Investing

If You Bought $100 of Recently Split Stock NVIDIA at Its IPO, This Is How Much It'd Be Worth Now

Published:

Last Updated:

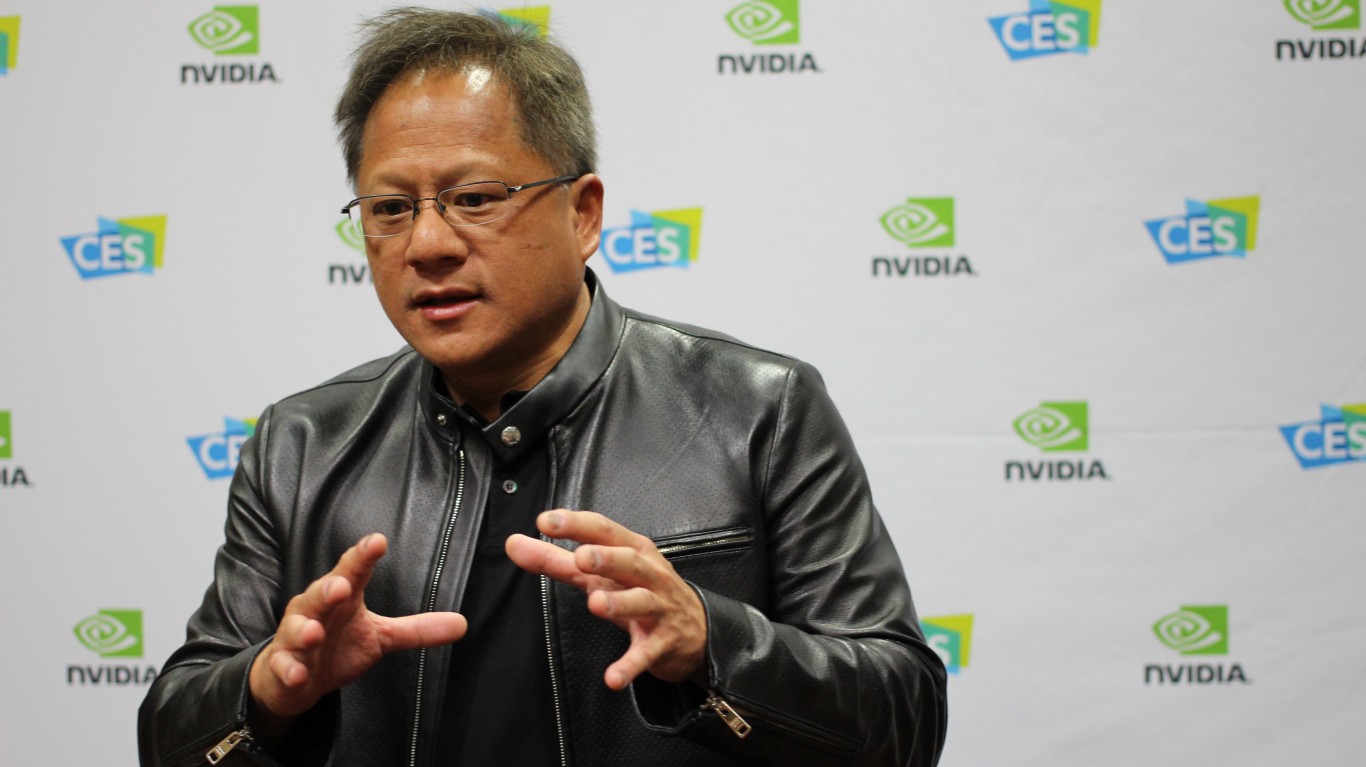

In case you have been living under a rock for the past year and a half, NVIDIA Corp. (NASDAQ: NVDA) has been the market’s hottest stock and is now one of the largest companies — as measured by market capitalization — in the entire world.

After the chipmaker underwent a recent 10-for-1 stock split on June 7, 2024, it awarded shareholders with nine additional shares each, thereby making the stock 90% cheaper for prospective investors.

But when considering all of the winners and losers in artificial intelligence (AI) stocks thus far, to really understand just how incredible the NVIDIA’s growth has been, we have to rewind first to the start of 2023, when it really began to pick up momentum amid the market’s AI-induced frenzy, and then farther back to its initial public offering (IPO) date.

When the stock market closed its first trading day of January 2023, shares of the AI-leveraged chipmaker were trading for $14.86 (on a post-split-adjusted basis). At the time of writing, NVIDIA is trading for $123.59, representing a gain of more than 731% over the past 18 months.

That June stock split was the company’s sixth such occurrence since going public. Based on those stock splits, if an investor had purchased one share of NVDA on its June 22, 1999, IPO date, they would be holding a total of 480 shares today.

Then, later in June, NVIDIA became just the third publicly traded company to join the $3 trillion market cap club. In doing so, it joined fellow Magnificent Seven tech giants Microsoft Corp. (NASDAQ: MSFT) and Apple Inc. (NASDAQ: AAPL), even briefly overtaking the latter for second on the list before a short-lived market sell-off pulled it back into third place. NVIDIA currently boasts a market cap of $3.07 trillion, with Microsoft coming in at $3.391 trillion and Apple close behind at $3.317 trillion.

But with shares of NVIDIA now selling at a perceived discount and the stock more accessible to investors’ portfolios, some are wondering if the best growth opportunities have already passed by.

According to the Wall Street Journal, though, that is hardly the case. The Journal’s analysts give NVIDIA a median one-year price target of $129.50, but also award the stock a high-end price target of $200. At that high-end price target, shares of the AI tech giant can potentially grab another 61.94% in upside potential by this time next year.

However, it is important to understand that price targets are speculative and therefore not the most reliable indictors of growth. And while rear-facing data is not predictive of what is coming, either, it can provide solid context when trying to understand just how good of an investment NVIDIA has been.

To do so, it is helpful to rewind the clock to NVIDIA’s IPO date. On that day, the company went public with a per share price of $12, six years after it was founded in 1993. But after its six stock splits, looking at its chart today shows an IPO price of 4 cents based on post-split price adjustments.

So if an investor purchased $100 worth of NVDA on June 22, 1999, today that initial investment would be worth a staggering $308,975.

Of course, hindsight is no more indicative of future performance than price targets are. To more accurately gauge NVIDIA’s forward-looking potential, investors should closely examine the company’s fundamentals, including: income statements, balance sheets, and cash flow statements. Doing so provides a clearer direction of the company’s growth, earnings per share (EPS) performance, and executive leadership.

The last time NVIDIA missed on its earnings forecast was the third quarter of 2023. At that time, estimates were for an EPS of 7 cents, but actual EPS came in at 6 cents per share. But since then, its EPS growth has been explosive and the company has beat forecasts every quarter. NVIDIA’s EPS for the quarter ending April 30, 2024, was 60 cents, marking a 629.27% year-over-year increase. And for the 12 months ending that same date, the annualized EPS was $1.71, good for a 790.1% year-over-year increase. Consensus EPS for the next quarter is 64 cents.

Looking into the chipmaker’s financial statements provides additional context as to why EPS has seen such exponential growth to the upside. Total revenue grew from $7.19 billion in April 2023 to $26.04 billion in April 2024 — good for a gain of 262.17%. Over the same period, NVIDIA saw its assets swell from $44.46 billion to $77.07 billion — a gain of 73.34%. Meanwhile, its total liabilities only grew from $19.94 billion to $27.93 billion, or 40%, meaning NVIDIA’s asset growth outpaced its liability growth by 33.34% over the course of those 12 months.

And then there is free cash flow, which to some is the most critical gauge of a company’s health. Free cash flow provides prospective investors with a measure of the money a company has left over after paying its operating expenses and capital expenditures, and it is where companies tap into to pay dividend distributions (NVIDIA’s dividend currently yields 0.032% annually, or 1 cent per share paid quarterly) and to fund share repurchase plans (a.k.a. stock buybacks).

In April 2023, NVIDIA posted free cash flow of $2.91 billion. By April of this year, that figure had reached $14.98 billion, representing a gain of 414.77% in just one year.

Additionally, looking at the semiconductor industry itself can paint a good picture of how NVIDIA is poised to continue its ascent.

Semiconductors are the lifeblood of the AI revolution. They provide the necessary hardware required for the complex computations, and NVIDIA’s graphics processing units (GPUs) are the mostly highly sought after in an industry experiencing unparalleled demand. Over 40,000 companies now rely on its chips, and according to Deloitte — one of the Big Four international accounting firms — things are only looking up for the industry.

Deloitte’s 2024 semiconductor industry outlook states that generative AI is driving heightened demand for chips, and that demand is not going to subside any time in the near future. Full-year revenue forecasts in 2024 are projected to be $588 billion, or 13% better than 2023 and even 2.5% better than 2022 when the industry set a record for revenue with $574 billion.

Beyond 2024, data platform Statista projects the semiconductor industry to expand at a compound annual growth rate (CAGR) of 10.06% every year from 2024 to 2029.

If an investor purchased $100 of NVIDIA stock on its IPO date back on June 22, 1999, today that would be worth $308,975. But hindsight is always 20/20. By scrutinizing the company’s fundamentals — including its financial statements, balance sheets, and cash flow statements — and combining that analysis with the projected CAGR for the broader semiconductor industry, the picture paints itself.

NVIDIA is poised for continued growth on near-, medium-, and long-term horizons, and prospective investors should consider adding exposure to the company, either directly or via an exchange-traded fund (ETF) with it as one of its top holdings.

If NVIDIA’s share price of $123.59 is still too costly, most brokerages now offer fractional shares. Or if you’re looking for broader exposure and diversification while still getting a piece of the pie, there are dozens of actively and passively managed ETFs that feature the company atop its weighted or unweighted portfolio positions. Some examples include:

No matter which direction you decide to take, always be sure to conduct your own due diligence before entering any trade. But adding at least some exposure to the leader of the AI-fueled market surge would not be a terrible idea for your portfolio’s overall well-being.

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.