Investing

3 Stocks That Have Seen Higher Share Gains Than Super Micro Computer

Published:

One of the stocks to benefit the most from the artificial intelligence (AI) craze has been Super Micro Computer (Nasdaq: SMCI). Before AI took over, Super Micro flew under the radar of many investors, blending into the technology landscape with its servers. But with the rise of AI, it turns out Super Micro Computer is in a sweet spot — data center servers. As a result, the stock has become an exciting play, even muscling its way onto the Forbes 500 list, snagging the 498th ranking.

With a market cap of $49.6 billion, Super Micro’s stock has more than doubled over the past 12 months as it eyes revenue in the $15 billion area for fiscal 2024. As a recent addition to the S&P 500 index, there’s no denying Super Micro stock’s impressive run of late. Given the demand for its AI servers and its cozy relationship with chipmakers Nvidia (NASDAQ: NVDA) and AMD (Nasdaq: AMD), it seems there is more where that came from.

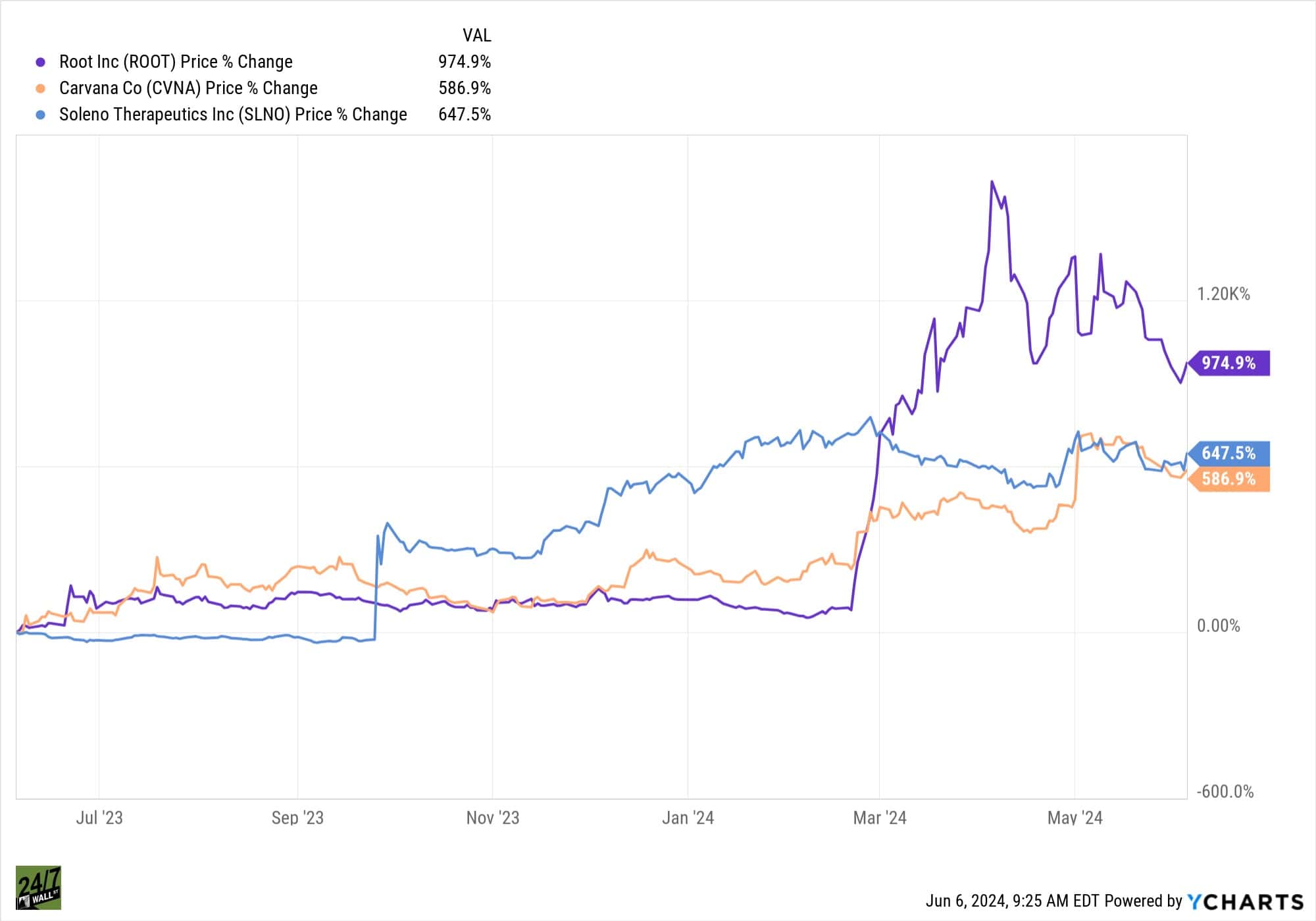

However, if you dig deeper you’ll find Super Micro Computer isn’t the top-performing stock over that stretch. We’ve spotted a trio of stocks that have seen higher share gains than Super Micro in the past 12 months, and they’re outside of the AI clique – Root (Nasdaq: ROOT), Carvana (NYSE: CVNA) and Soleno Therapeutics (Nasdaq: SLNO). All three stocks have advanced by triple-digit percentages over the period led by Root, a tech-focused insurance and financial services play.

Root (Nasdaq: ROOT) is one way to play the auto insurtech sector under the larger fintech umbrella. Root shares have climbed 975% higher in the past 12 months, making this stock hard to beat even for AI phenomenon Super Micro Computer. Root uses a combination of mobile tech and data science to simplify car insurance, helping good drivers to see better pricing.

With a market cap of $733.5 million, Root is far from a boring insurance play. In its first quarter, Root reported a 264% year-over-year increase in revenue to nearly $255 million. In Q1, the company flipped profitable with positive operating income of $5 million.

The company’s projected revenue growth of 25% per annum in the next three years surpasses the industry average of 5.9%. The company is in the early stages of growth but boasts an ambitious plan of transforming the insurance industry using tech. Wall Street is sold, as evidenced by an average price target of nearly $78 per share, reflecting upside of over 50%.

Carvana (NYSE: CVNA), a popular online platform for buying and selling used vehicles, became a household name ever since the pandemic when the supply chain was constrained. After a lull, the company has recaptured growth and investors have rewarded the stock with a nearly 600% gain in the past 12 months.

On the heels of the pandemic, Carvana hit a rough patch as sentiment around the brand turned negative amid economic headwinds including high interest rates. But by all accounts, management appears to have turned the ship around. The e-commerce auto platform has been strategizing on its debt, paying cash on its senior secured notes and repurchasing some of it as well. Carvana stock also caught the attention of the meme-stock crowd, which might have also helped to improve perception around the brand.

Carvana just reported a record first-quarter performance, including a 17% year-over-year increase in total revenue to over $3 billion, fueled by the sale of nearly 92,000 retail units. Additionally, net income of $49 million and a net income margin of 1.6% smashed company records, while its adjusted EBITDA margin of 7.7% surpassed the industry average among listed auto retailers. Carvana is on track to deliver on its full-year outlook as long as the environment for auto sales remains stable.

Wall Street analysts are bullish, including Evercore ISI, which added the stock to its tactical outperform list.

Last but not least, shares of Soleno Therapeutics, a clinical stage biopharmaceutical play, have advanced by a whopping 647% over the last 12 months. The company is headed for inclusion in the Russell 3000 Index, which will give it a spot in some major institutional portfolios that are looking for broad representation of big companies in the U.S. market.

With a market cap of $1.6 billion, Soleno Therapeutics is focused on the treatment of rare diseases and has a robust pipeline of innovative drugs in various stages. Last month, the company received a coveted designation from the U.S. FDA, which labeled one of its drugs with a Breakthrough Therapy Designation. Soleno’s diazoxide choline therapy for patients with Prader-Willi syndrome who suffer from extreme hunger.

Wall Street is largely bullish on Soleno Therapeutics stock, as evidenced by four “buy” ratings and zero “sells.” With an average price target of $70 per share, analysts are expecting further upside to the tune of roughly 60%. The point is, investors clearly don’t have to limit their portfolios to AI to see some of the best returns the market has to offer these days.

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4% today, and inflation is much higher. Checking accounts are even worse.

Every day you don’t move to a high-yield savings account that beats inflation, you lose more and more value.

But there is good news. To win qualified customers, some accounts are paying 9-10x this national average. That’s an incredible way to keep your money safe, and get paid at the same time. Our top pick for high yield savings accounts includes other one time cash bonuses, and is FDIC insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes and your money could be working for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.