24/7 Insights

- Passive Income can help investors not have to rely on Social Security

- Dividend stocks are a great way to generate passive income streams

- Access 2 legendary, high-yield dividend stocks Wall Street loves

Passive income is characterized by its ability to generate revenue without requiring the earner’s continuous active effort, making it a desirable financial strategy for those seeking to diversify their income streams or achieve financial independence.

According to the Internal Revenue Service (IRS), passive income generally includes earnings from rental activity or any trade or business in which the individual does not materially participate. It can also include income from limited partnerships and other similar enterprises where the individual is not actively involved.

We constantly screen our 24/7 Wall passive income stock research database looking for the best ideas, and we noticed six stocks that are often overlooked by investors. All are rated Buy at top Wall Street firms.

Why buy stocks for passive income?

More and more investors, especially those nearing or in retirement, seek passive income streams to supplement social security, pension income, or qualified retirement account withdrawals. Common stocks remain one of the easiset and best ideas.

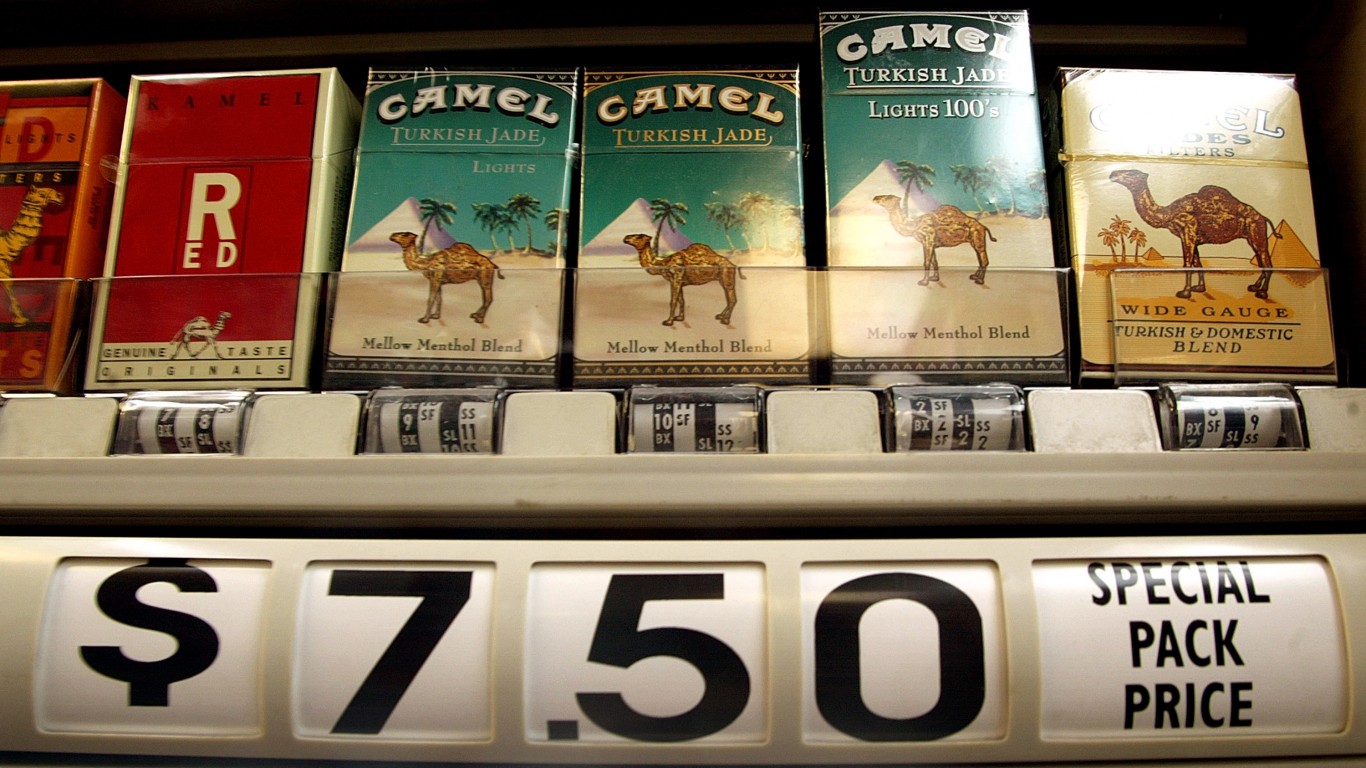

British American Tobacco

This European giant continues to print money and pays a massive 9.49% dividend. British American Tobacco plc offers:

- Vapor

- Tobacco heating

- Modern oral nicotine products

- Combustible cigarettes

- Traditional oral products, such as snus and moist snuff

The company offers its products under:

- Vuse,

- Glo

- Velo

- Grizzly

- Kodiak

- Dunhill

- Kent

- Lucky Strike

- Pall Mall

- Rothmans

- Camel

- Natural American Spirit

- Newport

- Vogue

- Viceroy

- Kool

- Peter Stuyvesant

- Craven A

- State Express 555

- Shuang Xi brands

Crown Castle International

This top cell tower company offers incredible growth and income possibilities with a fat 6.05% dividend. Crown Castle International Corp. is one of the largest U.S. wireless tower companies, with over 40,000 towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every primary U.S. market.

The company’s core business is leasing space on its wireless towers, primarily to wireless carriers, government agencies, and broadband data providers. This nationwide portfolio of communications infrastructure connects cities and communities to essential data, technology, and wireless service – bringing information, ideas, and innovations to the people and businesses that need them.

Crown Castle is one of the best stocks in the sector for more conservative investors. Its high yield distribution and low volatility make it a good holding for accounts seeking growth, income, and less risk.

Dominion Energy

Many of the Wall Street firms we cover are still very positive on utilities, and this company pays a strong 5.02% dividend.

Dominion Energy, Inc. operates through four segments:

- Dominion Energy Virginia,

- Gas Distribution,

- Dominion Energy South Carolina, and

- Contracted Assets.

The Dominion Energy Virginia segment generates, transmits, and distributes regulated electricity to residential, commercial, industrial, and governmental customers in Virginia and North Carolina.

The Gas Distribution segment engages in

- Regulated natural gas gathering

- Transportation

- Distribution and sales activities

- Distributes nonregulated renewable natural gas

This segment serves residential, commercial, and industrial customers.

The Dominion Energy South Carolina segment:

- Generates

- Transmits

- Distributes electricity and natural gas to residential, commercial, and industrial customers in South Carolina.

The company’s portfolio of assets included approximately:

- 30.2 gigawatts of electric generating capacity

- 10,500 miles of electric transmission lines

- 85,600 miles of electric distribution lines

- 94,200 miles of gas distribution lines

- Dominion serves approximately 7 million customers.

Gladstone Capital Corporation

Yielding a strong 8.87% dividend paid monthly to investors, this company is a steal at current trading levels. Gladstone Capital Corporation is a business development company specializing in:

- Lower middle market

- Growth capital,

- Add-on acquisitions

- Change of Control

- Buy & build strategies

- Debt refinancing,

- Debt investments in senior term loans, revolving loans, secured first and second lien term loans, senior subordinated loans, unitranche loans, junior subordinated loans

- Mezzanine loans and equity investments in common stock, preferred stock, limited liability company interests, or warrants.

The fund also makes private equity investments in acquisitions, buyouts, recapitalizations, and refinancing existing debts.

It targets small and medium-sized companies in the United States. It is industry agnostic and seeks to invest in companies engaged in:

- Business services

- Light and specialty manufacturing

- Niche industrial products and services

- Specialty consumer products and services

- Energy services

- Transportation and logistics

- Healthcare and education services

- Specialty chemicals

- Media and communications

- Aerospace and defense

Hess Midstream

This is the limited partnership midstream arm of one of the country’s top energy companies, which is being purchased by Chevron Corporation and pays a stellar 7.40% dividend. Hess Midstream LP owns, develops, operates, and acquires midstream assets.

The company operates through three segments:

- Gathering,

- Processing and Storage

- Terminating and exporting

The gathering segment owns natural gas gathering and crude oil gathering systems and produces water gathering and disposal facilities.

Its gathering system consists of approximately:

- 1,350 miles of high and low-pressure natural gas and natural gas liquids gathering pipelines with a capacity of about 450 million cubic feet per day,

- The crude oil gathering system comprises approximately 550 miles of crude oil gathering pipelines.

The Processing and Storage segment comprises:

- Tioga Gas Plant, a natural gas processing and fractionation plant located in Tioga, North Dakota

- 50% interest in the Little Missouri 4 gas processing plant located south of the Missouri River in McKenzie County, North Dakota

- Mentor Storage Terminal, a propane storage cavern, and rail and truck loading and unloading facility located in Mentor, Minnesota

The Terminaling and Export segment owns the Ramberg terminal facility, Tioga rail terminal, crude oil rail cars, Johnson’s Corner Header System, and a simple oil pipeline header system.

Pembina Pipeline

This overlooked Canadian pipeline companye pays a solid 5.40% dividend and works with some of the top companies in the industry. Pembina Pipeline Corporation provides energy transportation and midstream services.

It operates through three segments:

- Pipelines,

- Facilities, and Marketing &

- New Ventures.

The Pipelines segment operates conventional, oil sands and heavy oil, and transmission assets with a transportation capacity of 2.9 millions of barrels of oil equivalent per day, the ground storage capacity of 10 millions of barrels, and rail terminalling capacity of approximately 105 thousands of barrels of oil equivalent per day serving markets and basins across North America.

The Facilities segment offers infrastructure that provides customers with:

- Natural gas

- Condensate

- Natural gas liquids (NGLs), including ethane, propane, butane, and condensate; and includes 354 thousands of barrels per day of NGL fractionation capacity, 21 millions of barrels of cavern storage capacity, and associated pipeline, and rail terminalling facilities and a liquefied propane export facility.

The Marketing & New Ventures segment buys and sells hydrocarbon liquids and natural gas originating in the Western Canadian sedimentary basin and other basins.

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.