Investing

If NVIDIA Join the Dow, These 2 ETFs Will Super-Charge Your Returns

Published:

24/7 Wall Street Insights

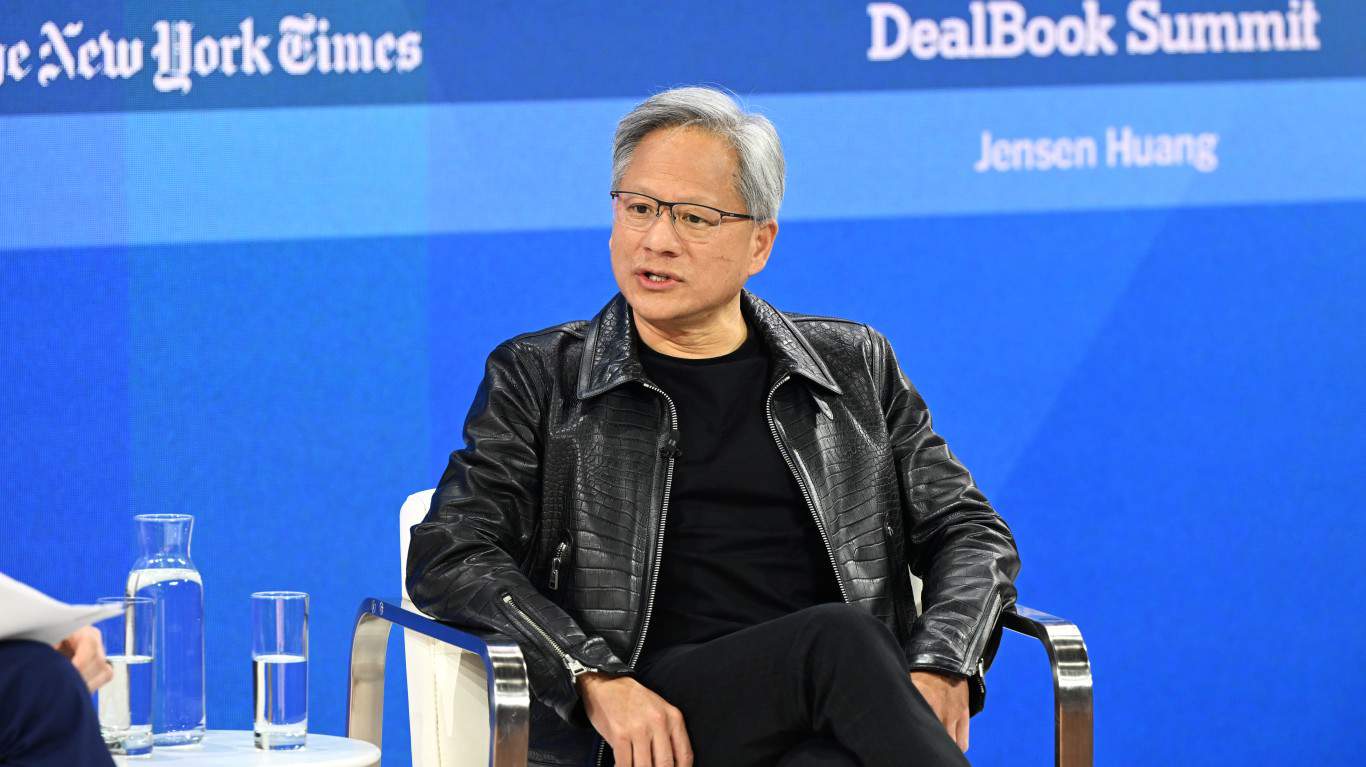

Nvidia (NASDAQ: NVDA) recently joined the exclusive $3 trillion market cap club with fellow “Magnificent Seven” tech stock members Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL). The stock is up over 150% since the start of 2024, and over 3,000% over the past 5 years. Nvidia’s Graphics Processing Units (GPU) have become indispensable for AI imaging and for future development. The demand for Nvidia’s H100 GPUs is so strong that both Elon Musk of Tesla and Larry Ellison of Oracle have been personally wooing Nvidia CEO Jensen Huang in order to obtain billions of dollars’ worth of allocations.

On May 22, 2024, Nvidia announced its Q1 2024 financials. In addition to increasing revenues 262% year-over-year, the company announced a forthcoming June 7th 10-for-1 forward split. As the cherry on top, the dividend would be increased 150%, to be paid on June 28th. Most intriguing was the notion that a reduced stock price post split would potentially remove one of the last perceived obstacles keeping Nvidia off the Dow Jones Industrial Average group of 30.

More explicit details were covered in an earlier 24/7 Wall Street article: “If This Happens, Nvidia Stock Will Soar Higher”.

If Nvidia does get added to the Dow Jones Industrial Average, analysis concur that the stock will get a strong upward push. This will be from a combination of new analyst coverage, institutional buying, and a large individual investor fan base. Although there are hundreds of thousands, if not more investors who have bought Nvidia stock and have held it, those who are more trade-minded may have shorter horizons. The proliferation of Nvidia option interest has led to a recent variation on Exchange Traded Funds that may pique their curiosity: the Nvidia single stock ETF. Several of these are up and trading, but the two we will look at are GraniteShares 2x Long NVDA Daily ETF (NASDAQ: NVDL) and T-REX 2X Long NVIDIA Daily Target ETF (CBOE: NVDX).

(Warning Note: Single Stock ETFs deploy leverage, which proportionately increases price volatility and are thus more risky than common stocks.)

Traditionally, the structure of ETFs was intended to provide a basket of securities that would be akin to an index or mutual fund. On its own, a single stock ETF would hold little appeal, since buying the actual stock itself would avoid fees and be cheaper. However, by introducing leverage on either the short or long side, the ETF becomes a short-term trading vehicle that, depending on the multiple, can potentially double or triple one’s profits. Traders who don’t want to overpay on option premiums for at or in-the-money call or put options (which are substantial for fast moving stocks like Nvidia) may find a single stock ETF an attractive alternative.

In theory, if a single stock ETF is 2X, then it doubles the activity of the underlying stock. Therefore, if Nvidia closed up 4.5% on the day, NVDL or NVDX, which are both 2X, would ostensibly be up 9%. Of course, the converse is also true: If Nvidia closed down 4.5%, NVDL or NVDX would be down 9%.

“Ostensibly” is the operative term here. Due to the costs involved with creating the leverage, which could be through margin loans, swaps agreements, or other arrangements, the longer an investor holds a single stock ETF, the more the profit potential erodes. The issuer is akin to a croupier or a broker and gets paid a percentage of the asset base, regardless of how the fund performs, since its price is pegged to the underlying stock.

This is why a single-stock ETF should only be utilized as a short-term trading vehicle. Unlike buying on margin directly, the investor’s loss is limited to the total traded principal amount, comparably to buying a call option. Therefore, there is no need for investor concern over a margin call if a stock takes a sudden steep drop.

At over $2.5 billion, GraniteShares 2x Long NVDA Daily ETF (NVDL) is the largest Nvidia single stock ETF at the time of this writing. New York based GraniteShares was formed in 2016 by Will Rhind with financial backing from Bain Capital. Using leverage from swaps contracts with other large investment houses, NVDL magnifies the stock movements of Nvidia (NVDA) by 200% on a daily basis. It trades on NASDAQ.

T-REX 2X Long NVIDIA Daily Target ETF (NVDX) trades on CBOE and is smaller, with a $524 million market cap. Rex Shares is based in Miami, FL, and operates in conjunction with Tuttle Management. NVDX also uses leverage from swaps contracts with major investment houses in order to deliver a 200% magnification of NVDA daily stock performance.

In a side-by-side comparison starting from December 2023 to the time of this writing, NVDX has returned 415% vs NVDL’s 359%. Other comparison points include:

| NVDL | NVDX | |

| Expense Ratio: | 1.15% | 1.05% |

| Drawdowns: | -37.75% | -37.65% |

| Volatility: | 27.70% | 27.47% |

NVDL’s dividend yield for the past trailing 12 months is 14.41%. NVDX does not pay a dividend. NVDL is traded 24 hrs on Robinhood, while NVDX is not.

Given the risk factors of NVDL and NVDX, these ETFs are not for investors as much as for traders, due to the upside decay factor. This is not unlike losing time value on out-of-the-money options. The fact that GraniteShares has allocated only 1% of comparable AUM to Apple and 0.1% to a Microsoft ETF blatantly declares that Nvidia is where the hot action is. So wise caution is advised for those who choose to go the ETF route. Double the profits can be made, but the losses can double just as quickly.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.