24/7 Insights

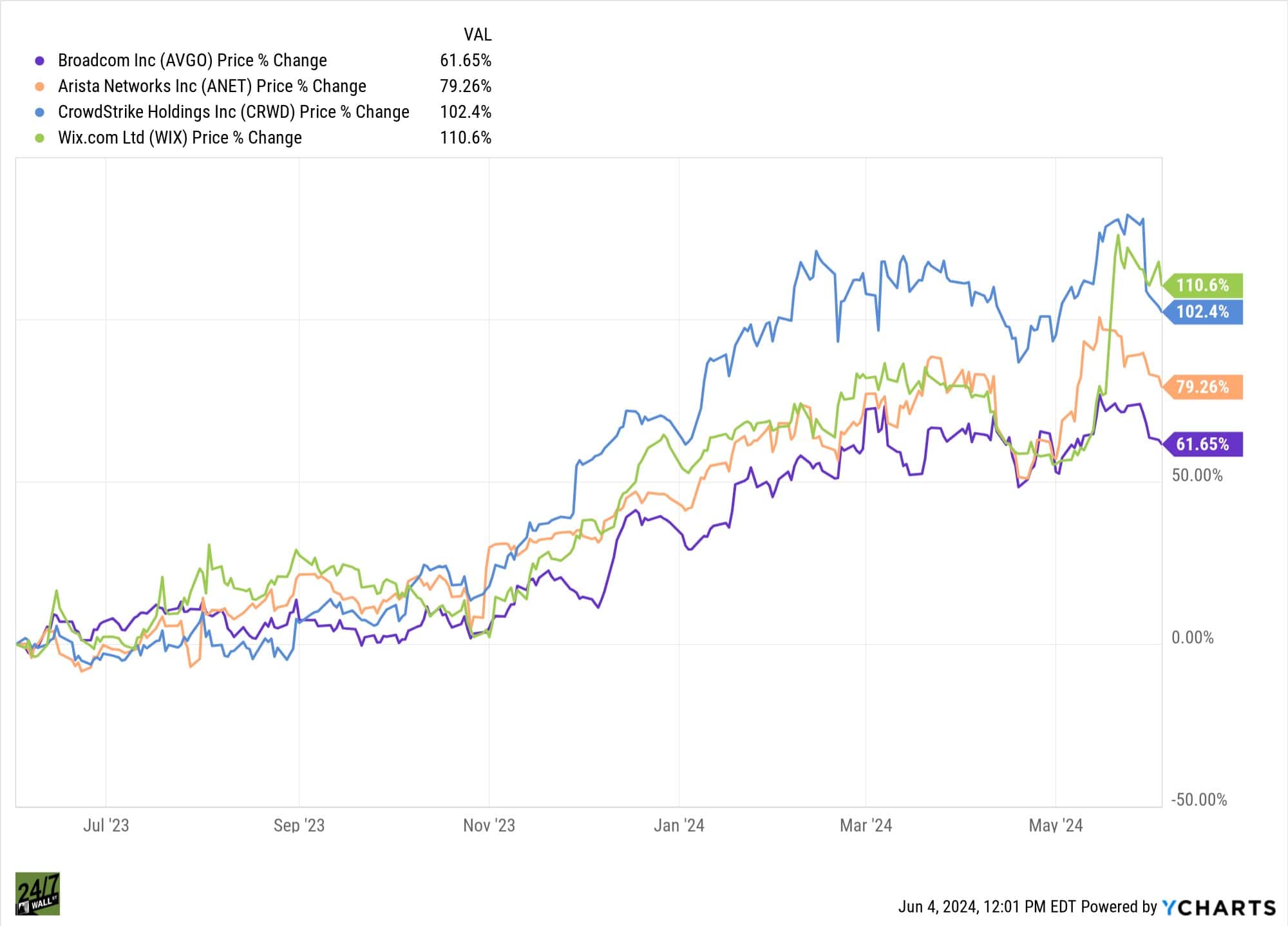

- Broadcom Corp. (NASDAQ: AVGO) stock is up sharply in the past year, but shares are pretty pricey.

- Here are three AI stocks that outperformed it and are cheaper.

It seems everyone wants to buy artificial intelligence (AI) stocks. After all, Nvidia Corp. (NASDAQ: NVDA), which has become a bellwether for the AI segment, rose almost 240% last year and is up 130% or so thus far in 2024. There are a lot of options when it comes to AI stocks, from Microsoft Corp. (NASDAQ: MSFT) to C3.ai Inc. (NASDAQ: AI). Even Tesla Inc. (NASDAQ: TSLA) can be seen as an AI stock. Another contender in the AI chip space is Broadcom Corp. (NASDAQ: AVGO).

Shares of leading fabless semiconductor company Broadcom are up about 63% in the past year, as well as more than 350% higher than five years ago. Analysts on average recommend buying the stock, and they project that the share price will rise another 17% or more in the next 12 months. However, as with Nvidia, the shares are pricey, changing hands for more than $1,000 apiece. Are there better options?

Turns out, the following three AI stocks have outperformed Broadcom in the past year, and they are trading for much less than 1,000 bucks a share. Let’s take a look.

Arista Networks

- Year-over-year share price change: 79%

- 52-week range: $148.32 to $329.04

- Market cap: $91 billion

Rosy Revenue Outlook and Buying Back Shares

Arista Networks Inc. (NYSE: ANET) is a leading provider of data-driven, client-to-cloud networking solutions for large data center, cloud computing, and AI environments. It was incorporated in 2004 and is headquartered in Santa Clara, California. Competitors include Cisco Systems Inc. (NASDAQ: CSCO) and Juniper Networks Inc. (NYSE: JNPR).

The company recently boosted its revenue guidance and announced a share buyback plan, prompting a number of price target hikes. Analysts on average now see the share price going to $319.29 in the coming year, which would be more than a 9% further gain. Of 25 analysts covering this AI stock, 16 recommend buying shares.

CrowdStrike

- Year-over-year share price change: 102%

- 52-week range: $139.37 to $365.00

- Market cap: $74 billion

Analysts Are Optimistic

Austin, Texas-based CrowdStrike Holdings Inc. (NASDAQ: CRWD) is focused on cybersecurity and AI-powered workflow automation. It recently partnered with Google Cloud and also expanded its partnership with Cloud Flare. It was established in 2011. Competitors include Palo Alto Networks Inc. (NASDAQ: PANW) and SentinelOne Inc. (NYSE: S).

Though some executives sold shares in May, analysts are optimistic about this AI stock. It has a further 31% to rise in the coming 52 weeks, based on their consensus price target of $400.47. Almost all of the 50 analysts who cover the stock recommend buying shares, 16 of them with Strong Buy ratings.

Wix.com

- Year-over-year share price change: 110%

- 52-week range: $73.39 to $174.09

- Market cap: $9 billion

A Fresh AI-Powered Website Builder

Incorporated in 2006 and headquartered in Tel Aviv, Israel, Wix.com Ltd. (NASDAQ: WIX) is a website development platform provider. Its platform is built on a freemium business model, with the company earning its revenues through premium upgrades. It had over 250 million registered users in 2023, and earlier this year launched its AI-powered website builder.

The company just completed a $225 million share buyback program, and it posted a first-quarter earnings beat and lifted its revenue guidance. The mean price target of $186.83 indicates analysts currently see another 15% or so upside potential. Their consensus recommendation is to buy shares of this AI stock.

Wix.com (WIX) Stock Price Prediction: Is It a Buy?

Should I Invest in AI?

Many AI stocks have soared in the past couple of years, and AI seems to be in headlines and in speculation everywhere. The question is whether AI is a fad, or if AI stocks are in a bubble. Signs suggest that it is more than a fad, but rather a trend, even a fundamental shift in industry and society. Whether stocks are in a bubble remains to be seen. As indicated above, analysts anticipate plenty of upside in Broadcom and these three other AI stocks.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.