Now that Nvidia (Nasdaq: NVDA) has become the most valuable company on the planet, investors may be wondering if it’s just luck. But given the early innings of generative AI, Nvidia is exactly where it wants to be.

After achieving a market cap roughly $3.335 trillion, Nvidia was thrust ahead of its tech peers including Microsoft (Nasdaq: MSFT) and Apple (Nasdaq: AAPL), proving there’s a new sheriff in town. Nvidia is the first company besides Microsoft or Apple to snag the No. 1 market cap ranking since before the pandemic when Amazon (Nasdaq: AMZN) made an appearance.

As economist Mohamed El-Erian shared, Nvidia began trading on the Nasdaq back in 1999, at which time Intel was the top semiconductor play. But for investors who were watching, Nvidia, which at the time was focused on the video game market (Microsoft, Sony (NYSE: SONY), etc.), muscled its way into the S&P 500 index in a three-year span, knocking out disgraced energy company Enron and setting into motion its growth trajectory for decades to come.

Over the past 25 years, the stock has delivered whopping returns of over 591,000%, considering dividends were reinvested over this stretch. As a Bloomberg report pointed out, the “cutting-edge chips” powering the AI boom are the clear winners. And Nvidia is out front.

1.) No. 1 Most Valuable Company

Nvidia’s achievement as the most valuable company in the world is no small feat. While networking giant Cisco System (Nasdaq: CSCO) managed to surpass Microsoft 20 years ago, when the dot-com bubble was at its height, this time is different. Nvidia’s growth is being fueled by unprecedented AI demand where the market is being driven by industry leaders with solid fundamentals, not fly-by-night startups.

Even former Cisco CEO John Chambers is betting on AI these days, telling The Wall Street Journal, “The implications in terms of the size of the market opportunity is that of the internet and cloud computing combined. The speed of change is different, the size of the market is different, the stage when the most valuable company was reached is different.”

A year ago, Nvidia was the No. 5 biggest company based on market cap, up from the No. 10 spot the year before that. Nvidia had been steadily making its way up the rankings until AI took over, catapulting Nvidia to the head of the pack. The very technology companies that have jockeyed for market share in the AI race are buying up Nvidia’s chip sets in the process, giving investors a reason to own NVDA stock now.

2.) AI Prowess

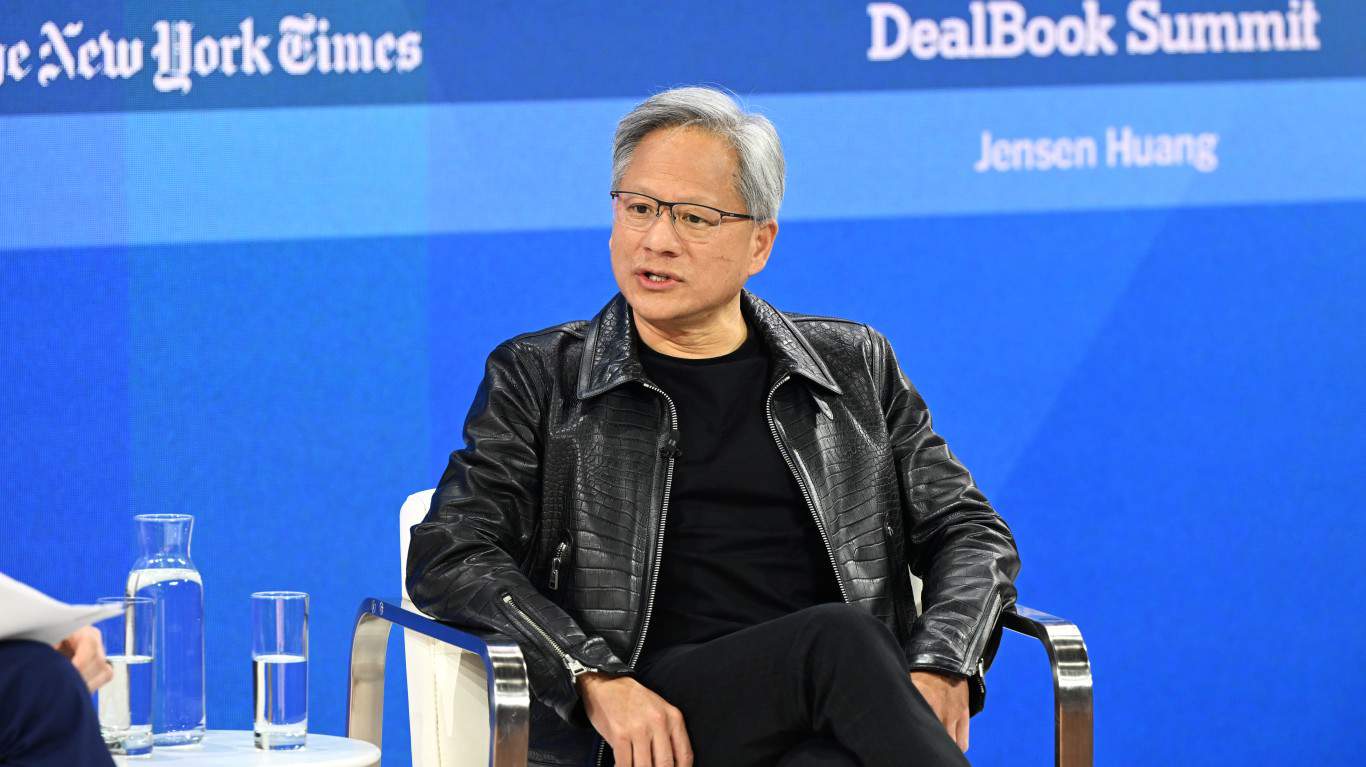

According to analysts, Nvidia is estimated to dominate between 70% and 95% of the U.S. market for AI accelerators. Those chip sets are used to teach and support AI models such as OpenAI’s ChatGPT chatbot or Google’s Gemini, which are all the rage. Nvidia has such a strong grip on technology like AI GPUs as well as its software dubbed NIM, which streamlines AI deployment, that it would be a headache for its customers to switch providers at this point, unless another company surpassed Nvidia in innovation. But with Jensen Huang at the wheel, that’s unlikely to happen.

3.) Ongoing Chipset Innovation

As far as Nvidia has come, the company isn’t resting on its laurels. Instead, it’s quite the opposite, as the company continues to roll out upgraded versions of its AI-chip technology while CEO Huang keeps one eye on the future and the other on his competitors. Huang has sped up Nvidia’s accelerator release schedule from every two years to every year, a pace that’s difficult for rivals to match. After introducing its Blackwell Architecture for generative AI solutions, the company is targeting 2025 for its B100 chip as well as a super chip that alongside Blackwell will make some of its older AI chip sets obsolete.

4.) CEO’s Skin in the Game

Nvidia boss Jensen Huang is also a co-founder of the company, which was created in the early 1990s. As part of the early vision of Nvidia, Huang should give investors a sense of stability on the future direction of the company. Huang, who learned from his mentor earlier in life to be a perfectionist, isn’t likely to be going anywhere, especially considering his incentives. The Nvidia CEO received a 60% pay increase last fiscal year to $34.2 million compared with $21.4 million in the prior year. Plus he currently holds 3.52% of the company which is 866 million shares.

5.) Wall Street Bulls

Wall Street analysts could not be more bullish on this growth stock, as fundamentals continue to support its rising valuation. Nvidia shares are up 175%% year-to-date and have more than doubled in the past 12-month period. The company’s massive growth is powering the stock gains, causing analysts to frequently reassess their outlooks on the company and revise accordingly. Among the recent analyst calls, Rosenblatt’s Hans Mosesmann increased his price target on NVDA stock by $60 to $200 per share, reflecting approximately 48% further upside potential. While there may be some profit taking occasionally, Nvidia is surely on its way.

6.) Tech by Association

Nvidia rubs shoulders with some of the biggest innovators in the world, including Michael Dell. Most recently, Nvidia and Dell Technologies (NYSE: DELL) have partnered for the development of an AI factory using Nvidia chips that will power fellow billionaire Elon Musk’s AI ambitions via xAI and its chatbot Grok. All of the excitement was too much for investors to contain, sending shares of Dell 5% higher while Nvidia stock tacked on another 3.5%. Musk’s xAI plans to introduce a supercomputer designed to securely support the Grok chatbot, and Dell will be responsible for supply 50% of the server racks for that supercomputer.

7.) Revenue Growing Hand Over Fist

Nvidia’s revenue growth supports its soaring valuation. Over the past four quarters, Nvidia has reported combined revenue of approximately $80 billion. In its latest quarter, Nvidia’s revenue of $26 billion handily surpassed management estimates of $24 billion. Nvidia’s sales increased threefold vs. the year-ago period for the third straight quarter, fueled by demand for its AI solutions. Bank of America analysts believe Nvidia’s free cash flow across FY 2025 and 2026 could reach $100 billion amid a FCF margin that’s poised to more than triple in the next two years to approximately 50%. For the current quarter, which ends in July , Nvidia expects its revenue to grow more than twofold year-over-year to $28 billion amid what Huang has described as “the next industrial revolution.”

8.) Nvidia’s ‘Skating to Where the Puck Is Going’

Hockey legend Wayne Gretzky famously said to “skate to where the puck is going to be, not where it has been.” Nvidia has seemingly taken that advice, as it’s been in the middle of the greatest tech booms of the 21st century so far. In addition to AI, Nvidia’s chips have also been critical to cryptocurrency mining, a computational process by which new coins like bitcoin are created. Data center demand continued to explode throughout the Covid era as companies shifted to the remote work model, strategically positioning Nvidia for a future in which generative AI chatbots like ChatGPT would catch on like wildfire.

9.) Dividend Driver

If explosive capital appreciation weren’t enough, Nvidia also pays investors cash dividends, a trend that is catching on among technology heavyweights. In its fiscal Q1, Nvidia announced a quarterly dividend of $0.10 per share, up from $0.04 per share previously, an increase of 150%. Following Nvidia’s 10-for-1 stock split earlier this month, that amounts to $0.01 per share. Nvidia has been making dividend payments to shareholders for over a decade and based on its performance would have little reason to deviate from that model anytime soon. Nvidia’s recent stock split has also made shares more approachable for many retail investors, as the company rolls out the welcome mat for investors of all levels to share in the AI boom.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.