Chipotle (NYSE: CMG) has been one of the most impressive stocks to hold in a portfolio of late. With 49.5% year-to-date gains, investors might be inclined to believe it’s the best-performing non-tech name out there. At roughly $3,100 per share, Chipotle has a stock split coming up, but it still might be out of reach for many investors.

While high-flying Chipotle might tend to steal the show, a few other select stocks have been outperforming the broader markets too, not all of which may be on every investor’s radar yet.

A couple of those shining stocks are restaurant chains, similar to Chipotle, but they tend to be more discount-oriented. Since the pandemic, the economy has been riddled with persistent inflation and elevated interest rates, sending consumers flocking to brands that offer more value. That demand is being reflected in rising market values.

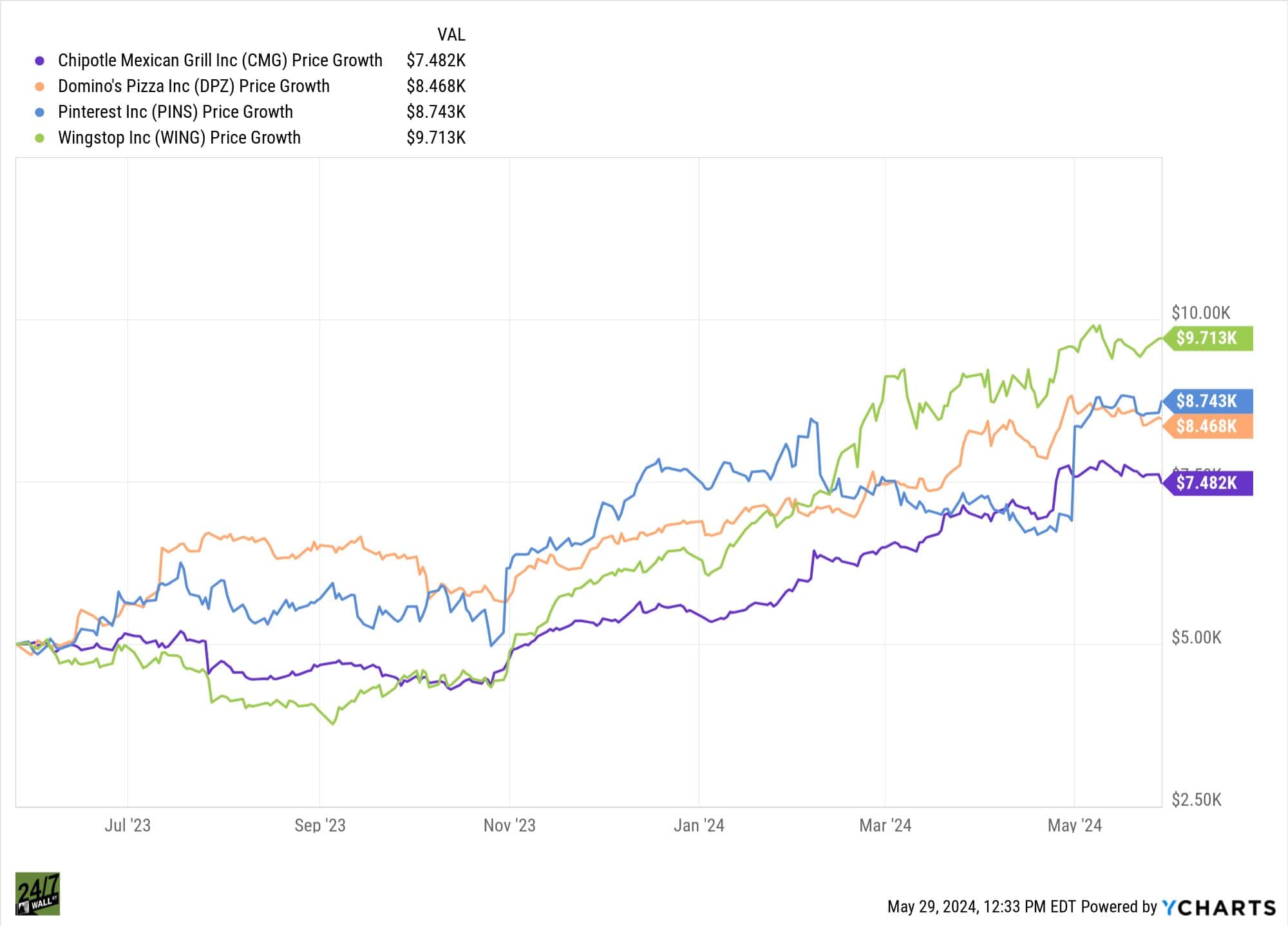

As the chart below shows, a $5,000 allocation to any of the following four stocks one year ago would have generated above-market returns. But as the chart also proves, Domino’s Pizza (NYSE: DPZ), Pinterest (NYSE: PINS) and Wingstop (Nasdaq: WING) have all beaten Chipotle’s performance over that period.

Investors would have fared the best by owning Wingstop shares, nearly doubling a $5k allocation to $9.7k over the past 12 months, while Pinterest and Domino’s aren’t too far behind, turning $5k into $8.7k and $8.5k, respectively, in the same period. Meanwhile, a $5k investment in Chipotle last May would be worth nearly $7.5k today, which isn’t too shabby, either.

Domino’s Pizza Stock Up 69.3%

Over the past 12 months, Domino’s Pizza stock has advanced by nearly 70%, outperforming Chipotle’s performance over the same stretch Founded in 1960 in Ypsilanti, Mich., Domino’s is one of the biggest pizza chains on the planet. As a publicly traded stock for the past two decades, DPZ has returned 8,200% for investors over the span compared with Alphabet’s (Nasdaq: GOOGL) 6,000%, as noted by Creative Planning Market Strategist Charlie Bilello.

Based on Q1 results, Domino’s is operating on all cylinders. The pizza chain experienced an impressive 5.6% jump in U.S. same-store sales and total revenue of $4.3 billion, up from $4.1 billion in the year-ago period and fueled by tailwinds like product and marketing innovation. Management noted that the same-store sales results are likely to experience some sequential moderation in Q2. Domino’s saw at least 3% of its sales originating from a recent marketing partnership with Uber Eats. The company is also benefiting from its newly implemented loyalty program.

It doesn’t hurt that Domino’s Pizza prioritizes returning shareholder value through cash dividends and share buybacks. In Q1, the company declared a quarterly dividend of $1.51 per share and is also in the midst of an aggressive $1.12 billion share buyback program.

If DPZ stock keeps up this pace, it will double from year-ago levels before long. Consumer demand for discount food chains isn’t likely to falter anytime soon, especially as food inflation continues to take a toll on household budgets. Over one dozen Wall Street analysts are bullish on Domino’s stock and have attached a “buy” rating. An average price target of $549 suggests there’s more runway for gains.

Pinterest Stock Up 74.8%

Another stock that’s been on a tear of late is online arts and crafts play Pinterest, including a 74% gain over the last 12 months and momentum on its side. In Q1, Pinterest reported a nearly 25% spike in Q1 revenue to $740 million coupled with a 12% jump in global monthly active users to over 518 million, a new record. The performance represented the strongest revenue growth for Pinterest in three years. Pinterest has benefited from tailwinds as investments in areas like artificial intelligence (AI) and “shoppability” have paid off.

Pinterest CEO Bill Ready, who took the helm of the company last year, is focused on growing margins and says they are on track, including “significant progress” in 2024 amid a corporate restructuring. Its recent partnership with Amazon Ads gives Pinterest greater exposure and is expected to introduce more brands to the Pinterest platform. Most Wall Street analysts who cover PINS stock have a buy rating attached with an average price target of $46, representing another 9% upside potential.

Wingstop Stock up 94.2%

Last but not least, Wingstop stock has been running circles around Chipotle. With a whopping 94.27% gain over the past 12 months, Wingstop stock is the best performer of the group. At $387 per share, Wingstop is knocking on the door of its 52-week high of $400 per share.

In its fiscal Q1, Dallas, Texas-based Wingstop reported a whopping 21.6% increase in domestic same-store sales growth, fueled largely by transaction growth as consumers flocked to the chicken wing experts. The company also reported a 36.8% increase in systemwide sales to $1.1 billion, its first billion-dollar quarter buoyed by the opening of 65 new locations during the period.

Wingstop, which practices menu innovation and price discipline, has been growing its digital sales. The company is also determined to minimize food-cost volatility for its restaurants. Wingstop’s cash balance hovers at over $100 million, while the company has delivered shareholder returns to the tune of 2,500% since its IPO in 2015.

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.