Knowing your money is safe should be your top priority when deciding where and how to invest your savings. That’s why the FDIC was created, in order to assuage consumer fears about banks going out of business and losing all their money. As younger people begin to save money and diversify their savings or investments, they will begin by looking into banks and companies and have to learn about FDIC insurance, what it means, and if they would be covered.

Why Are We Talking About This?

It can be confusing figuring out what types of accounts qualify for what kind of protection. Couple that with tax questions and where to invest your money, and it can become overwhelming. As younger generations (and older generations) learn to navigate the financial world, they have to begin by answering some of the basic questions before moving on to more complicated financial planning. We want to help.

Background on E*Trade

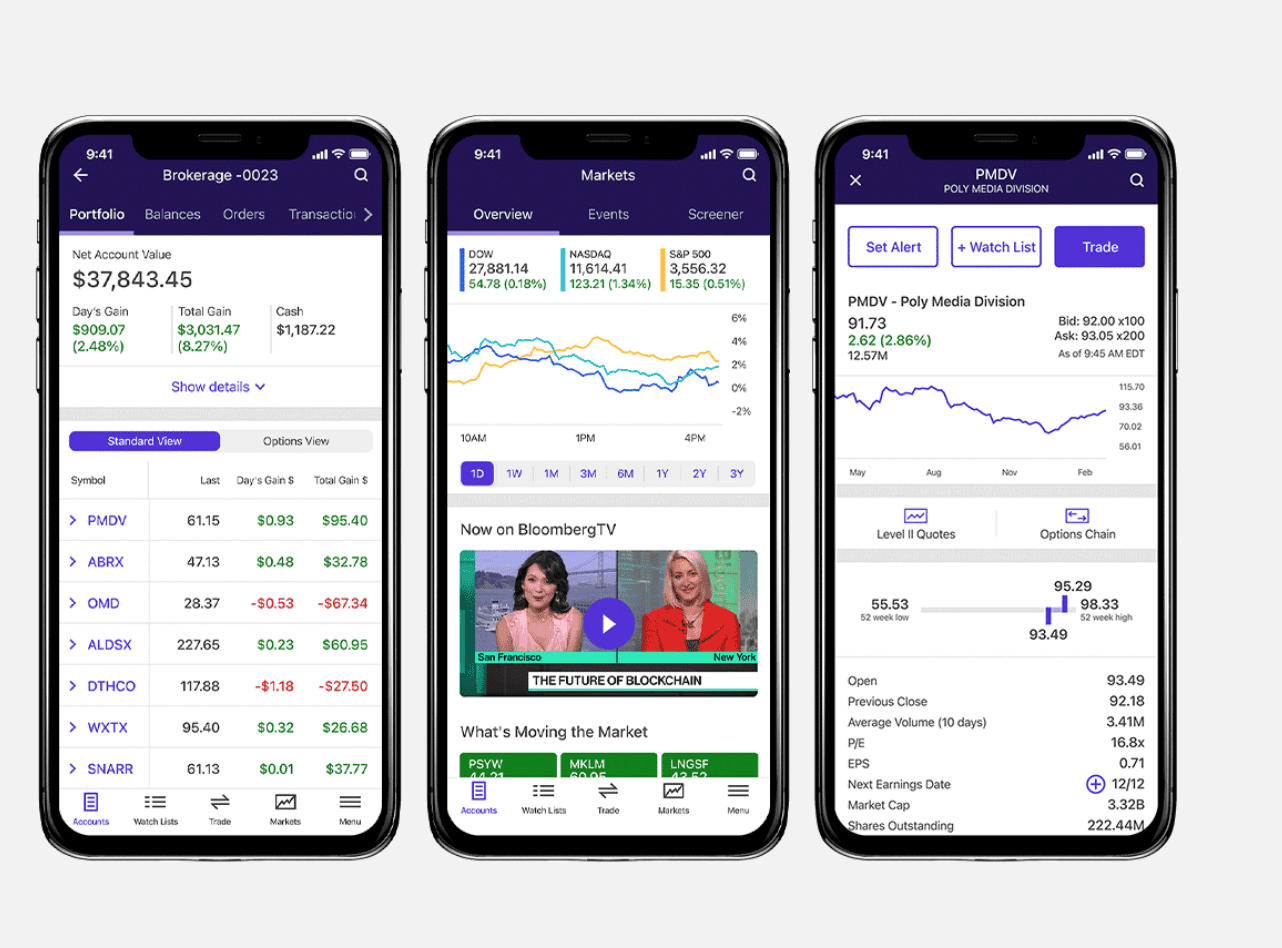

E*Trade is an online stock trading brokerage platform. It was launched in 1991 to large success as a cheaper and easier alternative to expensive and slow brokerages at the time.

Before platforms like E*Trade, buying stock was limited to over-the-phone deals or mail orders with individual brokers who took a substantial cut of sales and a hefty fee for purchases. Those with significant amounts of money could hire an asset manager to invest for them. These, too, took large fees to do so. People with less money couldn’t realistically invest in the stock market.

With E*Trade, millions of people began to invest and trade on the stock market, and it grew quickly. Read more about how to buy stock on E*Trade here.

When mobile-first trading platforms began to enter the market in recent years, millions of new users and first-time traders entered the market. These new platforms offered zero-commission trades, fewer fees, and no account minimums. E*Trade was forced to adapt, like many other brokerages, in order to survive. As a result, E*Trade eliminated its commissions on basic stock trades, many of its fees, and account minimums. Today, users can buy and sell any amount of stock without paying any commissions.

Read our full review of E*Trade here to learn more about the platform.

Is E*Trade FDIC Insured?

The short answer is yes, but that might be misleading.

The FDIC stands for The Federal Deposit Insurance Corporation which insures the money deposited into banking institutions. It covers $250,000 per customer for checking accounts of all types, and $500,000 per customer for savings accounts. Cash in brokerage accounts is also covered up to $500,000 for individual accounts and up to $1,000,000 for joint brokerage accounts. Read more about E*Trade’s checking accounts here.

In the past, E*Trade did not offer banking services so FDIC insurance would not have applied. If you don’t have a checking or savings account or don’t keep money in your brokerage account, then the FDIC coverage will not apply to you. Instead, you will want to look at The Securities Investor Protection Corporation (SIPC) which protects uninvested cash in your investment accounts.

Keep in mind: that there is no insurance against market activity. All money invested in the stock market is subject to increases and decreases in value, and all investors assume the risk of those fluctuations. If you lose everything overnight because a company goes bankrupt, there is no way to recoup the money you invested in its stock. Invest wisely.

Neither FDIC nor SIPC insurance will cover your assets from bad decisions or poor internet safety habits. It will only protect your money if the company goes bankrupt or other similar situations. FDIC insurance is very specific and limited in scope. If you are investing in risky ventures, not taking care of your account information, or otherwise not making wise decisions about where to invest or save your money, the only one you can blame when you lose everything is yourself and there is no insurance that can protect you.

All insurances, coverages, and guarantees for E*Trade are provided through Morgan Stanley’s (NYSE:MS) insurance and coverage limits since it owns E*Trade. You can learn more about FDIC insurance and what is covered on the FDIC website.

We strongly recommend you look into the additional protections offered by E*Trade and Morgan Stanley so you can better understand what is and is not covered and protected by them. The little amount of time you spend researching the financial limits and possibilities afforded by different banks and brokerages will pay enormous dividends in the future and save you from significant frustration and financial loss.

If you are curious about any other part of the E*Trade platform, check out this page: a regularly updated list of all our E*Trade guides, news coverage, and lists of benefits.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.