Investors of a certain age will remember the Coke vs. Pepsi debates of the 1980s. In 2024, investors are facing another battle that is between Nvidia Corporation (NASDAQ: NVDA) and Advanced Micro Devices Inc. (NASDAQ: AMD).

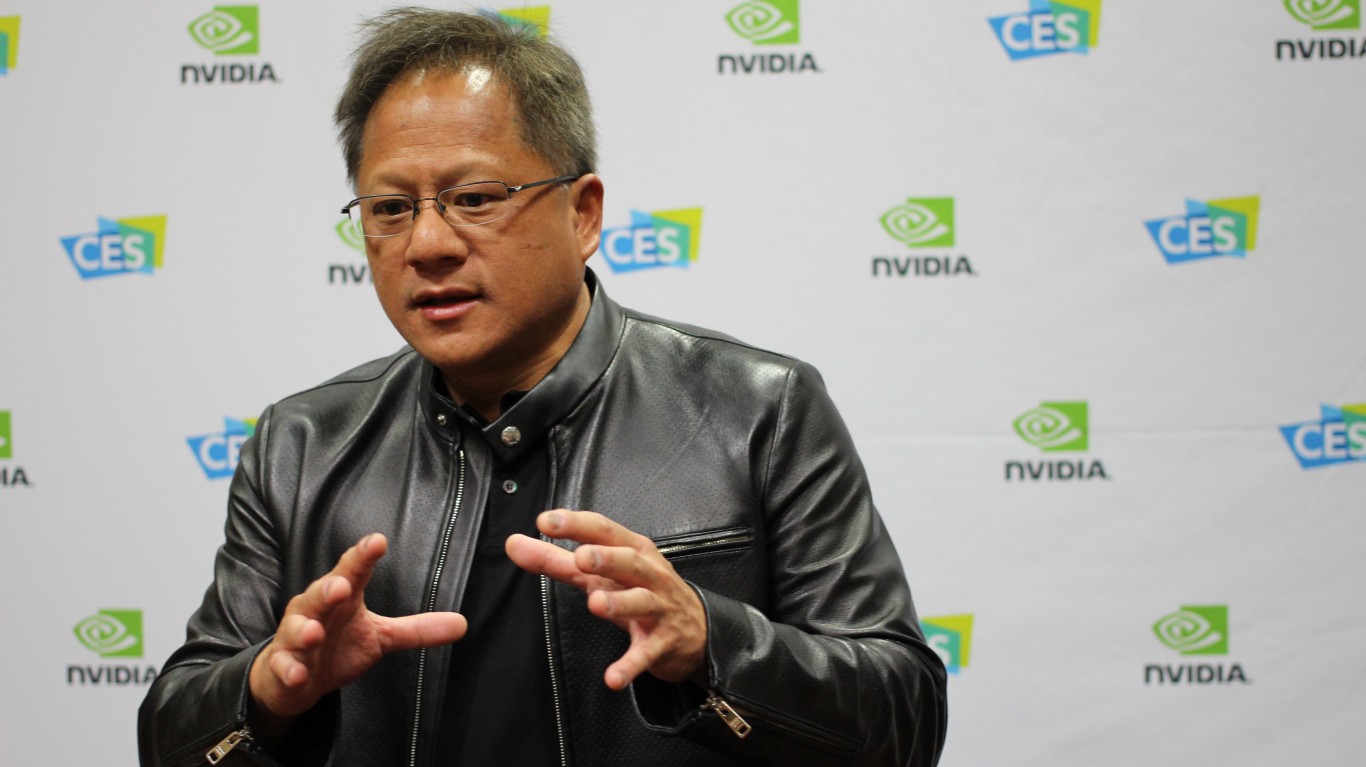

Nvidia was one of the top-performing stocks in 2023. After completing its 10-for-1 stock split in June, the company is improving investor psychology, increasing accessibility, and offering a lower price.

On the other hand, Advanced Micro Devices has been no slouch either. AMD stock is up 31% in the last 12 months, but it’s down 21% in the last three months as analysts are questioning the company’s ability to take market share from Nvidia.

That being said, investing is about predictive analysis. In this case it means thinking about which of these stocks is not just the better buy today, but the choice for years to come. Let’s take a look at how these two chip giants stack up.

Why This Matters?

Artificial intelligence is a megatrend with years of growth opportunities for investors. Right now, however, the technology that will power AI is still in its early stages. The stage we’re in is about building out the infrastructure that powers AI. Nvidia and AMD are two of the leading names to watch in this emerging sector.

The Tale of the Tape

If you just looked at the prior year’s earnings, Nvidia wins this going away. The company posted a 412% year-over-year revenue increase and a 122% beat on earnings per share (EPS). Investors have rewarded the company with a 217% increase in the NVDA stock price. By contrast, Advanced Micro Devices posted lower year-over-year revenue and earnings, and the stock is up just 31%.

However, investing is frequently about what have you done for me lately. Nvidia faces tough year-over-year comparisons, and the stock is expected to increase revenue by 20%. That’s good and will easily cover the company’s 4.65 forward price-to-earnings (P/E) ratio. On the other hand, AMD Is expected to grow earnings by over 66%. But it’s fair to ask if that’s enough to justify the company’s 64x forward P/E ratio.

Nvidia is Playing a Game of Catch Them If You Can

Despite having approximately 85% market share in the data center market, Nvidia is not resting on its laurels. The company is already developing its next-generation AI chip before many competitors have even gotten out of the starting blocks.

That’s because while demand for its initial H100 GPU remains strong, Nvidia has already launched its HGX H200 GPU. The key difference between the two GPUs is a 1.4x increase in memory.

Why is that important? Because consumers will need lots of memory to handle the needs of generative AI. This will be particularly true of data centers.

AMD Has an Opportunity by Living on the Edge

Despite Nvidia’s significant lead in data center market share, Advanced Micro Devices is not conceding the sector. In June 2024, the company unveiled its powerful new AI infrastructure that includes its expanded AMD Instinct accelerator roadmap.

One of the key components of this AI infrastructure is new central processing unit (CPU) and graphic processing unit (GPU) architectures. This will be necessary to take AI to the edge, which includes personal computers and gaming consoles. AMD already has a lead in these areas and may be able to expand that lead.

Nvidia or the Field

In the short term (12 to 18 months), Nvidia is about as safe an investment as investors can get. And, let’s face it, if the company continues to pay—and potentially increase—a dividend, NVDA stock could become a forever stock on par with Microsoft Corporation (NASDAQ: MSFT) and Apple Inc. (NASDAQ: AAPL).

But just as many companies are looking for alternatives to Nvidia’s chips, many investors may be looking for an alternative to NVDA stock. This is when you should ask yourself, if you’re trying to find the chip stock that will perform the best for the next 10 years or longer, do you take Nvidia or do you take the field?

That’s where the bullish case for AMD stock comes in. The company has an opportunity as a new cycle of CPUs and GPUs is launched to increase its market share lead in these two categories. And if it can get a foothold in the data center market, AMD stock may have better growth prospects for aggressive investors.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.