Have you ever wanted to invest in the hottest tech stocks, but the share price seems out of reach? The good news is you don’t need a huge sum of money to get started. Instead, you can take advantage of fractional shares, which allow you to invest in a portion of a stock, even if the whole share is above your budget.

This means you can spread your investment across multiple companies, even if you can’t buy a whole stock in any of them. Diversity is key to investing, and fractional shares are a great way to get around extremely expensive stock prices.

In this article, we’ll look at nine smart tech stocks. Even if you can’t buy whole shares in these stocks, fractional shares can let you get exposure to them for only $100.

1. Intel (INTC)

First on our list is a household name: Intel (NASDAQ: INTC). Intel is a huge leader in the semiconductor industry, which is required to power computers and other electronics. They’re also innovating in other tech areas, like artificial intelligence, potentially positioning them to be a serious growth stock.

The current share price is hovering around $35, making it a good fit for an investment of $100. You can purchase several full shares and even a fractional share with the leftovers. They have a long history of success and a potential for future gains.

However, as with any investment, there is still a risk involved here.

2. Palantir (PLTR)

Next up is Palantir Technologies (NYSE: PLTR), a company specializing in enterprise software that uses artificial intelligence for data analysis. They work with commercial clients and government agencies by sifting through massive datasets to uncover unique insights.

Their stock has seen significant growth over the past year, but it still remains under $10. It’s a great option for investors looking to get in on the ground floor of a high-potential tech stock.

However, Palantir is a relatively young company with a unique business model. This makes them a riskier choice. You should expect plenty of volatility within the stock and have a high-risk tolerance. Investors should keep a careful eye on this stock, too.

3. PubMatic (PUBM)

PubMatic (NASDAQ: PUBM) takes us into the world of advertising. This company specializes in “programmatic advertising.” Basically, this means that they automate buying and selling ad space online. Digital marketing is in a serious boom and probably isn’t going anywhere, making PubMatic a potentially great investment.

Their share price currently sits around $25, so you can buy several shares with $100.

Their focus on automation and efficiency sets them apart from other companies and will likely be a key driver in their future success. The advertising industry is always evolving, though, and PubMatic faces a lot of competition. Just like with all companies, they aren’t without their challenges.

4. Stem (STEM)

Stem (NYSE: STEM) is a completely different company than we’ve discussed so far. They use artificial intelligence to improve energy efficiency and improve the energy use of buildings, promoting a more sustainable future. They’re a company you can feel good about investing in. With a growing focus on renewable energy, this company is expected to see tons of future growth, making it a great company to invest in now.

Their stock price is currently less than $10, so you can buy many if you decide to put your whole investment into one company.

Stem technology has a huge potential to help businesses become more sustainable and participate in a cleaner world. However, they are heavily dependent on green energy incentives. That sector is still evolving, and there is a lot of risk that goes into investing in it.

5. Advanced Micro Devices (AMD)

Beyond Intel, there are several other semiconductor players in the industry, including Advanced Micro Devices (NASDAQ: AMD). You’ve probably heard of AMD. They’re often considered the underdog in their industry, but they are positioned to grow substantially over the next decades. The current share price is just under $100, so it’s a good option if you want to invest in the chip-making space.

They’re known for developing many new promising technologies, which can put them in a position for future growth. However, there is always risk involved, especially because they are not an industry leader. You should consider your risk tolerance before investing in them.

6. Nvidia (NVDA)

Next on our list is Nvidia (NASDAQ: NVDA), a company at the forefront of the graphics processing units industry. These chips are used in practically every computer. They’re the part that processes graphics, making them essential for gaming computers and those running lots of data. However, they are also used heavily in Bitcoin mining and processing huge datasets, which they are very good at. GPUs are also very expensive, which puts Nvidia at a high growth potential.

Their share is currently over $100, but you could purchase fractional shares instead, allowing you to make money off of their growth without purchasing a whole share.

Nvidia’s true strength and future growth lie in its innovation. It constantly produces new technology to make its chips work better than the competition, and it is considered a leader in the industry. Therefore, it is a less risky investment than any other option on this list, largely because it is already seen as an industry leader.

For more about Nvidia, take a look at our Nvidia stock price prediction.

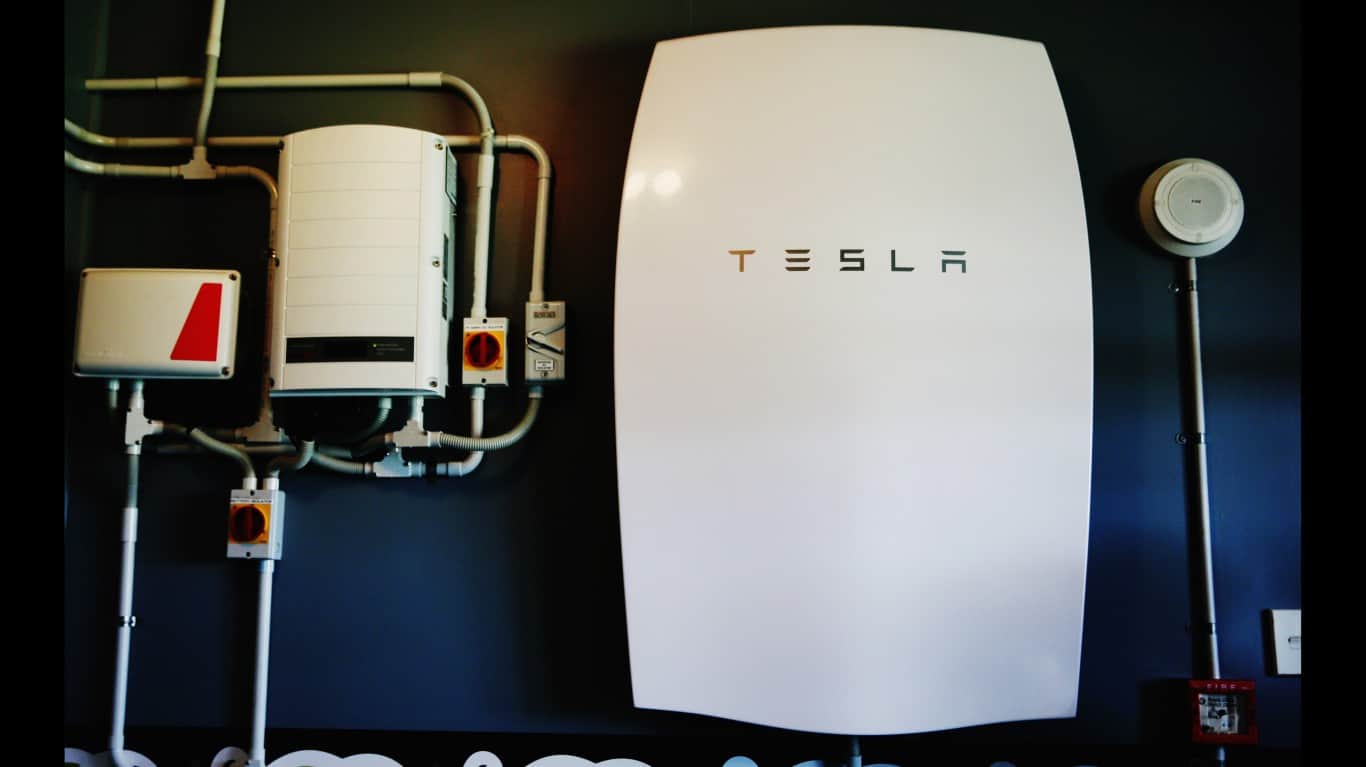

7. Tesla (TSLA)

While you cannot purchase a whole share of Tesla (NASDAQ: TSLA) with $100, you can own a fractional share and enjoy the company’s growth. Tesla is a very popular company, largely due to its owner, Elon Musk. They are also a leader in the electric vehicle industry, which is seeing a rise as technology improves. They’re absolutely seen as an innovative company, putting them in a position for serious growth.

Tesla’s stock moves around a lot. You can purchase a fractional share for $100, though, and that’s exactly what we recommend that you do.

This company is constantly innovating, and you’re investing in its future success just as much as you are in its current product line. Because this company is so innovative, though, you’re relying on the fact that future innovations will work, and the company will continue to discover new and exciting technologies that will fuel real-world projects.

8. Alphabet (GOOG)

While a full share of Alphabet (NASDAQ: GOOG), the parent company of Google, might be out of reach at around $2,500, fractional shares allow you to invest a smaller amount in this tech giant. Google remains a huge driving force in the economy as a whole, so even a fractional share is enough to get some exposure to this giant company.

Google is constantly innovating in tons of different industries, including self-driving cars, artificial intelligence, and healthcare. Their diversification makes them less risky compared to smaller, more specialized tech companies.

That said, Alphabet does face many challenges, such as regulatory scrutiny and competition from other tech giants.

9. Microsoft (MSFT)

Microsoft (NASDAQ: MSFT) is another giant tech company with a long history of success. It remains a leader in the software industry, with its Windows operating system powering billions of computers across the globe. They’re also a major player in cloud computing (Azure) and gaming (Xbox).

Their share price is well over $100, but you can purchase a fractional share to invest in this relatively stable company.

Microsoft has consistently been innovating and adapting over the years, allowing them to consistently stay relevant in the ever-changing tech landscape. Like many larger companies, their diversified business model provides some stability compared to smaller companies.

Microsoft does face competition from other big companies, such as Google.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.