Several Bloomberg analysts speculated about a potential rate cut in September, a notion dismissed as unlikely given current economic indicators. The inflation drop is minimal, and Fed officials like Neil Kashkari suggest no immediate need for a cut. With rates at historically normal levels, the risk of rekindling inflation outweighs potential benefits. Government spending is seen as a primary driver of inflation, and reducing rates might have limited impact.

Transcript:

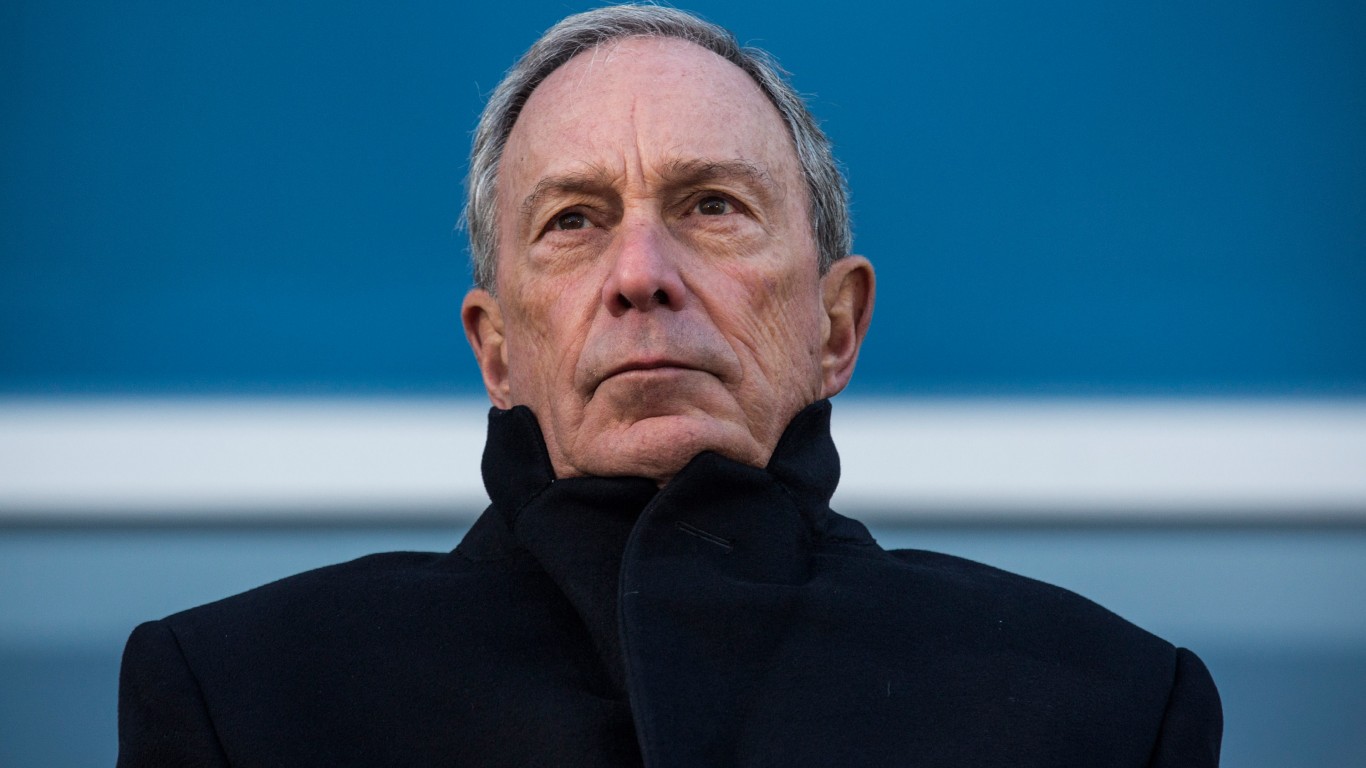

Bloomberg, three or four people said today that there was a chance for a rate cut in September.

Which I think is close to insane. I don’t know what they were drinking or smoking when they said that.

I would be surprised, wouldn’t be surprised if there was no rate cut at all.

I wouldn’t be surprised either. And, you know, it’s interesting when the inflation number comes in one basis point below what was expected.

It’s like, oh, my God, this is a different reading. We’ve seen nothing like this. And I think you’re right.

And, you know, Neil Kashkari even said, he’s like, well, maybe we could cut later this year, but the data doesn’t really indicate that we should be able to.

And the main thing is, is that rates at current levels, as you and I know from experience, you know, when you have Fed funds at five and a half, that’s not on a historical basis that high.

That’s right in line with historical numbers. It’s just that it was zero for 15 years.

If I’m a Fed governor and I sit in my secret meeting with all the other Fed governors, one of the first things I say to myself is, we’re not hurting the economy.

For the most part, we’re not hurting anything. We take a risk of rekindling inflation if we drop.

If we hold, who gets hurt?

Yeah, and as we’ve noted ad nauseum, the great bulk of the inflation is the weakening of the dollar driven by ridiculous government spending.

That’s absurd. And they can’t do much about that. I mean, even if they drop rates, 25, 50, 75 basis points, they’re still going to be at four and three quarters and you know, okay, so maybe we’re going to just fall to six and a half and you can buy it down a couple of points to six and a quarter.

They know that. I mean, you and I aren’t economists, but we also know that massive government spending has triggered the great bulk of this.

Find a Qualified Financial Advisor (Sponsor)

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.