Investing

Don't Forget These 5 Passive Income Dividend Stocks With Yields as High as 8.4%

Published:

Investors love dividend stocks because they provide dependable income and give investors a great opportunity for solid total return. Total return includes interest, capital gains, dividends, and distributions realized over time. In other words, the total return on an investment or a portfolio consists of income and stock appreciation.

Most dividend investors aim to secure a reliable passive income stream from quality dividend stocks. Passive income is a consistent unearned income that doesn’t require active traditional work. It’s a financial goal that can be achieved through various means, including investments, real estate, or side hustles.

With the stock market racing to new all-time highs on the strength of Artificial Intelligence mania, we decided to go bargain shopping, looking for top dividend stocks that, for whatever reason, are trailing this massive run-up in the markets.

Five exceptional companies have piqued our interest and are often overlooked despite their potential. Each presents investors with excellent entry points, substantial and reliable dividends, and the promise of consistent passive income. Moreover, all are buy-rated at top Wall Street firms, adding to the intrigue for potential investors.

Investors looking to generate passive income need to consider stocks that while well-known often get overlooked in the discussion for the top dividend ideas. We think these five offer investors outstsading entry points at current trading levels.

The electronics retail giant is priced to be bought and offers a hefty 5.15% dividend. Best Buy Inc. (NYSE: BBY) sells technology products in the United States and Canada.

The company operates in two segments:

Its stores provide:

The company’s stores also offer:

In addition, it provides consultation, delivery, design, installation, memberships, repair, set-up, technical support, health-related, and warranty-related services.

This top retailer got walloped back in early October and still offers an excellent entry point now, yielding a stunning 8.32%. Kohl’s Corp. (NYSE: KSS) operates department stores in the United States.

It provides private label, exclusive, and national brand apparel, footwear, accessories, beauty, and home products to children, men, and women customers. The company also sells its products online at Kohls.com and through mobile devices.

The company provides its products primarily under the brand names of:

Kohl’s has a partnership where Amazon customers can return items through the retailer. Some feel the deal should be expanded with a full partnership or even Amazon buying Kohl’s.

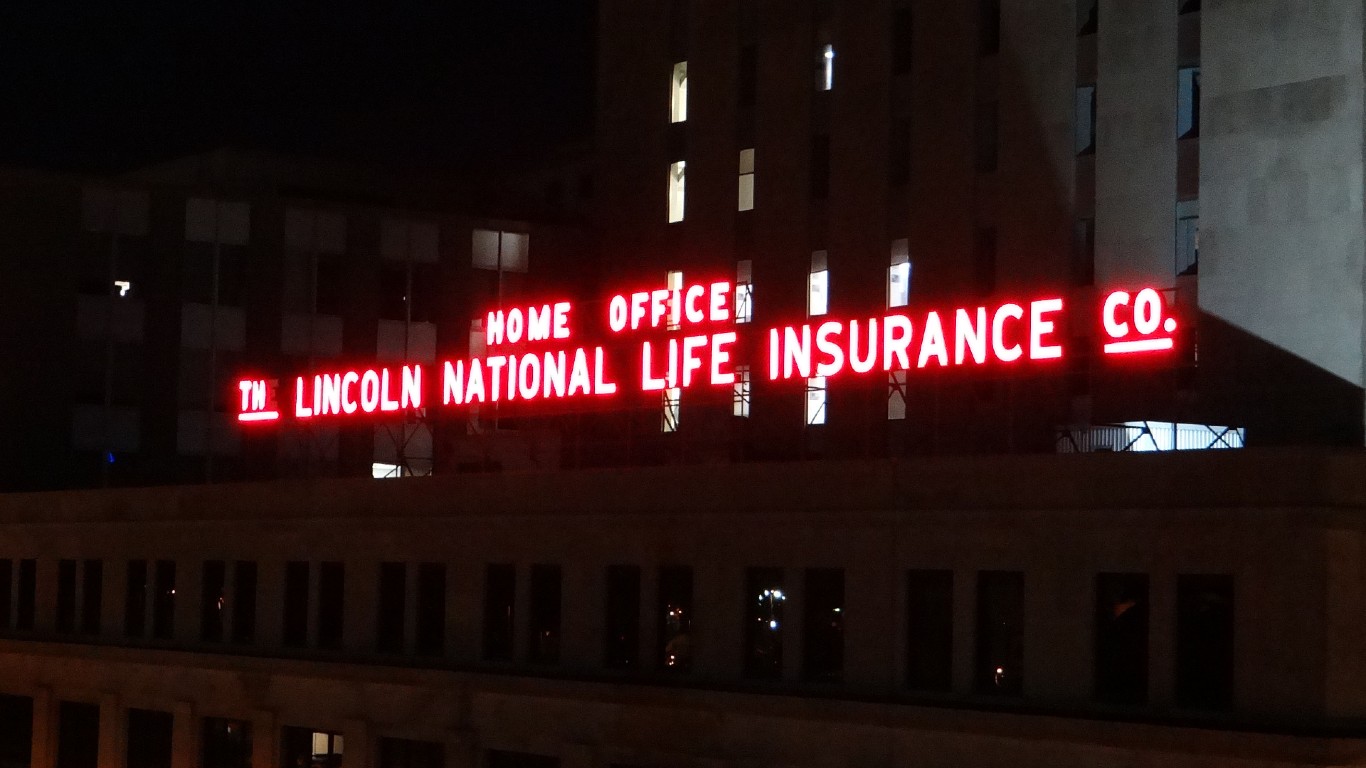

Insurance never goes out of style, and Lincoln National Corporation (NYSE: LNC) is one of the top companies in the industry that pays a rich 6.2% dividend. Through its subsidiaries, the company operates multiple insurance and retirement businesses in the United States.

It operates through four segments:

Under the Annuities segment, Lincoln National Corporation offers a variety of annuities, including variable, fixed, and indexed variable annuities.

The Retirement Plan Services segment is designed to cater to employers, providing them with a comprehensive range of retirement plan products and services, including:

The segment also offers a host of plan services, such as plan recordkeeping, compliance testing, participant education, and trust and custodial services, making it a one-stop solution for retirement planning.

The Life Insurance segment provides life insurance products, including:

This top pharmaceutical stock was a massive winner in the COVID-19 vaccine sweepstakes but has been crushed as many are not getting boosters. Pfizer Inc. (NYSE: PFE) discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products worldwide and pays a rich 6.05% dividend, which has risen yearly for the last 14 years.

The company offers medicines and vaccines in various therapeutic areas, including:

Pfizer also provides medicines and vaccines in various therapeutic areas, such as:

The potential for new home sales to increase is a big positive for this company, which pays a sizable 7.37% dividend. Whirlpool Corporation (NYSE: WHR) manufactures and markets home appliances and related products.

It operates through four segments:

The company’s principal products include:

Whirlpool markets and distributes its products primarily under the:

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.