Everyone is always looking for that next big “millionaire maker” stock. For decades, chipmaker Intel (NASDAQ: INTC) has reigned supreme in its little sector of the stock market and is regularly touted as a “millionaire stock.” However, the Intel boat may have already left the harbor.

Luckily, the world of technology is ever-changing, creating opportunities for new companies to rise. Enter Advanced Micro Devices (NASDAQ: AMD). Once a distant competitor, AMD has made significant strides in recent years.

Once overshadowed by Intel, AMD is now a disruptive force poised to capitalize on its competitor’s missteps. It offers a high-risk, high-reward opportunity to become a millionaire-maker stock.

We’ll explain all of this in depth below. But before we get ahead of ourselves, it’s important to remember that “millionaire maker” stocks typically involve substantial risk, including the potential for significant losses.

The Stumbles of a Giant: Intel’s Challenges

For many years, Intel was the name in computer processing power. Their chips powered almost everything (that was worth much, anyway). You could find them in everything from personal laptops to massive serves that kept the world running.

However, that tide could be turning. In recent years, Intel has faced many challenges that have hampered its growth and opened the door for competitors.

For instance:

- Manufacturing Delays: Intel has regularly struggled to meet production timelines. Many of their current projects are also being delayed. This leads to shortages, as we’ve all heard about on the news. Chip shortages can lead to customers looking elsewhere for their computer processing power.

- Process Node Issue: Intel is also having problems with process nodes. These smaller chips have had delays and yield problems, which has led to some doubting whether Intel can keep its technological lead.

- Loss of Market Share: Intel has also seen its market share in key segments like CPUs for laptops and servers begin to erode. It’s impossible to tell whether this is directly because of these challenges above. However, there has been a decline.

Yes, AI may help Intel regain some of their lost growth. However, they aren’t at the forefront of the AI sector right now. We consider Intel to be one of the top three AI stocks to avoid.

That said, if you did invest in Intel at its IPO, you’d currently have quite a lot of cash. (But you’d have even more if you sold it several years ago.)

These challenges have created a window of opportunity for AMD, and they haven’t been slow to capitalize on it.

The Rise of the Underdog: AMD’s Strategic Moves

Once the clear underdog in the CPU market, AMD has emerged as a formidable competitor to Intel. Capitalizing on Intel’s stumbles, AMD has made several strategic moves that make us hopeful for its future:

- Successful Product Launches: AMD’s Ryzen line of processors has been a game-changer. Offering competitive performance and efficiency at attractive price points, Ryzen processors have captured the attention of both gamers and PC enthusiasts. In fact, the next Ryzen processor is likely going to launch sooner than expected.

- Focus on Innovation: AMD has prioritized research and development, allowing it to push the boundaries with new products. This dedication is most obvious in its recent Zen CPU cores.

- Strategic Acquisitions: Most recently, AMD purchased Nod.ai to boost its ability to create AI software. This was the company’s second AI acquisition in only a few months.

- Market Position and Growth Potential: AMD’s market share is steadily increasing, and it’s likely to rise even further. This sound market position is backed by real products that people purchase every day.

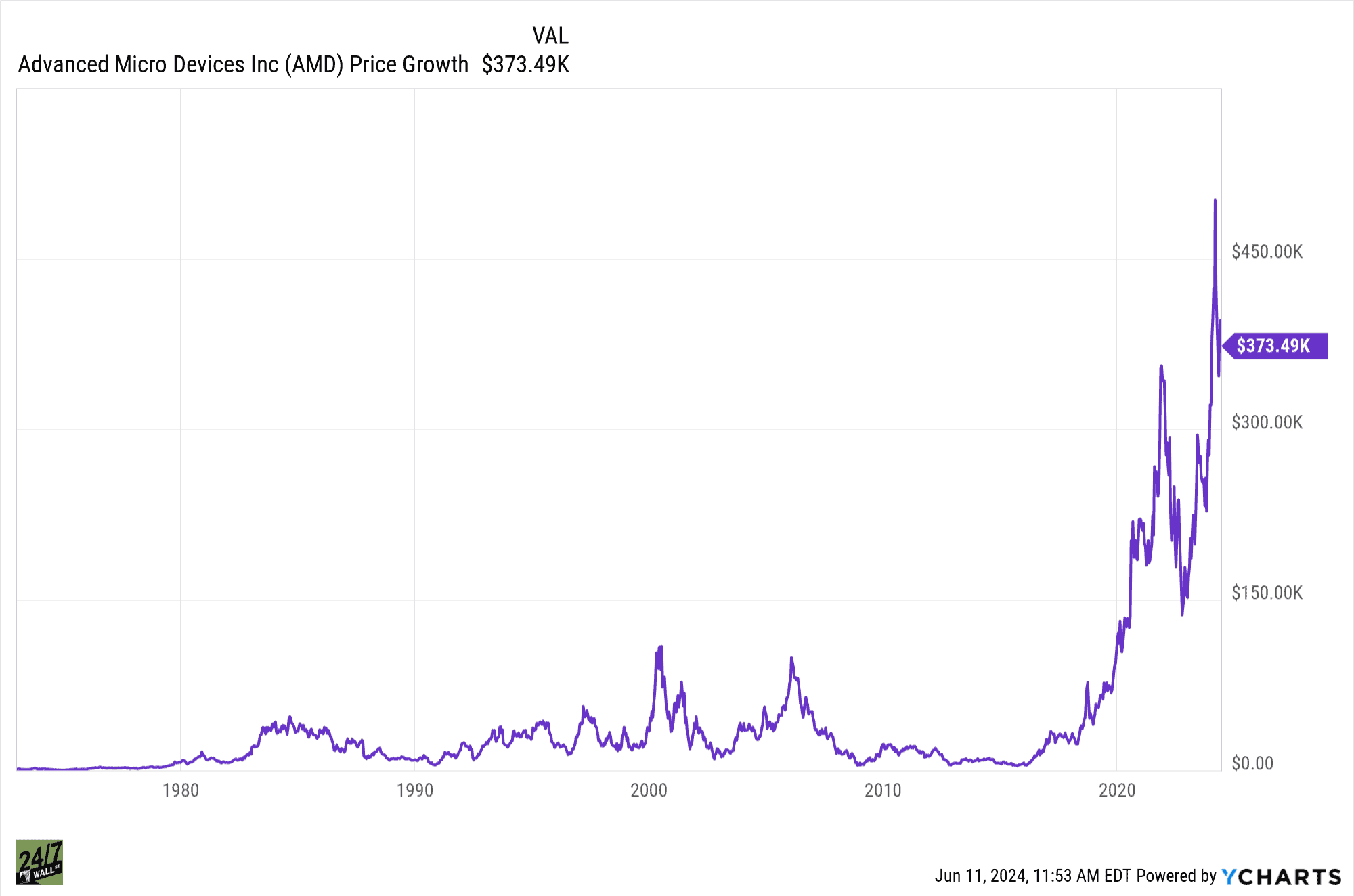

AMD could very well be the next millionaire-maker stock. Just take a look at its chart:

Why AMD Could Be the Millionaire-Maker Stock

The potential rewards for investors who believe in AMD’s story are significant. If AMD can continue to erode Intel’s market share, particularly in the server market, it could lead to a substantial increase in profit. This, in turn, could translate into higher stock prices, potentially rewarding early investors handsomely.

AMD is also well-positioned to benefit from the booming artificial intelligence market. Its strong GPU technology and focus on innovation put it in a good position to innovate and lead the market.

They could potentially be a key player in rapidly growing technology sectors.

However, the promises of AMD aren’t without their risk. AMD is a high-growth, high-volatility stock. AMD’s future success hinges on its ability to maintain its technological edge. Missteps in development or manufacturing can derail their momentum.

The tech sector is known for its volatility, and AMD’s stock price is likely to experience significant swings. Investors with a low-risk tolerance may struggle with the potential for short-term losses.

If you’re looking for a less volatile approach, diversification is key. You may want to invest in established tech giants or companies in other sectors to help mitigate the risks associated with high-growth stock.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.