Investing

Forget Intuitive Surgical: This Stock Is the Next Millionaire Maker

Published:

Imagine this: you walk into a hospital for a procedure. You expect a long, traditional surgery with a lengthy recovery. But what if, instead of the scalpel, you could invest in a company with the potential to revolutionize medicine, offering cures for diseases instead of just treating symptoms?

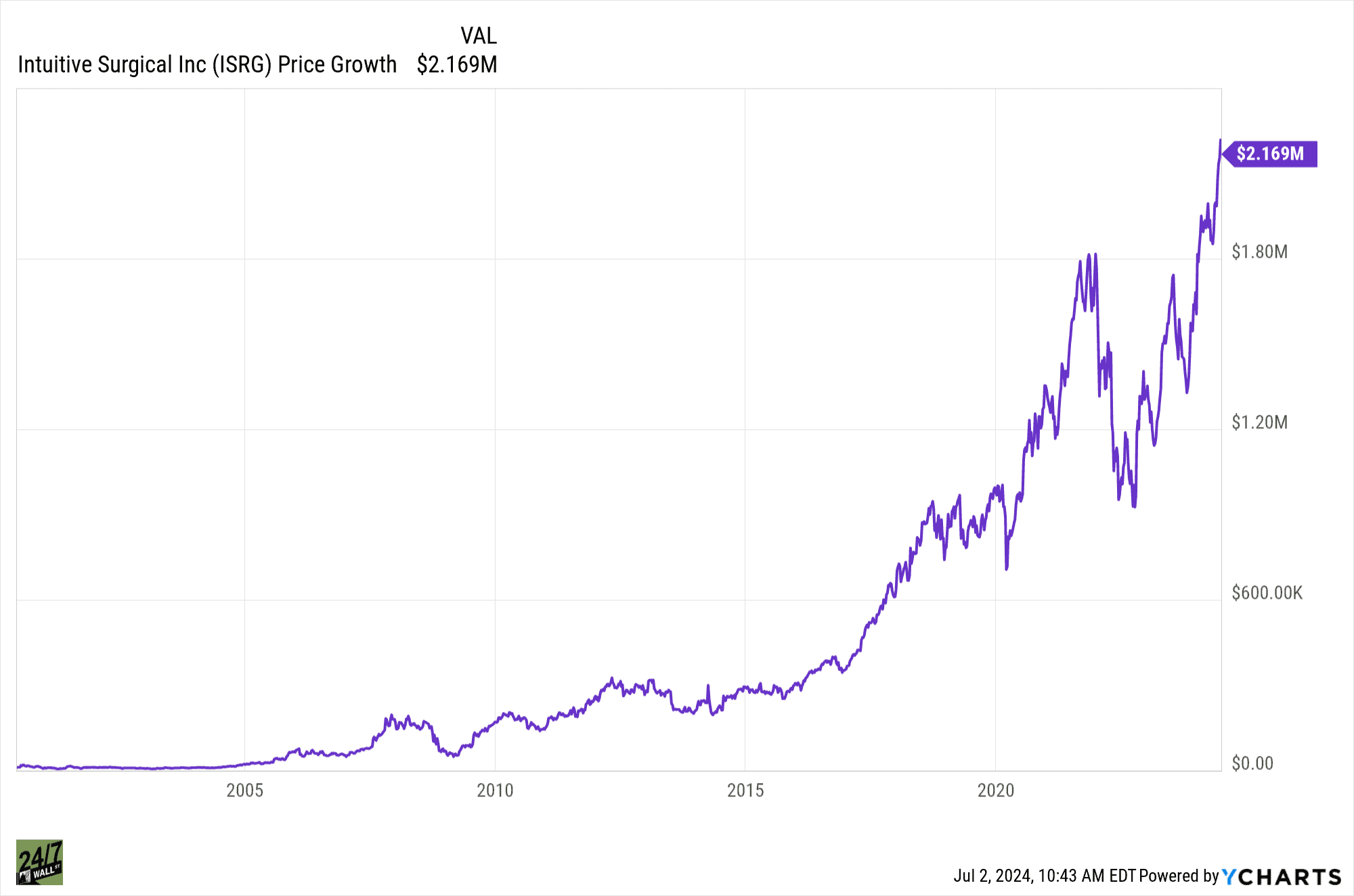

Intuitive Surgical (NASDAQ: ISRG) was once a leader in the field of minimally invasive surgery, but some argue it hasn’t kept pace with the rapid advancements in healthcare. It was also a good investment, as you can see from this chart:

Many traditional surgeries have been improved by intuitive techniques, but what if there was a way to go beyond minimally invasive and tackle the root cause of diseases altogether?

That’s where CRISPR Therapeutics (NASDAQ: CRSP) comes in. This company is pioneering a gene-editing technology called CRISPR-Cas9. This technology has the potential to rewrite medicine, potentially offering permanent cures for diseases that have plagued humanity for generations.

While an intuitive surgical procedure might offer a shorter recovery time, CRISPR Therapeutics could be the investment that fuels a future free from many diseases. We’ll explore why some believe CRISPR holds more promise for the future of medicine and may be a better investment opportunity.

Unlike the complex machinery behind a fancy coffee machine, CRISPR is an exceptionally complicated tool. It works a bit like a pair of scissors that can cut out a piece of DNA code. Scientists give the scissors the code they’d like removed, and the scissors remove anything that fits into this key.

Then, the scientists can replace it with whatever code they’d like. It’s DNA editing without having to “borrow” DNA from other species. (If you’ve ever seen Jurassic World, you know why this is a poor idea.)

Founded in 2013, CRISPR Therapeutics is at the very forefront of this revolution. They invented the technology and are still developing it, finding real-world uses for this exciting technology.

The potential of CRISPR’s technology is truly staggering. Unlike traditional medications that target symptoms, gene editing can treat diseases at their source. Faulty genes that we cannot fix now can be completely altered with CRISPR. This opens the door for a whole range of illnesses, once thought untreatable, to be cured permanently.

CRISPR is at the very forefront of this revolution, with ongoing clinical trials targeting some of the world’s most challenging diseases:

These are just a few examples of what CRISPR could treat. Some of these diseases are actually being fought with CRISPR, while others are currently in the planning phase. Either way, we do know that CRISPR has wide-arching uses. We just don’t know how far those uses could go.

Of course, with such groundbreaking potential comes a hefty dose of risk. Investing in high-growth companies like CRISPR Therapeutics is not for those with low-risk tolerance.

The road from promising technology to marketable treatment is very long. Yes, some uses of CRISPR have been approved by the FDA and are currently treating real diseases. However, that doesn’t mean that all promising clinical trials will succeed. And, even if they do, that success could be years or decades down the line.

Gene editing is a very new field, and we don’t know much about it. It’s possible for technical challenges or safety concerns to develop that we have no idea about could pop up at any time.

CRISPR also has to jump through many regulatory hoops to operate. Gene-editing therapies are new, which means that regulation is very strict.

Remember, even with its potential, CRISPR Therapeutics is still a young company with a lot to prove.

CRISPR Therapeutics sounds extremely promising. But does that mean it’s right for you? Not necessarily. There are two main investment approaches to consider:

Before investing in CRISPR, you should consider your risk tolerance and goals. While this stock may continue to grow as the company does, there is also the chance of obstacles and dead-ends as CRISPR develops its new technology.

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.