Investing

Wall Street Loves This 3% Dividend Stock and So Will Passive Income Investors

Published:

Everything and anything that is manufactured, from the smallest child’s toy to furniture, motorcycles, and naval aircraft carriers to skyscraper offices, is built and designed with a specific color scheme in mind. For 125 years, Akzo Nobel N.V. (OTC: AKZOY) has been providing paints and coatings for all types of products and applications. With headquarters in Amsterdam, Netherlands, Akzo Nobel, at $10.6 billion 2023 revenues, is the largest paints and coatings company in Europe, and number three globally, behind Sherwin-Williams (NYSE: SHW) with $22 billion and PPG Industries (NYSE: PPG) at $18 billion.

Several analysts are starting to get bullish in Akzo Nobel of late, including Zacks, which has given the company a Rank of #2 (Buy), as well as an A grade for Value. What factors have led to these prognostications? Perhaps the answers lie, at least in part, in the company’s past.

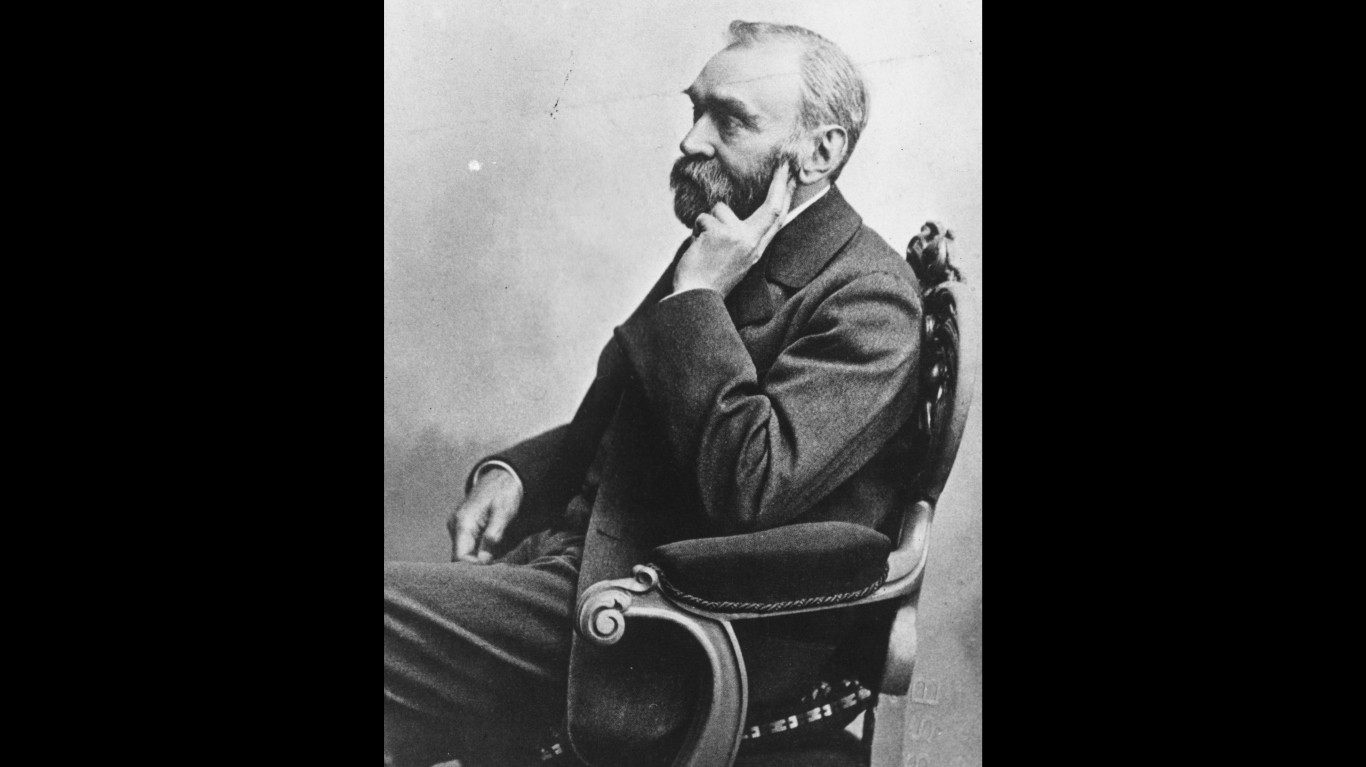

Akzo Nobel has a fascinating legacy that can be traced back to the 1600s (via acquired companies), and it includes a connection to renowned Swedish chemist Alfred Nobel, the founder of the Nobel Prize and the inventor of dynamite. Additionally, while it owns a paint and coatings company that dates back to the 1700s, the company itself had a long 50 year history in synthetic fabrics, chemicals, and pharmaceuticals, that have since been divested over the ensuing decades to focus on the current paint and coating industry.

While Akzo Nobel’s website claims its paint genesis started with the Groningen, Netherlands Sikkens paint and varnish works, which was founded in 1792, this was a later acquisition.

Akzo’s actual roots are in Vereinigte Glanzstoff-Fabriken, a German chemical company formed in 1899. Vereinigte became a leading producer of rayon, paint, and coatings during the Weimar Republic era. In 1929, Vereinigte merged with Nederlandsche Kunstzijdebariek (NK), a competing Dutch manufacturer of rayon. The post-merger company was named AKU (General Artificial Silk Union).

Throughout The Great Depression, WWII, and the subsequent Cold War era, AKU emerged as a market leader in rayon, nylon and polyester fibers, and was responsible for the invention of aramid in the 1960s, which is better known under its trademarked name as Kevlar.

AKU merged with KZO (Koninklijke Zout Organon, Eng: Royal Salt Organon)—a major Dutch producer of chemicals, drugs, detergents, and cosmetics—in 1969, and the resulting company was named Akzo.

The OPEC oil squeeze and subsequent high inflation of the 1970s would deal a crippling blow to the synthetic fiber industry. The high cost of petrochemicals required for fiber production. combined with the emergence of low-cost Japanese, Korean and Chinese manufacturing and fabrication. Additionally, DuPont shut Akzo out of the US market for aramid derivatives with its popular Kevlar body armor and related products

Arnout Loudon took over as CEO in 1982, and instituted a turnaround reorganization of Akzo. He cut synthetic fibers to 20% of corporate revenues and then focused on paint and coatings, going on an acquisition spree of about 30 companies, including businesses involved with different chemicals, salts, and pharmaceutical sector manufacturing.

While Alfred Nobel is best remembered for the prestigious Nobel Prize awards and his invention of dynamite, Nobel the chemist was an innovative genius, amassing over 350 patents during his lifetime. In 1994, Akzo acquired Nobel Industries to form Akzo Nobel, as the company is known today.

Starting in the later 1990s and throughout the 2000s would see Akzo Nobel go lean and divest itself of any businesses not related to its paint and coatings focus. As a result, divisions and subsidiaries would be subsequently sold off in the following areas:

At the same time, Akzo Nobel would concurrently be acquiring smaller rival brands, including ICI (Dulux Paint brand), Titan Paints, New Nautical Coatings, Mapaero, Huarun, Grupo Orbis, and Stahl’s powder coating, to date.

At present, Akzo Nobel carries an entire line of paints and coatings for every commercial application. Its divisions include:

As #1 in Europe and #3 globally, Akzo Nobel has a significant market share in the international paints and coatings market. After successfully warding off a contentious 2017 takeover bid from #2 global rival PPG, Akzo Nobel still has a number of current and future aspects that make it an attractive portfolio addition, based on market price at the time of this writing:

Operation Night Watch is a partnership with Rijksmuseum in Amsterdam. It is in the midst of a fascinating scientific research project to use Akzo Nobel’s expertise in paint and paint chemical composition to identify new and improved methods for restoration and conservation of priceless historic paintings from the Dutch old masters like Rembrandt and Vermeer, as well as others. Among the goals of the project are:

While Akzo Nobel certainly has an impressive legacy, its forward thinking holds potential for continued vertical growth within its sector through innovation and use of new technologies.

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.