Investing

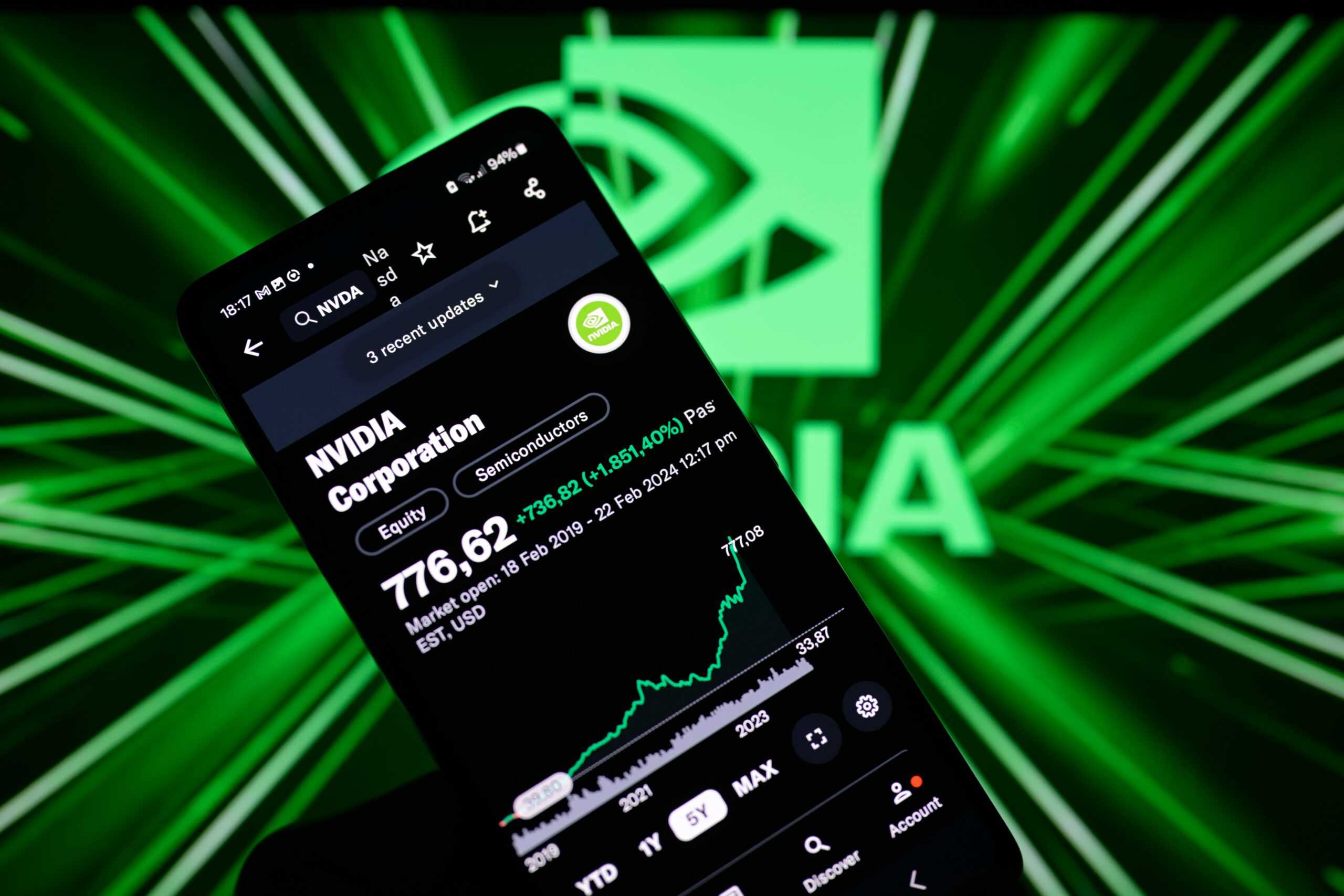

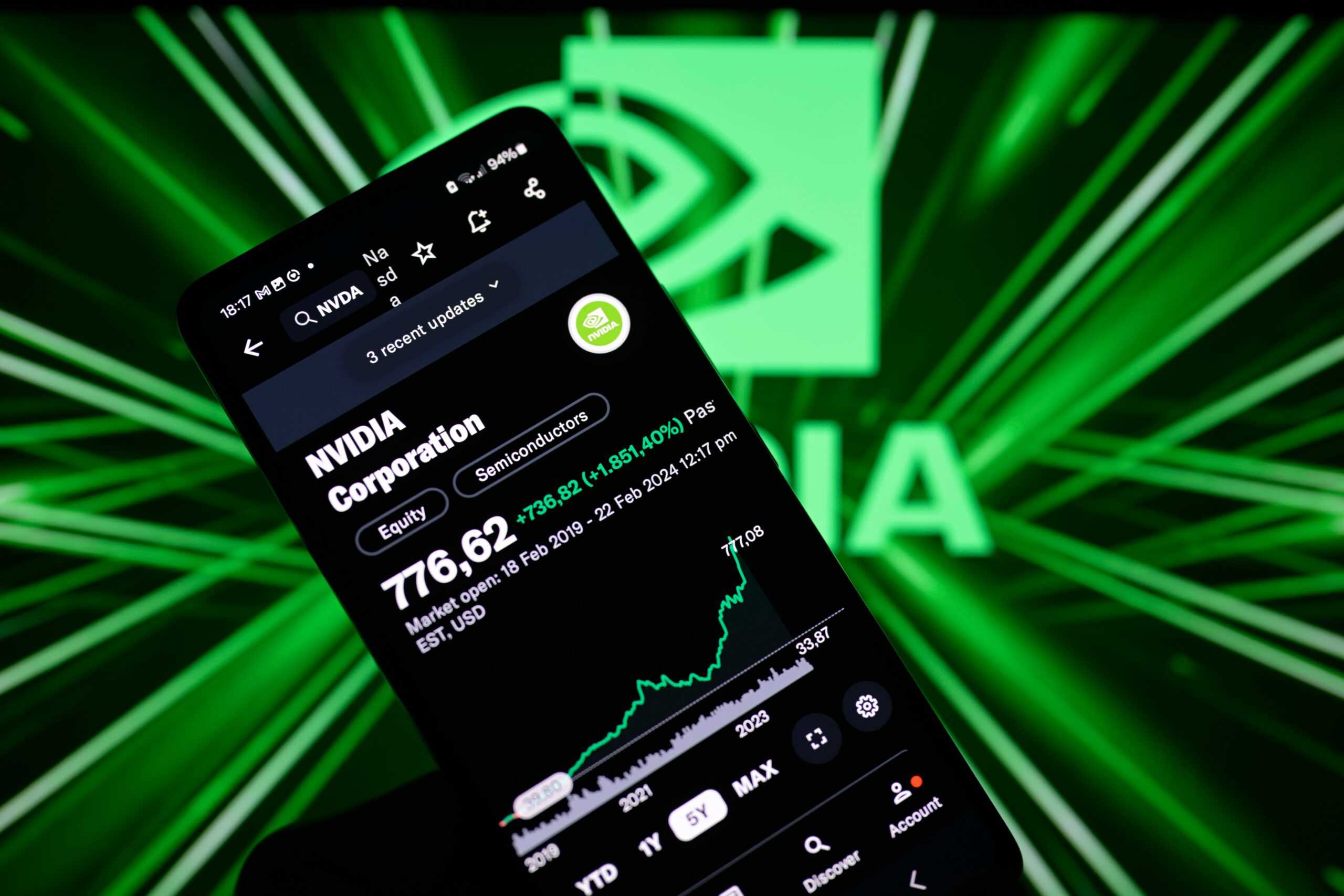

NVIDIA Started the AI Rally - Will It End Like the Dot-Com Bubble?

Published:

Does the rally in AI stocks have a long ways to go, or will it face the same fate as the Dot-Com rally in early 2000? In the discussion below, 24/7 Wall Street Analysts Austin Smith and Eric Bleeker compare the growth in AI stocks today to the Dot-Com era and break down why AI as a technology trend could be fundamentally different than trends across the past decade like smartphones and streaming.

The key points of this discussion are highlighted below.

Transcript:

Eric, let’s stick with AI.

The AI rally has defined the last two years.

How long can this rally really last?

And I’m seeing so many analogies being drawn to the dot-com bubble and burst, which of course is interesting because we all know that the internet, it almost went on to exceed the expectations that were expressed in the bubble.

The bubble was just early.

So I’m seeing a lot of analogies to that bubble and eventually bursting.

But then some of Earth’s greatest companies have come out of that and some of the biggest wealth generators of our time.

So how long can this AI rally last?

And, you know, is this analogous to the bubble or is this something wholly different?

Yeah, it’s a great question.

It’s maybe the hundred trillion dollar question about the way things are going.

You know, the big thing with the Internet, too, we eventually had the bubble burst in 19 or sorry, 2000.

But we also had times that we had drawdowns before then.

A lot of people are wondering, if AI could be headed for that, or if it’s just kind of pure nothing as well.

I saw that idea expressed in a tweet from a journalist.

This is David Roberts.

And he had said, this whole AI thing is remarkable to me.

It’s the first tech development in my life that to a first approximation, no consumer is asking for.

It’s not demand-driven.

So he’s saying basically tech companies have just decided this is the next trend and they are thrusting it upon us.

And I want to take a minute to kind of unpack the background of what is driving AI and what that says about how long it could last for.

So if we think about the last decade when it’s created incredible wealth for a series of technology companies, we can think about the main trends like smartphones.

One of the aspects of them is they didn’t really drive productivity.

You know, when the internet was first coming of age, the big thesis behind it was it would make people so much more productive.

But smartphones, it was more about the consumer surplus and what consumers got out of it.

The same could be said for social networking.

Being on social networking doesn’t make you more effective at your job.

Streaming with Netflix doesn’t.

Getting one day delivery with Amazon doesn’t.

The dirty secret of the recent technology rally is we didn’t enter some era where productivity helped boom the economy.

In fact, productivity growth has been pretty stagnant the past decade.

Now, AI, it does have plenty of consumer applications.

Open AI was one of the fastest, if not the fastest, products to ever hit 100 million users.

We’ve got AI being embedded across Google’s products.

We’ve got Apple about to do a big WWDC event that’s going to be all focused on AI.

AI is going out to consumers, but to reach its potential, it needs to be a trend that finally is you call it industrial.

It needs to help propel the entire economy forward.

So I want to highlight a couple of key quotes on this front.

The first is about JP Morgan and their use of AI.

Well, it’s still early days, and we are mindful not to get carried away with the hype, but management’s comments around AI-led productivity boost suggest that AI could redefine the bank industry cost structure.

As an example, in 2022, JP Morgan processed 155,000 files for a familiar customer with 3,000 employees.

By 2025, it will process 230,000, which is huge growth, with 20% fewer people or an 80 to 90% productivity boost.

Now, if we look at, I want to pair this with a quote from Amazon’s head of AWS.

This is him reporting as a contact to Wall Street.

He said that JP Morgan committed to a $10 billion project to put all their data in the cloud.

That’s JP Morgan, the same company that I just talked about with that productivity boost.

And he also believes that the next wave is regional banks and them embracing AI the same way as JP Morgan is a $60 billion opportunity to Amazon alone.

So just regional banks is a $60 billion opportunity to Amazon.

What you need to think about is this across the entire economy.

So if your framework for AI is thinking of this as a consumer play like smartphones or streaming, it’s the wrong way to think about because it’s not going to reach its potential.

And I think if you look at those examples in finance, if we are seeing them across the economy, there’s not going to be any slowing down.

One final quote from that same AWS head of financial services.

He said, if NVIDIA doubled their production this year, AWS would still have a problem because they need 10 times more GPUs to satisfy all their use cases.

This is going to be a three to five-year marathon rather than a sprint.

I will close it there just to say, if AI is boosting productivity across the entire economy, if you think this isn’t going to be a wave that lasts for three, five years or even more, you’re probably going to miss out on the trend.

Eric, one of the things that stands out to me when you say that is, comparing it to the prior dot-com bubble, the Internet as incredible and as much that has unleashed for us economically, it took a while for the connections to materialize between millions of people.

An Internet connection between two individuals does not result in productivity gains.

But AI doesn’t necessarily need that network effect.

It will be enhanced by it as you have more AIs working together and interacting together.

But someone like JP Morgan can realize all of that efficiency gain locally today.

Unlike the Internet, which needed all those years for these connections to be built out for that value to be unlocked, AI can be immediately ROI positive today, and that will even be further enhanced as the technology improves and AI becomes integrated across industries and organizations.

It’s really pretty incredible.

Certainly, and you look at JP Morgan, if they’re winning on this, that’s why that opportunity moves to regional banks.

If it’s that successful, if it’s boosting productivity to 80-90 percent, if you’re not copying what they’re doing, you’re going to be finished as a business.

And that’s going to drive a lot of rapid adoption.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.