If you were thinking of buying shares of semiconductor and software company Broadcom (Nasdaq: AVGO) before, the company has ensured that you’ve got even more reasons to do so now. After announcing a 10:1 stock split in its record-breaking fiscal Q2 results, Broadcom now expects this performance to continue, fueled largely by demand for its artificial intelligence (AI) solutions. While Broadcom doesn’t make the same chips as Nvidia (Nasdaq: NVDA), it does build components that are critical for networking applications including those needed in AI data centers around the world.

Broadcom, which designs ASIC chips for AI applications, has been around since the early nineties, and it has a history of growing its revenue hand over fist. Over the past five-year period, Broadcom’s annual revenues have increased by 58% to hover at $35.8 billion as of year-end 2023. With the AI winds in its sails, Broadcom is forecasting even more revenue growth in its current fiscal year to put it over the top.

While Broadcom’s stock has already gained close to 60% year to date, for a market cap of $807 billion and rising, there’s reason to believe there’s more room left in the tank, making AVGO a compelling opportunity. We’ve identified 10 catalysts that make good reasons to buy Broadcom stock now.

Reason No. 1: Co-Founder on the Board

Broadcom’s chairman of the board is Henry Samueli, who is also one of the company’s original co-founders. Samueli has held multiple executive roles over the years, including chief technical officer at the time of the company’s combination with Avago Technologies. While there was controversy surrounding Broadcom’s founding members, it involved Samueli’s business partner, Henry Nicholas. Samueli’s legacy is tied to Broadcom, and so far this has worked in the company’s favor.

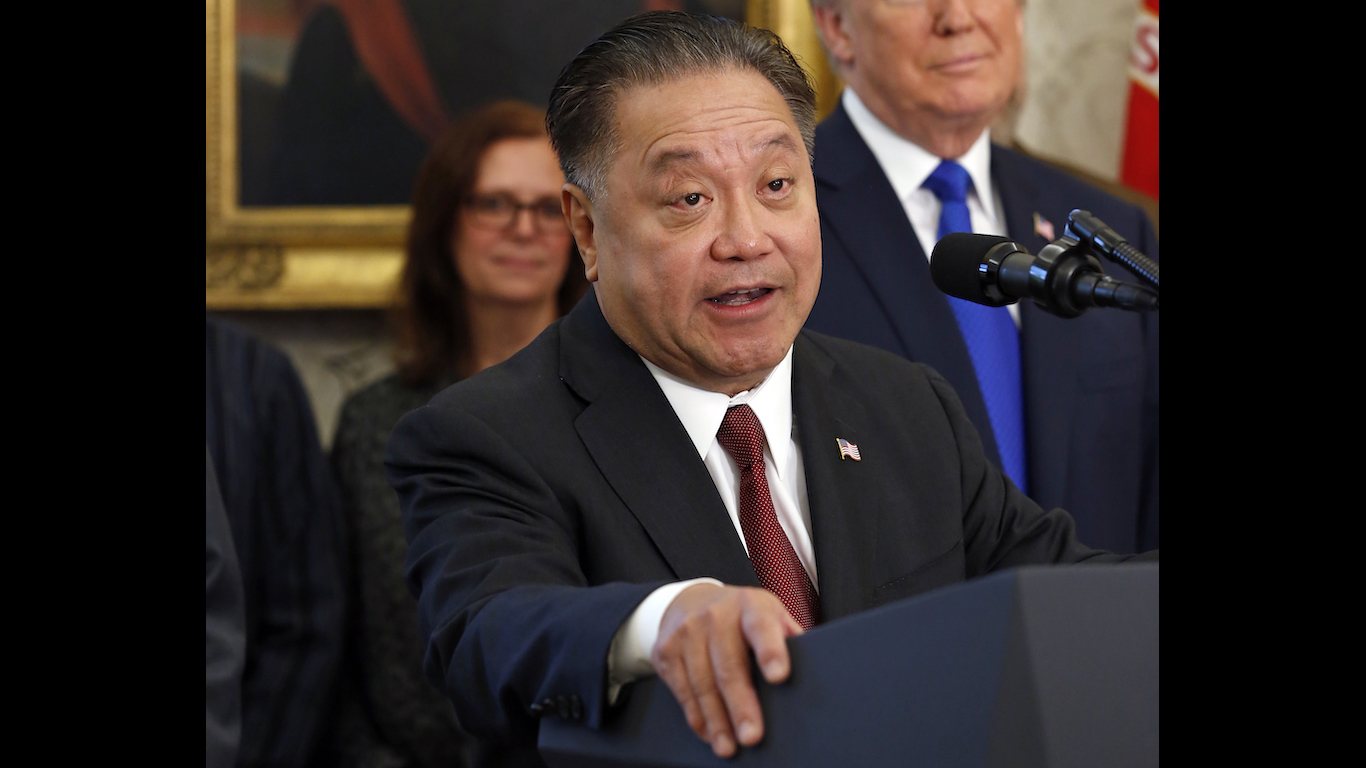

Reason No. 2: Broadcom CEO’s Compensation

Reason No. 3: Broadcom’s Upcoming Stock Split

Broadcom is preparing for a 10:1 forward stock split of its shares, which are currently hovering at $1,678 per share. The stock, which will begin trading on a split-adjusted basis on July 15, has already ballooned by nearly 60% year-to-date, but the stock split serves as yet another catalyst that’s likely to embolden the Broadcom bulls. Broadcom hasn’t completed a stock split since its 2016 acquisition of Avago and appears to have been waiting for the perfect time. Considering the excitement around generative AI, which is a commanding part of Broadcom’s total revenue, investors are likely to find it was worth the wait.

Reason No. 4: Revenue Growth and Forecast

Since its acquisition of Avago, Broadcom’s revenue took a sharp upward turn, increasing from $17.6 billion in 2016 to $38.87 billion in 2023. In fiscal Q2, Broadcom reported revenue of $12.5 billion, a 43% increase year-over-year and beating consensus estimates, fueled by a combination of AI demand and its VMware segment. Revenue from Broadcom’s AI segment hit a fresh all-time high at $3.1 billion, a 281% increase, offsetting any weakness from the enterprise and telecom segments. In response, management lifted its full-year consolidated revenue guidance to $51 billion, up from a previous prediction of of $50 billion, and increased their outlook for AI-based revenue from $10 billion to $11 billion.

Reason No. 5: Insatiable AI Demand

As a chip solutions company, Broadcom is right in the middle of the AI boom. The company has an impressive roster of clients for its AI chip segment, including tech giants like Google parent company Alphabet (Nasdaq: GOOGL), Apple (Nasdaq: AAPL), and Meta (Nasdaq: META). In fact, the iPhone maker is Broadcom’s biggest customer and represented roughly one-fifth of its revenue last year. Now that Apple has partnered with ChatGPT maker OpenAI, Broadcom’s solutions could be in even greater demand. Broadcom management recently tipped their hand to yet another client for its AI solutions, leading Wall Street analysts to speculate that it is China’s ByteDance, maker of the TikTok app. Broadcom is strategically positioned for the transition of AI data centers to bandwidth with speeds of 800 Gbps, benefiting its digital signal processors, optical lasers and PIN diodes.

Reason No. 6: VMWare

Since Broadcom acquired VMWare in 2023, it has increased its competitive position in enterprise software. VMWare brings its cloud computing prowess to the relationship, allowing Broadcom to harness expertise on both the hardware and software sides of the table. Thanks to the combination with VMWare, Broadcom’s Q2 infrastructure software revenue increased to $5.3 billion, up 175% year-over-year. That performance included a $2.7 billion contribution by VMWare as more businesses integrated its software stack for their own cloud purposes. Broadcom management says the integration of VMWare is going smoothly, while the company transitions the software company’s products to a subscription model.

Reason No. 7: Wall Street Bulls

Wall Street analysts are highly bullish on Broadcom stock, with nearly two-dozen “buy” ratings and zero “sells.” With an average price target of $1,883, analysts believe Broadcom stock offers 8.5% upside potential on top of its double-digit-percentage gains so far this year. Among the most bullish analysts on AVGO stock is Oppenheimer’s Rick Schafer, who in response to the company’s Q2 report lifted his price target by 33%, from $1,500 to $2,000, with an “outperform” rating on the stock. Not to be outdone, Bank of America similarly raised its price target on Broadcom to $2,000 while increasing its 2025 revenue forecast to nearly $60 billion. If Bank of America is right, that sales performance would represent a 16% increase over Broadcom’s projected full-year performance in fiscal 2024.

Reason No. 8: Cash Dividend

While Broadcom might be a growth stock that invests heavily in capex (Broadcom directed $132 million in capex in fiscal Q2), it is also a dividend-paying stock. In fiscal Q2, Broadcom announced a quarterly cash dividend of $5.25 per share, for which it allocated capital of $2.4 billion. With a dividend yield of 1.21%, Broadcom has a history of raising its distribution amount each year, including a 14% increase in fiscal 2024 vs. year-ago levels. As a result, investors should feel confident that Broadcom has a proven history of prioritizing shareholder value. With a payout ratio of 70%, Broadcom directs much of its earnings towards dividends, but it also has the fundamentals that make this model sustainable.

Reason No. 9: Free Cash Flow

Broadcom has a strong cash position and solid liquidity, which should help investors to sleep at night. The company ended fiscal Q2 with $9.8 billion in cash and $74 billion of gross debt. In the quarter, free cash flow rose 18% to $5.3 billion excluding merger integration and restructuring costs. The company’s five-year free cash flow trend is positive, rising from $9.6 billion in 2019 to $18 billion last fiscal year, and 87.5% increase. As of 2023, Broadcom had a free cash flow margin of 50%, surpassing that of its peers.

Reason No. 10: Broadcom Doesn’t Compete With Nvidia on GPUs

While both Broadcom and Nvidia operate in the semiconductor industry, and both are AI juggernauts, they don’t go head to head in this segment, at least on GPUs. Even Broadcom’s Tan explained on the last earnings call that Nvidia is highly efficient at GPUs, which is the merchant’s “AI accelerator of choice.’ Tan said, “We don’t even think about competing against them in that space, not in the least.” Where he does see Broadcom participating in this area is with its IP portfolio for tailored ASIC AI accelerators. He admits, however, on Ethernet networking, the gloves are off.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.