Portfolios. This replacement of the human advisor makes these plans a much more affordable and attractive option than traditional managed portfolios that would often charge an expensive fee to invest on your behalf. This means customers can still work with a human advisor along with E*Trade’s digital counterpart. See our full review of E*Trade’s Robo Advisor.

So how do you get started with automatic investing? First, you will need to pick the kind of automation you want. Do you want the machine to take care of everything for you? Then you will want to go with E*Trade’s Core Portfolios. Do you want them to only take care of the part of picking a portfolio for you and allocate the money equally? Then more straightforward automatic investment plans would be best.

For both options, you can find the menu options within your E*Trade app or account. You can’t activate or test automatic investment plans without an account.

If you want a robo-advisor (at E*Trade they are called Core Portfolios), you will go to the Account Types menu option and pick either Core Portfolios or Managed Portfolios to see more account options. After reading about the Core Portfolio option, you can select Get Started to set up your account.

If you want to enable automatic investments, you will want to select the Prebuilt Portfolios option under the Investment Choices menu tab if you just want E*Trade to help you pick a pre-built portfolio. Or, if you want full automation, you can go to E*Trade’s automation page and begin the process of setting that up. You will need an account to explore these options.

Things to Keep in Mind

No matter how much time and effort you put into your investments, trading stock is never a risk-free endeavor. Only ever invest the amount of money you are willing to lose and always do your research before investing in any company or with any brokerage.

If you end up choosing to use an automatic investment plan or service, you should still check in on your account from time to time. These services might be impressive, and they might be good, but they are not perfect. Only you know your limits and your financial goals, so only you can judge whether your automatic investment plan is working the way you want it to. There is no such thing as a perfect investment strategy.

If you are curious about any other part of the E*Trade platform, check out this page: a regularly updated list of all our E*Trade guides, news coverage, and lists of benefits.

Find a Qualified Financial Advisor (Sponsor)

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.