Between this year’s return of meme stocks and the recent surge in initial public offerings (IPOs), investors can often overlook how important a role fundamental analysis can play. Instead, many are favoring investments that receive a lot of media attention, trading momentum, and social media hype.

But having a firm understanding of fundamental analysis enables investors to find the hidden gems — the stocks that are often disregarded by mainstream financial media or Reddit communities despite being worthy of their attention.

So while IPOs grab headlines and meme stocks — which are entirely void of sound fundamentals and rely solely on publicity and elevated trading volume — captivate audiences, being able to identify deep value stocks with the help of fundamental analysis can assist your portfolio’s performance.

What Are ‘Deep Value’ Stocks?

Before diving into the three stocks that fit this deep value mold, it is important to first understand what makes a particular equity a “deep value” stock. Foremost, these are equities that are considered undervalued at their current per share prices.

These stocks are regarded as bargains because they are trading below their intrinsic values, meaning that according to their underlying financials, their perceived value exceeds the current market’s asking prices.

In the case of deep value, these are discounted equities when considering their price-to-earnings — or P/E — ratios.

What Is a Price-to-Earning Ratio?

Simply put, a P/E ratio is a means of valuing a company by comparing its current stock price to its most recent earnings. There is even a tidy little equation for it: the P/E ratio equals the price per share divided by the company’s earnings per share, or EPS.

The idea is that investors can use P/E ratios as a measure to determine whether or not an asset is fairly priced. In this regard, the lower the P/E ratio, the more the stock is perceived as being undervalued. The higher the P/E ratio, the more its viewed as being overvalued. A negative P/E ratio, on the other hand, implies that the company is currently unprofitable.

Returning to the meme stock example, GameStop (NYSE: GME) currently sports an incredibly high P/E ratio of 308.95. That makes sense given how the company’s current valuation is based on its meme-driven popularity in retail investing circles, and not because of its income statements. GameStop is currently trading around $25 per share despite the fact that the company has posted negative EPS for four out of the past five quarters.

Using publicly traded companies in the S&P 500 as a model, the average P/E ratio falls between 20 and 25. Therefore, stocks with a P/E ratio below 20 are considered to have a low P/E multiple. In other words, they present the investor with deep value, just like the following three examples.

No. 1: PutleGroup Inc.

As the third largest homebuilding company in the U.S. with an over 70-year history, PulteGroup Inc. (NYSE: PHM) has built around 800,000 homes since its inception. And despite interest rates for 30-year fixed mortgages remaining near 20-year highs, the company continues its efforts to construct enough single-family homes to help address the ~1 million shortfall the America currently faces.

According to PulteGroup’s first quarter earnings report, the company increased its EPS to a record $3.10, marking a 32% year-over-year increase. For the same quarter, it set another record with $3.8 billion in home sale revenues, which was good for a 10% year-over-year increase. Additionally, the homebuilder was able to increase its gross margin by 50 basis points, marking a 9.4% year-over-year increase.

Yet PulteGroup’s stock is sporting a P/E ratio of 8.77, which is absurdly cheap given its strong earnings, record revenue, the U.S. housing inventory shortage the company is seeking to address as well as its $23.09 billion market cap.

And while referring to a stock currently trading for $109.75 as “cheap” may be difficult to understand, given PulteGroup’s stellar underlying fundamentals, it is no surprise why analysts are bullish on it. The Wall Street Journal gives PHM a median one-year price target of $131.86 with a high-end price target of $183 — prices that are more aligned with the company’s income statement, balance sheet and cash flow.

No. 2: Banco Macro SA

Banco Macro SA (NYSE: BMA) might be the best bank stock investors have never heard of. That is because the company is based in Argentina despite trading on an American exchange.

Importantly, Banco Macro SA is doing business in a nation with runaway inflation. And if you think the 41-year high for inflation — as measured by the Consumer Price Index — that the U.S. hit in June 2022 was bad, think again. In May, Argentina reported an inflation rate of 276.4%, which is somehow down from April’s reading of 292.2%.

And as has been demonstrated in the U.S. over the past few years, when inflation rises quickly, central banks enact measures of quantitative tightening, thereby reducing liquidity and increasing interest rates.

The latter — higher interest rates — are good news for banks, because with higher rates, lenders are able to see higher returns on repayments from borrowers while also increasing inflows for banking instruments like certificates of deposit and high-yield savings accounts, which are more attractive when yields increase.

Banco Macro SA is also very active in mergers and acquisitions. BMA is Argentina’s second-largest private bank, and since 1996, it has merged with or acquired nine competitors before being listed on the New York Stock Exchange in 1997, ultimately contributing to its current $5.35 billion market cap.

In 2009, the bank began a run of 28 consecutive quarters spanning seven years where it posted net profits. So far this year it has posted $3.8 trillion in revenue, up an astounding 35% from 2023’s total revenue. And since 2020, Banco Macro SA’s total assets have increased from $1.1 trillion to $6.7 trillion, which marks an increase of 509%.

Despite these strengths, the stock is trading at a P/E ratio of just 5.63. However, analysts understand that its underlying fundamentals warrant a much higher price. With its current $57.90 per share price, Wall Street Journal analysts give BMA a median one-year price target of $93.72 and a high-end price target of $200.62.

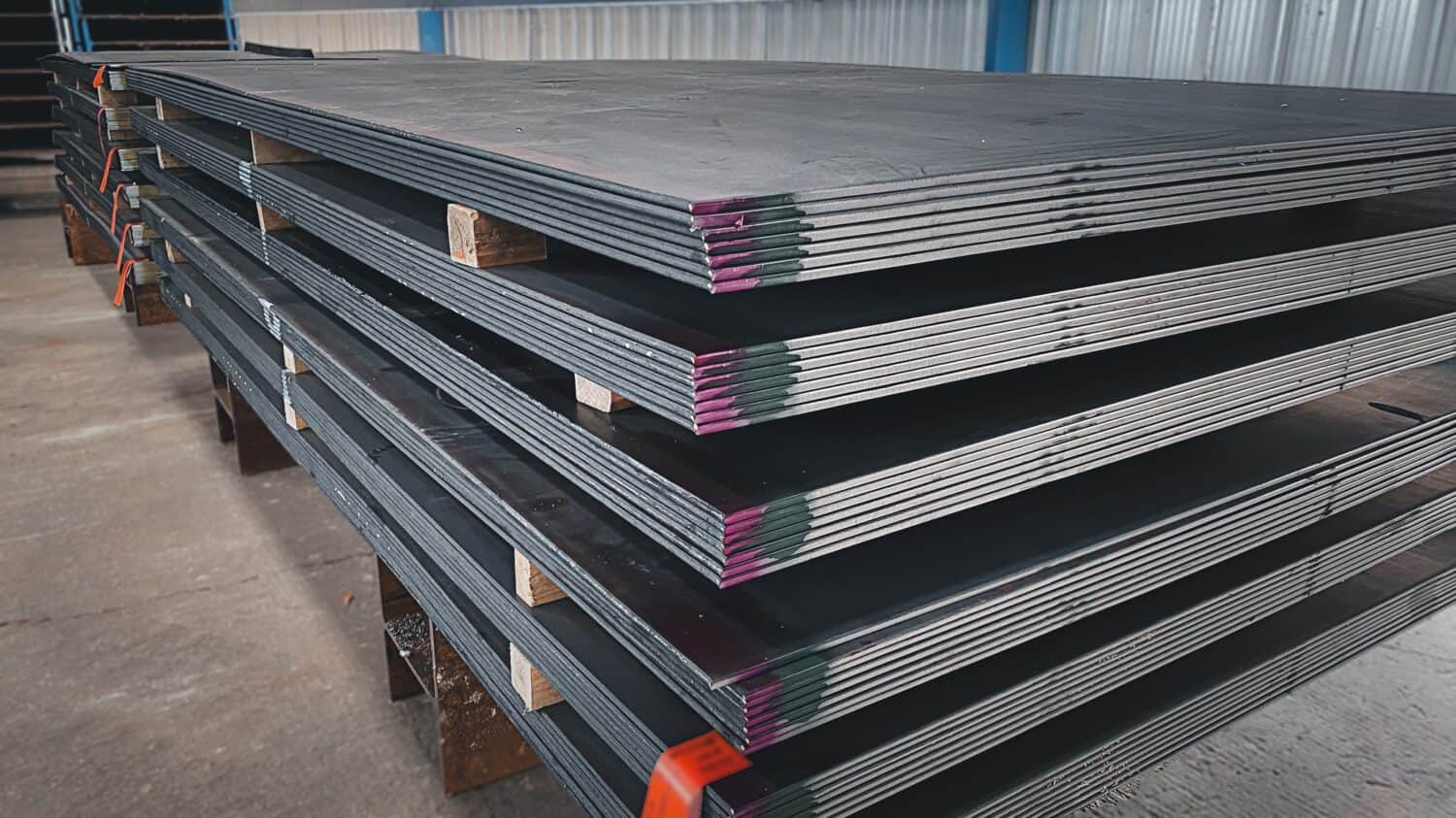

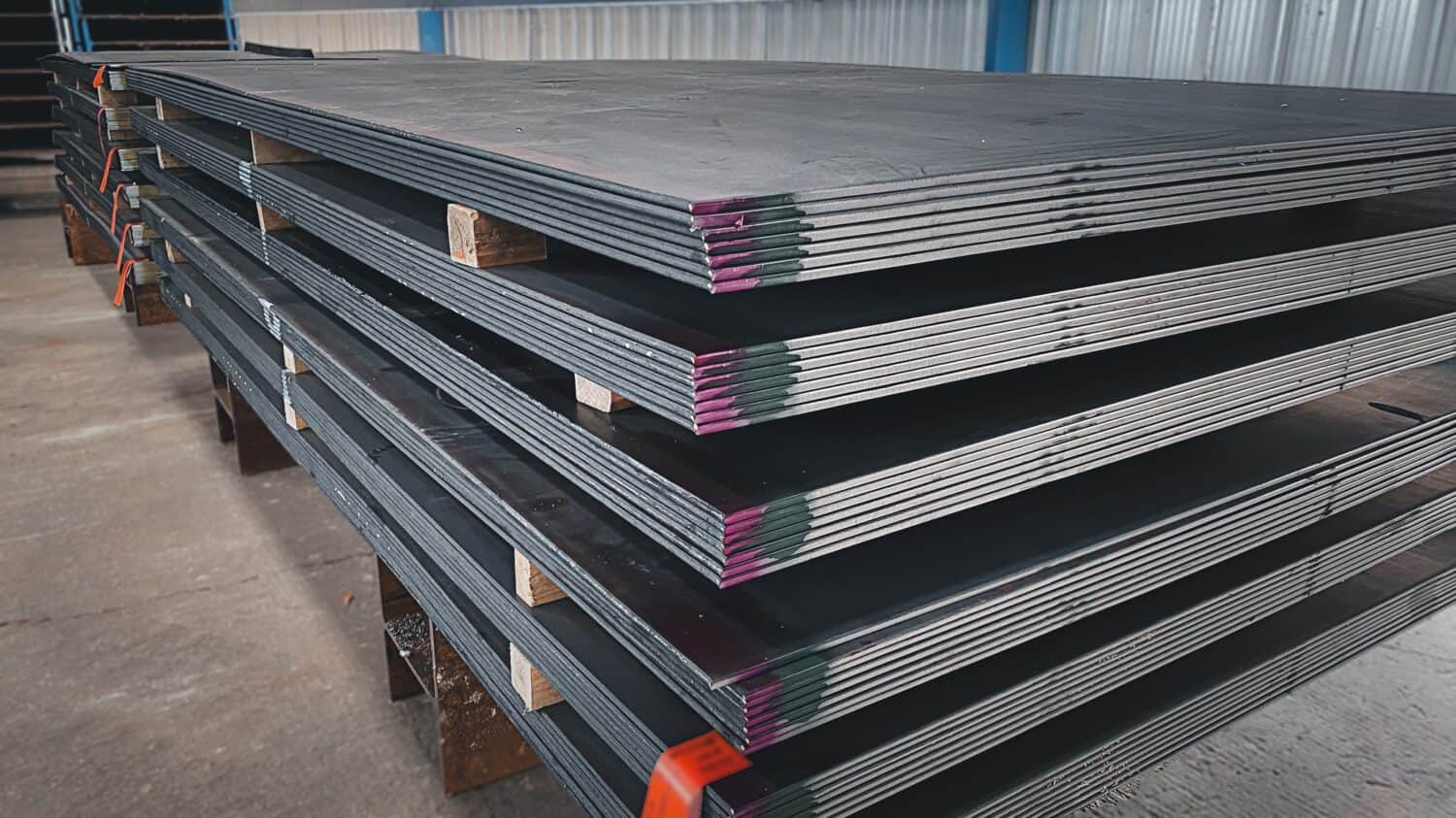

No. 3: Steel Dynamics Inc.

Steel Dynamics (NASDAQ: STLD) is another example of a deep value stock with a P/E ratio that suggests major upside potential is ahead. The company, with its $19.6 billion market cap, is the third largest producer of steel in the U.S.

Steel Dynamics beat earnings forecasts six out of the past eight quarters, and according to its first quarter investor presentation, the company posted $4.7 billion in quarterly revenue that translated to $584 million in net profit and $355 million in cash flow from operations. That was good for an EPS of $3.67.

The company also repurchased $298 million worth of its own shares and has increased its dividend payout amount every year since 2009 — 15 years ago.

Nonetheless, the company currently has a P/E ratio of 8.57 based on a per share price of $125.05. But like the other two stocks discussed earlier, this has caught the attention of analysts, who expect STLD’s price to catch up to its earnings. The Wall Street Journal gives the stock a median one-year price target of $134, and a high-end price target of $160.

Bottom Line

For value investors, identifying stocks that are currently trading a lower multiples can help medium- and long-term portfolio performance. Warren Buffett has famously quipped that the stock market is the only place that, when items go on sale, people run out of the store.

When it comes to deep value, “the store” is replete with undervalued stocks trading at unwarranted low P/E ratios. Investors who understand that are poised to potentially profit.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.