24/7 Insights:

- Apple (NASDAQ: AAPL) has been on an incredible run this year, recently minting a new all-time high.

- Despite this success, the company’s overall growth rate has slowed, and expectations have come down.

- Here’s another top growth stock we’re watching instead, and why we think it may have more upside than Apple over the medium-term.

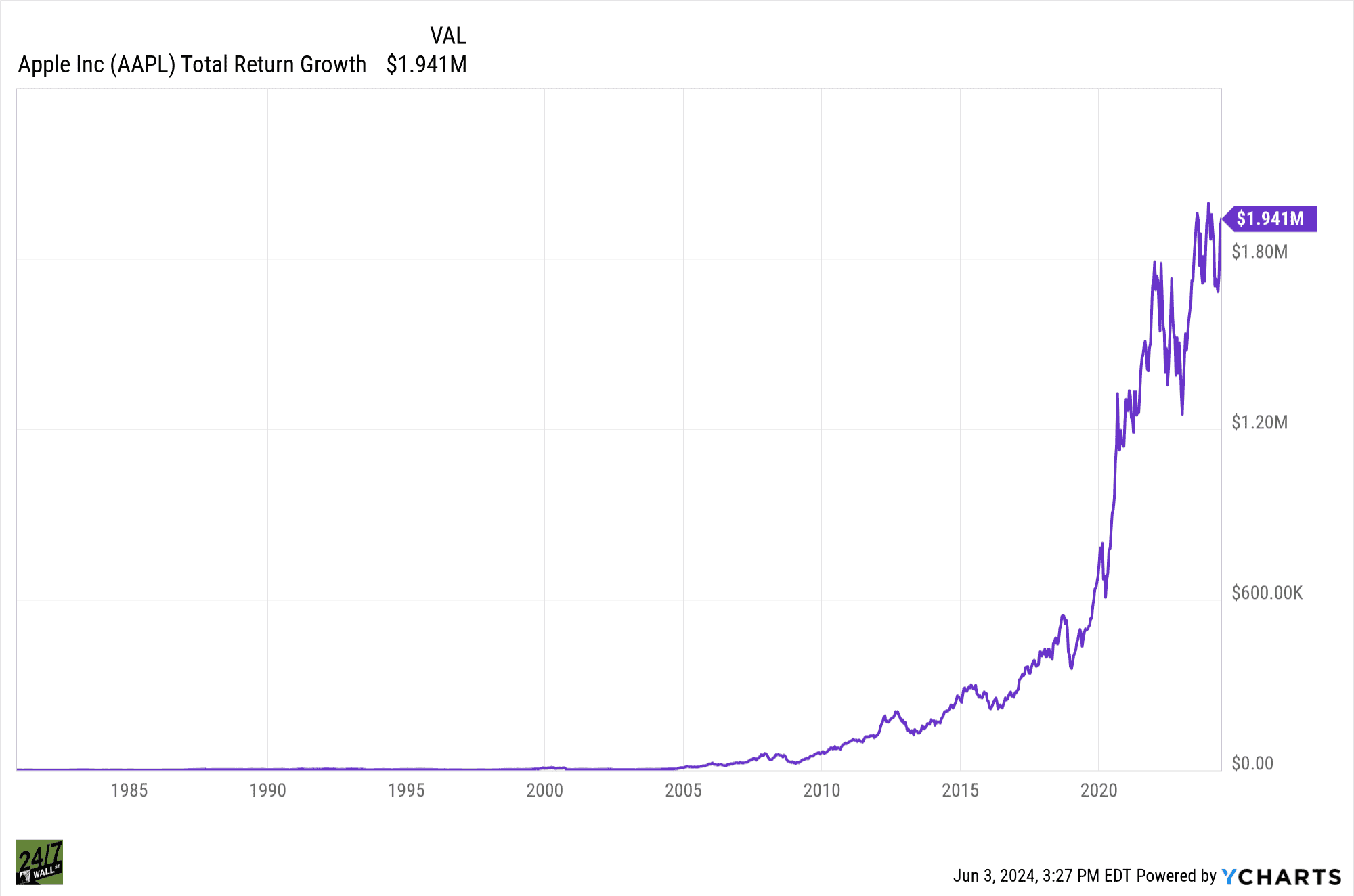

The search for the top millionaire-maker stocks is always on, for many growth investors. For much of the past two decades, Apple (NASDAQ: AAPL) has been the stock that’s likely minted the most millionaires (though that’s now a debate, given the recent rise of the so-called “Magnificent 7” stocks in the market).

The top holding in Warren Buffett’s portfolio, Apple is now trading above $205 per share. That’s good for a fresh all-time high, benefiting those investors who continued to buy the dip along the way.

In my view, the tech sector appears disproportionately favorable to investors who are overweight large and mega-cap tech names. These companies have entrenched moats, operate in monopoly-like oligopolies, with a few key players dominating the growth seen in entire sectors. Many of the same underlying catalysts drive these names higher, but for those seeking exposure to the growth potential AI has to offer, Nvidia (NASDAQ: NVDA) is the clear and easy choice as the company with the potential to rival Apple over the long-term in its millionaire-minting ability.

Nvidia’s Growth Catalysts Are Being Proven Out

One of the key detrimental factors many investors point to when they think about what could possibly go wrong with Nvidia’s impressive rally is the reliability and sustainability of the underlying growth trends the company is seeing. The question is whether the kind of growth we’re seeing can continue, and how much capital companies, governments and institutions will be willing to put to work in this sector in the years to come.

Right now, AI is viewed as a ubiquitous catalyst for many companies in most industries. Acquiring a few Nvidia high-performance processors (or thousands in the case of many mega-cap tech names) can allow a company to go from a simple software, cybersecurity, or tech name to one that’s a newly repackaged AI company. This playbook hasn’t gotten old yet, and the orders continue to flow into the world’s largest high-performance chip maker.

Additionally, we’ve actually seen an acceleration in what appears to be a transition that may be much longer-lasting than many previously thought. Thus, it’s possible we are still early, and there is the potential for these growth catalysts to be much longer-lasting than many had previously thought.

But…Apple’s Making Moves Into AI, Too

Most of the recent momentum around Apple has to do with its WorldWide Developers Conference (WWDC), which is just wrapping up (at the time of writing). Apple announced some rather impressive AI features and a partnership with OpenAI to provide unique services for its new line of upcoming iPhones, Macs and iPads. Launching “Apple Intelligence” is a bid to capture more market share and mind share among consumers looking for AI-driven solutions, while the company also works on developing its own solutions in-house.

Yes, Apple does appear to be relying on its own M1 chips for much of the compute necessary for these advancements. And Apple is among the companies looking to rely less on competitors like Nvidia, bringing this production in-house.

But over the long-term, few companies have the ability to do just this. So, maybe we shouldn’t forget about Apple altogether. But for an AI-driven future, it’s becoming increasingly clear we’re likely going to rely on Nvidia in a much bigger way than many thought. For those invested in Nvidia, that’s a good thing (and it’s great for everyone else who owns an index fund as well right now). My money would be on NVIDIA making more millionaire going forward than Apple.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.