One of the worst feelings in the world is seeing a surprise fee in your account. Being charged money, no matter how small, because you didn’t look closely enough at the details or because the company used sneaky tactics to hide the fees from you is never fun. Depending on the size of the fee, most of us just choose to stay with a particular company instead of transitioning to a new one because of the hassle involved. So, to help you on your investment journey, and help you avoid being stuck with a company you don’t like, what are E*Trade’s major fees?

Why Are We Talking About This?

Too often we get sucked in by the marketing and features of a product or service and forget to look at the fine print until it’s too late. At best this can be annoying, at worst it can be an expensive mistake. We want to help you avoid this issue, and combat the misleading tactics used by large companies in some small way. The best tool to protect yourself against financial blunders is information.

The Background on E*Trade

E*Trade was among the first online trading platforms, launched in 1991. At the time, stock trading was limited to slow, cumbersome mail-in forms, expensive brokers over the phone, or asset managers limited to only the rich. Only those who had significant amounts of money to invest were willing and able to trade on the stock market.

When E*Trade launched, it lowered the barrier to entry into the stock market. Trading was now fast, easy, and significantly cheaper. Millions soon began buying and selling stock who would not have had the opportunity before. E*Trade still charged commission fees and many of the other fees that larger brokers charged at the time, but the online functionality and no trade minimums meant that everyday people had unfettered access to the markets.

In 1996, after substantial success, E*Trade went public and it continued to grow quickly. Then digital-first trading platforms began to enter the market in the 2000s, charging zero commissions on stock trades, and eliminating many of the fees that were standard in the industry and that many large brokers had taken for granted. The clean, simple design of these platforms, along with the potential for free stock trades, enticed millions of people (mostly millennials) to begin trading on the stock market. As a result, many large brokers eliminated their regular fees, including E*Trade.

Now, people can trade stock and complete other basic market transactions on E*Trade without paying expensive commissions or paying account fees.

Morgan Stanley (NYSE:MS) acquired E*Trade in 2020. The trading company was quickly integrated into Morgan Stanley’s larger financial banking ecosystem, and new features were added to the E*Trade platform. This includes a high-yield savings account, checking accounts, a variety of retirement options, a debit card that you can attach to your brokerage account, and much more.

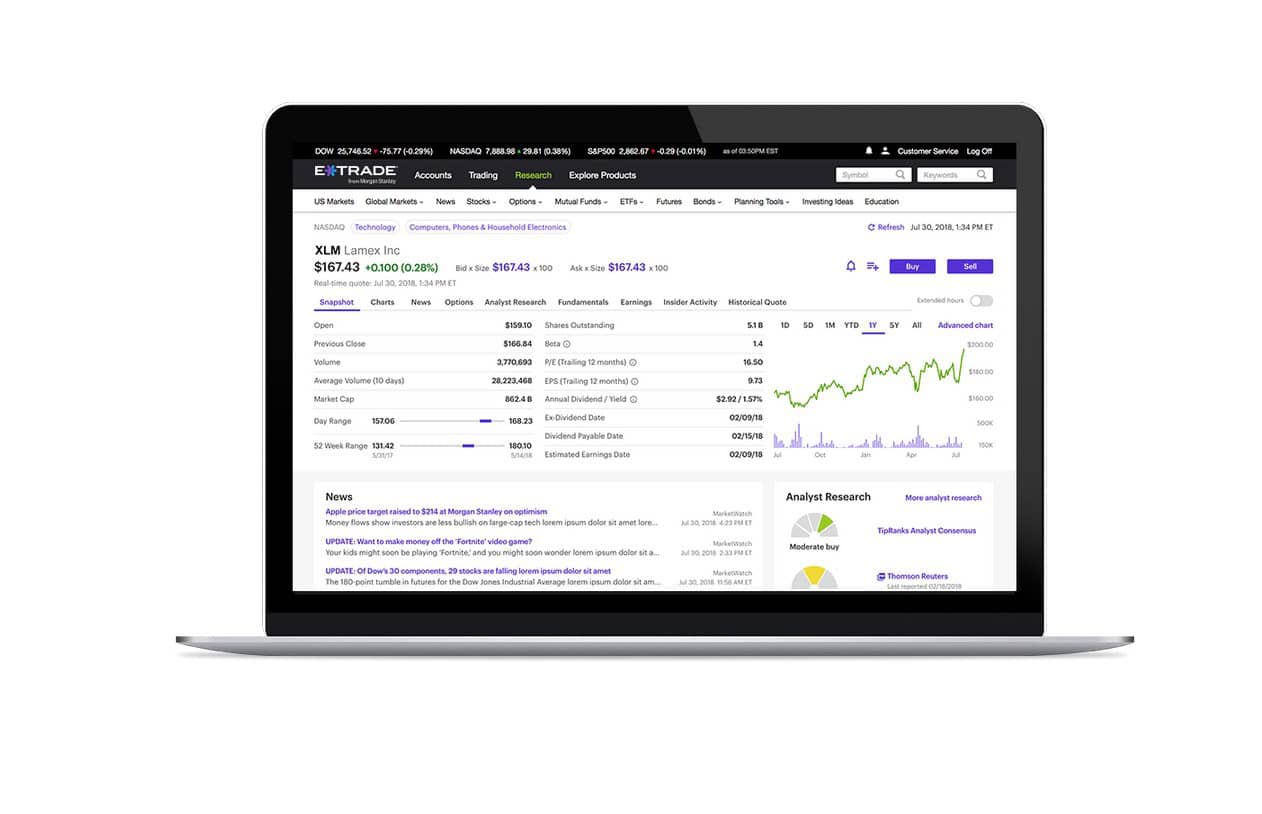

Read our full review of E*Trade here to learn more about the platform.

What Are E*Trade’s Major Fees?

Naturally, the fees you might pay at E*Trade depend on what type of account you have and what kinds of activities you want to engage in. It is possible to use E*Trade in some capacity without paying any fees, but we will cover all the fees currently charged by the company so you can get a full picture and make a better-informed decision about where to do business just in case you want to expand your investing goals in the future.

For stocks and options: there are no fees for trades, but there is a fee of $0.65 for every options contract if you do fewer than 30 every quarter. If you purchase 30 or more options contracts per quarter, that fee drops to $0.50 per contract. There is no exercise or assignment fee and no fee for short positions closed at less than 10 cents. E*Trade does not charge any fees for exchange-traded funds (ETFs). Read more about how to buy stock on E*Trade here.

There is a $25 fee for broker-assisted trades and you might have to pay commissions for any trades executed with the help of a broker.

For any over-the-counter stock trades, E*Trade charges a fee of $6.95. This includes all stocks, ETFs, and options trades. If you make more than 30 over-the-counter trades per quarter, however, the fee is reduced to $4.95.

For bonds, there are only fees for online secondary trades, at $1 for each bond traded with a minimum of $10 and a trade maximum of $250. There is a $20 commission for any broker-assisted trades involving bonds.

For futures, there is a $1.50 fee for every futures contract, not including any applicable fees. For cryptocurrency futures, the fee increases to $2.50. All futures contracts are subject to fees levied by the NFA, and any floor brokerage fees. The fees are charged by third parties, so they are not listed individually on E*Trade’s website. The only way to discover what they are is to set up a futures contract and see what fees are applied.

There are no fees for no-load mutual funds.

For margin trading, the margin rate decreases as your debit balance increases. The lowest rate is for balances less than $10,000 at 14.20% (2.50% higher than the base margin rate). The rate falls to 13.95% for balances up to $24,999.99, 13.70% for balances up to $49,999.99, 13.20% for balances up to $99,999.99, 12.70% for margin balances up to $249,999.99, and finally 12.20% for balances up to $499,999.99.

For any balance over that amount (meaning over $500,000), customers need to contact E*Trade directly to learn about what rates might apply.

If you want to use Core Portfolios, which is E*Trade’s robo-advisor service, you will need to pay a small fee every month. For account values less than $500, the service is free, but once your account surpasses that value, you must begin to pay a 0.30% advisory fee in advance to continue using the service for that month.

There are other miscellaneous fees for niche trades such as fees for index options (the fee depends on the particular index you are trading), and FINRA trades. There are also the typical account fees you would expect to see from other institutions like returned check and insufficient funds fees at $25, fees for account restrictions or forced liquidation, foreign transaction fees (at 1% of the transaction amount), a fee of $2.00 for paper statements, $25 for overnight mail, $75 for transferring your account to another company, $25 for stop payment requests, $25 for outgoing wire transfers, and so on. If you have transactions or company requirements that require these types of transactions or requests, we suggest you visit E*Trade’s fee schedule to see what fees you might expect to pay on a regular basis.

Keep in mind that all of these fees can change at E*Trade’s discretion at any moment. It is not obligated to notify you of the changes, especially those that are charged by third-party organizations. We encourage all users to stay on top of all potential fees that E*Trade might charge and check your account regularly. A $75 fee to transfer your account from E*Trade can be too expensive for some people to pay, so avoiding it in the first place is a better option.

If you are curious about any other part of the E*Trade platform, check out this page: a regularly updated list of all our E*Trade guides, news coverage, and lists of benefits.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.