24/7 Insights:

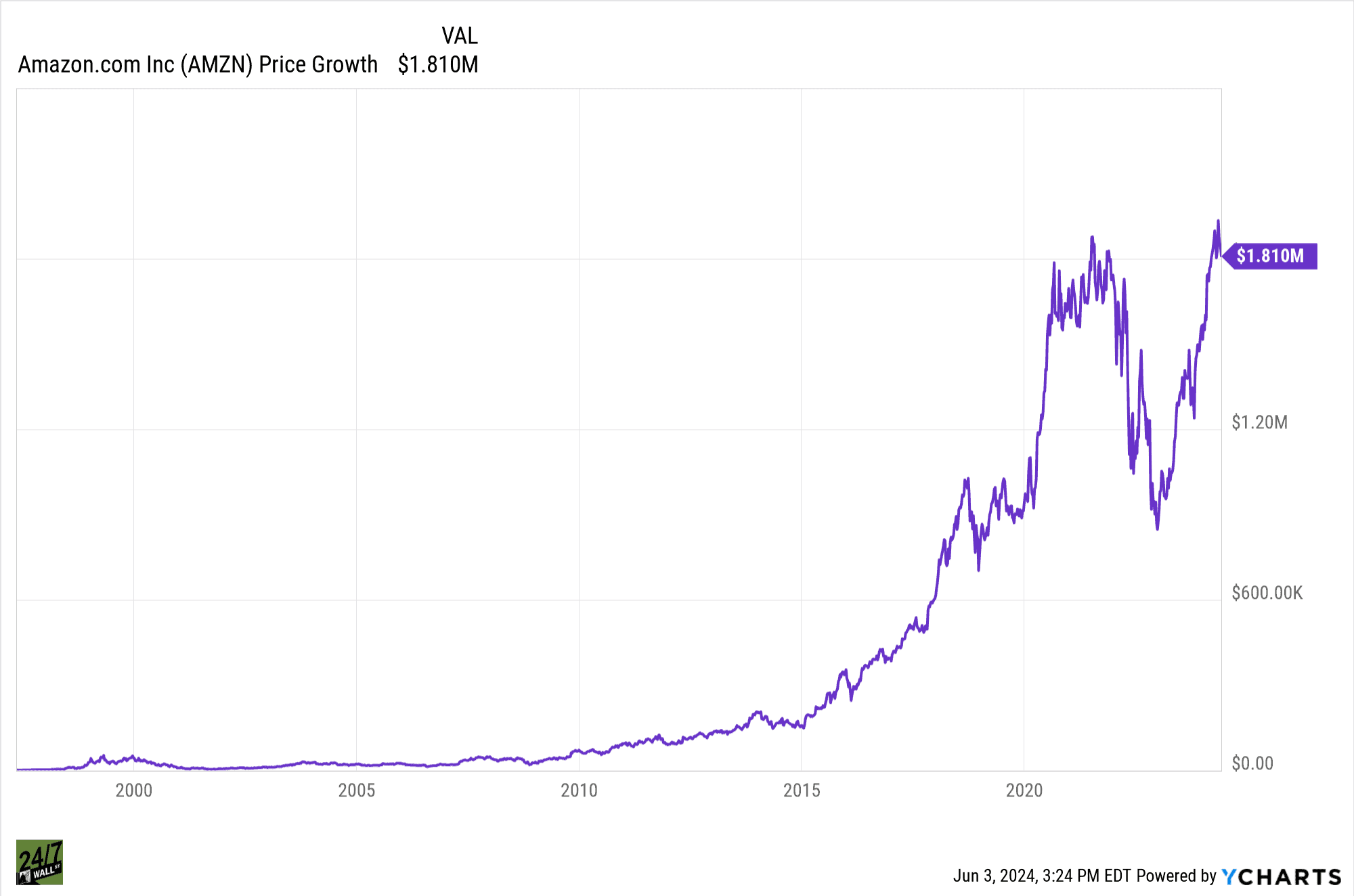

- Amazon (NASDAQ: AMZN) remains a top mega-cap stock investors continue to focus on due to its durable competitive advantages.

- However, there are other key players to consider in the e-commerce world.

- One such e-commerce player that may garner outsized attention in the years to come is Shopify (NYSE: SHOP)

Amazon (NASDAQ: AMZN) is so much more than an e-commerce giant. The company’s AWS division is its real profit center, with an incredible amount of revenue driven from its logistics, streaming, and other segments outside of traditional e-commerce.

That said, when folks think of Amazon, they’re likely thinking of the package they just ordered that they expect to be delivered tomorrow. The company’s competitive advantage comes from its logistics side of the business, where expanding same-day or next-day delivery has changed the way we think about ordering items online.

The thing is, as the e-commerce sector continues to see growth far outpacing that of traditional retail, there’s plenty of room for other players to step into the market and serve other niches. One such company I think could be a higher-growth option to consider in this world is Shopify (NYSE: SHOP).

What Does Shopify Do?

Amazon may be the first option for many retailers looking to sell goods online. That’s largely due to the company’s entrenched fulfillment network, which allows retailers to benefit from the ultra-fast delivery that’s simply not available on other platforms.

Of course, there are downsides to this business model. The fees amazon charges sellers for these services are high, and have been going up over time. There are penalties for failing to resupply stock on time, and there’s always the potential for Amazon’s algorithm to simply favor items it includes in its arsenal that are slightly cheaper and very similar to a retailer’s best-selling items (nope, I didn’t say knock-offs).

Enter Shopify. Shopify allows companies of every size to set up online shops and manage payments and fulfillment through its platform. While same-day or next-day delivery may be difficult with this model, the platform does allow merchants to keep more of their dollars, with Shopify earning a small transaction fee for transactions above a certain threshold.

So, the more the e-commerce space grows, and the better merchants do on its network, the better Shopify (and its investors) do. This is a formula that worked incredibly well during the recent post-pandemic spike. But with comps becoming increasingly impossible to hit, Shopify’s stock price plunged in 2022. And while Shopify has made a nice recovery off the bottom, its stock price could still double from here and have a ways to go to hit a new all-time high.

Why Is Shopify a Millionaire-Maker Stock?

The underlying thesis underpinning Shopify hitting new highs and potentially much higher really depends on the market share makeup investors expect to see five or 10 years down the road. If Shopify is able to garner increased market share from retailers, and bring many larger retailers into its fold, this is a company that could become a feasible threat to the Amazon e-commerce dynasty. That’s the bullish thesis that many have espoused from the time this was an itsy-bitsy Canadian software stock no one was paying attention to.

There’s also the reality that as the e-commerce pie grows in proportion to the physical bricks-and-mortar retail market, Shopify could continue to see outsized growth relative to the S&P 500 if it can simply hold steady. A combination of the two factors (market share gains vs. Amazon and overall e-commerce market growth) provide the catalysts that could lead this stock to mint many more millionaires.

Position sizing is important, but this is one of the software stocks I’ve got on my radar right now. I think at current levels, Shopify looks compelling. If we do get lower interest rates, and retailers opt out of the Amazon ecosystem en masse, Shopify stands to gain.

We’ll see how everything plays out, but it’s my view that at least in the e-commerce world, Shopify may be a better bet than Amazon at current levels.

Cash Back Credit Cards Have Never Been This Good

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.