24/7 Insights

- Nvidia Corp. (NASDAQ: NVDA) stock is up sharply in the past year.

- Here are three other AI stocks that outperformed it.

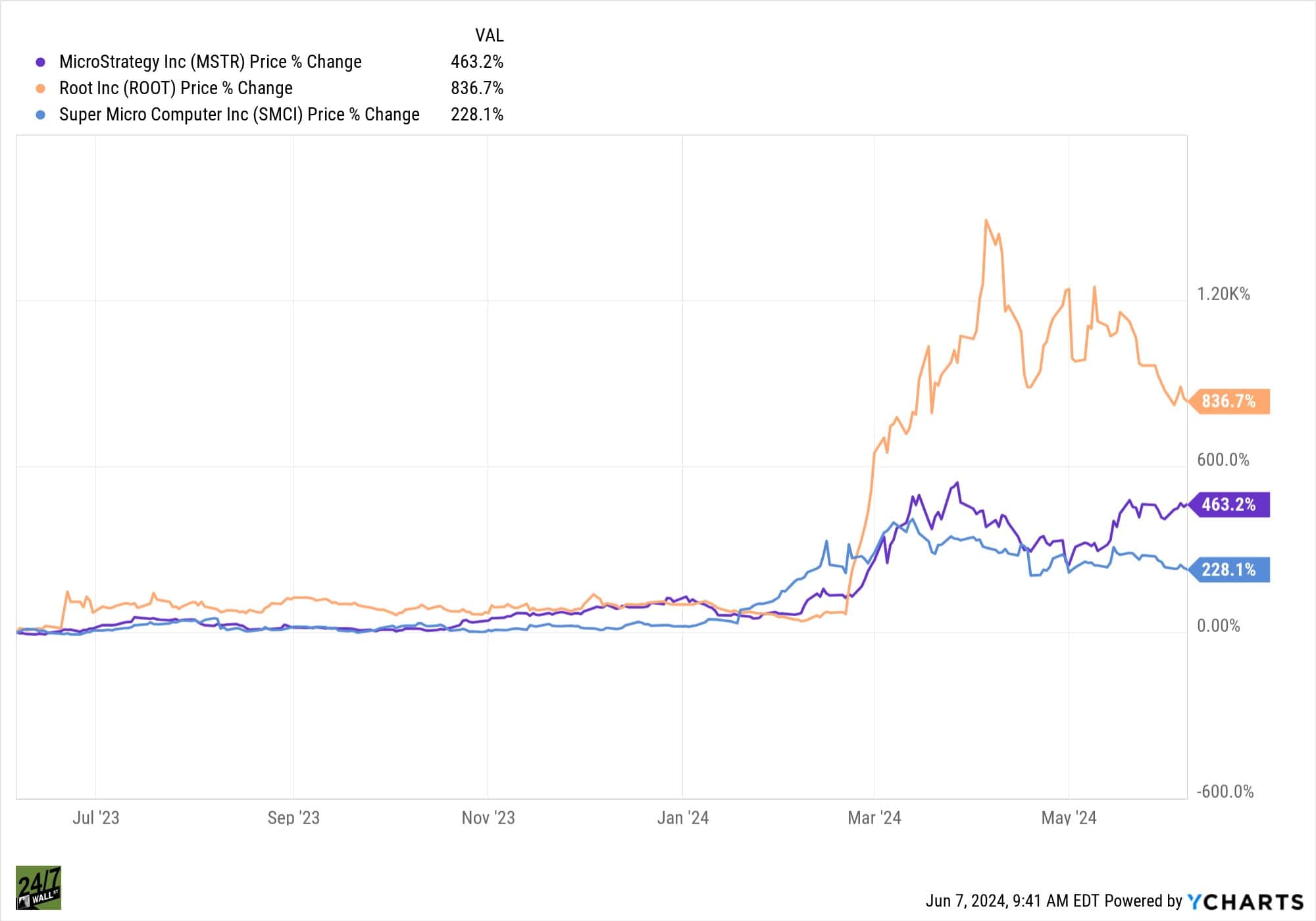

It seems everyone wants to buy artificial intelligence (AI) stocks these days. After all, Nvidia Corp. (NASDAQ: NVDA), which has become a bellwether for the AI segment, saw its shares rise almost 240% last year, and they are up 140% or so thus far in 2024. Plus, Nvidia stock is effecting a 10-for-1 split. Ahead of the split, analysts on average recommended buying shares. However, they currently do not see further upside in the next 52 weeks, as their consensus price target is less than the current share price.

Are there better options? There are a lot of AI stocks to choose, from Microsoft Corp. (NASDAQ: MSFT) to C3.ai Inc. (NASDAQ: AI). Even Tesla Inc. (NASDAQ: TSLA) can be seen as an AI stock. Turns out, the following three stocks have outperformed Nvidia in the past year. A couple of them could be candidates for a stock split as well. Let’s take a look.

MicroStrategy

- Year-over-year share price change: 463%

- 52-week range: $1,666.79 to $1,717.70

- Market cap: $30 billion

How Much More Upside Ahead?

MicroStrategy Inc. (NASDAQ: MSTR) is a provider of AI-powered enterprise analytics software and services. It serves federal, state, and local governments and government agencies, as well as a range of industries, including retail, banking, manufacturing, health care, and telecommunications. It was incorporated in 1989 and is headquartered in Tysons Corner, Virginia. Competitors include Microsoft and Salesforce Inc. (NYSE: CRM).

MicroStrategy is one of the world’s largest corporate holders of Bitcoin. The stock will soon be joining the Russell 1000 index. Analysts on average currently see the share price going to $1,756.95 in the coming year, which would be about a 5% further gain.

Root

- Year-over-year share price change: 836%

- 52-week range: $5.53 to $86.57

- Market cap: $740 million

A Different Kind of Insurer

Columbus, Ohio-based Root Inc. (NASDAQ: ROOT) is a provider of insurance products and services. It offers automobile, homeowners, and renters insurance primarily through mobile applications, as well as through its website. It was established in 2015. Competitors include Allstate Corp. (NYSE: ALL) and Lemonade Inc. (NYSE: LMND).

Root posted better-than-expected first-quarter results with improving retention rates. While the consensus recommendation is to hold shares, the $68.75 mean price target indicates that the analysts see more than 41% further upside potential. The high price target is up at $103.

Super Micro Computer

- Year-over-year share price change: 228%

- 52-week range: $213.08 to $1,229.00

- Market cap: $45 billion

Cloud, AI, and 5G

Incorporated in 1993 and headquartered in San Jose, California, Super Micro Computer Inc. (NASDAQ: SMCI) manufactures high-performance server and storage solutions. The company provides its products to enterprise data centers, cloud computing, artificial intelligence, and 5G and edge computing markets. Competitors include Dell Technologies Inc. (NYSE: DELL) and Hewlett Packard Enterprise Co. (NYSE: HPE).

Super Micro Computer recently became a Fortune 500 company. And its stock is popular on Reddit’s WallStreetBets. The Wall Street consensus recommendation is a cautious Buy. The analysts have a mean price target of $1,057.46. Reaching that target would be a gain of more than 38% for the shares. The high price target is up at $1,500 a share.

A Once-in-a-Generation Investment: 1 AI Stock You Don’t Want to Miss Out On

Should I Invest in AI?

Many AI stocks have soared in the past couple of years, and AI seems to be in headlines and in speculation everywhere. The question is whether AI is a fad, or if AI stocks are in a bubble. Signs suggest that it is more than a fad, but rather a trend, even a fundamental shift in industry and society. Whether stocks are in a bubble remains to be seen. As indicated above, analysts anticipate at least a little upside in these three other AI stocks.

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.