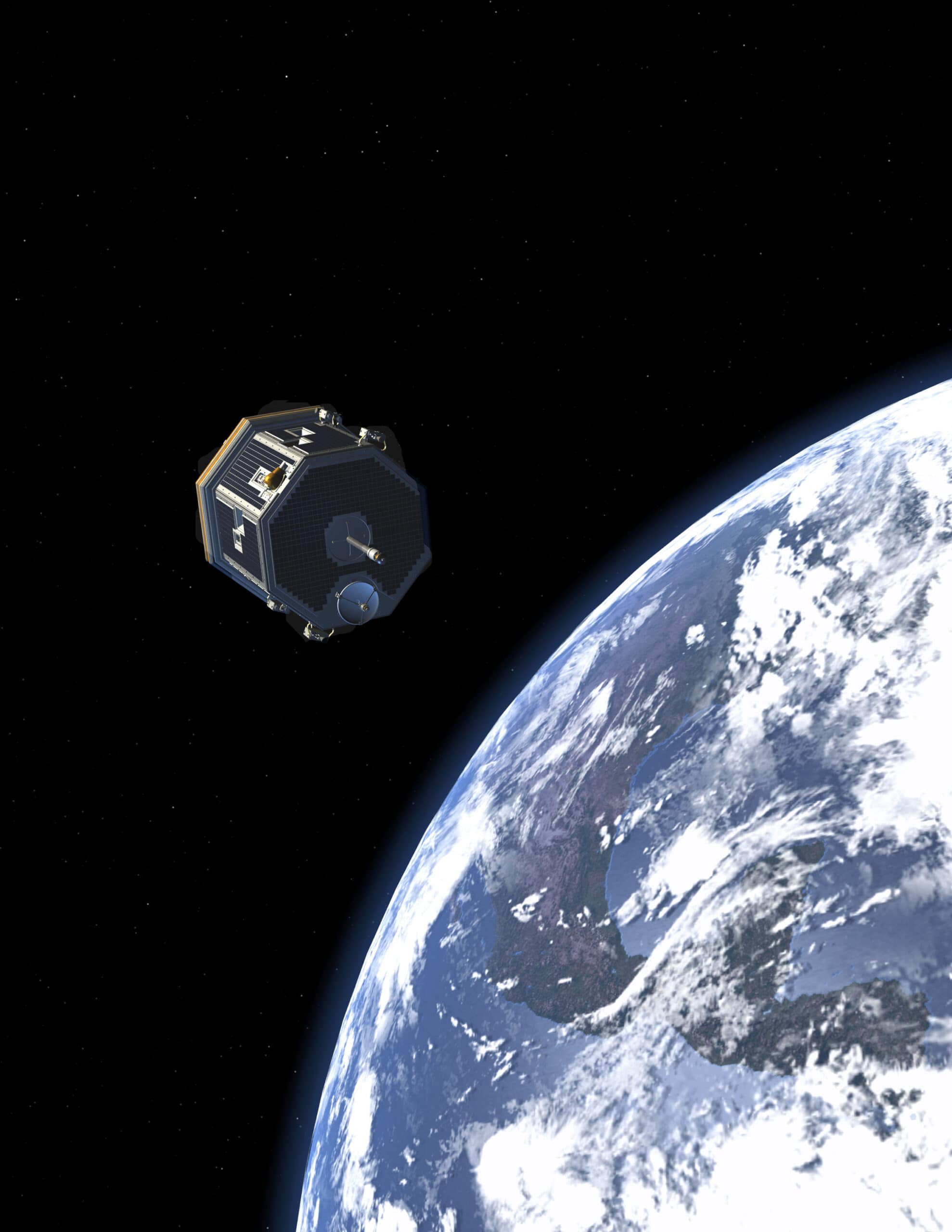

The allure of space travel has captivated humanity for centuries, and Virgin Galactic (NYSE: SPCE) is leading the charge in making that dream a reality. This aerospace and space tourism company is looking to develop vehicles that usher in the era of commercial spaceflight.

Despite recent setbacks, Virgin Galactic remains a frontrunner in the burgeoning space tourism industry. It offers a high-risk, high-reward investment opportunity with the potential for exponential growth.

The time to invest in commercial spaceflight is now. Of course, investing in a sector that isn’t active brings a lot of risk. However, if SPCE gets off the ground, the potential growth for the stock is huge. Already, the stock has seen some crazy gains, which is why it’s important to get in now.

Here are ten reasons to get in on the ground with Virgin Galactic:

1. First-Mover Advantage

Virgin Galactic isn’t just a player in the space tourism industry; it’s a pioneer. Founded in 2004 by Richard Branson, the company has been at the forefront of developing technologies and experiences for suborbital spaceflight.

This first entry into the market gives Virgin Galactic a unique advantage.

Being a first-mover allows Virgin Galactic to establish itself first. It could easily become the most trusted brand in the minds of potential space tourists once things get off the ground. Plus, this company has benefited from initial media coverage and public fascination. It’s in a great position to set itself as the company in space tourism.

This brand recognition can translate into customer loyalty as Virgin Galactic refines its offerings. Plus, the company has also had time to experiment and innovate, allowing it to set itself apart far into the future, too.

Their accumulated knowledge can be a barrier to preventing new competitors from catching up.

2. Experienced Team

Virgin Galactic’s innovative technology is great, yes. However, they also have a dream team that designs, operates, and maintains their spacecraft. This company boasts some big names on its team, which can help ensure its future success.

For instance, CEO Michael Colglazier brings expensive knowledge of business operations and customer experience from his previous role at Disney. The flight deck is packed with a team with previous experience at NASA and US Air Force.

For instance, CJ Sturckow logged four successful missions aboard the Space Shuttle while at NASA.

This experience is crucial for getting a space tourism company off the ground.

3. Innovative Spacecraft Design

Virgin Galactic is doing things a bit differently compared to other space-oriented companies. Their spacecraft design is unique. For instance, their current vehicle, the VSS Unity, combines a mothership and a passenger spaceship – two of their previous designs.

A twin-engine jet aircraft carries the VSS Unity to a high altitude and then releases it. The VSS Unity continues upwards to reach the edge of space using its own rockets. This two-stage approach has many advantages.

The jet aircraft acts as a launch platform, eliminating the need for VSS Unity to travel all the way to space by itself. Over time, this is expected to lower operational costs.

The design also prioritizes passenger experience. For instance, the internal cabin is spacious with large windows, providing passengers with a great view.

Virgin Galactic is constantly developing new and better ways to reach space, too. They’re currently developing a new generation of spacecraft that has an even greater passenger capacity.

4. Pent-Up Demand for Space Tourism

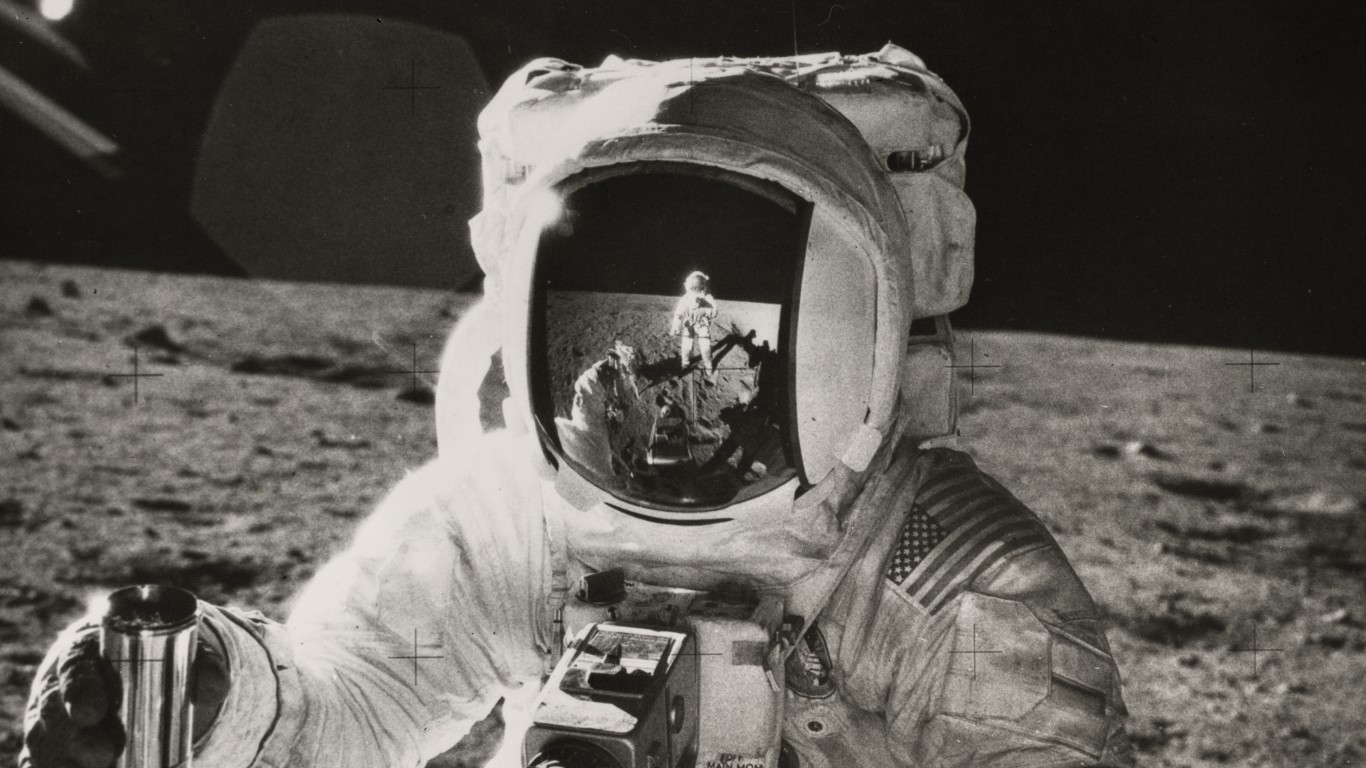

Space exploration has captivated humanity for generations. Virgin Galactic is looking to turn the dream of space travel into a reality, not a science fiction. A growing number of individuals are yearning for extraordinary experiences, and space tourism offers a chance to push the boundaries of human adventure.

This pent-up demand can potentially put a powerful tailwind behind Virgin Galactic.

The demand for space travel may increase even more in the future, too. The success of private spaceflights by companies like SpaceX and Blue Origin has generated significant media attention and taken the reigns from government-funded programs.

A new generation of high-net-worth individuals with a taste for adventure could also provide the funds needed to take space tourism to the broader public.

Virgin Galactic could benefit from this demand. They offer a suborbital experience that provides a taste of spaceflight at a relatively accessible price point. Plus, they’re focused on customer experience, which sets them apart from many other companies.

5. Growing Market Opportunity

Space tourism is poised for explosive growth. According to a report by Grand View Research, the space tourism market is expected to grow at an annual rate of 44.8% until 2030. This exponential growth is due to several factors:

- Increasing disposable income: More high-net-worth individuals seek unique and exclusive experiences. Space tourism has the opportunity to be the next frontier for these individuals.

- Technological advancements: This market benefits greatly from advancements in spacecraft. As innovation increases, the market is expected to increase, too.

- Shifting consumer preferences: Experiences have become increasingly more valuable compared to material possessions. Space tourism can take advantage of this changing trend.

As the pioneer of space tourism, Virgin Galactic is set to capture a big share of this market. Their first-mover advantage can cause huge problems as this market opens up to more and more people.

6. Strategic Partnerships

Virgin Galactic has the opportunity to partner with well-established companies as space tourism opens up. Once the market grows larger, it’s likely that established aerospace companies and travel agencies will want a cut. When they do, partnering with a space tourism company like Virgin Galactic may be the way to go!

These partnerships can provide Virgin Galactic with access to valuable resources, like manufacturing capabilities and testing facilities.

Virgin Galactic can also partner with companies offering complementary services. For instance, this could be companies specializing in space hotels or space-based entertainment experiences. Once space tourism becomes established, there is no telling what ways Virgin Galactic will be able to grow.

It isn’t just about suborbital flight. It is all the things that come after that, too.

7. Technological Advancement

Virgin Galactic knows that affordable space travel is a long way off, but they are tactically working to make that dream a reality. Their focus is largely on research and development, ensuring that they continue to stay ahead of the pack.

Currently, much of their research is focused on lowering the cost per flight. They’re doing this by innovating their propulsion system and materials. They’re also innovating in spacecraft design and maintenance procedures. These discoveries could translate to a faster turnaround time between flights, allowing them to serve more customers.

Their innovations aren’t only about space tourism, either. There is also a chance that their discoveries could be sold to and used by other markets, like aerospace.

8. Training Infrastructure

As space tourism becomes more widespread, more pilots will need to be trained. Virgin Galactic is in the perfect spot to offer this service to other budding companies, too. Already, this company has invested in comprehensive tourist training infrastructure, which they use to ensure everything goes smoothly.

For instance, to become a space tourist, you must go through a selection process that involves meeting certain physical and mental requirements. Once selected, passengers must undergo a multi-day training program.

Virgin Galactic already has dedicated facilities where this training happens. It wouldn’t be a huge jump to start using these facilities and techniques to train pilots and not just passengers.

9. Potential for Additional Revenue Streams

Virgin Galactic isn’t solely focused on passenger space tourism. They’re actively exploring ways to diversify their revenue streams and solidify their position within the broader space industry.

For instance, their spacecraft could potentially be used for small, time-sensitive cargo deliveries within Earth’s atmosphere. This could be particularly attractive for high-value goods. As the space tourism market matures, Virgin Galactic could also have the chance to offer other entertainment experiences.

These experiences could include hosting life events in space or partnering with media companies to film documentaries. Either way, Virgin Galactic could easily expand their offerings as the demand appears.

10. Long-Term Investment Potential

While space tourism is exciting, it’s important to remember that this is a long-term investment. The space tourism industry is still very tiny. Like with any venture into space, Virgin Galactic faces inherent risks.

The spaceflight industry is complex, and unforeseen technical hurdles may appear. We don’t know if something will pop up that makes space tourism nearly impossible.

The regulatory environment surrounding space tourism is still evolving. Virgin Galactic needs to navigate these regulations and obtain the necessary licenses to operate commercially. We don’t know how governments will respond to space tourism or what hops will appear.

Eventually, other companies will probably look for a piece of the space tourism pie. Virgin Galactic will need to keep its edge after this occurs.

Despite these challenges, there is great potential for buy-and-hold investors. If you keep your eyes on the long game, you could benefit massively from investing in Virgin Galactic now.

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.